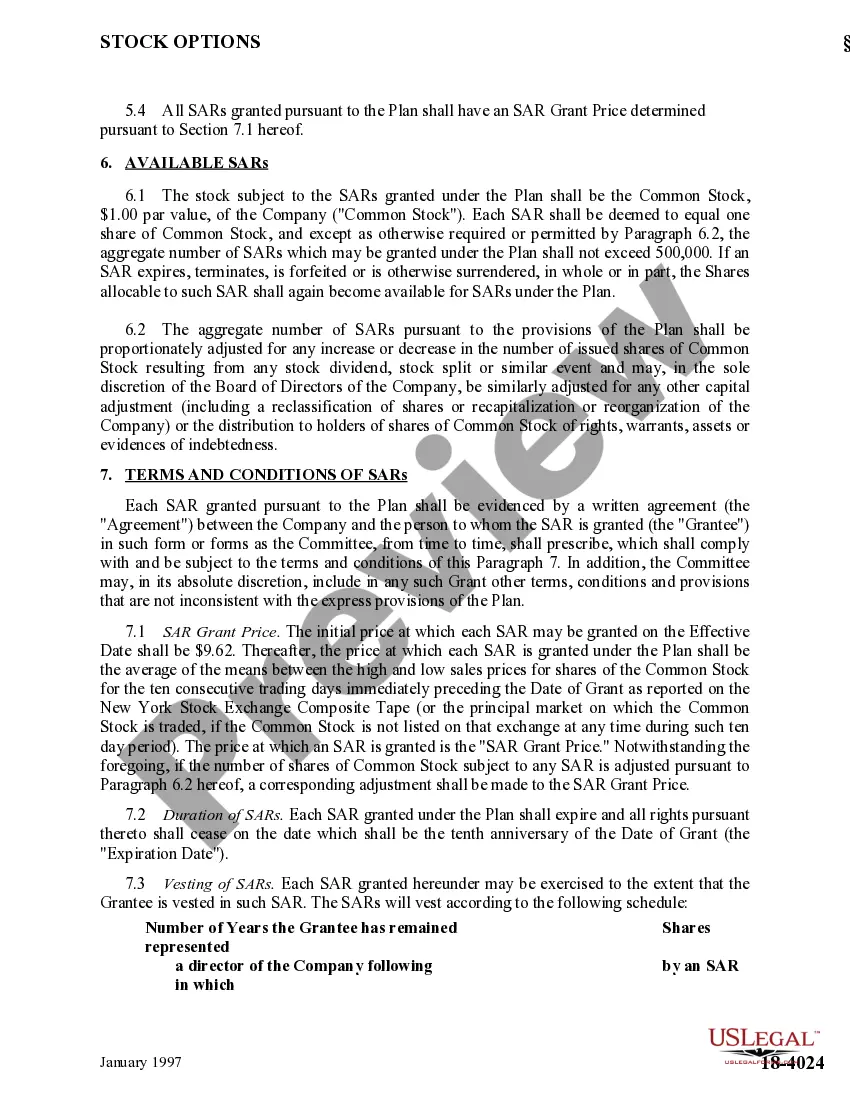

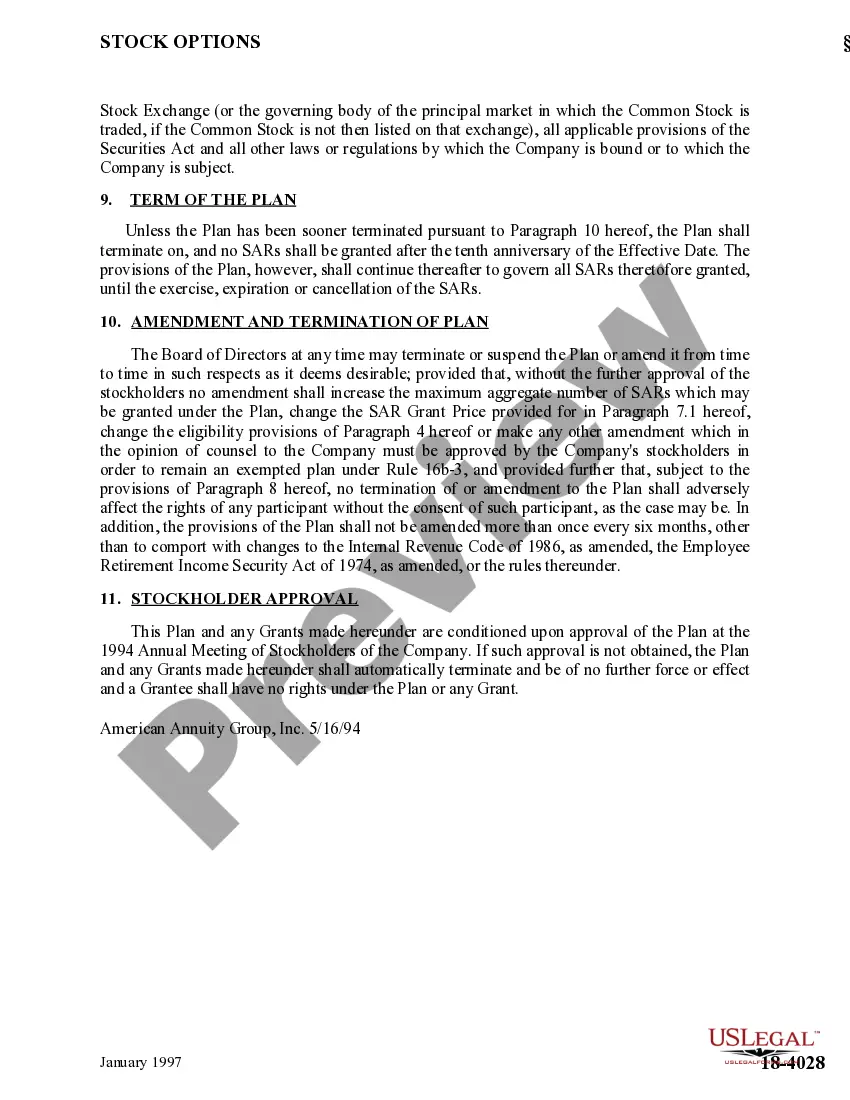

Directors Stock Appreciation Rights Plan of American Annuity Group, Inc.

Description

How to fill out Directors Stock Appreciation Rights Plan Of American Annuity Group, Inc.?

When it comes to drafting a legal form, it is better to leave it to the specialists. Nevertheless, that doesn't mean you yourself can’t find a template to utilize. That doesn't mean you yourself cannot find a sample to use, nevertheless. Download Directors Stock Appreciation Rights Plan of American Annuity Group, Inc. right from the US Legal Forms web site. It offers a wide variety of professionally drafted and lawyer-approved forms and samples.

For full access to 85,000 legal and tax forms, users just have to sign up and choose a subscription. After you are signed up with an account, log in, look for a specific document template, and save it to My Forms or download it to your device.

To make things less difficult, we’ve included an 8-step how-to guide for finding and downloading Directors Stock Appreciation Rights Plan of American Annuity Group, Inc. fast:

- Make confident the document meets all the necessary state requirements.

- If possible preview it and read the description prior to buying it.

- Click Buy Now.

- Select the appropriate subscription to meet your needs.

- Make your account.

- Pay via PayPal or by credit/credit card.

- Select a preferred format if a few options are available (e.g., PDF or Word).

- Download the document.

As soon as the Directors Stock Appreciation Rights Plan of American Annuity Group, Inc. is downloaded you can fill out, print out and sign it in any editor or by hand. Get professionally drafted state-relevant documents within a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

Stock appreciation rights are a type of incentive plan based on your stock's value. Employees receive a bonus in cash or equivalent number of shares based on how much the stock value increases over a set period of time - usually from the date of granting the right up until the right is exercised.

There are no federal income tax consequences when you are granted stock appreciation rights. However, at exercise you must recognize compensation income on the fair market value of the amount received at vesting. An employer is generally obligated to withhold taxes.

Stock appreciation rights are a type of incentive plan based on your stock's value. Employees receive a bonus in cash or equivalent number of shares based on how much the stock value increases over a set period of time - usually from the date of granting the right up until the right is exercised.

Generally, any profit you make on the sale of a stock is taxable at either 0%, 15% or 20% if you held the shares for more than a year or at your ordinary tax rate if you held the shares for less than a year. Also, any dividends you receive from a stock are usually taxable.

Stock Appreciation Rights Are Not Securities. Claim that exercise of cash appreciation of Stock Appreciation Rights involved insider trading and securities fraud rejected for lack of evidence of fraud and because the Rights are not securities. Riverwood granted its senior executives stock appreciation rights (SARs).

There are no federal income tax consequences when you are granted stock appreciation rights. However, at exercise you must recognize compensation income on the fair market value of the amount received at vesting. An employer is generally obligated to withhold taxes.

Invest for the long term. Take advantage of tax-deferred retirement plans. Use capital losses to offset gains. Watch your holding periods. Pick your cost basis.

In many cases, you can calculate the stock price appreciation simply by subtracting the current price of the stock from the original price of the stock. For example, if you bought a stock for $100 a year ago and now it is worth $120, subtract $100 from $120 to find the stock price has appreciated by $20.