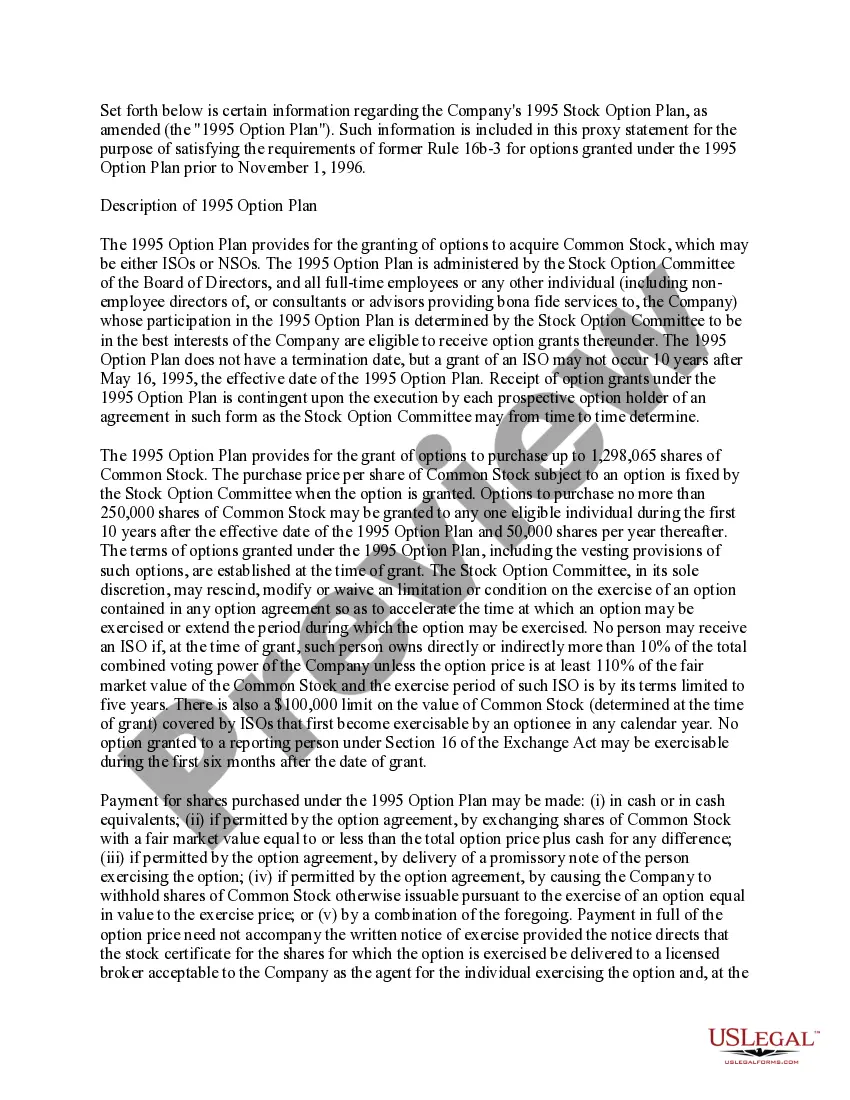

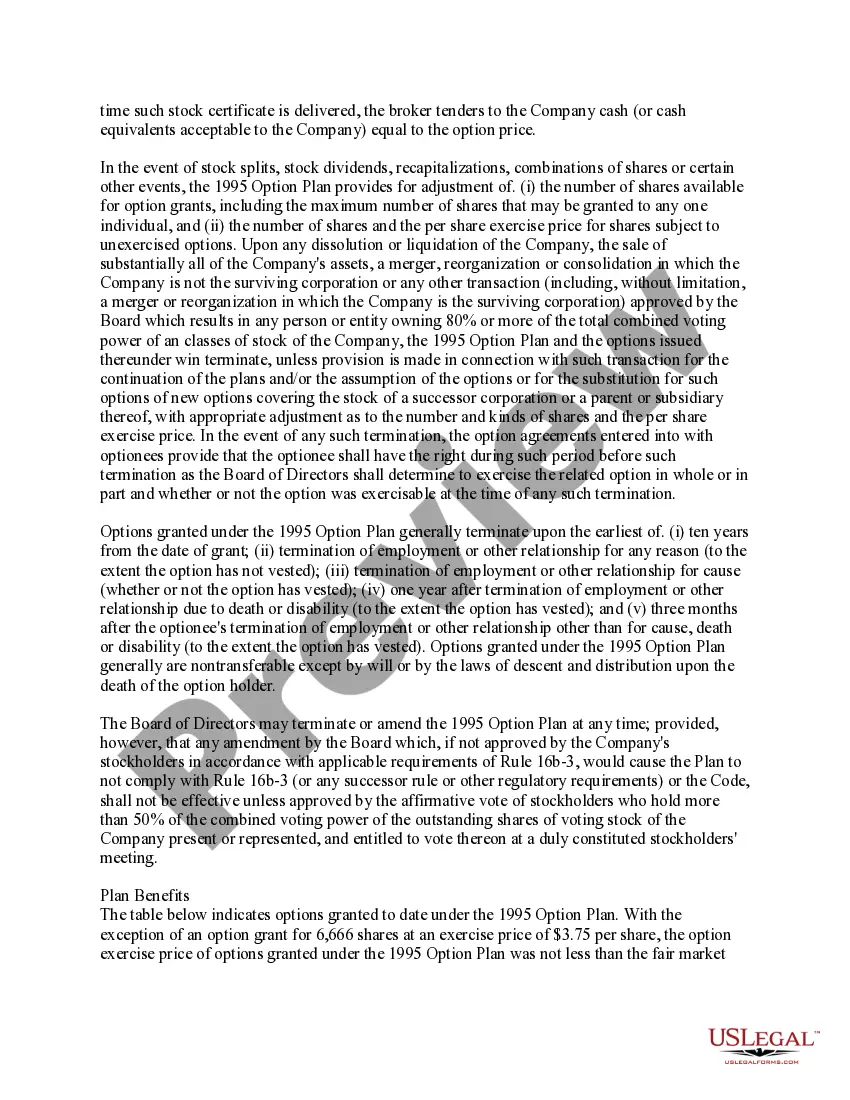

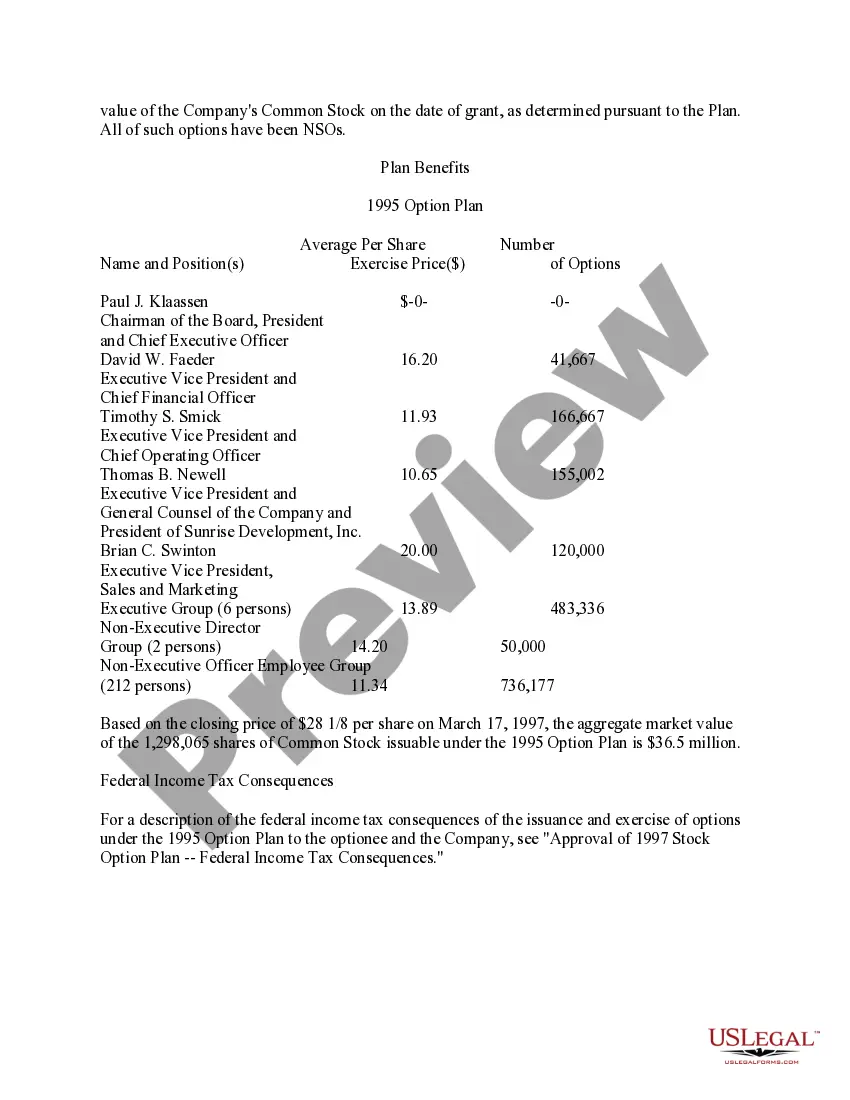

Approval of Stock Option Plan

Description

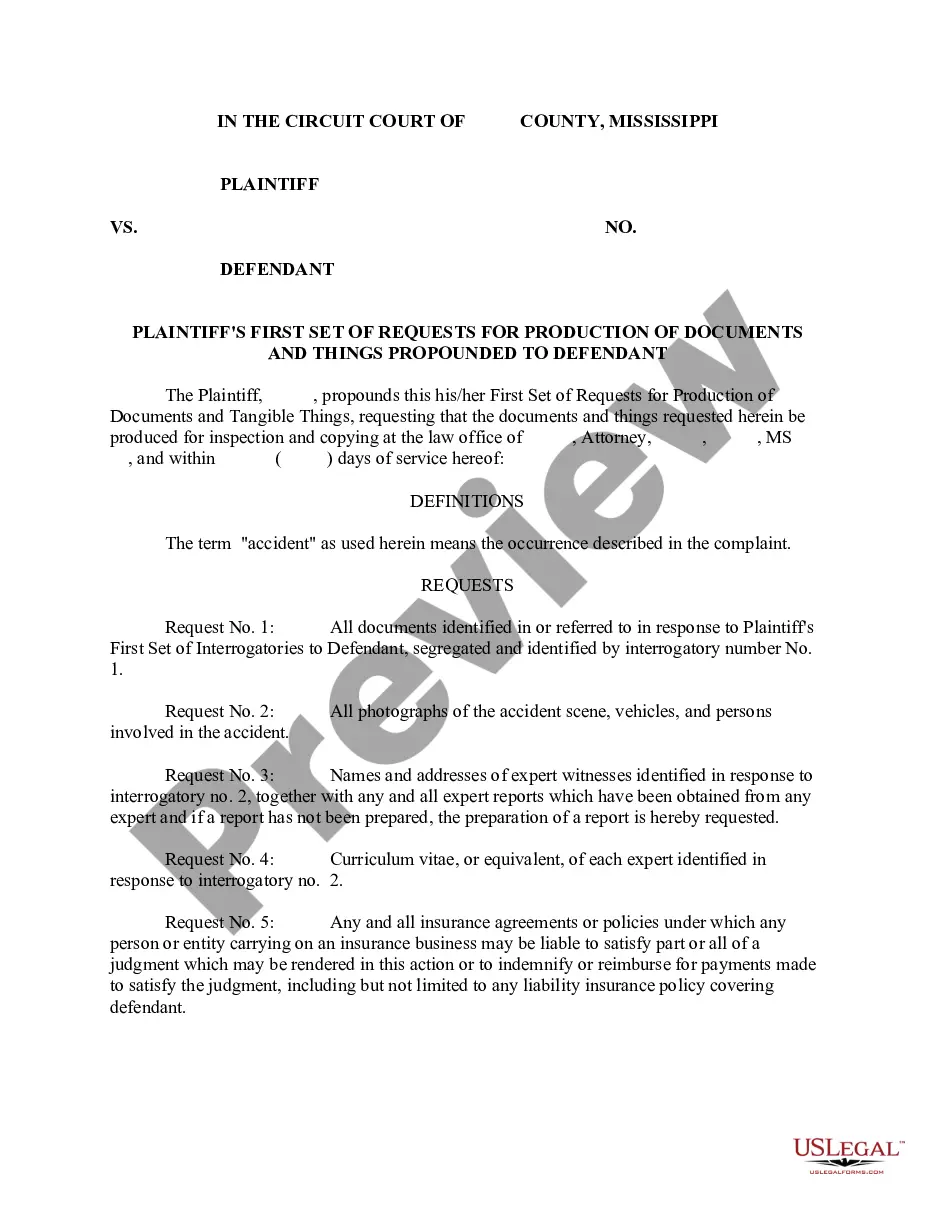

How to fill out Approval Of Stock Option Plan?

When it comes to drafting a legal form, it’s easier to delegate it to the specialists. However, that doesn't mean you yourself can’t get a sample to use. That doesn't mean you yourself can’t get a template to utilize, nevertheless. Download Approval of Stock Option Plan straight from the US Legal Forms web site. It gives you a wide variety of professionally drafted and lawyer-approved documents and templates.

For full access to 85,000 legal and tax forms, users simply have to sign up and select a subscription. As soon as you’re registered with an account, log in, find a certain document template, and save it to My Forms or download it to your device.

To make things easier, we’ve incorporated an 8-step how-to guide for finding and downloading Approval of Stock Option Plan promptly:

- Make confident the document meets all the necessary state requirements.

- If possible preview it and read the description before purchasing it.

- Hit Buy Now.

- Choose the suitable subscription for your needs.

- Create your account.

- Pay via PayPal or by debit/bank card.

- Select a preferred format if a number of options are available (e.g., PDF or Word).

- Download the document.

Once the Approval of Stock Option Plan is downloaded you may complete, print and sign it in almost any editor or by hand. Get professionally drafted state-relevant documents in a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

Shareholder Approval means approval of holders of a majority of the shares of Stock represented and voting in person or by proxy at an annual or special meeting of shareholders of the Company where a quorum is present.

"Stock options" are often called derivatives because they are derived from stock prices. Options trading is by far the most cost-effective way of trading the stock market.

The most important variables to consider in deciding when to exercise your stock option are taxes and the amount of money you are willing to put at risk. Most companies offer you the opportunity to exercise your stock options early (i.e. before they are fully vested).

Appointment of auditors (if there are any) Appointment or re-appointment of directors. Removal of a director or the auditor. Adoption of the annual accounts and the reports of the directors and auditors. Declaration of dividends.

The Company's board of directors must approve all stock option grants, including the name of the recipient, the number of shares, the vesting schedule and the exercise price. This can be done either in a board meeting or via unanimous written consent.

After your options vest, you can exercise them that is, pay for the stock and own it.It may be couched in language such as company repurchase rights, redemption or forfeiture. But what it means is that the company can claw back your vested stock options before they become valuable.

Stock options are a form of compensation. Companies can grant them to employees, contractors, consultants and investors. These options, which are contracts, give an employee the right to buy or exercise a set number of shares of the company stock at a pre-set price, also known as the grant price.

If an employee is getting a market level salary with employee stock options, they should certainly accept the deal. In that way, you have possibly less chance to lose anything. But if you are accepting stock options in exchange for a lower salary, make sure you have a good understanding with the company.

Broadly speaking, equity incentive compensation refers to the grant by a company to its key employees and service providers of an ownership stake.