Proposal to amend certificate of incorporation to effectuate a one for ten reverse stock split

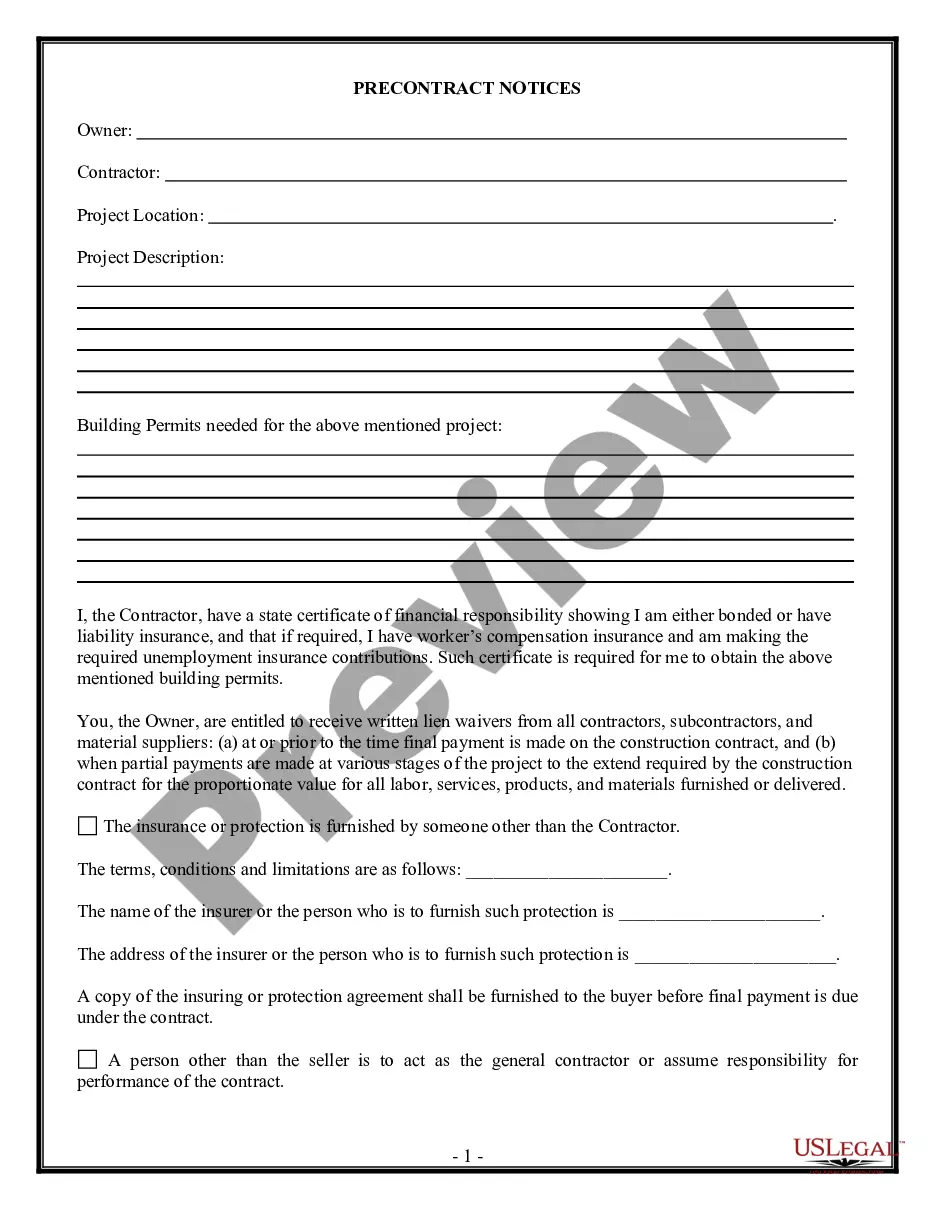

Description Stock Reverse Split

How to fill out Amend Incorporation Stock?

When it comes to drafting a legal form, it’s easier to delegate it to the specialists. However, that doesn't mean you yourself cannot get a template to utilize. That doesn't mean you yourself can’t get a template to use, however. Download Proposal to amend certificate of incorporation to effectuate a one for ten reverse stock split straight from the US Legal Forms site. It provides a wide variety of professionally drafted and lawyer-approved forms and samples.

For full access to 85,000 legal and tax forms, customers simply have to sign up and select a subscription. When you’re signed up with an account, log in, find a specific document template, and save it to My Forms or download it to your device.

To make things less difficult, we have provided an 8-step how-to guide for finding and downloading Proposal to amend certificate of incorporation to effectuate a one for ten reverse stock split quickly:

- Make sure the document meets all the necessary state requirements.

- If available preview it and read the description before buying it.

- Press Buy Now.

- Select the appropriate subscription for your requirements.

- Make your account.

- Pay via PayPal or by debit/visa or mastercard.

- Select a needed format if a number of options are available (e.g., PDF or Word).

- Download the file.

As soon as the Proposal to amend certificate of incorporation to effectuate a one for ten reverse stock split is downloaded it is possible to complete, print and sign it in almost any editor or by hand. Get professionally drafted state-relevant documents within a matter of minutes in a preferable format with US Legal Forms!

Proposal Amend Certificate Form popularity

Incorporation 1 Form Other Form Names

Incorporation Reverse FAQ

The definition of incorporated is combined or put together into one unit. An example of something incorporated is a classroom that has students from all learning levels. An example of something incorporated is several parts of a business combined together to form a legal corporation.

An 'incorporated' company means that the directors of the company, as well as previous directors, are jointly and severally liable for any debts and liabilities of the company during their respective periods of office. The owners of a personal liability company are considered separate from the company.

Form CL-1 Initial Annual Report of Corporations must be submitted by both domestic and foreign corporations to the Secretary of State. LLC's filing as a corporation must submit Form CL-1 to SCDOR within 60 days of conducting business in this state.The annual report (Schedule D) is part of the corporate tax return.

Corresponding to corporation, e.g., any group of persons treated by the law as an individual or unity having rights or liabilities, or both, distinct from those of the persons composing it.

Regardless of whether you are forming a C corporation or an S corporation, the company formation document is called the Articles of Incorporation or Certificate of Incorporation. This document provides the state with necessary information on your business.

The main reason for forming a corporation is to limit the liability of the owners. In a sole proprietorship or partnership, the owners are personally liable for the debts and liabilities of the business, and in many instances, creditors can go after their personal assets to collect business debts.

What does it mean to incorporate? Incorporating a business means turning your sole proprietorship or general partnership into a company formally recognized by your state of incorporation. When a company incorporates, it becomes its own legal business structure set apart from the individuals who founded the business.

The incorporation of a company refers to the legal process that is used to form a corporate entity or a company. An incorporated company is a separate legal entity on its own, recognized by the law. These corporations can be identified with terms like 'Inc' or 'Limited' in their names.

A corporation is created when it is incorporated by a group of shareholders who have ownership of the corporation, represented by their holding of common stock, to pursue a common goal.A corporation can have a single shareholder or several. With publicly traded corporations, there are often thousands of shareholders.