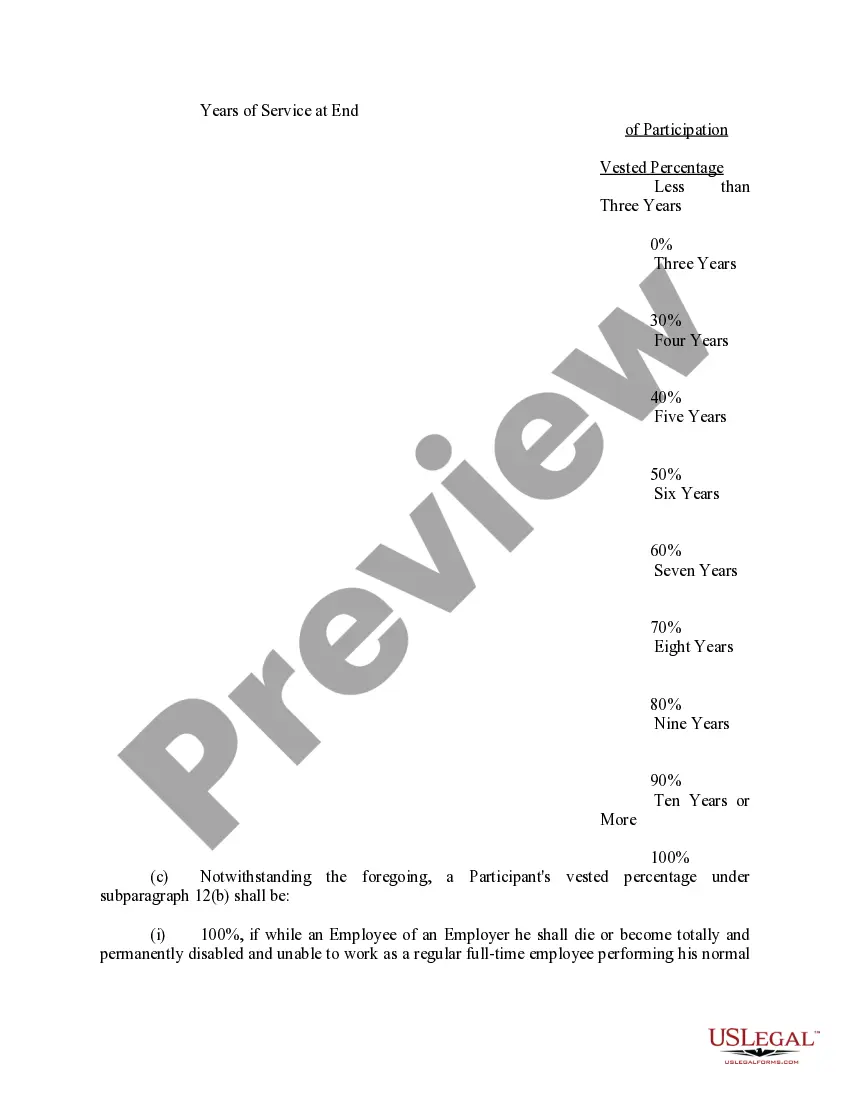

Executive Stock Incentive Plan of Octo Limited

Description

How to fill out Executive Stock Incentive Plan Of Octo Limited?

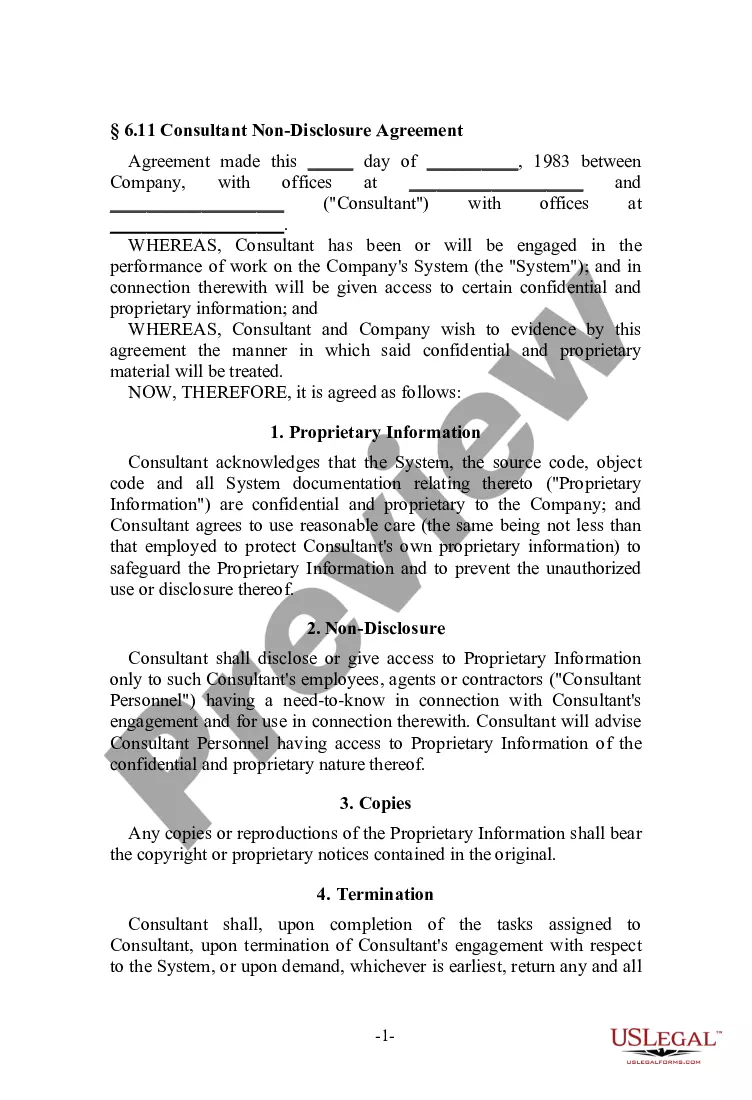

When it comes to drafting a legal document, it is better to leave it to the professionals. Nevertheless, that doesn't mean you yourself cannot get a template to utilize. That doesn't mean you yourself cannot find a sample to use, however. Download Executive Stock Incentive Plan of Octo Limited straight from the US Legal Forms website. It gives you numerous professionally drafted and lawyer-approved forms and samples.

For full access to 85,000 legal and tax forms, customers just have to sign up and select a subscription. After you are registered with an account, log in, find a certain document template, and save it to My Forms or download it to your gadget.

To make things less difficult, we have provided an 8-step how-to guide for finding and downloading Executive Stock Incentive Plan of Octo Limited promptly:

- Make confident the document meets all the necessary state requirements.

- If available preview it and read the description before buying it.

- Press Buy Now.

- Choose the appropriate subscription to meet your needs.

- Create your account.

- Pay via PayPal or by debit/credit card.

- Select a needed format if a few options are available (e.g., PDF or Word).

- Download the file.

As soon as the Executive Stock Incentive Plan of Octo Limited is downloaded you can complete, print out and sign it in any editor or by hand. Get professionally drafted state-relevant documents in a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit. The profit on qualified ISOs is usually taxed at the capital gains rate, not the higher rate for ordinary income.

An executive stock option is a contract that grants the right to buy a specified number of shares of the company's stock at a guaranteed "strike price" for a period of time, usually several years.

Executive stock options incentivize CEOs to preform at the highest level. These increases in compensationdriven by improved business performancewould not represent a transfer of wealth from shareholders to executives.

An incentive scheme basically involves monetary rewards, i.e., incentive pay but also includes non-monetary rewards. Incentives are variable rewards granted according to level of achievement of specific results. Incentives are payment for performance or payment by results.

They offer employees an opportunity to have ownership in the company they work for and feel more connected to the business as well as to their co-workers. They are a cost-effective company benefit that can help make employment packages more attractive.

Stock options are often issued as a part of a company's incentive program to the company's and its subsidiaries' key persons who are working on the company's projects. The purpose of the stock options is to give personnel a financial incentive to work hard to increase the company's shareholder value.

An incentive scheme basically involves monetary rewards, i.e., incentive pay but also includes non-monetary rewards. Incentives are variable rewards granted according to level of achievement of specific results. Incentives are payment for performance or payment by results.

The price at which the options may be "exercised" is usually the price of the company's stock on the date the options are granted. If the company performs well, the stock price will increase over the exercise price, giving the options value and rewarding the executive for his role in the company's success.

Stock Options When shares go up in value, executives can make a fortune from options. But when share prices fall, investors lose out while executives are no worse off. Indeed, some companies let executives swap old option shares for new, lower-priced shares when the company's shares fall in value.