Stock Option Plan - Permits Optionees to Transfer Stock Options to Family Members or Other Persons for Estate Planning Purposes

Description Stock Transfer Persons Purposes

How to fill out Stock Option Plan - Permits Optionees To Transfer Stock Options To Family Members Or Other Persons For Estate Planning Purposes?

When it comes to drafting a legal form, it is easier to delegate it to the specialists. Nevertheless, that doesn't mean you yourself can’t get a template to utilize. That doesn't mean you yourself cannot get a template to use, however. Download Stock Option Plan - Permits Optionees to Transfer Stock Options to Family Members or Other Persons for Estate Planning Purposes from the US Legal Forms website. It offers a wide variety of professionally drafted and lawyer-approved forms and samples.

For full access to 85,000 legal and tax forms, customers just have to sign up and select a subscription. Once you are signed up with an account, log in, search for a certain document template, and save it to My Forms or download it to your device.

To make things less difficult, we’ve provided an 8-step how-to guide for finding and downloading Stock Option Plan - Permits Optionees to Transfer Stock Options to Family Members or Other Persons for Estate Planning Purposes promptly:

- Be sure the form meets all the necessary state requirements.

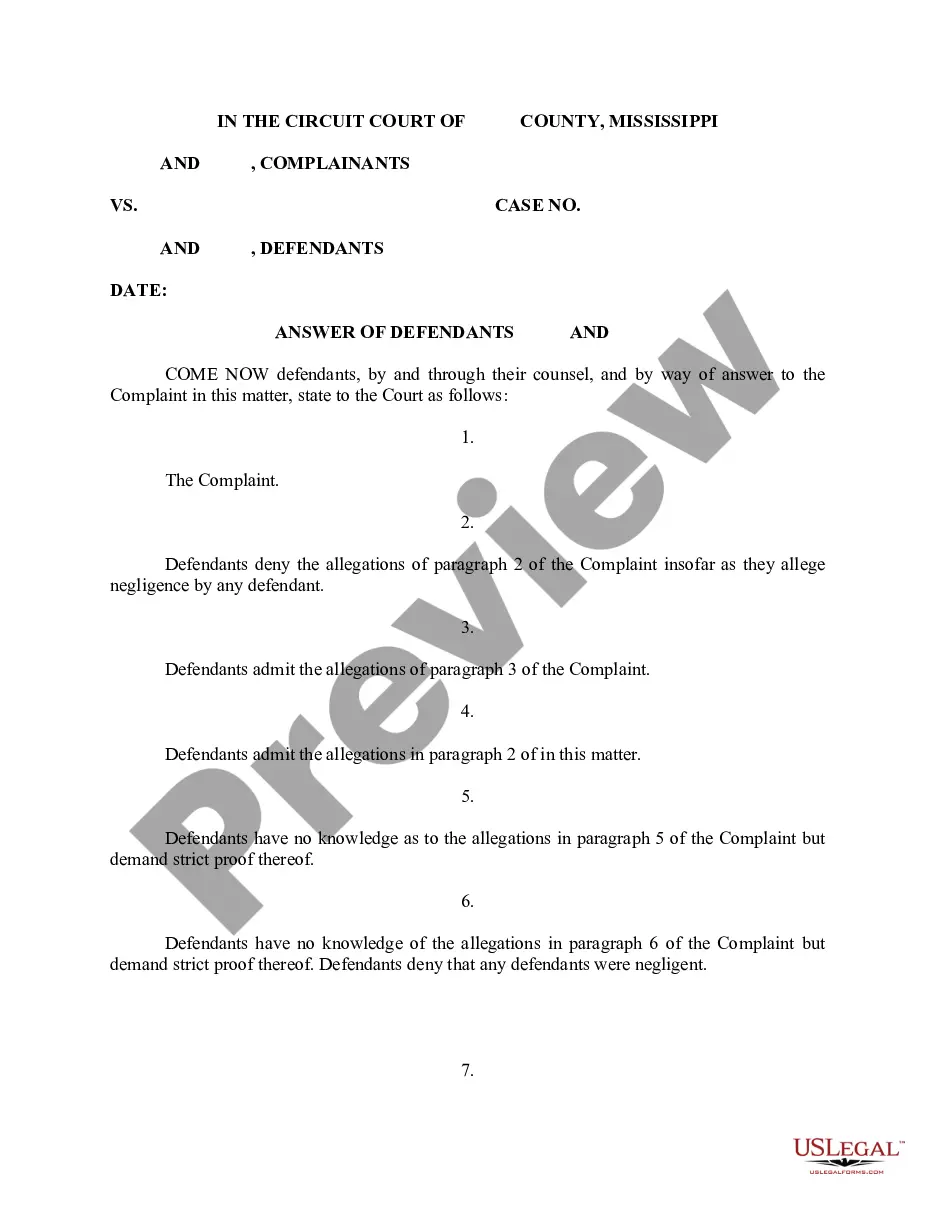

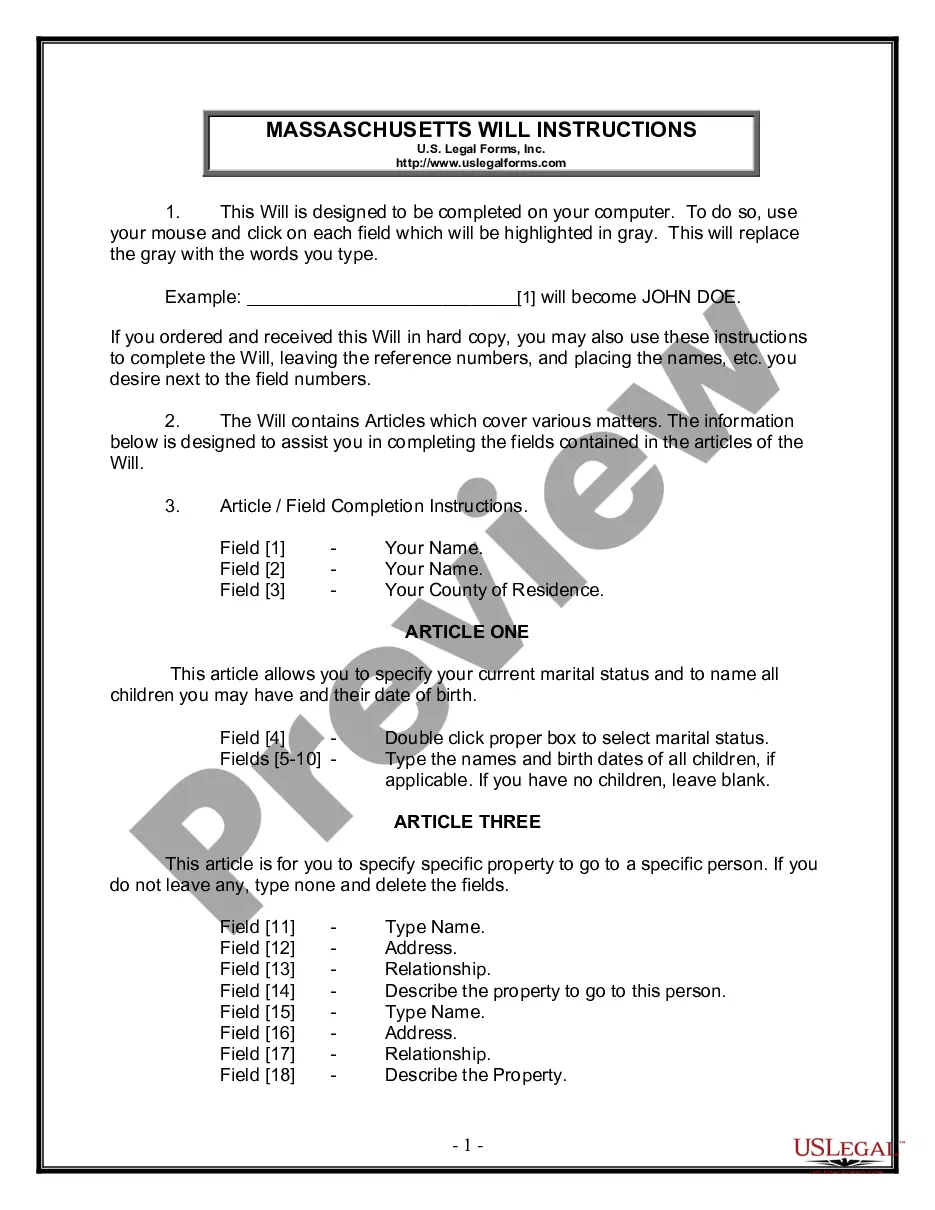

- If available preview it and read the description prior to buying it.

- Hit Buy Now.

- Choose the appropriate subscription to meet your needs.

- Create your account.

- Pay via PayPal or by credit/bank card.

- Choose a preferred format if several options are available (e.g., PDF or Word).

- Download the file.

Once the Stock Option Plan - Permits Optionees to Transfer Stock Options to Family Members or Other Persons for Estate Planning Purposes is downloaded you can complete, print out and sign it in almost any editor or by hand. Get professionally drafted state-relevant documents within a matter of minutes in a preferable format with US Legal Forms!

Stock Transfer Persons Form popularity

FAQ

Stocks can be given to a recipient as a gift whereby the recipient benefits from any gains in the stock's price. Gifting stock from an existing brokerage account involves an electronic transfer of the shares to the recipients' brokerage account.

Develop your philosophy. Your stock option plan is an expression of your company philosophy. Paper it. Adopt your stock plan and option agreements and get board and stockholder approval. Make it official. Work with your lawyers to obtain all relevant state permits for your option plan.

The strike price of the options. The vesting schedule. The last round valuation (per share as well as in dollars, post-money) The last round date and lead investors. Details on the terms of the last round. The company's employee count over the past few years (get a LinkedIn premium account to do this)

These options, which are contracts, give an employee the right to buy or exercise a set number of shares of the company stock at a pre-set price, also known as the grant price. This offer doesn't last forever, though. You have a set amount of time to exercise your options before they expire.

You'll pay capital gains tax on any increase between the stock price when you sell and the stock price when you exercised. In this example, you'd pay capital gains tax on $5 per share (the $10 sale price minus $5, which was the price of the stock when you exercised).

The quick way of calculating the value of your options is to take the value of the company as given by the TechCrunch announcement of its latest funding round, divide by the number of outstanding shares and multiply by the number of options you have.

Cost-Basis Confusion With nonqualified stock options, for employees the spread at exercise is reported to the IRS on Form W-2 For nonemployees, it is reported on Form 1099-MISC (starting with the 2020 tax year, it will be reported on Form 1099-NEC ). It is included in your income for the year of exercise.

Non-Qualified Stock Options (NQSOs) are transferrable to a charity in theory, but many option plans will not allow such a transfer, and, even if they do, donors rarely decide to contribute NQSOs because of the way they are taxed.

Determine the market compensation for the role (e.g. $100k/year). Determine how much you can/want to pay in cash (e.g. $80k/year). Determine for how long this gap should be covered. Determine the value and strike price of the stock options. Determine the number of stock options to be granted.