Dividend Equivalent Shares

Description

How to fill out Dividend Equivalent Shares?

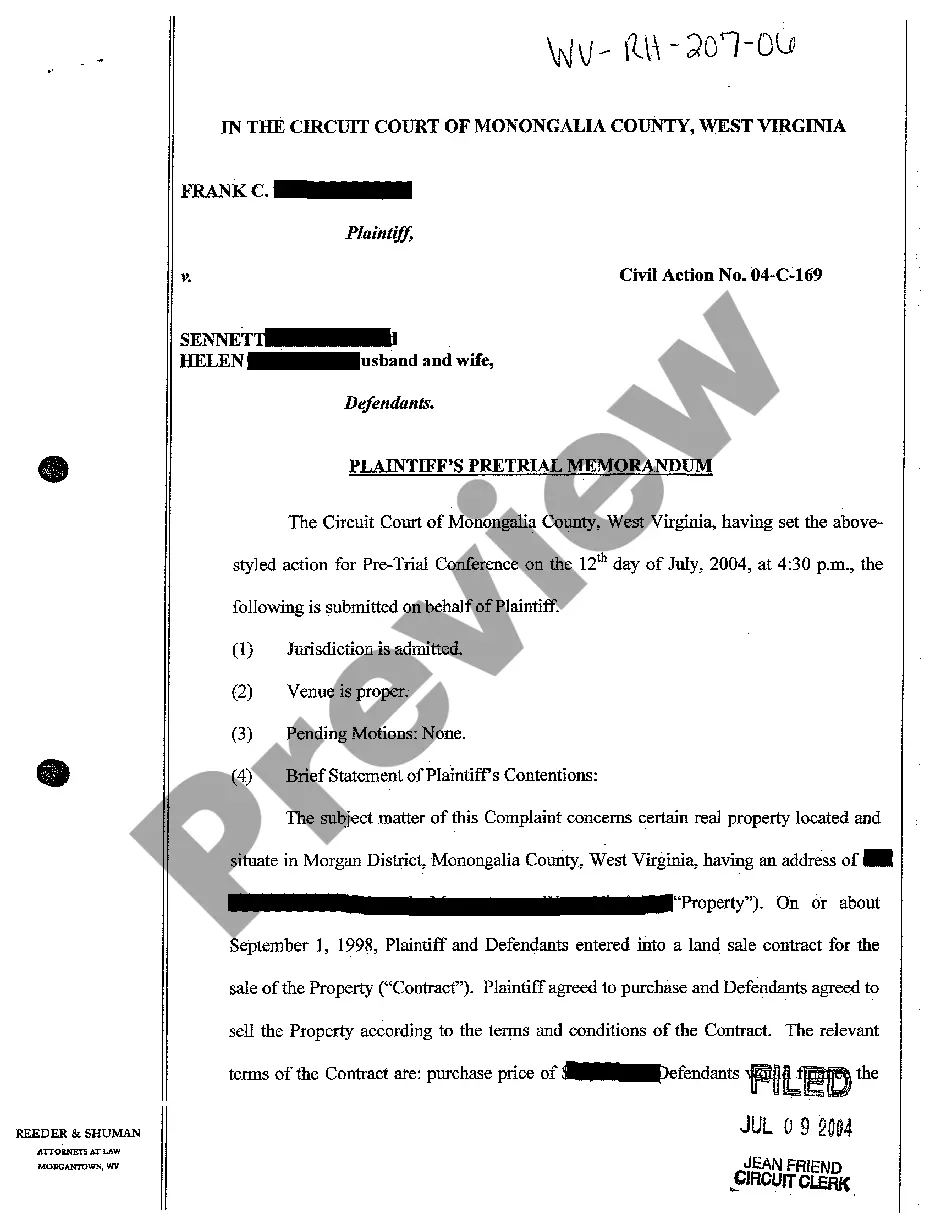

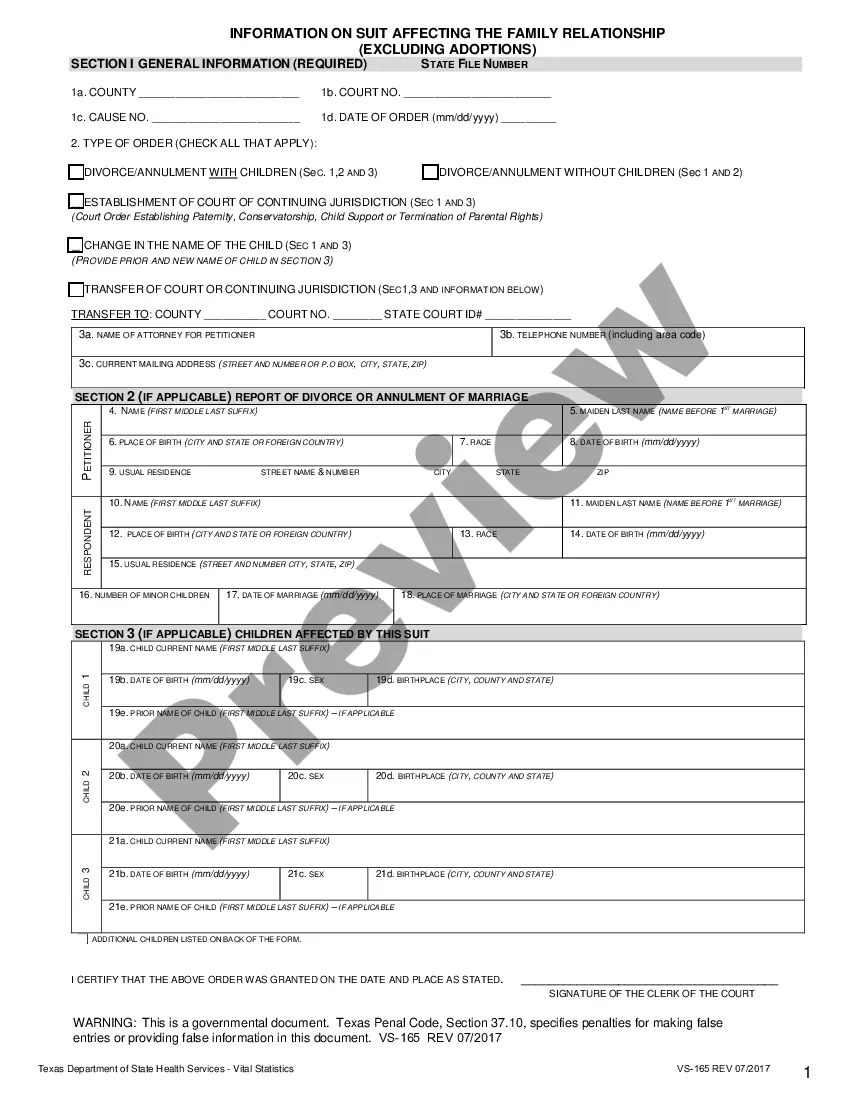

When it comes to drafting a legal document, it is better to delegate it to the specialists. However, that doesn't mean you yourself cannot get a template to use. That doesn't mean you yourself can’t get a template to utilize, however. Download Dividend Equivalent Shares straight from the US Legal Forms site. It provides numerous professionally drafted and lawyer-approved documents and samples.

For full access to 85,000 legal and tax forms, users simply have to sign up and select a subscription. When you’re signed up with an account, log in, find a specific document template, and save it to My Forms or download it to your device.

To make things less difficult, we’ve included an 8-step how-to guide for finding and downloading Dividend Equivalent Shares quickly:

- Make confident the document meets all the necessary state requirements.

- If available preview it and read the description before buying it.

- Press Buy Now.

- Select the suitable subscription for your requirements.

- Make your account.

- Pay via PayPal or by debit/credit card.

- Choose a needed format if several options are available (e.g., PDF or Word).

- Download the document.

After the Dividend Equivalent Shares is downloaded it is possible to complete, print out and sign it in almost any editor or by hand. Get professionally drafted state-relevant files within a matter of minutes in a preferable format with US Legal Forms!

Form popularity

FAQ

You typically receive the shares after the vesting date. Only then do you have voting and dividend rights. Companies can and sometimes do pay dividend equivlent payouts for unvested RSUs.Unlike stock options, RSUs always have some value to you, even when the stock price drops below the price on the grant date.

Shares outstanding include shares of unvested restricted stock.Shares of unvested restricted stock are excluded from our calculation of basic weighted average shares outstanding, but their dilutive impact is added back in the calculation of diluted weighted average shares outstanding.

RSUs are taxed as income to you when they vest. If you sell your shares immediately, there is no capital gain tax, and the only tax you owe is on the income. However, if the shares are held beyond the vesting date, any gain (or loss) is taxed as a capital gain (or loss).

With restricted stock and restricted stock units, upon job termination you almost always forfeit whatever stock has not vested. Exceptions can occur, depending on the vesting terms of your employment agreement or stock plan, such as special provisions for disability, retirement, or an acquisition.

IPO Lock-Up Period and Long Term Capital Gains In most scenarios when your RSUs vest you can sell them immediately and there is almost no tax impact.However, if the stock reverts to the original IPO/Vesting date price, don't hesitate to sell since there will be no additional tax benefit.

Dividend equivalents paid on restricted stock units are treated as compensation income and will be subject to federal income tax when paid to the employee.When dividend equivalents are paid on a current basis, they are subject to federal income tax at the time of the payment.

Dividend Equivalents means a right, granted to a Participant under the Plan, to receive cash, shares, other Awards or other property equal in value to dividends paid with respect to shares of Stock.

A dividend equivalent payment is any gross amount that references the payment of a dividend on a U.S. equity and that is used to compute any net amount transferred to or from the long party, even if the long party make a net payment to the short party or the net payment is zero.

RSUs do not offer voting rights until actual shares are issued at vesting. No Dividends. RSUs cannot pay dividends, because no actual shares are used (employers can pay cash dividend equivalents if they choose). No Section 83(b) Election.