Employee Bonus Plan Template

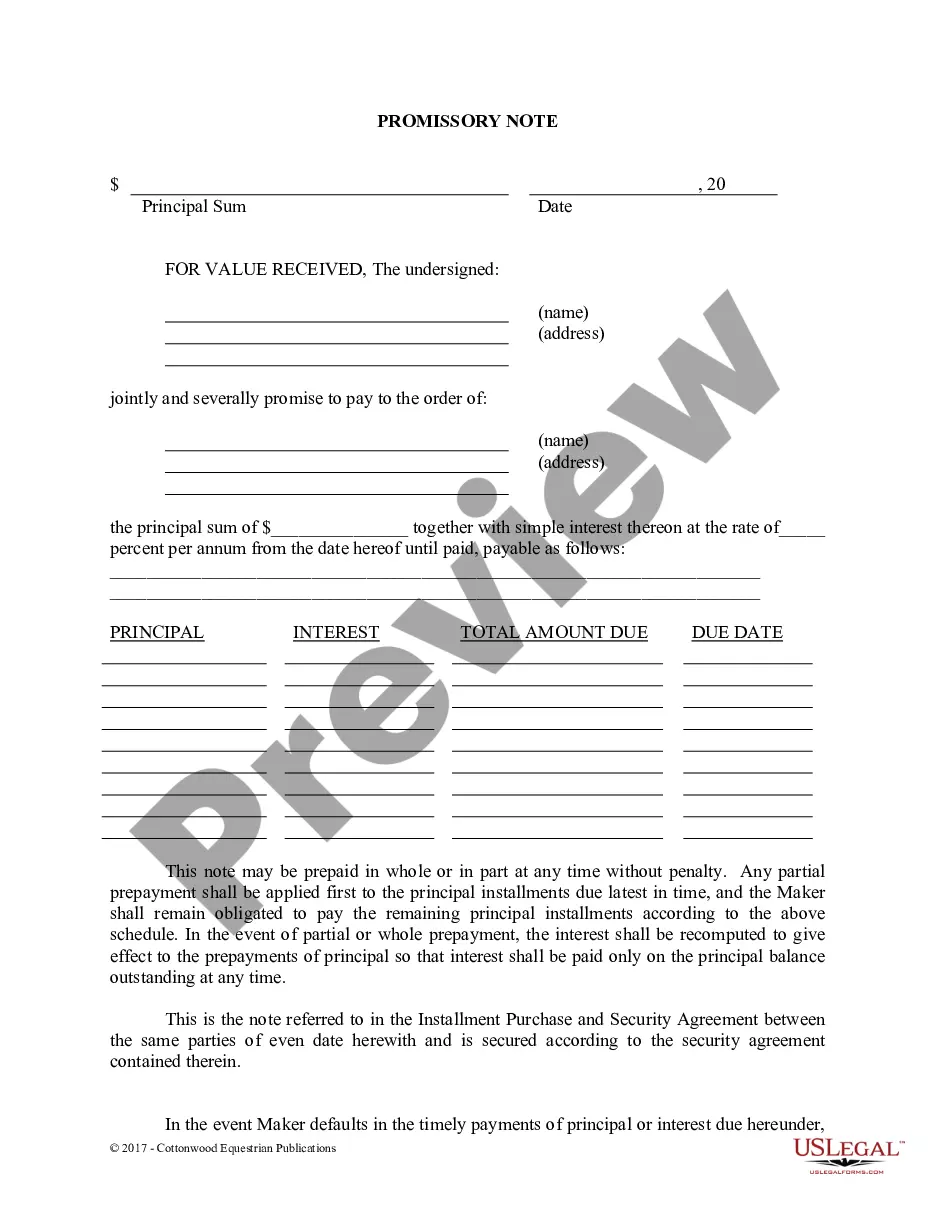

Description Executive Plan

How to fill out Executive Plan Sample?

When it comes to drafting a legal document, it is better to delegate it to the professionals. However, that doesn't mean you yourself can’t get a sample to use. That doesn't mean you yourself can’t get a template to utilize, nevertheless. Download Executive Bonus Plan right from the US Legal Forms website. It provides a wide variety of professionally drafted and lawyer-approved forms and templates.

For full access to 85,000 legal and tax forms, customers just have to sign up and choose a subscription. Once you’re registered with an account, log in, search for a certain document template, and save it to My Forms or download it to your gadget.

To make things much easier, we’ve included an 8-step how-to guide for finding and downloading Executive Bonus Plan promptly:

- Make confident the form meets all the necessary state requirements.

- If possible preview it and read the description before purchasing it.

- Hit Buy Now.

- Select the suitable subscription to meet your needs.

- Make your account.

- Pay via PayPal or by debit/visa or mastercard.

- Select a needed format if a number of options are available (e.g., PDF or Word).

- Download the file.

Once the Executive Bonus Plan is downloaded you can complete, print out and sign it in any editor or by hand. Get professionally drafted state-relevant documents in a matter of minutes in a preferable format with US Legal Forms!