Profit Sharing Plan

Description

How to fill out Profit Sharing Plan?

When it comes to drafting a legal document, it’s better to leave it to the specialists. Nevertheless, that doesn't mean you yourself can’t get a sample to use. That doesn't mean you yourself cannot get a template to use, nevertheless. Download Profit Sharing Plan from the US Legal Forms website. It provides numerous professionally drafted and lawyer-approved forms and samples.

For full access to 85,000 legal and tax forms, users just have to sign up and choose a subscription. After you’re registered with an account, log in, look for a particular document template, and save it to My Forms or download it to your device.

To make things much easier, we’ve incorporated an 8-step how-to guide for finding and downloading Profit Sharing Plan promptly:

- Be sure the form meets all the necessary state requirements.

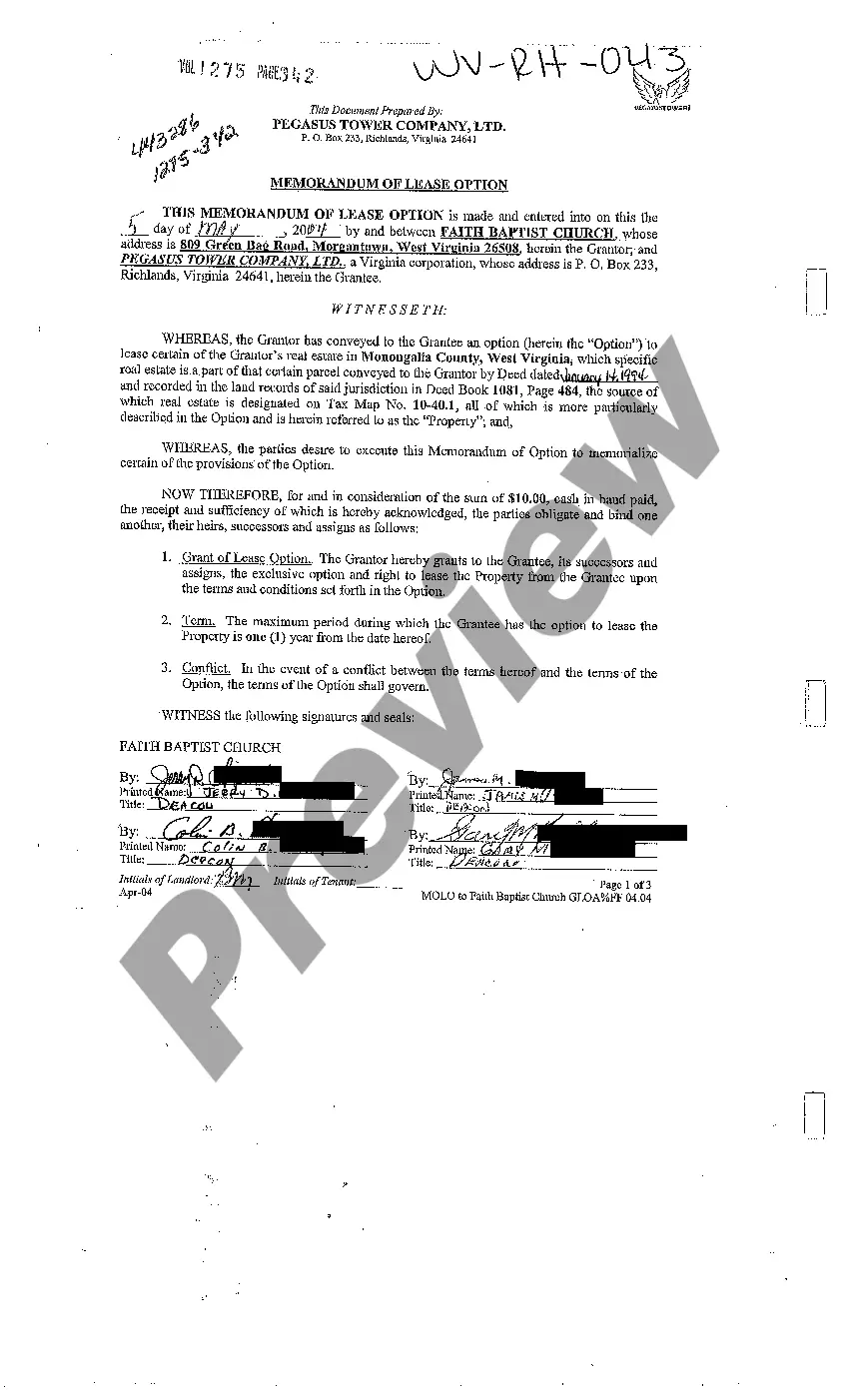

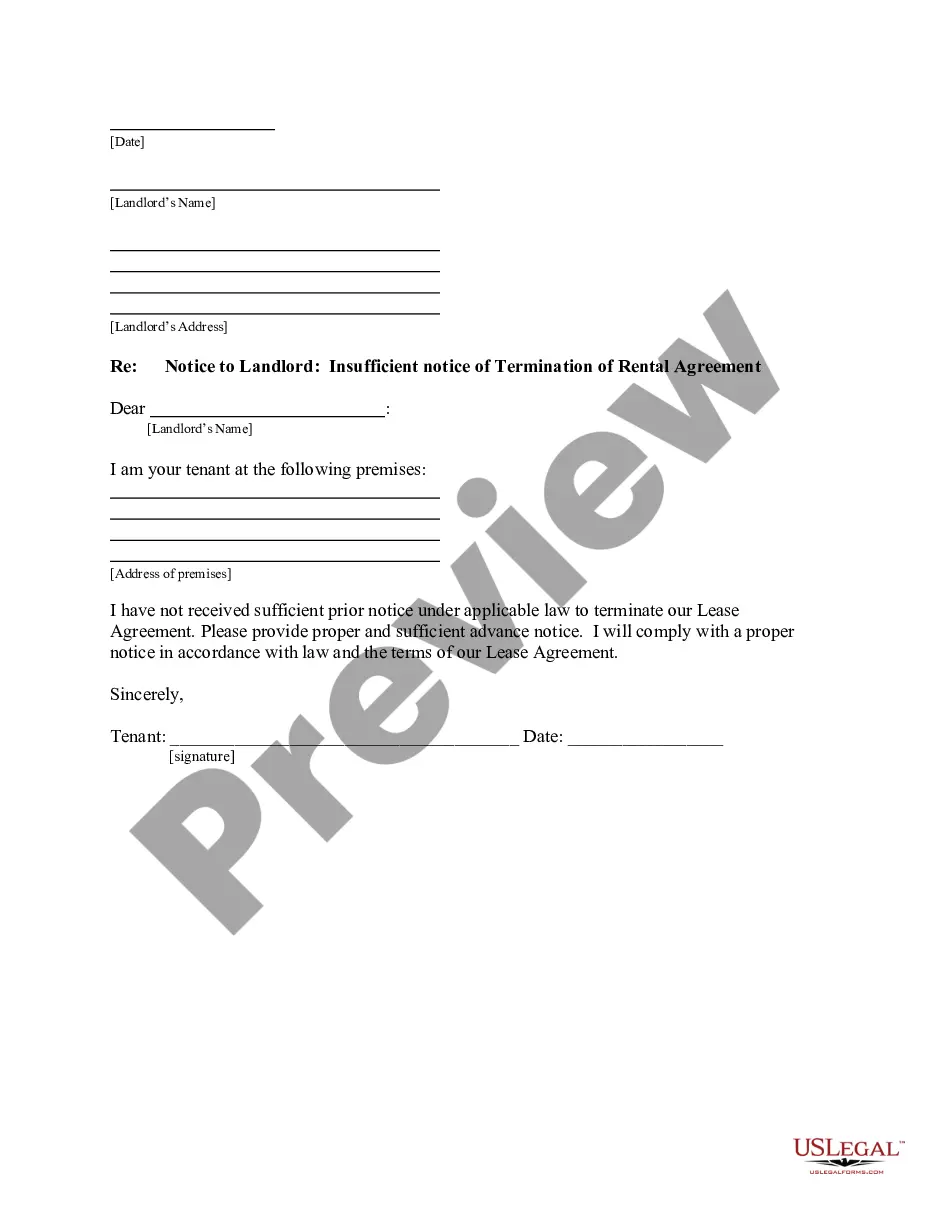

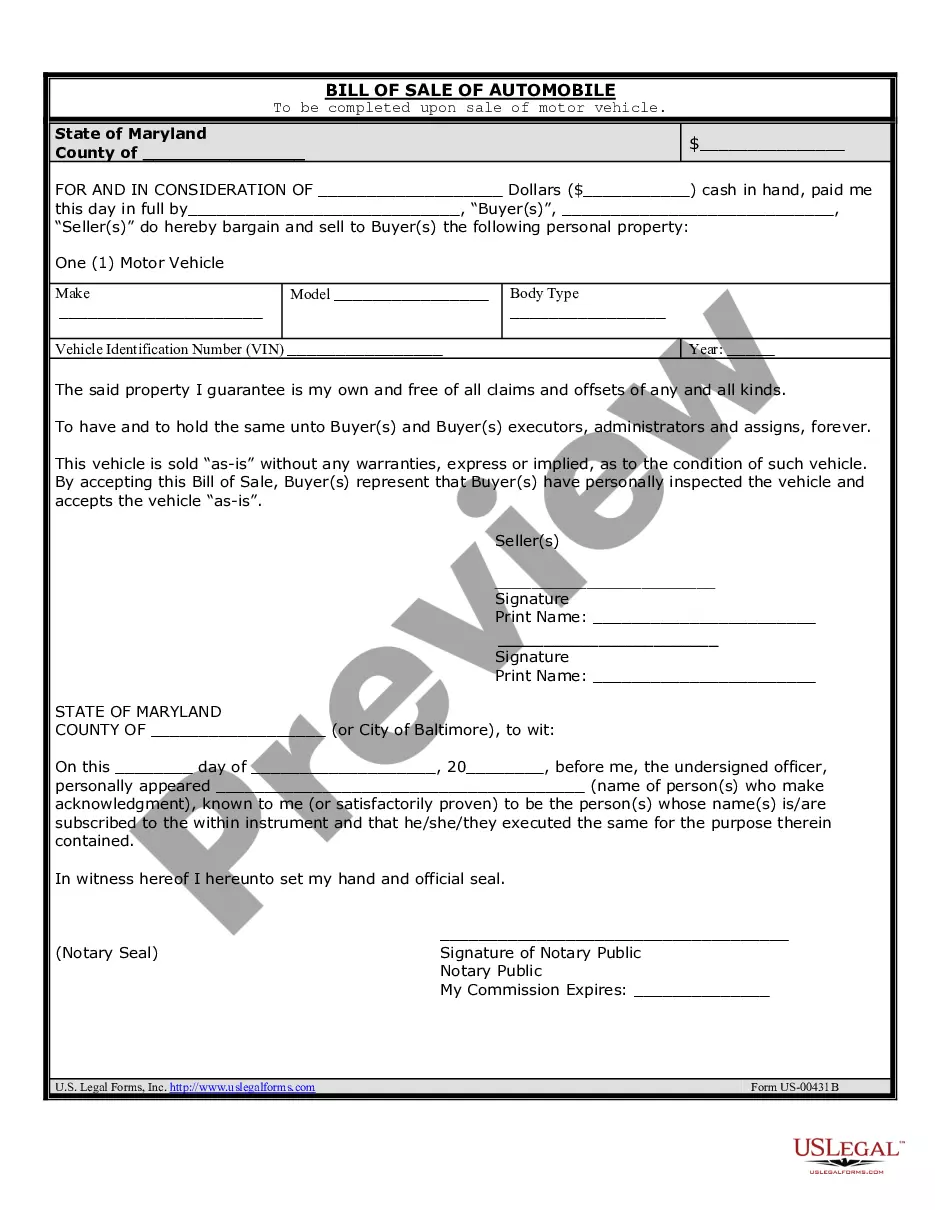

- If available preview it and read the description before buying it.

- Click Buy Now.

- Select the suitable subscription for your needs.

- Make your account.

- Pay via PayPal or by debit/bank card.

- Choose a needed format if several options are available (e.g., PDF or Word).

- Download the document.

After the Profit Sharing Plan is downloaded you can complete, print and sign it in almost any editor or by hand. Get professionally drafted state-relevant documents in a matter of minutes in a preferable format with US Legal Forms!

Form popularity

FAQ

Profit sharing example Divide each employee's individual compensation for the period by the total compensation for the period. Then, multiply your profit share percentage by your profits for the period. Finally, multiply the two totals together to determine each employee's payment amount.

Profit-sharing plans can be a great way to improve and keep employee morale, loyalty, and retention up. They are also a good way to motivate employees in participating in earning and protecting company profits because as part of the plan they have a vested interest in doing so.

Contribution limits The lesser of 25% of compensation or $58,000 (for 2021; $57,000 for 2020, subject to cost-of-living adjustments for later years).

Defined-Contribution Plan Most-profit sharing plans are set up as defined-contribution pension plans, similar to a 401(k) account.With these plans, an employer cannot withdraw money it has previously contributed. The tax-deferred type of profit-sharing plan also provides tax benefits to the employer.

401(k)s and profit-sharing plans are two types of retirement accounts that are offered to employees from their employer. 401(k) plans are typically funded by deferring employee wages into the account.A profit-sharing plan is funded entirely by the employer, with no employee contribution at all.

In a 401(k) that allows an employer match employees can receive employer contributions as well as make their own contributions.But in a profit-sharing plan, only employer contributions are permitted (i.e. an employee cannot make any contributions).

Example of a Profit-Sharing Plan If the business owner shares 10% of the annual profits and the business earns $100,000 in a fiscal year, the company would allocate profit share as follows: Employee A = ($100,000 X 0.10) X ($50,000 / $150,000), or $3,333.33.

Profit sharing is an incentivized compensation program that awards employees a percentage of the company's profits. The amount awarded is based on the company's earnings over a set period of time, usually once a year. Unlike employee bonuses, profit sharing is only applied when the company sees a profit.