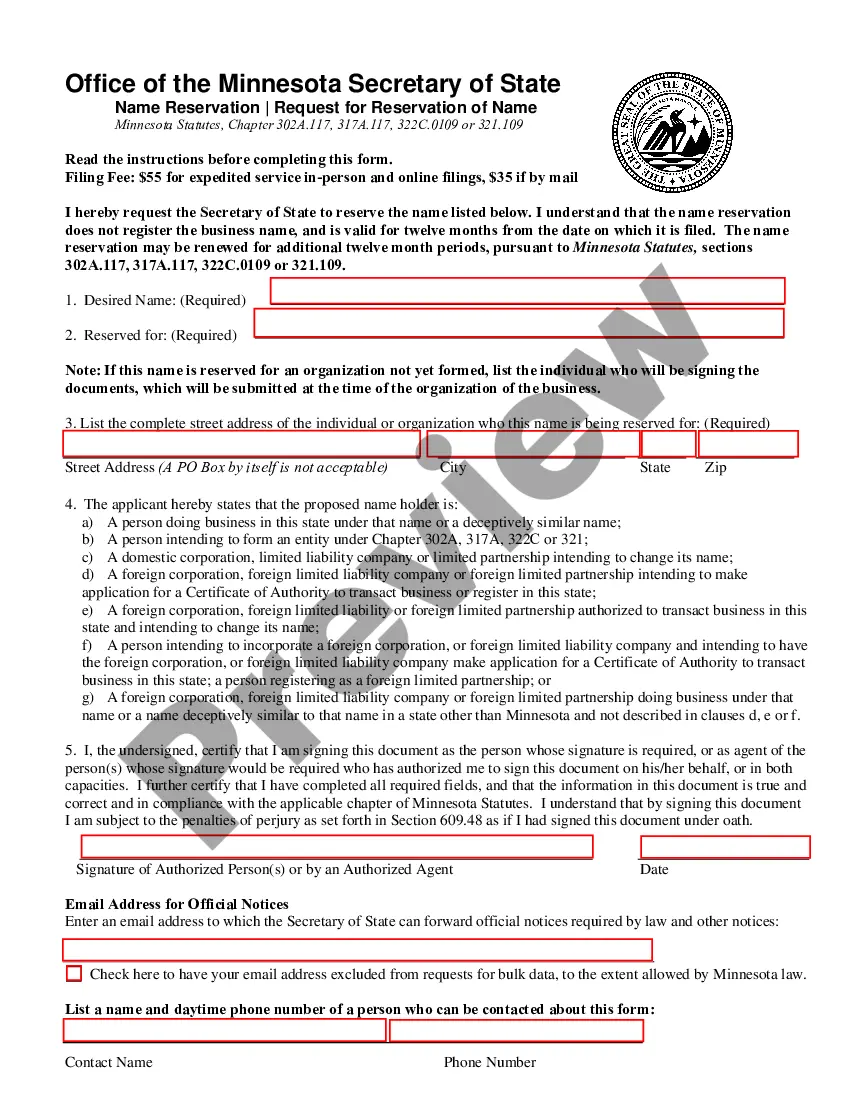

Proposal to amend certificate to reduce par value, increase authorized common stock and reverse stock split with Exhibit

Description Par Value Common

How to fill out Amend Reduce Reverse?

When it comes to drafting a legal form, it’s easier to delegate it to the experts. However, that doesn't mean you yourself can not get a sample to use. That doesn't mean you yourself cannot get a sample to utilize, however. Download Proposal to amend certificate to reduce par value, increase authorized common stock and reverse stock split with Exhibit right from the US Legal Forms website. It provides numerous professionally drafted and lawyer-approved documents and templates.

For full access to 85,000 legal and tax forms, users just have to sign up and choose a subscription. When you are registered with an account, log in, find a particular document template, and save it to My Forms or download it to your device.

To make things easier, we have provided an 8-step how-to guide for finding and downloading Proposal to amend certificate to reduce par value, increase authorized common stock and reverse stock split with Exhibit quickly:

- Make confident the document meets all the necessary state requirements.

- If available preview it and read the description prior to buying it.

- Hit Buy Now.

- Choose the appropriate subscription to meet your needs.

- Make your account.

- Pay via PayPal or by credit/credit card.

- Choose a preferred format if a few options are available (e.g., PDF or Word).

- Download the file.

When the Proposal to amend certificate to reduce par value, increase authorized common stock and reverse stock split with Exhibit is downloaded you can fill out, print out and sign it in any editor or by hand. Get professionally drafted state-relevant documents within a matter of seconds in a preferable format with US Legal Forms!

Certificate Par Common Form popularity

Value Common Stock Other Form Names

Par Increase Authorized FAQ

For a brief period, the financial giant saw its stock trade below $1 per share, and even after many of its peers had fully recovered from the crisis, Citigroup did a 1-for-10 reverse split in 2011 to get its stock price back into double digits.

Visit any financial website that provides a stock splits calendar, such as Yahoo Finance, Nasdaq or MSN Money. Click the text box at the top of the page that allows you to search within the website.

The first stock on this list is Broadcom (AVGO) which is arguably the top dividend stock in the last decade.Despite the massive gain, the company also has an attractive dividend yield of 3.6%. Further, Broadcom's dividend per share has risen from $0.07 in December 2010 to $3.25 per share in June 2020.

Broadcom (AVGO) has 0 splits in our Broadcom stock split history database. Looking at the Broadcom stock split history from start to finish, an original position size of 1000 shares would have turned into 1000 today.

The most recent bank to split its stock was Toronto-Dominion Bank (TSX:TD)(NYSE:TD) in 2014. It currently trades at about $71, lowest among the big banks. This stock likely won't be splitting anytime soon.

Adobe Systems went public on Aug.I say "around" because information on the Abobe website only gives the $0.17 split-adjusted price for its IPO, which is a fraction of what the stock was actually trading at the time. The stock has split at a 2-for-1 ratio six times.

NEW YORK, Oct 29 (Reuters) - Power company Dominion Resources D.N said on Monday it raised its dividend 11 percent and will split its stock. The board increased the quarterly dividend on pre-split shares to 79 cents per share from 71 cents.Separately, the board approved a two-for-one stock split.

But that's usually not the case with reverse stock splits. In factwith a few rare exceptionsreverse stock splits are bad news for investors.The number one reason for a reverse stock split is because the stock exchangeslike the NYSE or Nasdaqset minimum price requirements for shares that trade on their exchanges.