Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation

Description

How to fill out Cash Award Paid To Holders Of Non-Exercisable Stock Options Upon Merger Or Consolidation?

When it comes to drafting a legal form, it’s easier to delegate it to the experts. Nevertheless, that doesn't mean you yourself cannot find a template to utilize. That doesn't mean you yourself can not find a template to use, nevertheless. Download Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation from the US Legal Forms website. It offers a wide variety of professionally drafted and lawyer-approved forms and templates.

For full access to 85,000 legal and tax forms, customers just have to sign up and select a subscription. When you are registered with an account, log in, find a particular document template, and save it to My Forms or download it to your device.

To make things easier, we’ve included an 8-step how-to guide for finding and downloading Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation quickly:

- Make confident the document meets all the necessary state requirements.

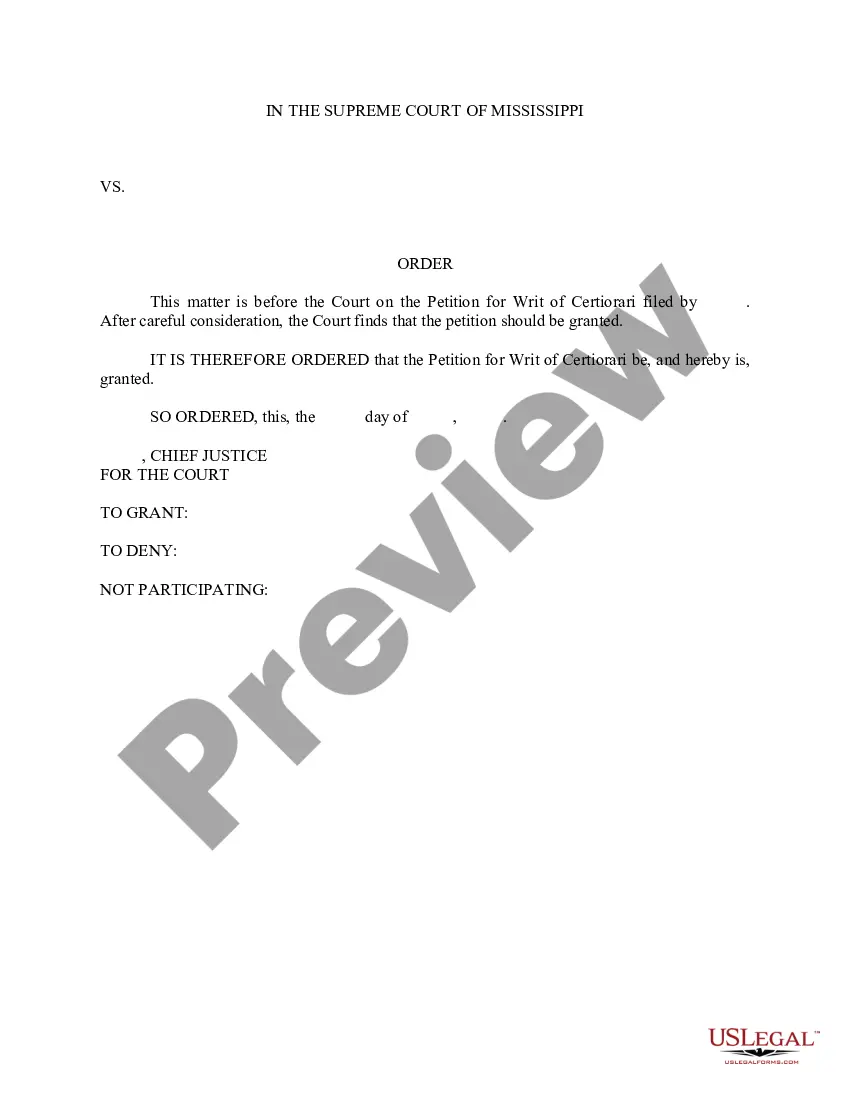

- If possible preview it and read the description before purchasing it.

- Press Buy Now.

- Select the appropriate subscription for your requirements.

- Make your account.

- Pay via PayPal or by debit/bank card.

- Choose a needed format if a few options are available (e.g., PDF or Word).

- Download the file.

After the Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation is downloaded you are able to complete, print out and sign it in almost any editor or by hand. Get professionally drafted state-relevant files in a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

All-Stock Offer With an all-stock merger, the number of shares covered by a call option is changed to adjust for the value of the buyout. The options on the bought-out company will change to options on the buyer stock at the same strike price, but for a different number of shares.

A few things can happen to your unvested options, depending on the negotiations: You may be issued a new grant with a new schedule for this amount or more in the new company's shares. They could be converted to cash and paid out over time (like a bonus that vests). They could be canceled.

What happens to SPAC stock after the merger? After a merger is completed, shares of common stock automatically convert to the new business. Other options investors have are to: Exercise their warrants.

When one company acquires another, the stock price of the acquiring company tends to dip temporarily, while the stock price of the target company tends to spike. The acquiring company's share price drops because it often pays a premium for the target company, or incurs debt to finance the acquisition.

Since you'll have to exercise your option through your employer, your employer will usually report the amount of your income on line 1 of your Form W-2 as ordinary wages or salary and the income will be included when you file your tax return.

The options on the bought-out company will change to options on the buyer stock at the same strike price, but for a different number of shares. Normally, one option is for 100 shares of the underlying stock. For example, company A buys company B, exchanging 1/2 share of A for each share of B.

After your options vest, you can exercise them that is, pay for the stock and own it.It may be couched in language such as company repurchase rights, redemption or forfeiture. But what it means is that the company can claw back your vested stock options before they become valuable.

In case the company is bought , your employer will grant you the options, they have vesting schedule attached, which is the length of time that you have to wait before you can actually exercise the option to buy share. If your options are vested, you've held the options long enough and can exercise them.