Restricted Stock Plan of RPM, Inc.

Description

How to fill out Restricted Stock Plan Of RPM, Inc.?

When it comes to drafting a legal document, it is better to delegate it to the specialists. However, that doesn't mean you yourself can’t find a template to utilize. That doesn't mean you yourself can not get a template to utilize, nevertheless. Download Restricted Stock Plan of RPM, Inc. right from the US Legal Forms site. It provides numerous professionally drafted and lawyer-approved forms and templates.

For full access to 85,000 legal and tax forms, users just have to sign up and choose a subscription. Once you are registered with an account, log in, look for a particular document template, and save it to My Forms or download it to your gadget.

To make things easier, we’ve included an 8-step how-to guide for finding and downloading Restricted Stock Plan of RPM, Inc. fast:

- Be sure the form meets all the necessary state requirements.

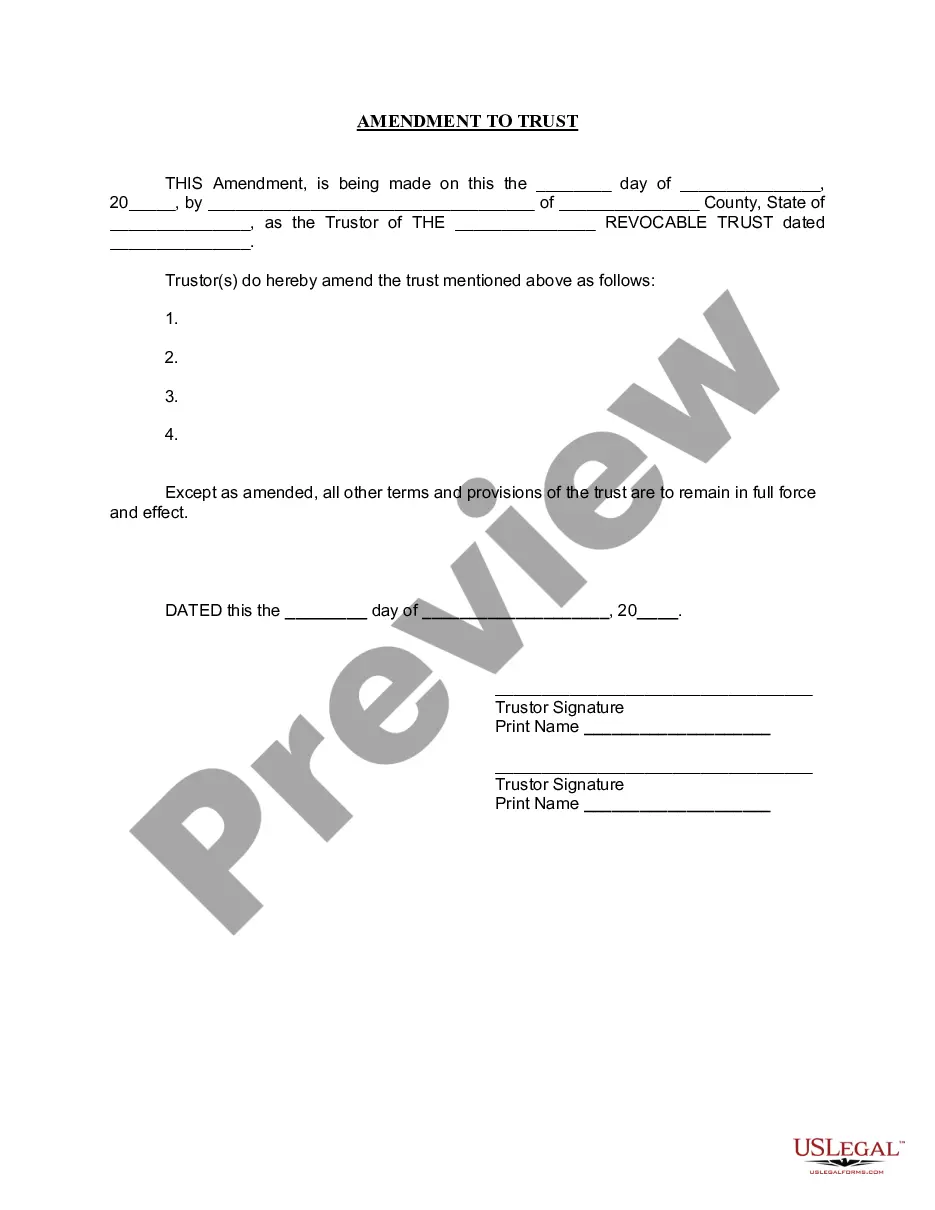

- If available preview it and read the description before buying it.

- Click Buy Now.

- Choose the appropriate subscription for your needs.

- Create your account.

- Pay via PayPal or by credit/visa or mastercard.

- Choose a needed format if a number of options are available (e.g., PDF or Word).

- Download the file.

As soon as the Restricted Stock Plan of RPM, Inc. is downloaded you can complete, print out and sign it in any editor or by hand. Get professionally drafted state-relevant papers in a matter of minutes in a preferable format with US Legal Forms!

Form popularity

FAQ

Stock options are only valuable if the market value of the stock is higher than the grant price at some point in the vesting period. Otherwise, you're paying more for the shares than you could in theory sell them for. RSUs, meanwhile, are pure gain, as you don't have to pay for them.

Restricted stock refers to unregistered shares of ownership in a corporation that are issued to corporate affiliates, such as executives and directors. Restricted stock is non-transferable and must be traded in compliance with special Securities and Exchange Commission (SEC) regulations.

RSUs are generally always worth something versus stock options, which can expire worthless if the stock price is below the strike price. Additionally, with RSUs you don't have to come up with the cash to exercise the options if your company doesn't offer some sort of cashless exercise option.

Restricted stock units are often offered as part of a compensation package to attract and retain key employees They are restricted in that certain requirements must be met before the employee can obtain full ownership rights to the value of the units.

RSUs give an employee interest in company stock but they have no tangible value until vesting is complete.Upon vesting, they are considered income, and a portion of the shares is withheld to pay income taxes. The employee receives the remaining shares and can sell them at their discretion.