Adjustments in the event of reorganization or changes in the capital structure

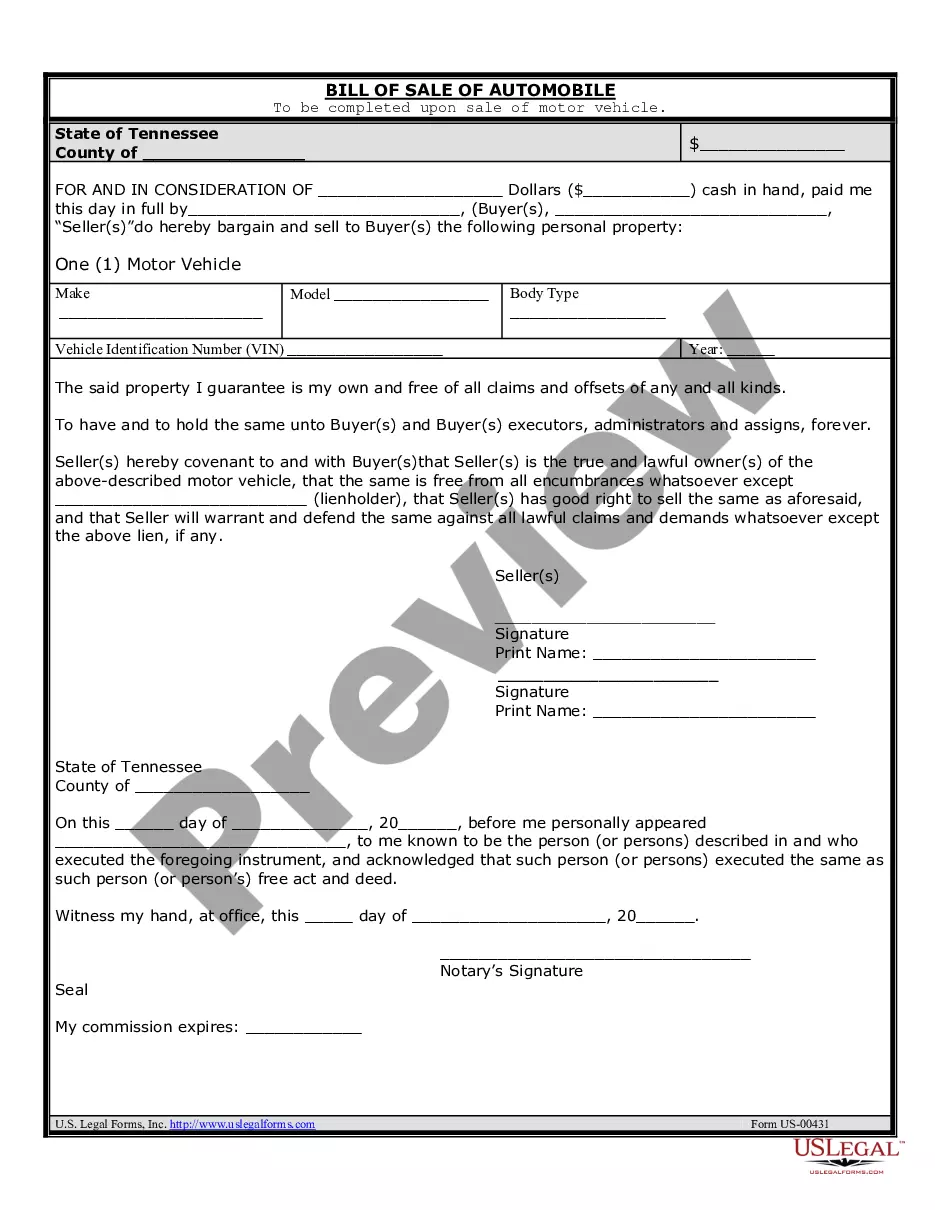

Description

How to fill out Adjustments In The Event Of Reorganization Or Changes In The Capital Structure?

When it comes to drafting a legal document, it is better to leave it to the experts. Nevertheless, that doesn't mean you yourself can’t find a template to use. That doesn't mean you yourself can’t get a template to utilize, nevertheless. Download Adjustments in the event of reorganization or changes in the capital structure straight from the US Legal Forms website. It offers numerous professionally drafted and lawyer-approved documents and samples.

For full access to 85,000 legal and tax forms, customers just have to sign up and select a subscription. When you’re registered with an account, log in, look for a specific document template, and save it to My Forms or download it to your gadget.

To make things less difficult, we have included an 8-step how-to guide for finding and downloading Adjustments in the event of reorganization or changes in the capital structure promptly:

- Make confident the document meets all the necessary state requirements.

- If available preview it and read the description before purchasing it.

- Hit Buy Now.

- Choose the appropriate subscription to suit your needs.

- Create your account.

- Pay via PayPal or by credit/visa or mastercard.

- Select a needed format if a few options are available (e.g., PDF or Word).

- Download the file.

Once the Adjustments in the event of reorganization or changes in the capital structure is downloaded you are able to complete, print and sign it in any editor or by hand. Get professionally drafted state-relevant papers in a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

Capital Structure is referred to as the ratio of different kinds of securities raised by a firm as long-term finance. The capital structure involves two decisions- Type of securities to be issued are equity shares, preference shares and long term borrowings (Debentures).

Corporate restructuring is an action taken by the corporate entity to modify its capital structure or its operations significantly.

The capital structure is the particular combination of debt and equity used by a company to finance its overall operations and growth.Debt comes in the form of bond issues or loans, while equity may come in the form of common stock, preferred stock, or retained earnings.

Equity Capital. Equity capital is the money owned by the shareholders or owners. Debt Capital. Debt capital is referred to as the borrowed money that is utilised in business. Optimal Capital Structure. Financial Leverage. Importance of Capital Structure.

The only way any decision can change the value of operations is by changing either expected free cash flows or the cost of capital. Business Risk. Business Risk. F/P - V. The higher the fixed costs, the higher the operating leverage and the higher the operating leverage, the higher the business risk.

A firm's capital structure is the composition or 'structure' of its liabilities. For example, a firm that has $20 billion in equity and $80 billion in debt is said to be 20% equity-financed and 80% debt-financed. The firm's ratio of debt to total financing, 80% in this example, is referred to as the firm's leverage.

Theoretically, restructuring leads to a more efficient and modernized entity, however it may lead as well to the deletion of jobs and the layoff of personnel. The procedure of restructuring generally focuses on problems with financing debt and very often, involves selling portions of the company to investors.

Reorganization, or business restructuring, is a process where a company does an overhaul of its current strategy, setup, and operations.A successful company restructure can result in increased profits, operational efficiency, and debt paydown.

Capital restructuring involves changing the amount of leverage a firm has without changing the firm's assets. The firm can increase leverage by issuing debt and repurchasing outstanding shares. The firm can decrease leverage by issuing new shares and retiring outstanding debt.