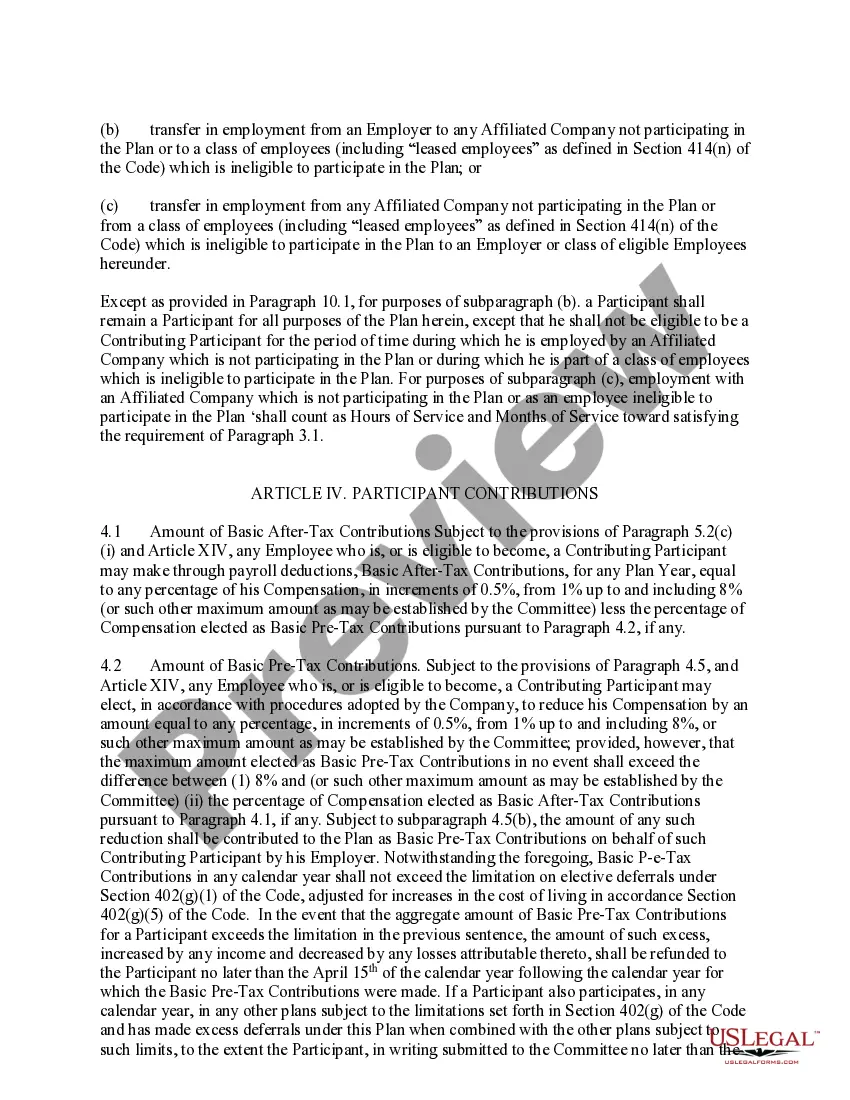

Savings Plan for Employees

Description

How to fill out Savings Plan For Employees?

When it comes to drafting a legal form, it is easier to delegate it to the professionals. However, that doesn't mean you yourself can not find a template to use. That doesn't mean you yourself can’t find a template to use, however. Download Savings Plan for Employees from the US Legal Forms web site. It gives you numerous professionally drafted and lawyer-approved forms and templates.

For full access to 85,000 legal and tax forms, customers just have to sign up and choose a subscription. As soon as you are registered with an account, log in, search for a particular document template, and save it to My Forms or download it to your device.

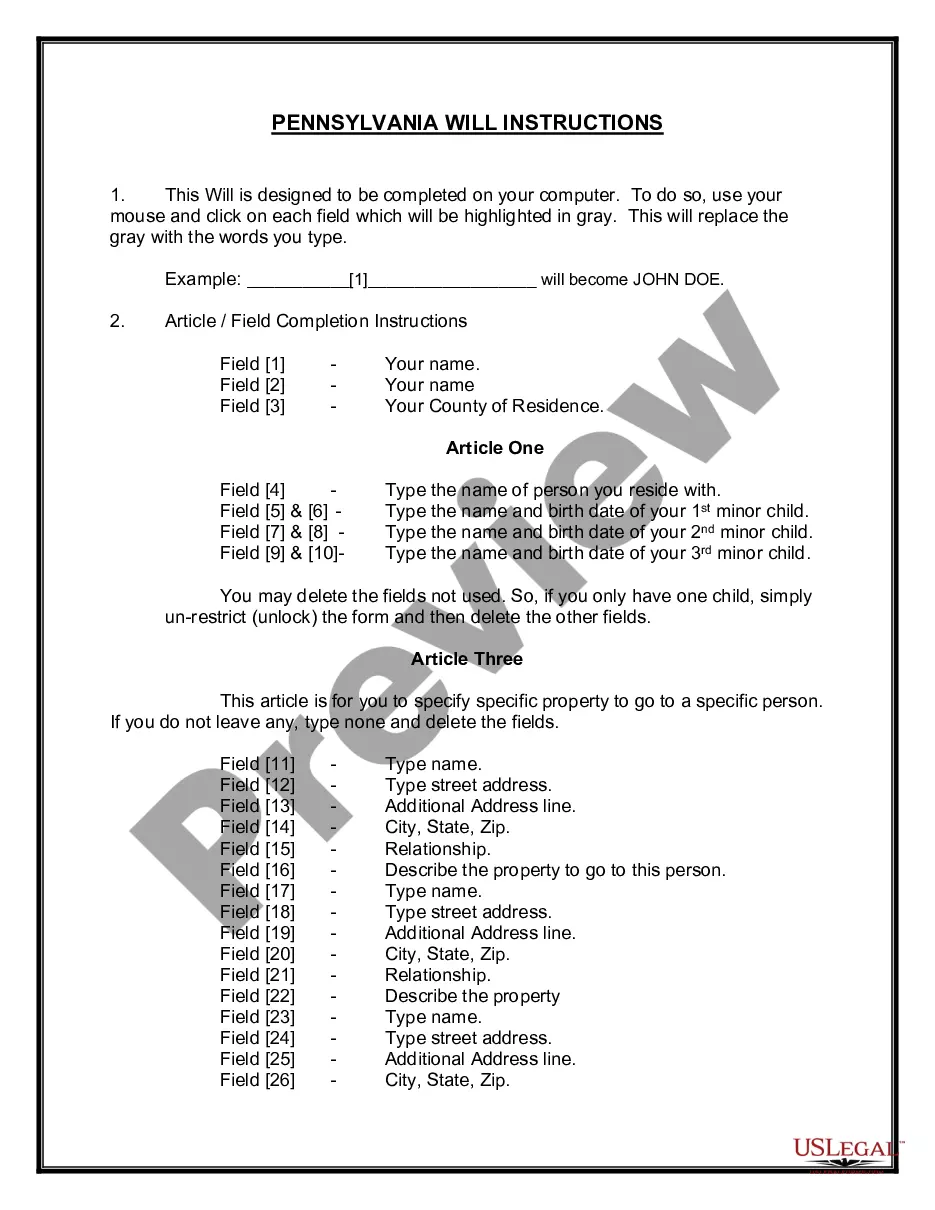

To make things less difficult, we have incorporated an 8-step how-to guide for finding and downloading Savings Plan for Employees fast:

- Be sure the document meets all the necessary state requirements.

- If possible preview it and read the description before purchasing it.

- Click Buy Now.

- Select the suitable subscription for your requirements.

- Create your account.

- Pay via PayPal or by credit/visa or mastercard.

- Choose a needed format if a number of options are available (e.g., PDF or Word).

- Download the file.

After the Savings Plan for Employees is downloaded you can fill out, print and sign it in any editor or by hand. Get professionally drafted state-relevant papers within a matter of minutes in a preferable format with US Legal Forms!

Form popularity

FAQ

What is an employee savings plan? An employee savings plan is a pooled investment account that is often matched by an employer. Similar to a 401(k), an employee savings plan, or ESP, lets workers deposit a portion of their pretax earnings, with employers contributing a certain percentage or dollar amount.

Products including 401(k) plans and employee stock option plans, both designed to help employees save for their futures as defined benefit retirement plans, gradually became the rule rather than the exception among large employers.

More In Retirement Plans A 401(k) is a feature of a qualified profit-sharing plan that allows employees to contribute a portion of their wages to individual accounts. Elective salary deferrals are excluded from the employee's taxable income (except for designated Roth deferrals).

A Savings Incentive Match Plan for Employees (SIMPLE IRA) is a retirement plan that may be established by employers, including self-employed individuals. The SIMPLE IRA allows eligible employees to contribute part of their pretax compensation to the plan.

A payroll savings plan is an automatic method of purchasing savings bonds.You may open your payroll savings plan by selecting an amount, series, and registration for your savings bond purchases using functionality in your TreasuryDirect® account.

An employee savings plan is a pooled investment account that is often matched by an employer. Similar to a 401(k), an employee savings plan, or ESP, lets workers deposit a portion of their pretax earnings, with employers contributing a certain percentage or dollar amount.

What's the difference between a pension plan and a 401(k) plan? A pension plan is funded by the employer, while a 401(k) is funded by the employee.A 401(k) allows you control over your fund contributions, a pension plan does not. Pension plans guarantee a monthly check in retirement a 401(k) does not offer guarantees.

What is a workplace savings plan?As the name implies, it's an employee benefit designed to help you save for retirement. You choose how much of your paycheck to put into your plan account each pay period. And you decide how your money is invested by selecting from the investment options your employer offers.