Restricted Stock Plan of Sundstrand Corp.

Description

How to fill out Restricted Stock Plan Of Sundstrand Corp.?

When it comes to drafting a legal form, it is better to delegate it to the specialists. However, that doesn't mean you yourself can not get a template to use. That doesn't mean you yourself can not get a sample to utilize, however. Download Restricted Stock Plan of Sundstrand Corp. right from the US Legal Forms website. It provides numerous professionally drafted and lawyer-approved forms and samples.

For full access to 85,000 legal and tax forms, customers simply have to sign up and choose a subscription. Once you’re signed up with an account, log in, look for a particular document template, and save it to My Forms or download it to your gadget.

To make things much easier, we’ve incorporated an 8-step how-to guide for finding and downloading Restricted Stock Plan of Sundstrand Corp. quickly:

- Make confident the document meets all the necessary state requirements.

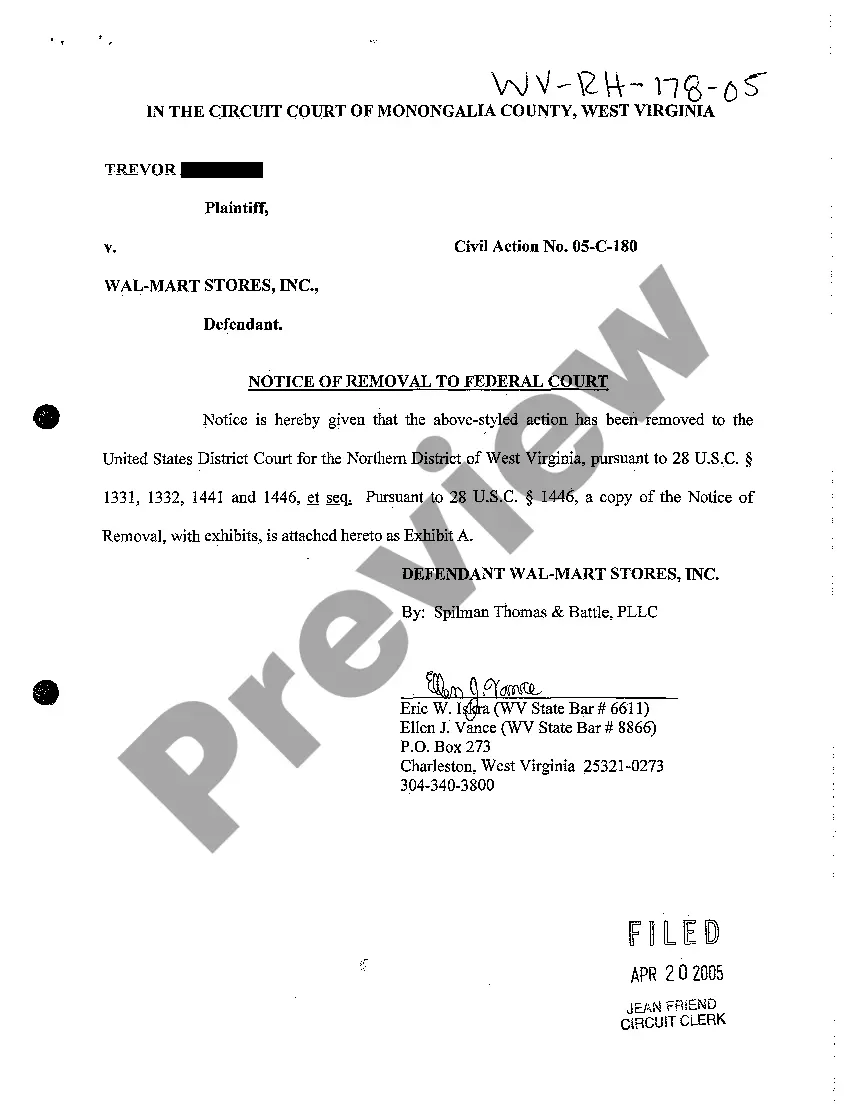

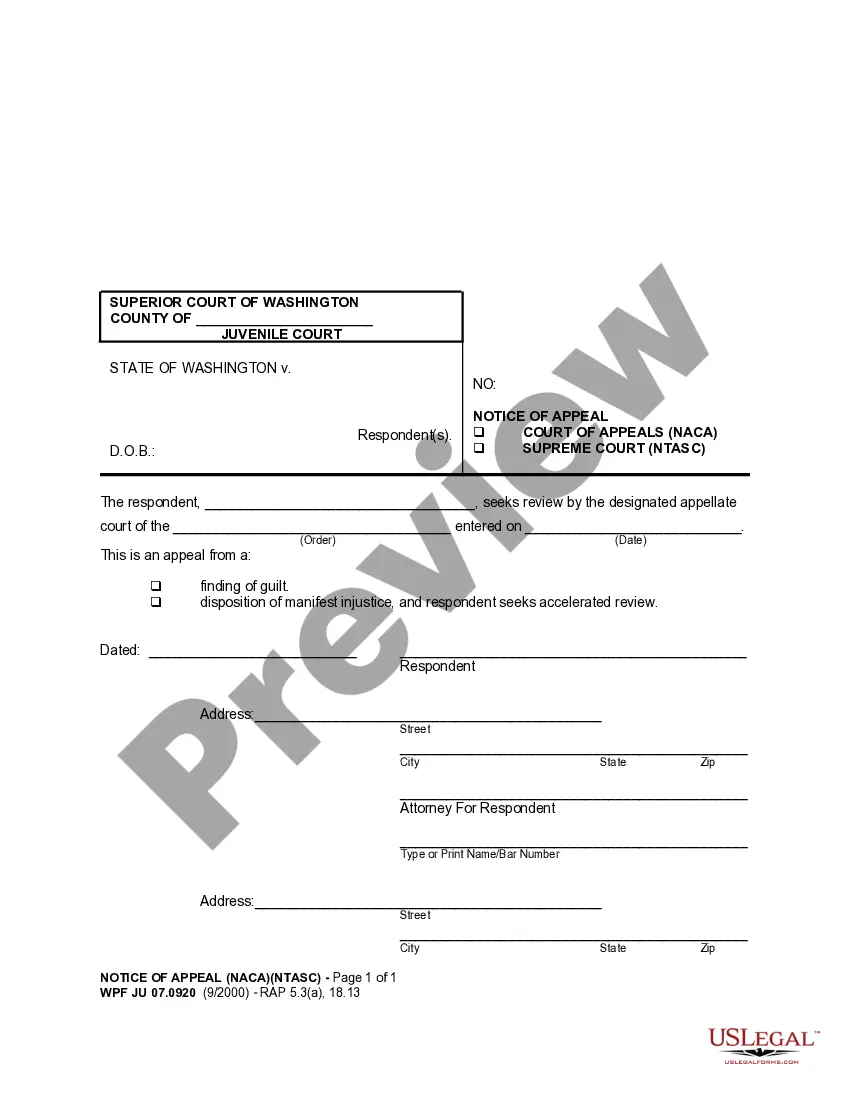

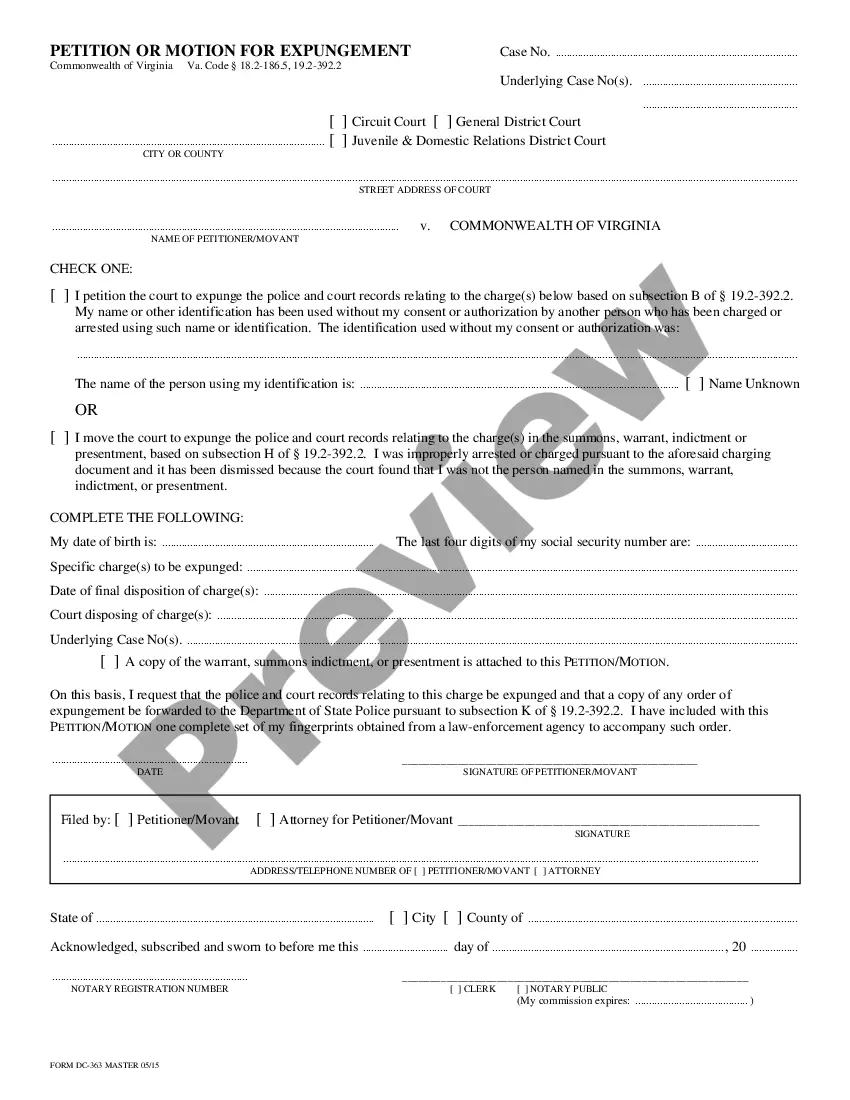

- If possible preview it and read the description before buying it.

- Hit Buy Now.

- Select the appropriate subscription to meet your needs.

- Make your account.

- Pay via PayPal or by debit/credit card.

- Choose a needed format if a few options are available (e.g., PDF or Word).

- Download the file.

Once the Restricted Stock Plan of Sundstrand Corp. is downloaded you can fill out, print and sign it in almost any editor or by hand. Get professionally drafted state-relevant files within a matter of minutes in a preferable format with US Legal Forms!

Form popularity

FAQ

Tax ownership of stock.If the corporation is an S corporation, the recipient does not report any of the corporation's taxable income or loss as a shareholder. It is not unusual for S corporations to require that recipients of restricted stock make Section 83(b) elections.

S corp stock options are limited, as these corporations are not allowed to issue common or preferred stock. S corporations also must be careful about how many stocks they are issuing, as having too many shareholders can cause the loss of the S corporation tax status.

Protected assets. An S corporation protects the personal assets of its shareholders. Pass-through taxation. Tax-favorable characterization of income. Straightforward transfer of ownership. Cash method of accounting. Heightened credibility.

Consequently, an S corporation may have a phantom stock plan without terminating its S corporation election. To avoid losing the "S election," the phantom stock plan must be structured carefully. Some of the criteria for an effective phantom stock plan for an S corporation includes: Liquidation rights must be limited.

RSUs are generally always worth something versus stock options, which can expire worthless if the stock price is below the strike price. Additionally, with RSUs you don't have to come up with the cash to exercise the options if your company doesn't offer some sort of cashless exercise option.

Be a domestic corporation. Have only allowable shareholders. Have no more than 100 shareholders. Have only one class of stock.

Since stock you receive through stock grants and RSUs is essentially compensation, you'll usually see it reported automatically on your W-2. Typically, taxes are withheld to go against what you might owe when you do your taxes.

Stock options are only valuable if the market value of the stock is higher than the grant price at some point in the vesting period. Otherwise, you're paying more for the shares than you could in theory sell them for. RSUs, meanwhile, are pure gain, as you don't have to pay for them.

Stock Component is also a significant part of the CTC at most companies. This component contains company shares, equity, ESOPs (Employee Stock Ownership Plan), or RSUs (Restricted Stock Units) depending on whether the company is listed in the stock market or not. The stocks are generally not provided when you join.