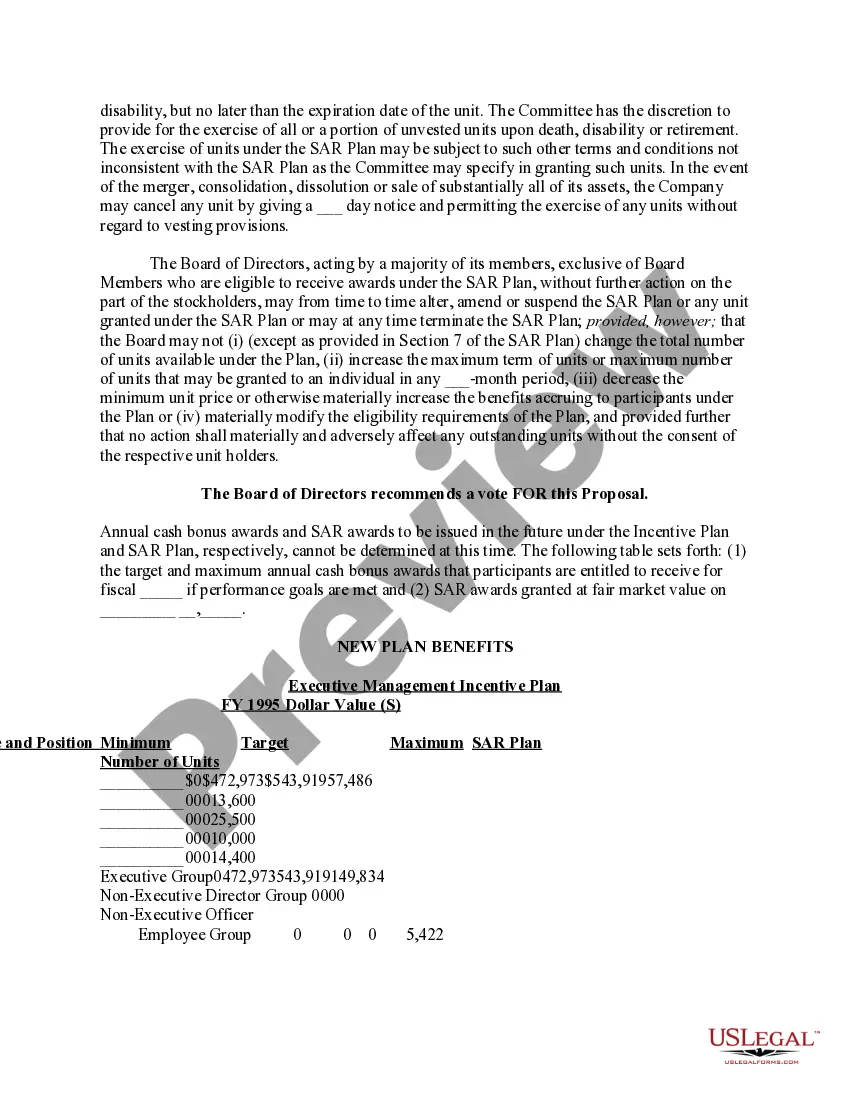

Proposal to approve material terms of stock appreciation right plan

Description

How to fill out Proposal To Approve Material Terms Of Stock Appreciation Right Plan?

When it comes to drafting a legal document, it’s easier to delegate it to the specialists. However, that doesn't mean you yourself cannot get a template to utilize. That doesn't mean you yourself can’t find a template to use, nevertheless. Download Proposal to approve material terms of stock appreciation right plan right from the US Legal Forms web site. It gives you a wide variety of professionally drafted and lawyer-approved forms and templates.

For full access to 85,000 legal and tax forms, users simply have to sign up and select a subscription. After you’re signed up with an account, log in, look for a certain document template, and save it to My Forms or download it to your gadget.

To make things less difficult, we have provided an 8-step how-to guide for finding and downloading Proposal to approve material terms of stock appreciation right plan fast:

- Make sure the document meets all the necessary state requirements.

- If possible preview it and read the description prior to buying it.

- Hit Buy Now.

- Select the suitable subscription for your needs.

- Create your account.

- Pay via PayPal or by credit/visa or mastercard.

- Choose a needed format if several options are available (e.g., PDF or Word).

- Download the document.

When the Proposal to approve material terms of stock appreciation right plan is downloaded you can complete, print out and sign it in almost any editor or by hand. Get professionally drafted state-relevant documents within a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

In accounting for such stock appreciation right (SAR) agreements, the company should accrue a liability and recognize expense over the term of service. At the end of this service period, the liability will be settled with cash or stock or both.

SAR uses the motion of the radar antenna over a target region to provide finer spatial resolution than conventional beam-scanning radars.To create a SAR image, successive pulses of radio waves are transmitted to "illuminate" a target scene, and the echo of each pulse is received and recorded.

What Are Stock Appreciation Rights? Stock appreciation rights (SARs) are a type of employee compensation linked to the company's stock price during a predetermined period. SARs are profitable for employees when the company's stock price rises, which makes them similar to employee stock options (ESOs).

Stock Appreciation Rights Are Not Securities. Claim that exercise of cash appreciation of Stock Appreciation Rights involved insider trading and securities fraud rejected for lack of evidence of fraud and because the Rights are not securities. Riverwood granted its senior executives stock appreciation rights (SARs).

There are no federal income tax consequences when you are granted stock appreciation rights. However, at exercise you must recognize compensation income on the fair market value of the amount received at vesting. An employer is generally obligated to withhold taxes.

SAR Agreement means a written agreement between the Company and a Participant evidencing the terms and conditions of an individual Award of Stock Appreciation Rights.

Key Takeaways. Stock appreciation rights (SARs) are a type of employee compensation linked to the company's stock price during a preset period. Unlike stock options, SARs are often paid in cash and do not require the employee to own any asset or contract.

Stock appreciation rights (SAR) is a method for companies to give their management or employees a bonus if the company performs well financially. Such a method is called a 'plan'. SARs resemble employee stock options in that the holder/employee benefits from an increase in stock price.

Stock appreciation rights are a type of incentive plan based on your stock's value. Employees receive a bonus in cash or equivalent number of shares based on how much the stock value increases over a set period of time - usually from the date of granting the right up until the right is exercised.