Elimination of the Class A Preferred Stock

Description

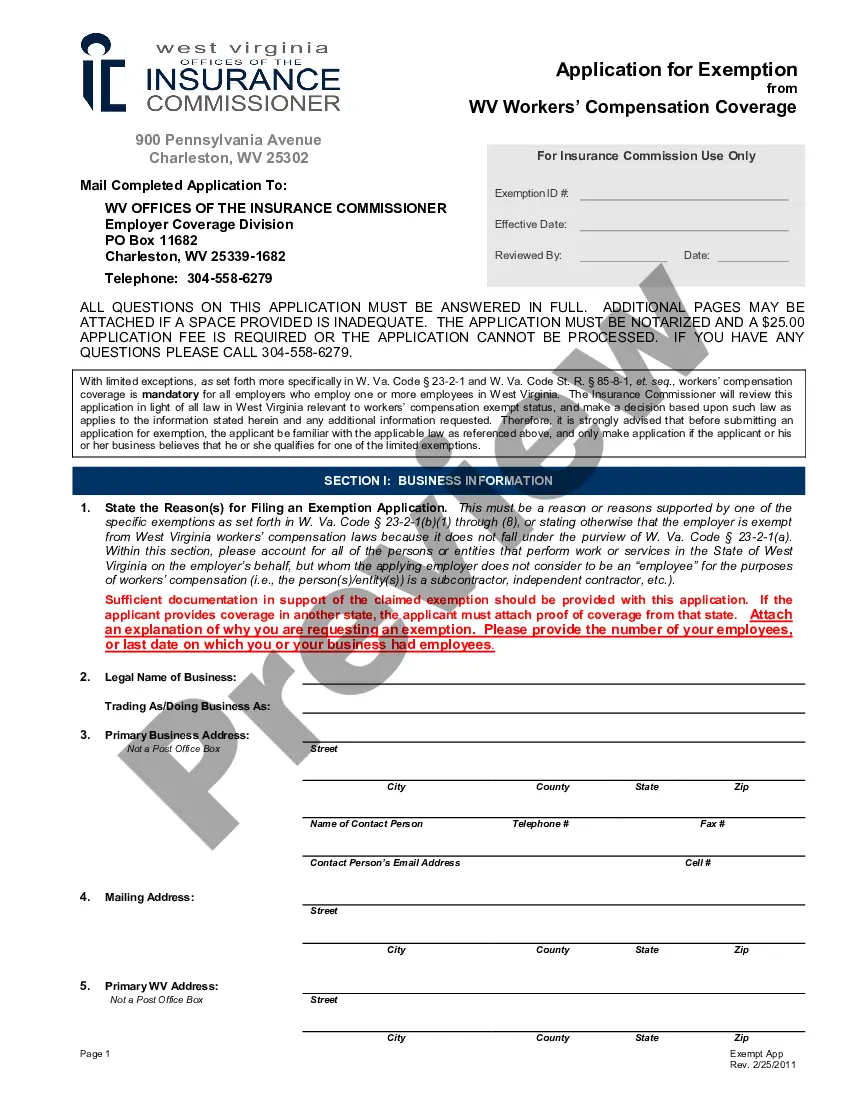

How to fill out Elimination Of The Class A Preferred Stock?

When it comes to drafting a legal form, it is better to leave it to the experts. However, that doesn't mean you yourself can not find a template to use. That doesn't mean you yourself cannot get a template to use, nevertheless. Download Elimination of the Class A Preferred Stock right from the US Legal Forms web site. It gives you a wide variety of professionally drafted and lawyer-approved documents and templates.

For full access to 85,000 legal and tax forms, users simply have to sign up and choose a subscription. Once you are signed up with an account, log in, look for a certain document template, and save it to My Forms or download it to your gadget.

To make things less difficult, we’ve incorporated an 8-step how-to guide for finding and downloading Elimination of the Class A Preferred Stock quickly:

- Make confident the document meets all the necessary state requirements.

- If possible preview it and read the description before purchasing it.

- Hit Buy Now.

- Select the suitable subscription to meet your needs.

- Make your account.

- Pay via PayPal or by credit/bank card.

- Choose a preferred format if several options are available (e.g., PDF or Word).

- Download the file.

As soon as the Elimination of the Class A Preferred Stock is downloaded you may complete, print out and sign it in any editor or by hand. Get professionally drafted state-relevant papers in a matter of minutes in a preferable format with US Legal Forms!

Form popularity

FAQ

In finance, a class A share refers to a share classification of common or preferred stock that typically has enhanced benefits with respect to dividends, asset sales, or voting rights compared to Class B or Class C shares.In a class A share, the sales load is up front, typically at most 5.75% of the amount invested.

Most preferred shares will have a stated redemption or liquidation value. A company that issues preferred shares may not want to keep paying dividends indefinitely, so it will have the option of buying back the shares at a fixed price.

If the buyout is an all-cash deal, shares of your stock will disappear from your portfolio at some point following the deal's official closing date and be replaced by the cash value of the shares specified in the buyout. If it is an all-stock deal, the shares will be replaced by shares of the company doing the buying.

When more than one class of stock is offered, companies traditionally designate them as Class A and Class B, with Class A carrying more voting rights than Class B shares. Class A shares may offer 10 voting rights per stock held, while class B shares offer only one.

Although preferred stock ETFs offer some benefits, there are also risks to consider before investing. Share prices of preferred stocks often fall when interest rates move higher because of increased competition from interest-bearing securities that are deemed safer, like Treasury bonds.

When a company is bought out by an individual or another company, the purchaser will usually take possession of all of the common or voting stock of that company.As preferred shares are generally not voting shares, it is not necessary that the purchaser redeem or buy them out when taking over a company.

After a preferred shareholder converts their shares, they give up their rights as a preferred shareholder (no fixed dividend or higher claim on assets) and become a common shareholder (ability to vote and participate in share price declines and rises).

A callable preferred stock issue offers the flexibility to lower the issuer's cost of capital if interest rates decline or if it can issue preferred stock later at a lower dividend rate.The proceeds from the new issue can be used to redeem the 7% shares, resulting in savings for the company.