Amendment to the articles of incorporation to eliminate par value

Description Amendment To Articles Incorporation

How to fill out Article Incorporation Concept?

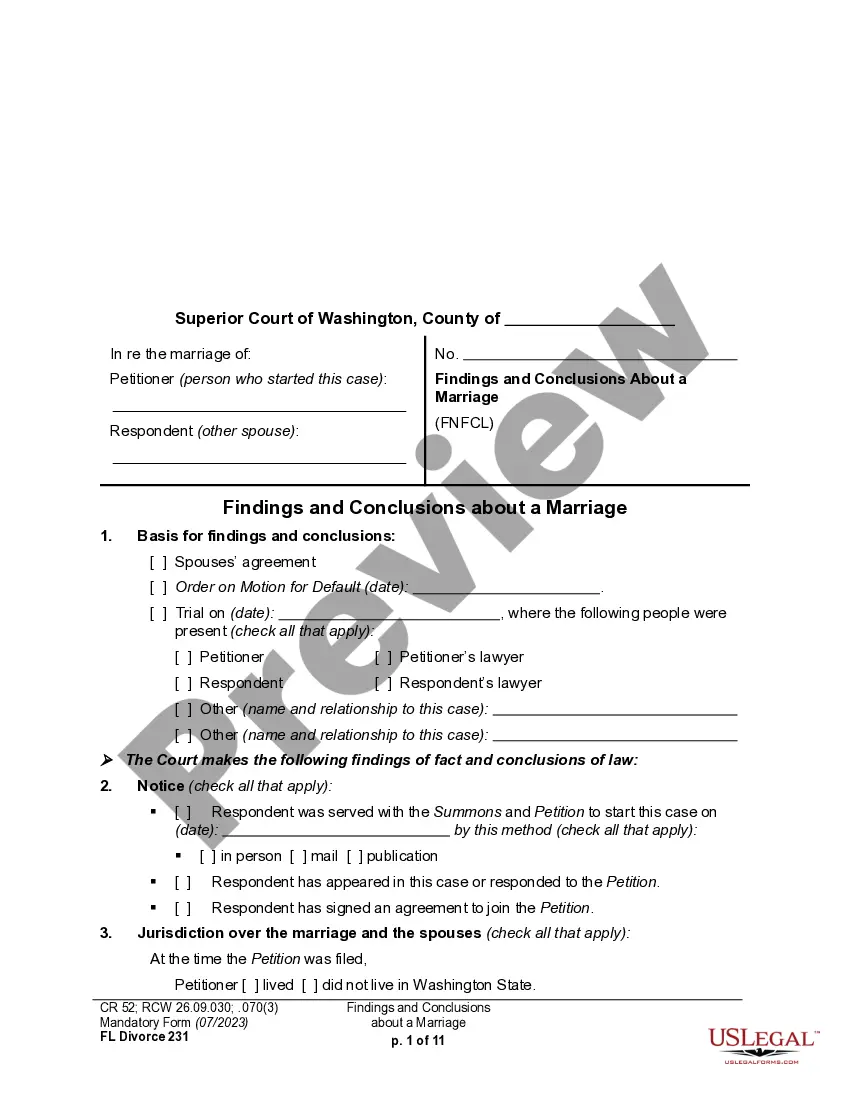

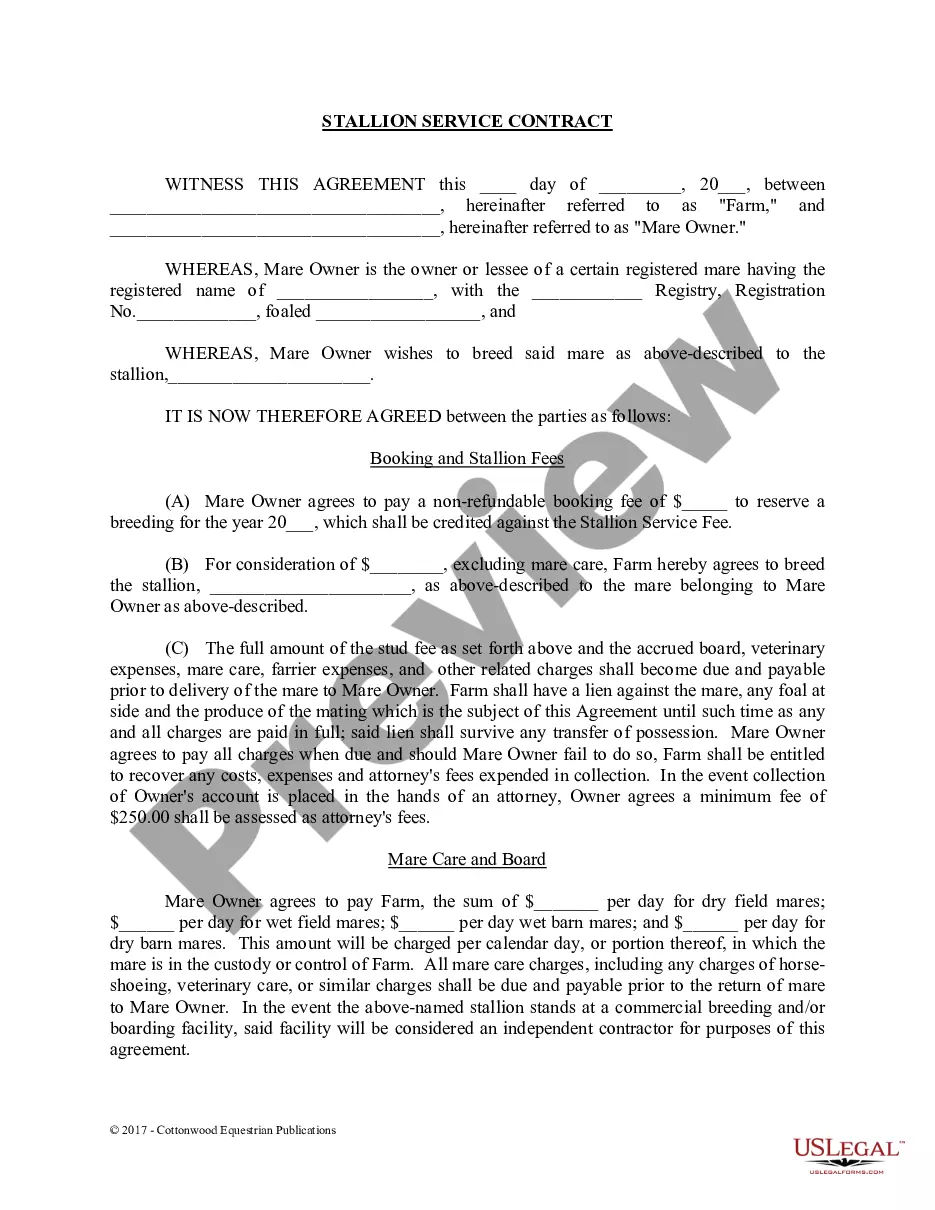

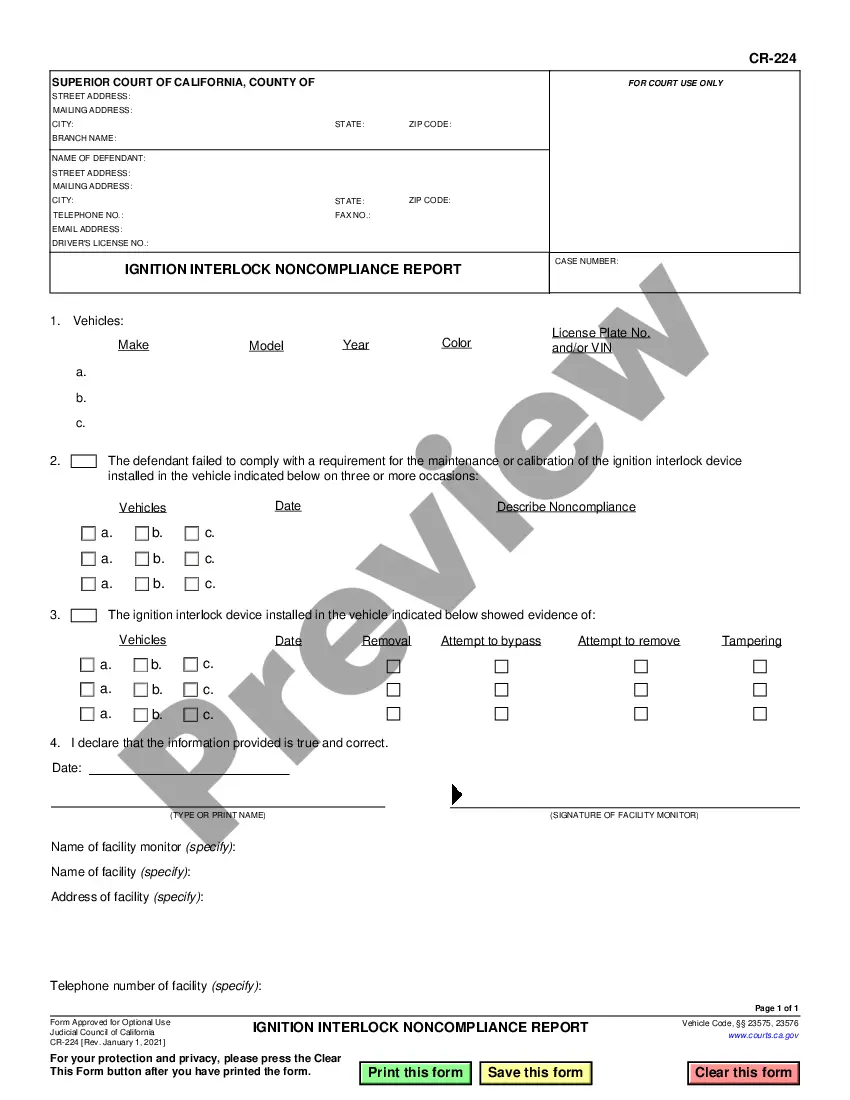

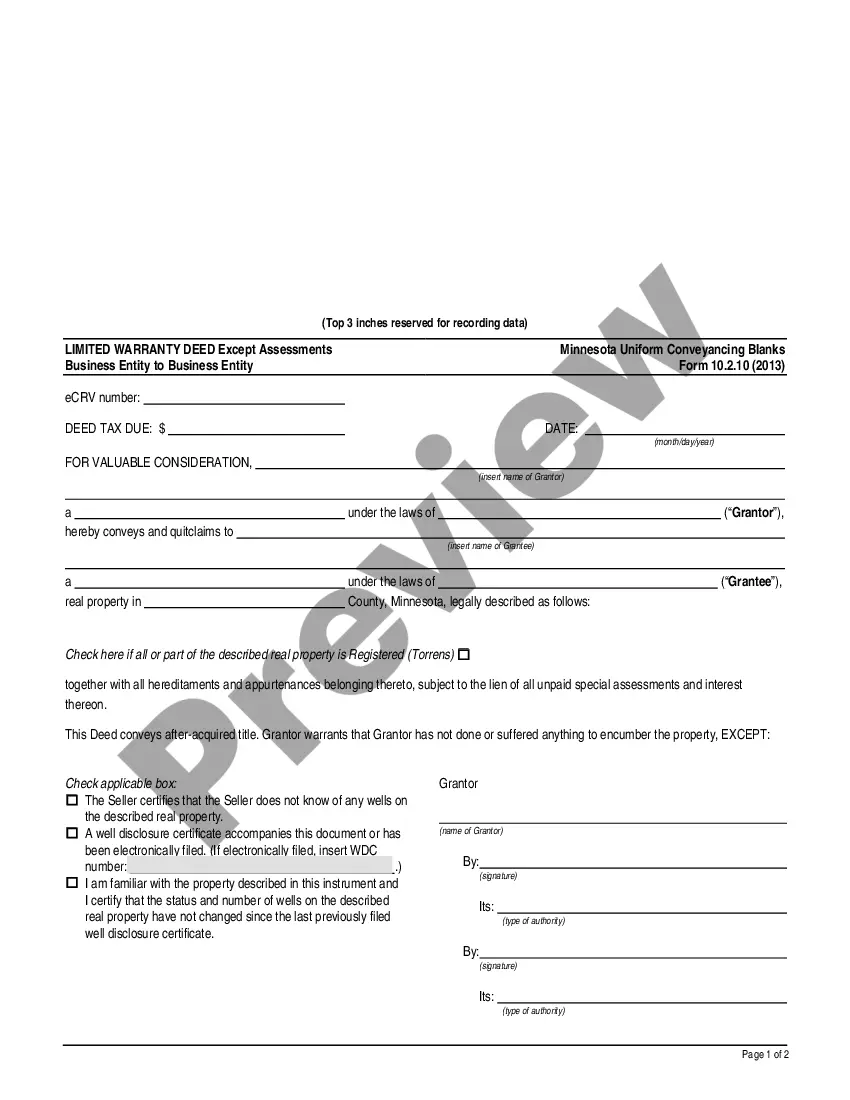

When it comes to drafting a legal document, it is easier to leave it to the specialists. However, that doesn't mean you yourself cannot find a sample to use. That doesn't mean you yourself cannot get a sample to utilize, nevertheless. Download Amendment to the articles of incorporation to eliminate par value from the US Legal Forms site. It provides numerous professionally drafted and lawyer-approved forms and samples.

For full access to 85,000 legal and tax forms, customers simply have to sign up and choose a subscription. When you are registered with an account, log in, find a certain document template, and save it to My Forms or download it to your gadget.

To make things easier, we have incorporated an 8-step how-to guide for finding and downloading Amendment to the articles of incorporation to eliminate par value promptly:

- Be sure the document meets all the necessary state requirements.

- If available preview it and read the description prior to buying it.

- Hit Buy Now.

- Choose the appropriate subscription for your needs.

- Create your account.

- Pay via PayPal or by credit/visa or mastercard.

- Choose a needed format if several options are available (e.g., PDF or Word).

- Download the file.

When the Amendment to the articles of incorporation to eliminate par value is downloaded it is possible to complete, print out and sign it in any editor or by hand. Get professionally drafted state-relevant papers in a matter of seconds in a preferable format with US Legal Forms!

Amend Share Incorporation Form popularity

Amendment Incorporation Other Form Names

Share Incorporation Stock FAQ

A stock's par value is its stated value, not its actual value. When a stock sells, it will be issued at its actual value and not the stated par value. The most common reason for a change in par value is a stock split. During a split, the total par value will actually remain unchanged.

Check your bylaws and state law. First, review your company's bylaws to see what steps you must take to change the articles. Have the board of directors vote on the proposed changes. Hold a shareholder vote, if necessary. Prepare and file an amendment form.

No-par value stock is issued without a par value.The advantage of no-par value stock is that companies can then issue stock at higher prices in future offerings. While no-par value stock is issued with no face value, low-par value stock is issued with a price as low as $0.01.

A par value for a stock is its per-share value assigned by the company that issues it and is often set at a very low amount such as one cent. A no-par stock is issued without any designated minimum value.

That the articles of incorporation or any amendment thereto is not substantially in accordance with the form prescribed herein; 2. That the purpose or purposes of the corporation are patently unconstitutional, illegal, immoral, or contrary to government rules and regulations; 3.

Furthermore, the names of the incorporators, the first set of directors and subscribers, the initial treasurer, their original subscription and the place and date of execution of the first Articles of Incorporation cannot be amended.

You can help keep your company private by reducing the number of stock shares available for purchase. A reverse split raises your stock's par value and reduces the number of shares at the same time. The reverse split doesn't change the value of the retained earnings, paid-in capital or cash accounts.

When a company's stock splits, the change in the par value is offset by a corresponding change in the number of shares so the total par value remains the same. The total stockholders' equity is unaffected by the stock split and no entries are recorded.

Does the Par Value Change? It's important to note that the par value of a bondthe amount you will receive at maturitywill never change regardless of the market rate or bond price. If the market interest rate is higher than the interest payable on a bond, the bond is said to be selling at a discount (below par value).