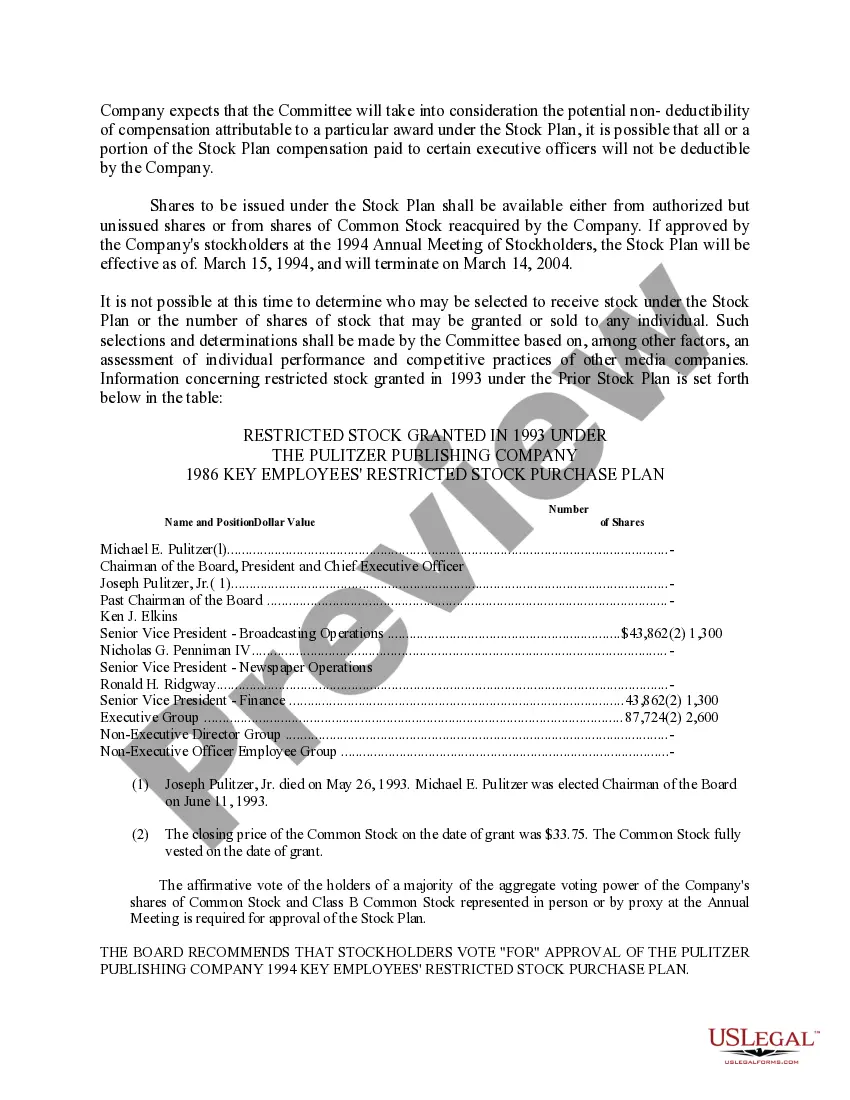

Approval of Key Employees' Restricted Stock Purchase Plan of The Pulitzer Publishing Co.

Description

How to fill out Approval Of Key Employees' Restricted Stock Purchase Plan Of The Pulitzer Publishing Co.?

When it comes to drafting a legal document, it is easier to leave it to the professionals. However, that doesn't mean you yourself cannot find a template to utilize. That doesn't mean you yourself can’t find a template to use, nevertheless. Download Approval of Key Employees' Restricted Stock Purchase Plan of The Pulitzer Publishing Co. right from the US Legal Forms site. It gives you a wide variety of professionally drafted and lawyer-approved documents and samples.

For full access to 85,000 legal and tax forms, customers just have to sign up and choose a subscription. Once you’re signed up with an account, log in, find a particular document template, and save it to My Forms or download it to your device.

To make things less difficult, we’ve included an 8-step how-to guide for finding and downloading Approval of Key Employees' Restricted Stock Purchase Plan of The Pulitzer Publishing Co. fast:

- Make confident the form meets all the necessary state requirements.

- If possible preview it and read the description prior to buying it.

- Hit Buy Now.

- Select the appropriate subscription for your needs.

- Create your account.

- Pay via PayPal or by debit/bank card.

- Select a preferred format if a number of options are available (e.g., PDF or Word).

- Download the document.

As soon as the Approval of Key Employees' Restricted Stock Purchase Plan of The Pulitzer Publishing Co. is downloaded it is possible to fill out, print out and sign it in almost any editor or by hand. Get professionally drafted state-relevant files within a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

Stock options are when a company gives an employee the ability to purchase stock at a predetermined price at a given time.Conversely, RSUs are grants of stock that a company gives to an employee without any purchase. Employees get these either as shares or a cash equivalent.

RSUs give an employee interest in company stock but they have no tangible value until vesting is complete.Upon vesting, they are considered income, and a portion of the shares is withheld to pay income taxes. The employee receives the remaining shares and can sell them at their discretion.

IPO Lock-Up Period and Long Term Capital Gains In most scenarios when your RSUs vest you can sell them immediately and there is almost no tax impact.However, if the stock reverts to the original IPO/Vesting date price, don't hesitate to sell since there will be no additional tax benefit.

For RSUs, the profit/gain is the difference between the sale price and the vesting price. For ESOPs, the profit/gain is the difference between the sale price and the exercise price. For ESPPs, the profit/gain is the difference between the sale price and the market price, at the time of purchase.

A Restricted Stock Plan is a common way to share stock with employees in public companies.Customarily, restricted stock will carry a vesting schedule so that employees will forfeit some or all of the shares unless they remain with the company for a specified number of years (e.g. 3 or 4).

So that's the basic accounting for restricted stock under GAAP. The key takeaways are:The value recognized for each restricted share is the same as its current share price (for non-dividend paying stock). Restricted stock is recognized on the income statement over the service period.

If you measure 1 RSU against 1 stock option, RSUs are pretty much always going to win. Because an RSU is basically just a stock option with a $0 strike price, and a stock option is always going to have a strike price higher than $0.Companies know this and generally will offer you more options than they would RSUs.