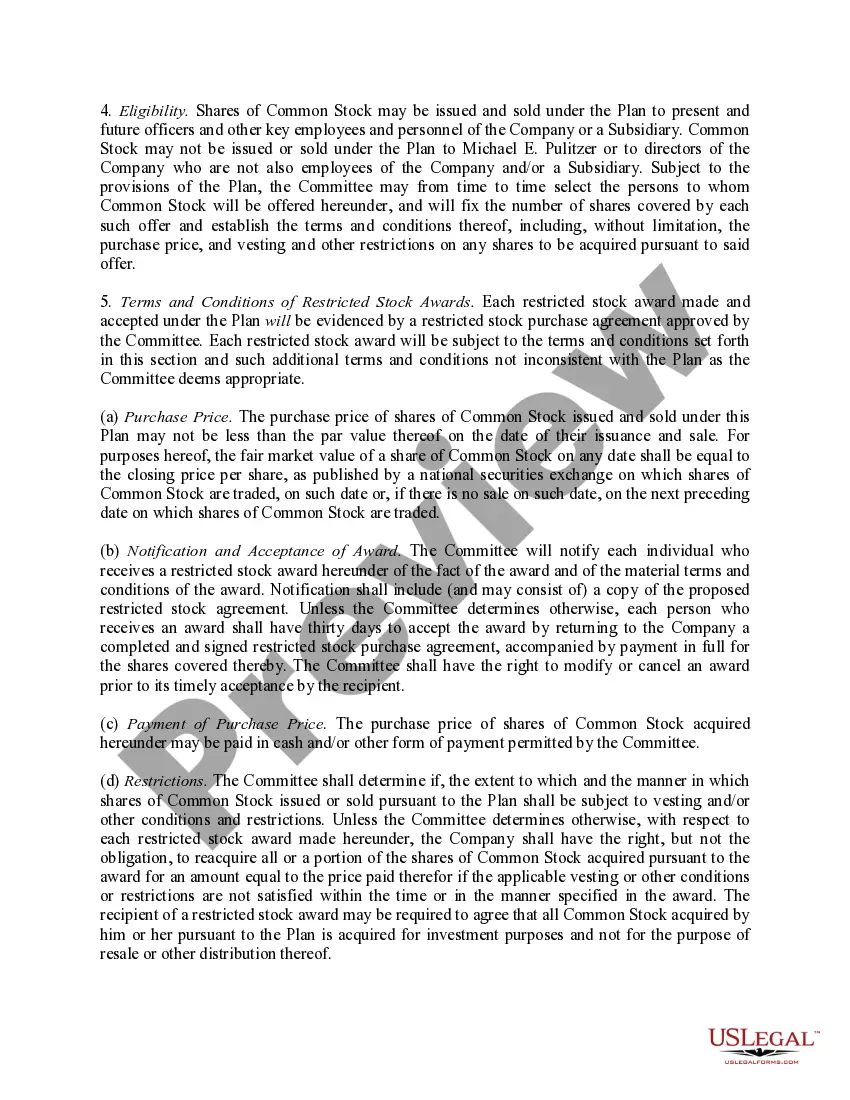

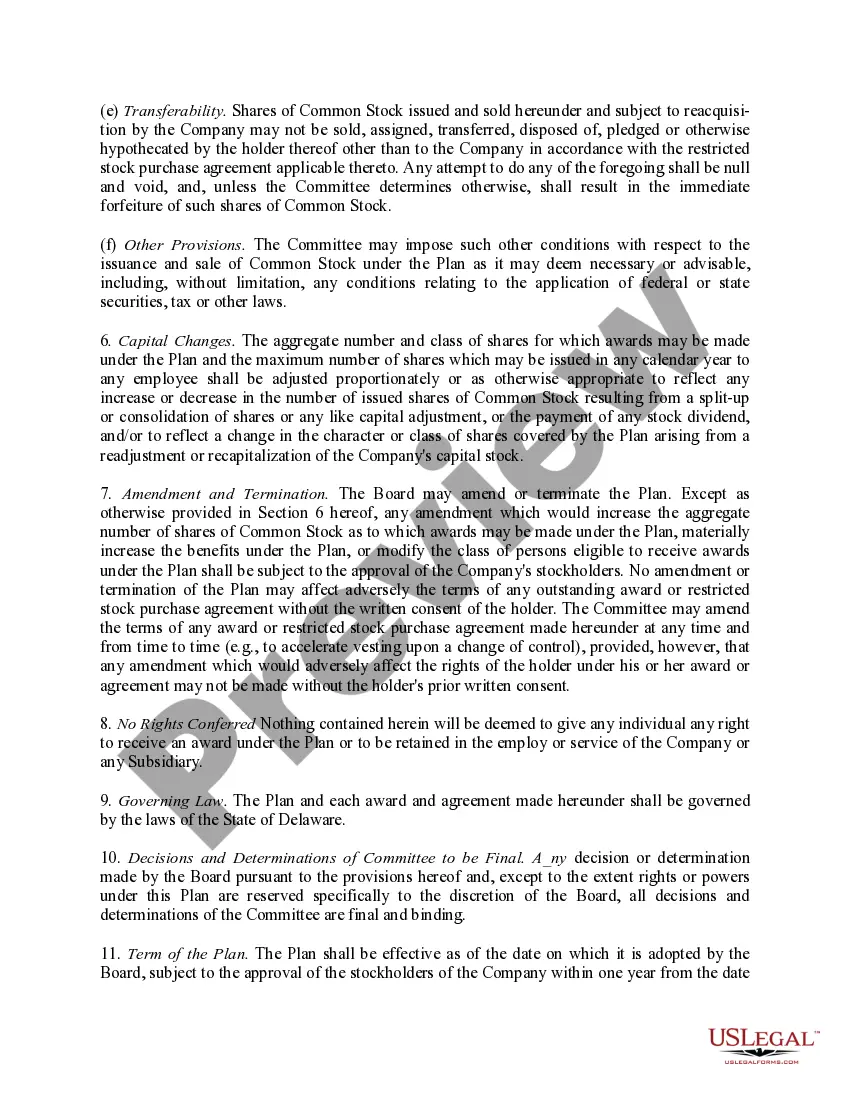

Key Employees' Restricted Stock Purchase Plan for Pulitzer Publishing Co.

Description Employees Stock Publishing

How to fill out Key Employees' Restricted Stock Purchase Plan For Pulitzer Publishing Co.?

When it comes to drafting a legal form, it is easier to delegate it to the professionals. However, that doesn't mean you yourself can’t find a sample to utilize. That doesn't mean you yourself cannot get a template to utilize, nevertheless. Download Key Employees' Restricted Stock Purchase Plan for Pulitzer Publishing Co. right from the US Legal Forms site. It offers a wide variety of professionally drafted and lawyer-approved documents and templates.

For full access to 85,000 legal and tax forms, customers just have to sign up and select a subscription. After you are registered with an account, log in, search for a specific document template, and save it to My Forms or download it to your device.

To make things much easier, we’ve incorporated an 8-step how-to guide for finding and downloading Key Employees' Restricted Stock Purchase Plan for Pulitzer Publishing Co. promptly:

- Make sure the document meets all the necessary state requirements.

- If possible preview it and read the description before buying it.

- Click Buy Now.

- Choose the suitable subscription to meet your needs.

- Make your account.

- Pay via PayPal or by credit/credit card.

- Choose a preferred format if a number of options are available (e.g., PDF or Word).

- Download the file.

As soon as the Key Employees' Restricted Stock Purchase Plan for Pulitzer Publishing Co. is downloaded you are able to fill out, print out and sign it in almost any editor or by hand. Get professionally drafted state-relevant documents within a matter of seconds in a preferable format with US Legal Forms!

Employees Stock Purchase Form popularity

Restricted Purchase Order Other Form Names

FAQ

RSUs are generally always worth something versus stock options, which can expire worthless if the stock price is below the strike price. Additionally, with RSUs you don't have to come up with the cash to exercise the options if your company doesn't offer some sort of cashless exercise option.

When you receive an RSU, you don't have any immediate tax liability. You only have to pay taxes when your RSU vests and you receive an actual payout of stock shares. At that point, you have to report income based on the fair market value of the stock.

A Restricted Stock Plan is a common way to share stock with employees in public companies.Customarily, restricted stock will carry a vesting schedule so that employees will forfeit some or all of the shares unless they remain with the company for a specified number of years (e.g. 3 or 4).

The details of RSU accounting are beyond the scope of this brief discussion, but, in general, RSUs that can be settled only in shares receive accounting treatment similar to restricted stock. The fair value of the award, based on the stock price at the time of the grant, is expensed over the service period.

Stock options are only valuable if the market value of the stock is higher than the grant price at some point in the vesting period. Otherwise, you're paying more for the shares than you could in theory sell them for. RSUs, meanwhile, are pure gain, as you don't have to pay for them.

So that's the basic accounting for restricted stock under GAAP. The key takeaways are:The value recognized for each restricted share is the same as its current share price (for non-dividend paying stock). Restricted stock is recognized on the income statement over the service period.

Restricted shares are shares that are already included in the number of outstanding shares.Typically, these shares are owned by insiders such as employees and initial investors.

Fulfill the SEC holding period requirements. From the date the shares are fully paid for, you must hold them at least six months. Comply with federal reporting requirements. Check trading volume. Remove the stock legend. Conduct an ordinary brokerage transaction. File required notices with the SEC.

The relevant considerations are whether you should keep the shares and, if not, when to sell them. In the majority of cases, it's best to sell your vested RSU shares as you receive them and add the proceeds to your well-diversified investment portfolio.