Phantom Stock Plan of Hercules, Inc.

Description

How to fill out Phantom Stock Plan Of Hercules, Inc.?

When it comes to drafting a legal form, it is better to delegate it to the experts. However, that doesn't mean you yourself can’t get a template to utilize. That doesn't mean you yourself can not get a template to utilize, nevertheless. Download Phantom Stock Plan of Hercules, Inc. right from the US Legal Forms site. It gives you numerous professionally drafted and lawyer-approved documents and samples.

For full access to 85,000 legal and tax forms, customers simply have to sign up and choose a subscription. After you’re signed up with an account, log in, search for a particular document template, and save it to My Forms or download it to your device.

To make things less difficult, we have provided an 8-step how-to guide for finding and downloading Phantom Stock Plan of Hercules, Inc. fast:

- Be sure the document meets all the necessary state requirements.

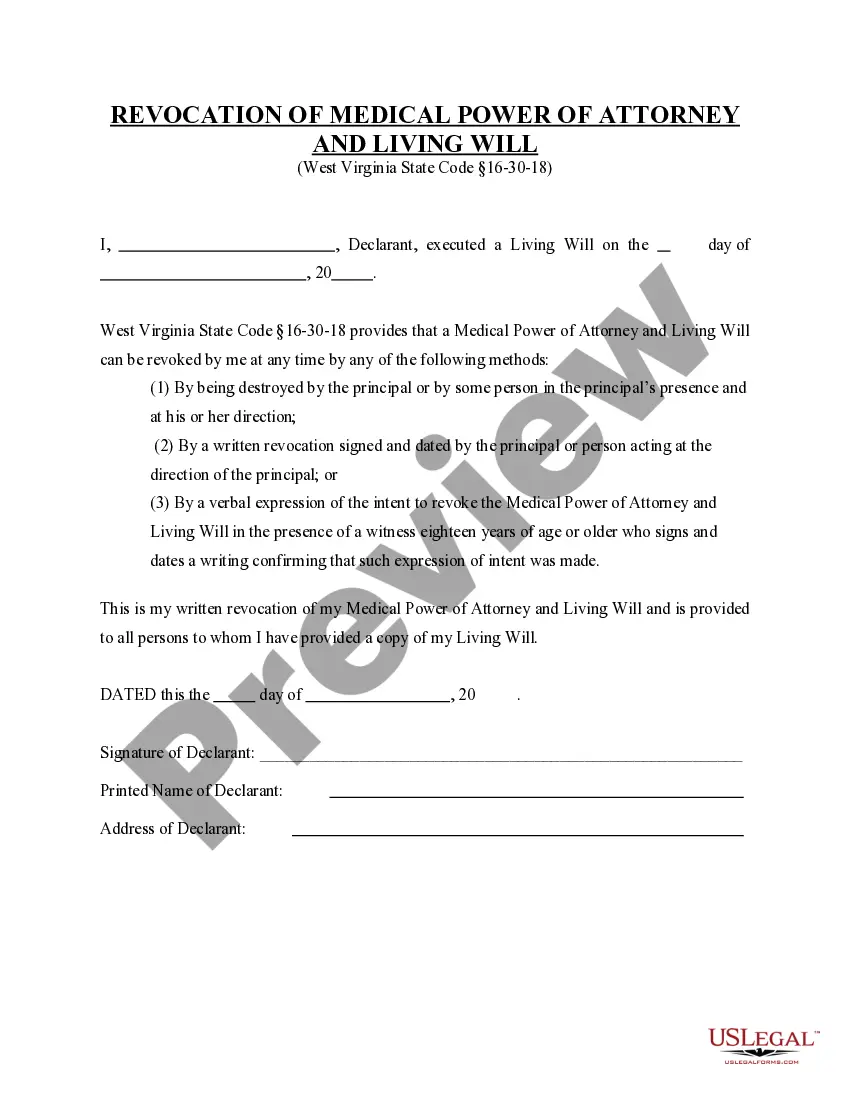

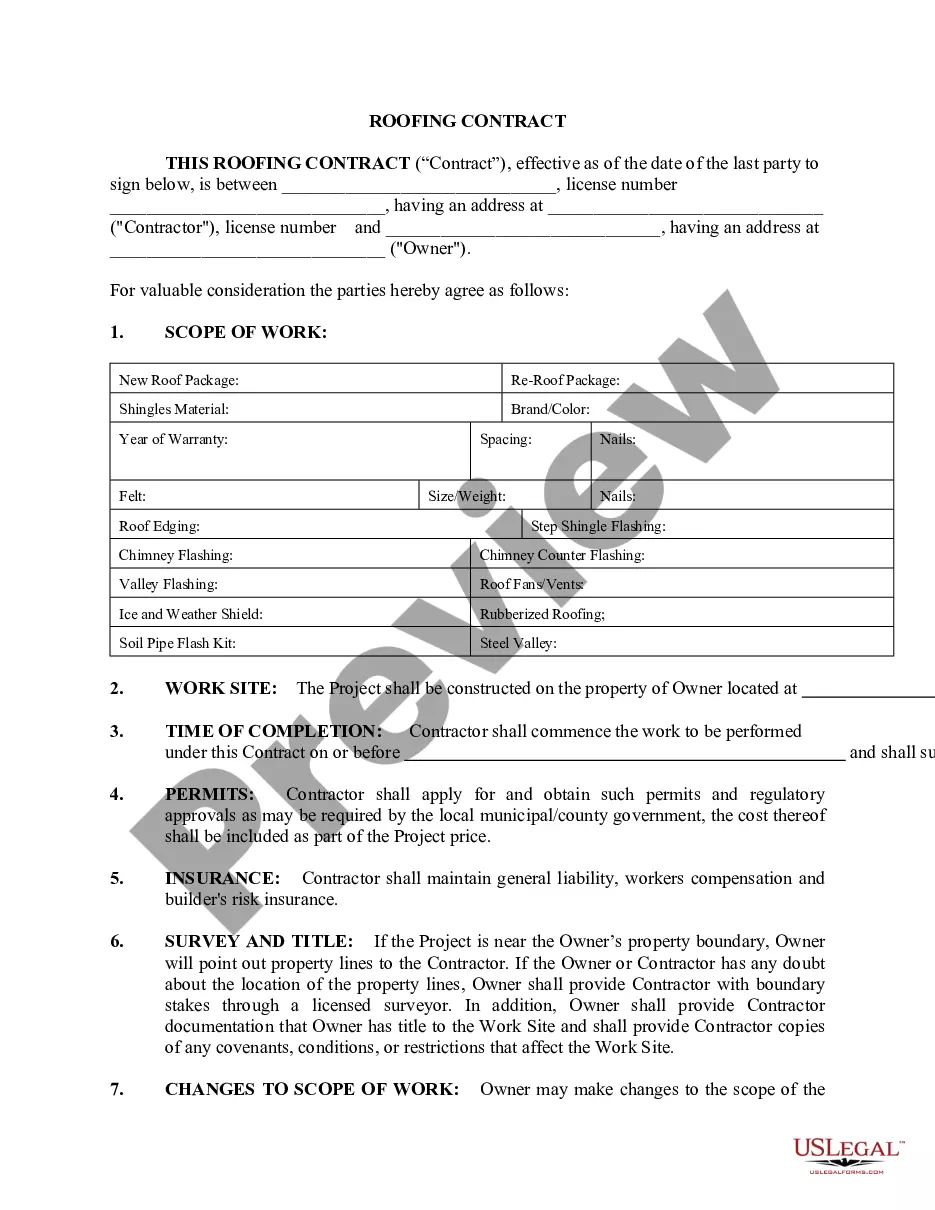

- If available preview it and read the description prior to buying it.

- Hit Buy Now.

- Choose the suitable subscription to meet your needs.

- Create your account.

- Pay via PayPal or by debit/visa or mastercard.

- Select a needed format if several options are available (e.g., PDF or Word).

- Download the document.

After the Phantom Stock Plan of Hercules, Inc. is downloaded you can complete, print and sign it in any editor or by hand. Get professionally drafted state-relevant files within a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

Phantom stock plans are considered liability awards for accounting purposes (assuming they will be settled in cash rather than stock). As such, the sponsoring company must recognize the plan expense ratably over the vesting period. Varying accrual schedules can be found in the market.

Understand what you are and aren't offering. Set a proper valuation. Create your shares. Decide how to award stock. Set a reward schedule.

Once these two answers are known, the phantom share price is calculated as the former (the value) divided by the latter (the number of shares). The value of the company can be established by a variety of means, including: Stock exchange (for public companies)

A. A phantom stock plan is a deferred compensation plan that provides the employee an award measured by the value of the employer's common stock. However, unlike actual stock, the award does not confer equity ownership in the company. In other words, there is no actual stock given to the employee.

For employees, there's no need to purchase phantom stock shares as regular stockholders must do on the open market. Instead, phantom shares are given to employees with no money changing hands. That's a big benefit to employees, who share in the stock's profits without having to pay for it.

A phantom stock plan is an employee benefit plan that gives selected employees (senior management) many of the benefits of stock ownership without actually giving them any company stock. This type of plan is sometimes referred to as shadow stock. Rather than getting physical stock, the employee receives mock stock.

A phantom stock plan is a deferred compensation plan that provides the employee an award measured by the value of the employer's common stock. However, unlike actual stock, the award does not confer equity ownership in the company. In other words, there is no actual stock given to the employee.