Proposed amendment to the restated certificate of incorporation to authorize preferred stock

Description Amendment Certificate Incorporation

How to fill out Restated Stock?

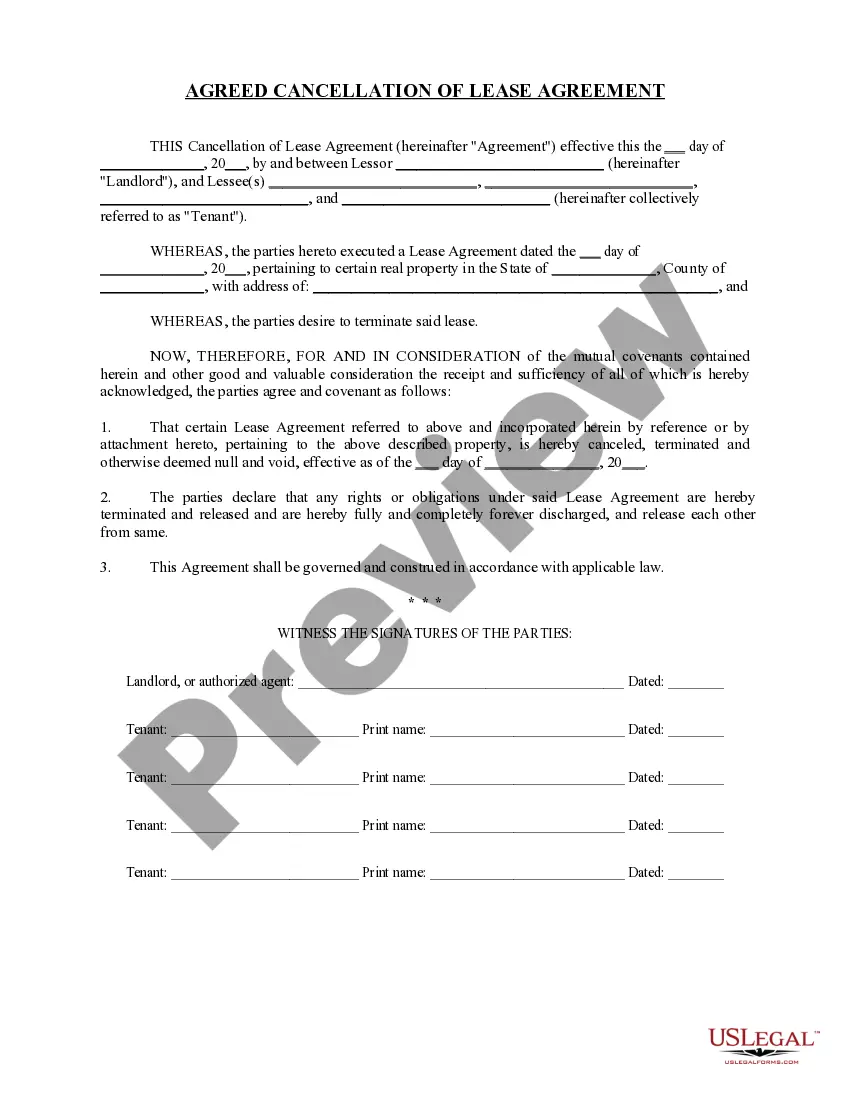

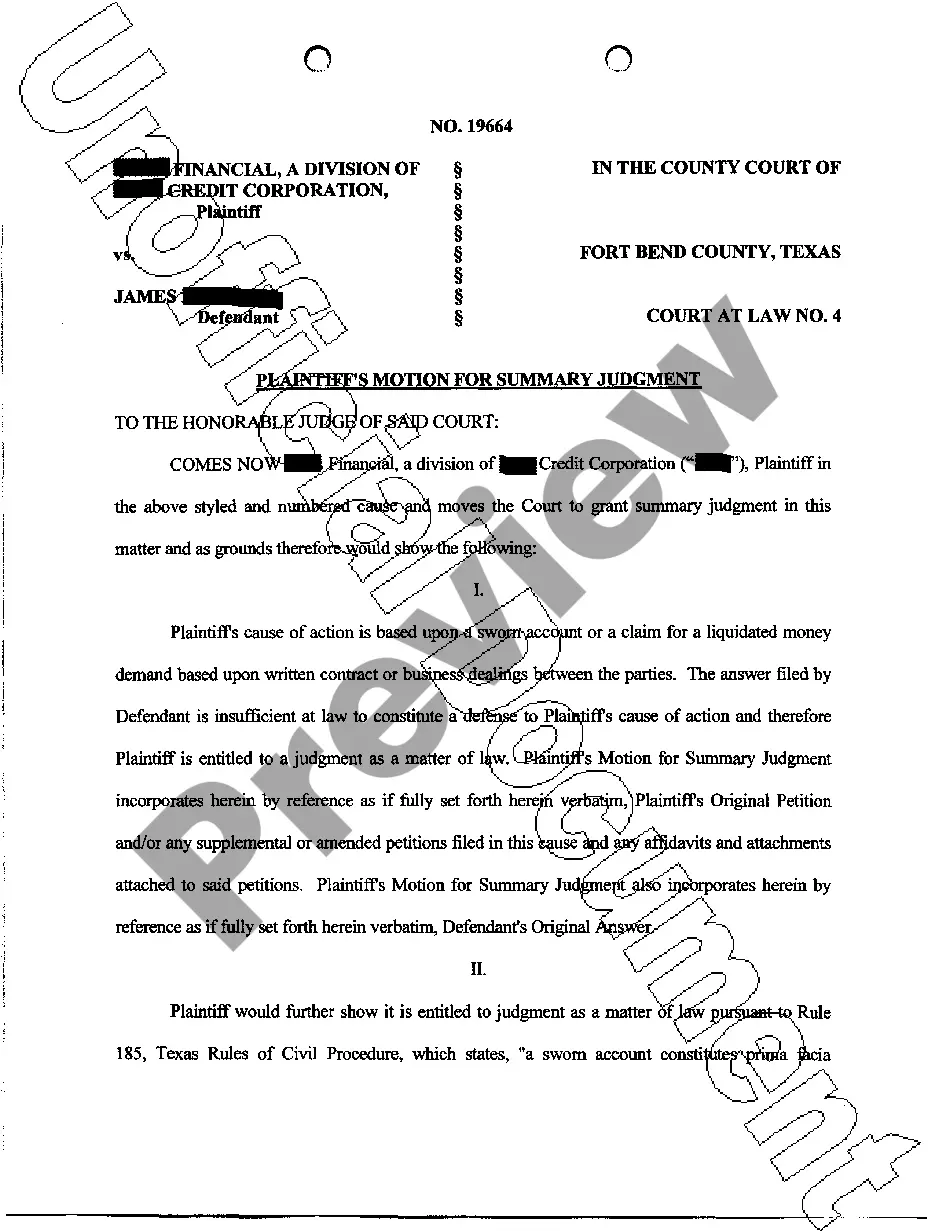

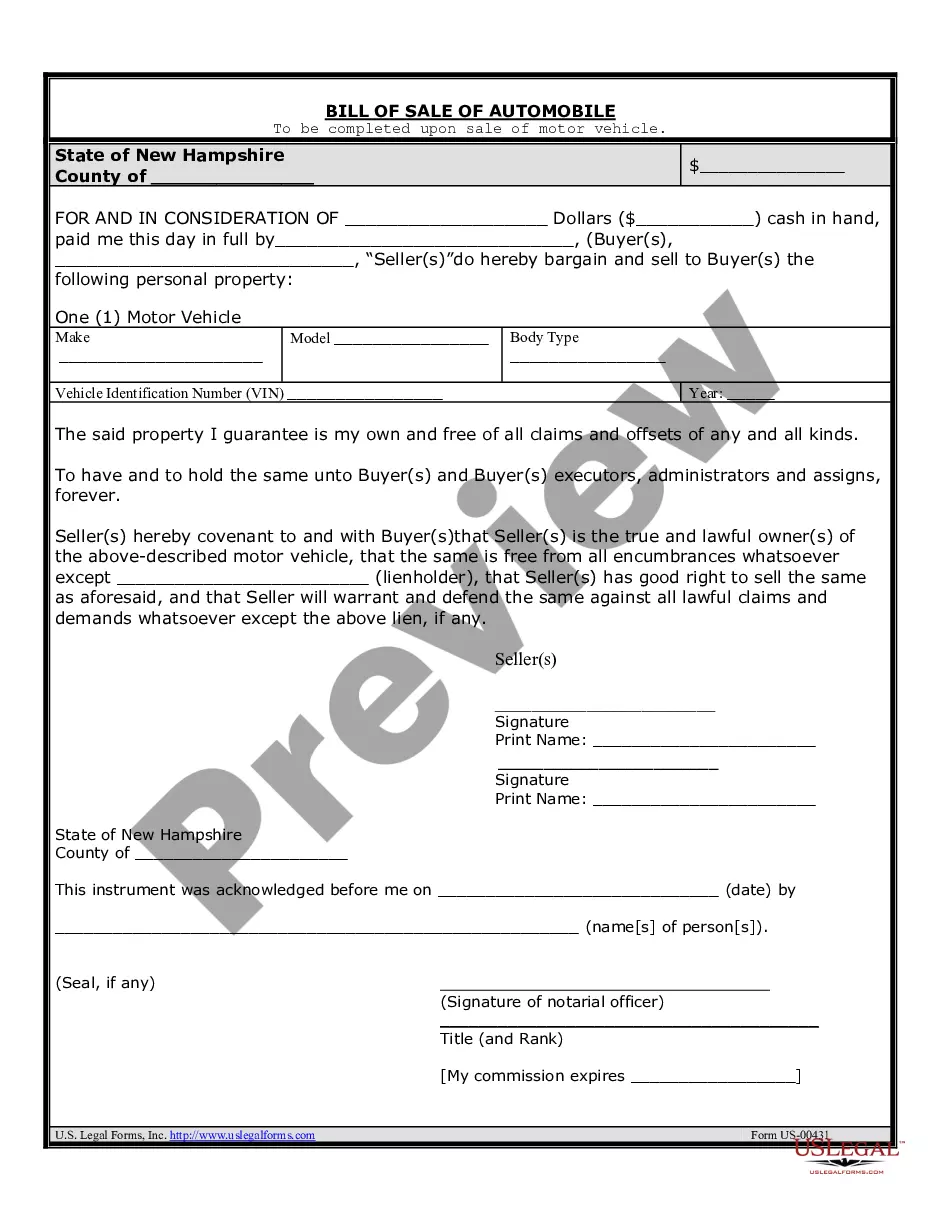

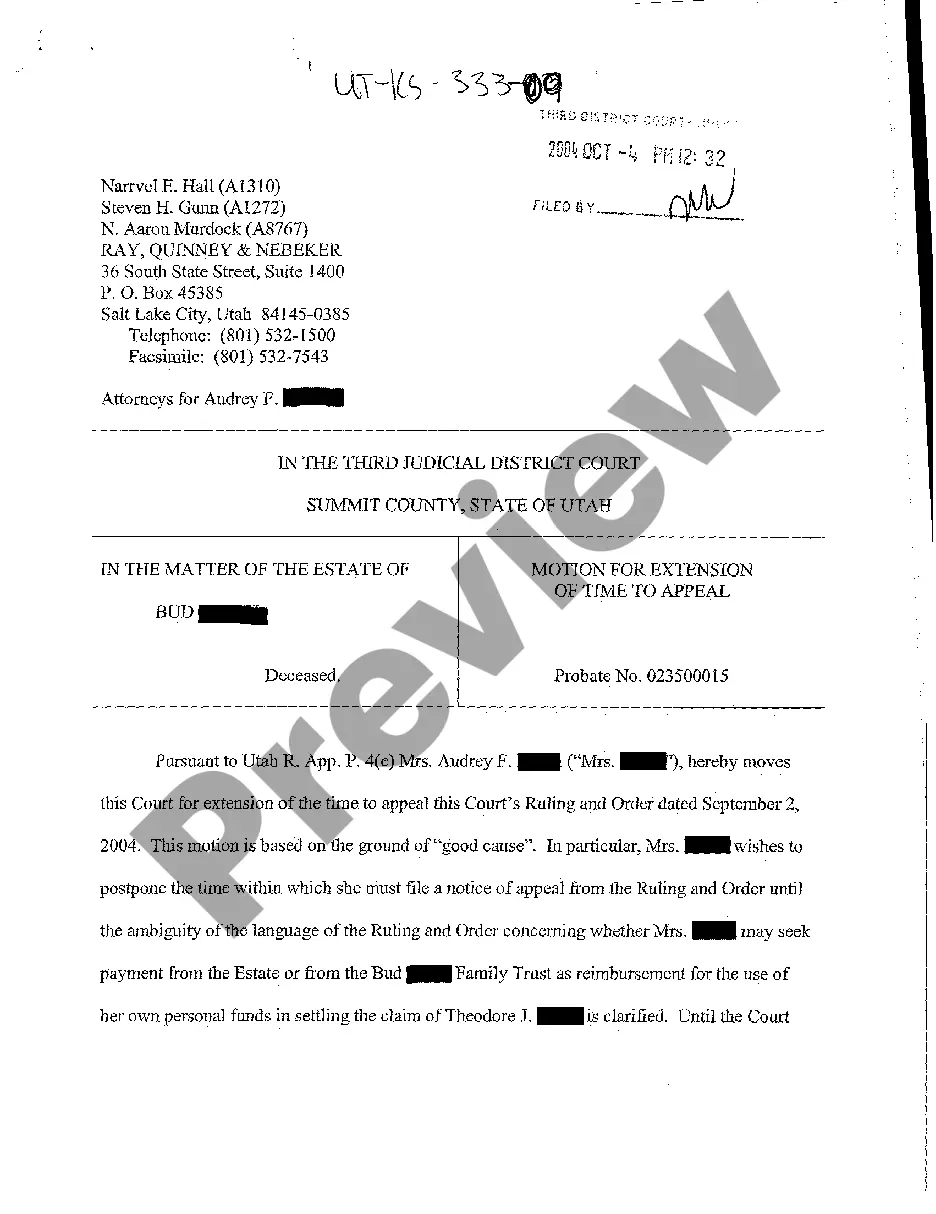

When it comes to drafting a legal document, it is easier to leave it to the experts. Nevertheless, that doesn't mean you yourself can’t get a template to use. That doesn't mean you yourself can’t find a sample to utilize, nevertheless. Download Proposed amendment to the restated certificate of incorporation to authorize preferred stock right from the US Legal Forms website. It offers a wide variety of professionally drafted and lawyer-approved forms and templates.

For full access to 85,000 legal and tax forms, users simply have to sign up and choose a subscription. After you are registered with an account, log in, search for a certain document template, and save it to My Forms or download it to your device.

To make things much easier, we have included an 8-step how-to guide for finding and downloading Proposed amendment to the restated certificate of incorporation to authorize preferred stock promptly:

- Make sure the document meets all the necessary state requirements.

- If available preview it and read the description before buying it.

- Hit Buy Now.

- Choose the appropriate subscription for your requirements.

- Make your account.

- Pay via PayPal or by debit/bank card.

- Select a preferred format if several options are available (e.g., PDF or Word).

- Download the file.

As soon as the Proposed amendment to the restated certificate of incorporation to authorize preferred stock is downloaded it is possible to complete, print out and sign it in almost any editor or by hand. Get professionally drafted state-relevant papers within a matter of minutes in a preferable format with US Legal Forms!

Series Company Which Form popularity

Amendment To Restated Other Form Names

Restated Stock Order FAQ

Obtain articles of amendment of the articles of incorporation (sometimes called the certificate of amendment of articles of incorporation) from your state's Secretary of State. Obtain a copy of the original articles of incorporation. Propose the change in the articles of incorporation to the Board of Directors.

Amendments allow laws and policies to be refined over time rather than replaced outright. Local, state, and federal laws can be changed through the ratification of amendments.

To file a certificate of amendment if the entity seeks only to change its registered agent or its Page 4 Form 424 4 registered office. A filing entity may file a statement of change of registered agent/registered office pursuant to section 5.202 of the BOC.

Sometimes, however, only some shareholders can vote. In some states, officers or directors may change the articles of incorporation even if only these voting shareholders have concluded that they want to make changes. In other states, the shareholders may not even need to approve the change.

Unless otherwise prescribed by this Code or by special law, and for legitimate purposes, any provision or matter stated in the articles of incorporation may be amended by a majority vote of the board of directors or trustees and the vote or written assent of the stockholders representing at least two-thirds (2/3) of

The filing fees for a merger are $300 ($50 for nonprofit corporations and cooperatives) plus the filing fee for any new Texas filing entity created by the merger. For example: The filing fee for the merger of a Texas corporation that creates a new Texas limited partnership is $300 plus $750 for a total of $1050.

A domestic corporation may change its Certificate of Incorporation from time to time to (1) change the name and address of its designated address for the New York Secretary of State to mail service of process, (2) change its county location, or (3) make, revoke or change the designation of a registered agent by filing

A corporation may amend its Certificate of Incorporation from time to time by filing a Certificate of Amendment under Section 805 of the Business Corporation Law.