Tax Sharing Agreement

Description Sharing Agreement File

How to fill out Other Parent Sharing?

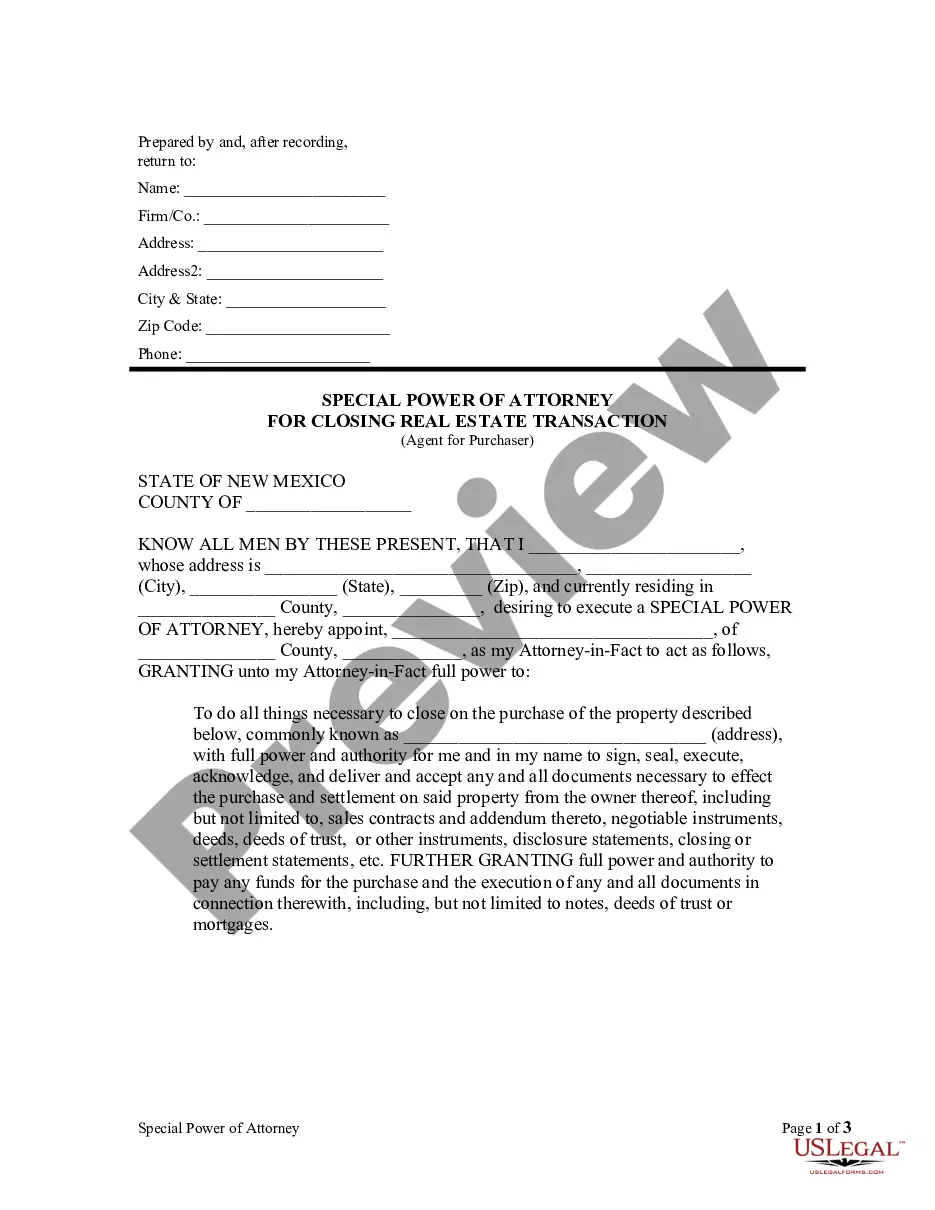

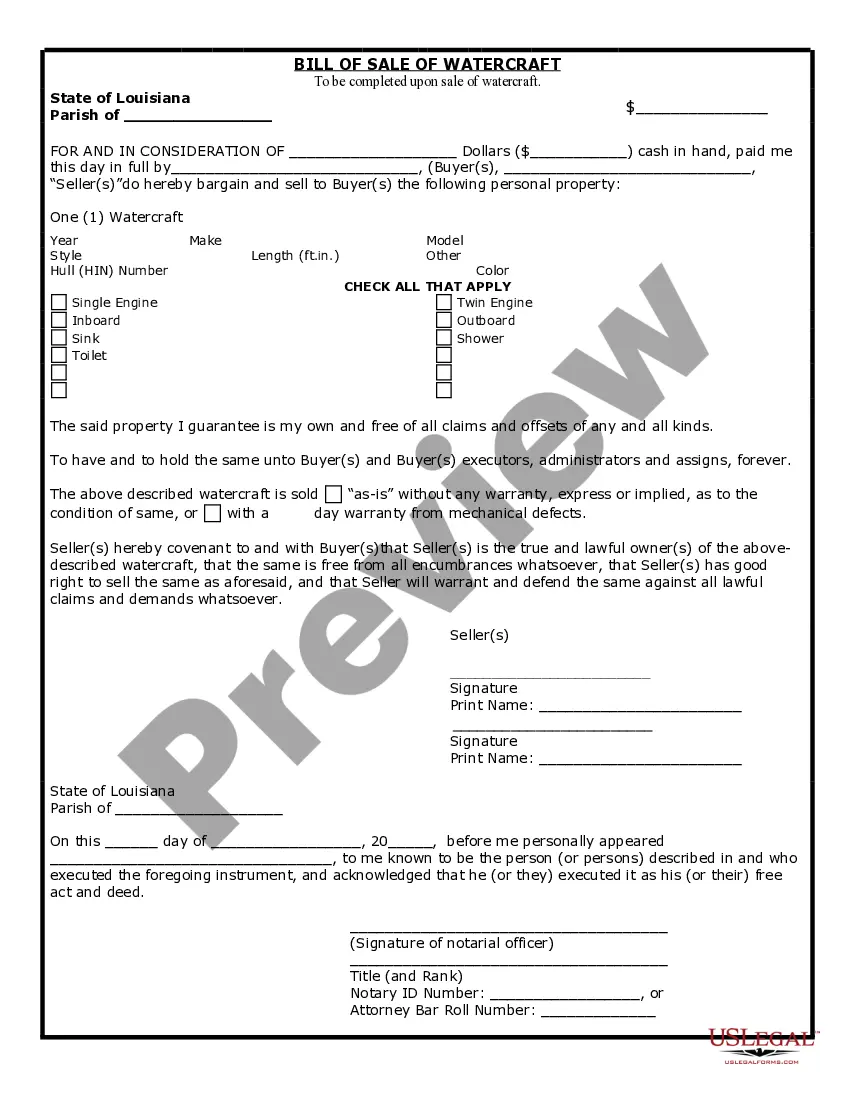

When it comes to drafting a legal document, it is easier to delegate it to the professionals. However, that doesn't mean you yourself can not find a sample to use. That doesn't mean you yourself can’t get a sample to utilize, nevertheless. Download Tax Sharing Agreement from the US Legal Forms site. It gives you numerous professionally drafted and lawyer-approved documents and samples.

For full access to 85,000 legal and tax forms, customers simply have to sign up and choose a subscription. As soon as you’re signed up with an account, log in, find a specific document template, and save it to My Forms or download it to your gadget.

To make things easier, we’ve incorporated an 8-step how-to guide for finding and downloading Tax Sharing Agreement quickly:

- Make sure the form meets all the necessary state requirements.

- If possible preview it and read the description before buying it.

- Press Buy Now.

- Choose the appropriate subscription to suit your needs.

- Create your account.

- Pay via PayPal or by credit/visa or mastercard.

- Choose a preferred format if a number of options are available (e.g., PDF or Word).

- Download the file.

As soon as the Tax Sharing Agreement is downloaded it is possible to fill out, print out and sign it in almost any editor or by hand. Get professionally drafted state-relevant files within a matter of seconds in a preferable format with US Legal Forms!

Company Which Parent Form popularity

Sharing Agreement Form Other Form Names

Sharing Agreement Paper FAQ

Tax Sharing Agreement means any Contract (including any provision of a Contract) pursuant to which the Company is obligated to indemnify or gross up any Person for, or otherwise pay, any Tax of another Person, or share any Tax benefit with another Person.

A tax indemnity provision in a legal document generally states that one party will cover certain taxes, or will be responsible to protect the other party should tax problems arise. Such provisions are common: they appear in many variations, and show up across a wide variety of contracts and agreements.

Tax allocation agreements are often used by the members of a consolidated group in order to determine how to allocate and distribute such funds.In this role, the parent corporation pays the group's tax liability, receives its tax refunds, and interacts with the IRS on the group's behalf.

The Internal Revenue Service doesn't require corporations to file consolidated tax returns with their subsidiaries, but it does allow them to do so. Before a corporation can file a consolidated return, it must satisfy certain stock ownership and voting requirements.

What Is a Consolidated Tax Return? A consolidated tax return is a corporate income tax return of an affiliated group of corporations, who elect to report their combined tax liability on a single return.

The principal advantage of filing consolidated returns is the ability to combine the income and loss of each member of an affiliated group into a single taxable income. 8 Thus, net operating losses of one member of the group can be used to offset the taxable income of another member.

Tax consolidation, or combined reporting, is a regime adopted in the tax or revenue legislation of a number of countries which treats a group of wholly owned or majority-owned companies and other entities (such as trusts and partnerships) as a single entity for tax purposes.

Requirements for filing Only entities organized in the United States and treated as corporations may file a consolidated Federal income tax return. The return is filed by a common parent and only those subsidiaries in which the common parent owns 80% or more of the vote AND value.

Advantages and Disadvantages of Consolidated Tax Returns netting out capital gains and losses; no tax on intercompany distributions; the recognition of income is deferred on intercompany transactions; any unused foreign tax credit by one company can be used by the other affiliates within the group; and.