Approval of savings plan for employees

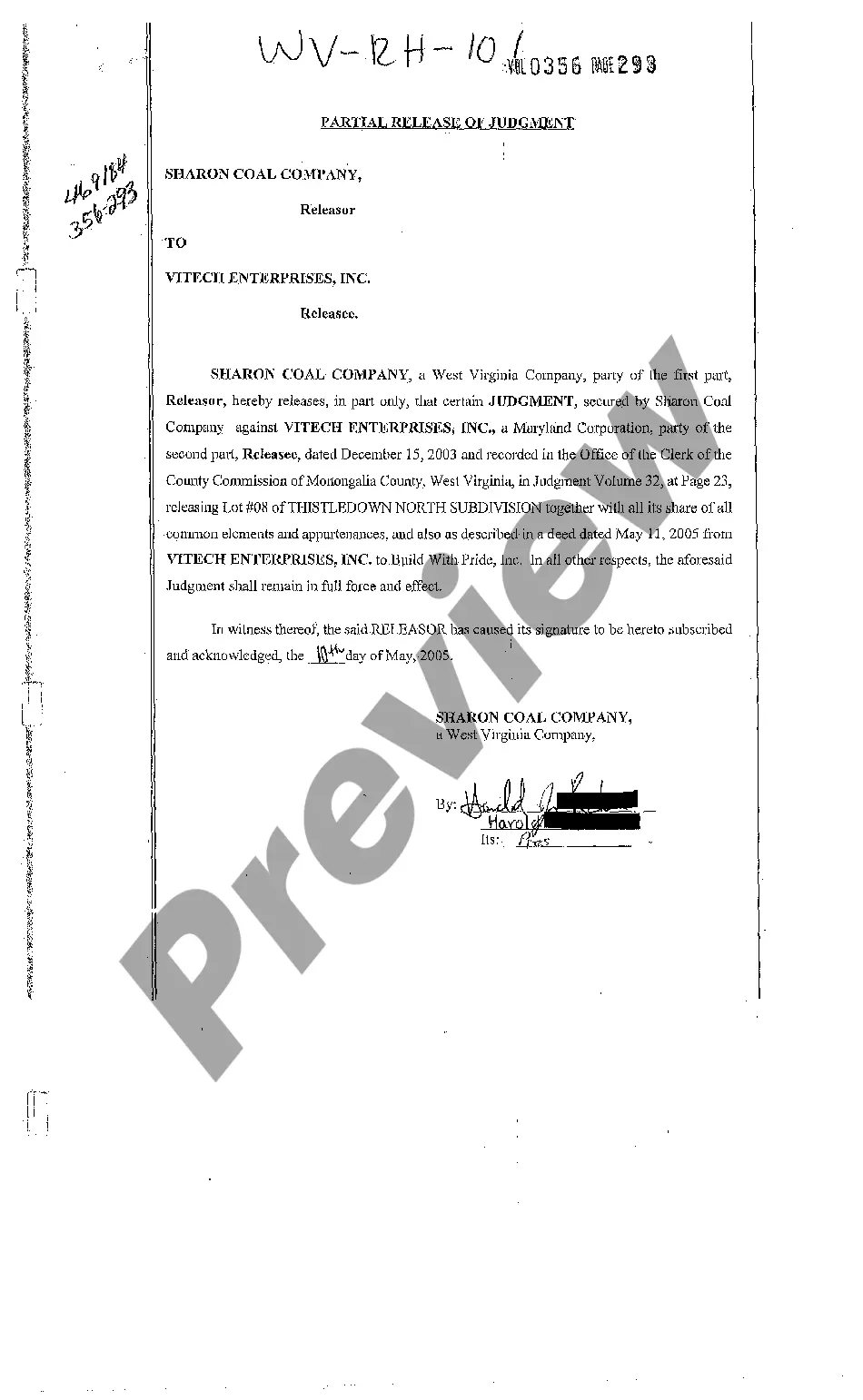

Description

How to fill out Approval Of Savings Plan For Employees?

When it comes to drafting a legal form, it’s easier to leave it to the experts. However, that doesn't mean you yourself can not find a template to utilize. That doesn't mean you yourself can’t get a template to utilize, however. Download Approval of savings plan for employees straight from the US Legal Forms website. It provides numerous professionally drafted and lawyer-approved forms and templates.

For full access to 85,000 legal and tax forms, users just have to sign up and choose a subscription. Once you are signed up with an account, log in, look for a specific document template, and save it to My Forms or download it to your gadget.

To make things much easier, we’ve included an 8-step how-to guide for finding and downloading Approval of savings plan for employees fast:

- Make confident the form meets all the necessary state requirements.

- If available preview it and read the description before purchasing it.

- Click Buy Now.

- Select the suitable subscription for your requirements.

- Make your account.

- Pay via PayPal or by debit/visa or mastercard.

- Select a needed format if several options are available (e.g., PDF or Word).

- Download the file.

When the Approval of savings plan for employees is downloaded it is possible to fill out, print and sign it in any editor or by hand. Get professionally drafted state-relevant files in a matter of minutes in a preferable format with US Legal Forms!

Form popularity

FAQ

Nondiscrimination in coverage, contributions, and benefits. Minimum age and service requirements. Minimum vesting standard. Limits on contributions and benefits. Top-heavy plan requirements.

OregonSaves is a mandate requiring all Oregon business owners to provide a retirement plan to their employees. The mandate was effective starting November 2017 and requires business owners to either sponsor a 401(k) plan (or other qualified retirement plan) or adopt the state-run OregonSaves retirement plan.

How do I Opt Out of OregonSaves? You can go to the website: www.Oregonsaves.com to Opt Out or call 1-844-661-6777 and tell them that you do not wish to have an OregonSaves retirement savings account.

Qualification rules include: Nondiscrimination in coverage, contributions, and benefits. Minimum age and service requirements. Minimum vesting standard. Limits on contributions and benefits.

Qualified retirement plans are employer-sponsored plans that meet the requirements of the Internal Revenue Code for tax-free contributions and tax-deferred growth. Qualified plans can take the form of defined-contribution or defined-benefit plans and can run the gamut from 401(k) plans to pension plans.

Is OregonSaves mandatory? OregonSaves is mandatory only for employers that do not offer a qualified retirement plan. The program is completely voluntary for employees. After you enroll your employees in the program, the state will inform your employees about their automatic enrollment.

The Employee Retirement Income Security Act of 1974 (ERISA) is a Federal law that sets minimum standards for retirement plans in private industry.ERISA does not require any employer to establish a retirement plan. It only requires that those who establish plans must meet certain minimum standards.

An employee savings plan is a pooled investment account that is often matched by an employer. Similar to a 401(k), an employee savings plan, or ESP, lets workers deposit a portion of their pretax earnings, with employers contributing a certain percentage or dollar amount.

OregonSaves is a Roth IRA retirement account with automated enrollment. Employee participation is completely voluntary, and money in workers' accounts is 100 percent fully vested and portable if they change jobs.