Purchase by company of its stock

Description

How to fill out Purchase By Company Of Its Stock?

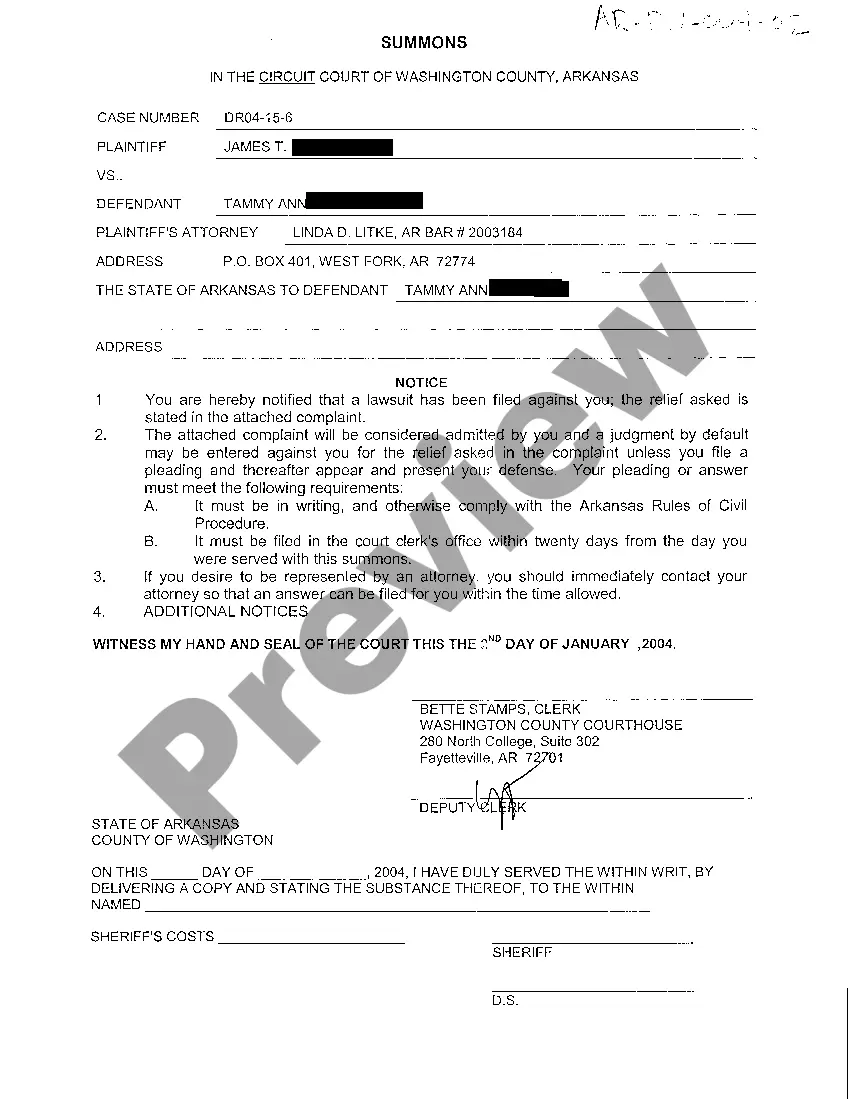

When it comes to drafting a legal form, it is easier to leave it to the experts. However, that doesn't mean you yourself can’t find a sample to utilize. That doesn't mean you yourself can’t get a template to use, however. Download Purchase by company of its stock straight from the US Legal Forms web site. It provides a wide variety of professionally drafted and lawyer-approved forms and templates.

For full access to 85,000 legal and tax forms, customers just have to sign up and select a subscription. As soon as you are registered with an account, log in, search for a particular document template, and save it to My Forms or download it to your device.

To make things much easier, we’ve provided an 8-step how-to guide for finding and downloading Purchase by company of its stock quickly:

- Make confident the document meets all the necessary state requirements.

- If possible preview it and read the description before purchasing it.

- Hit Buy Now.

- Select the appropriate subscription to meet your needs.

- Make your account.

- Pay via PayPal or by debit/bank card.

- Select a needed format if several options are available (e.g., PDF or Word).

- Download the document.

After the Purchase by company of its stock is downloaded you can complete, print out and sign it in almost any editor or by hand. Get professionally drafted state-relevant files in a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

If you are not an employee, you can buy stock from a company directly through either a Direct Stock Purchasing Program (DSPP) or a Dividend Reinvestment Plan (DRIP). By purchasing stock through a DSPP or DRIP, you can bypass brokers and brokerage fees to buy stock directly from your company of choice.

A big advantage of buying stock directly from a company versus a broker is that it's cheap.When you consider opening a DSPP with a company, read the plan brochure or prospectus carefully. There is sometimes a one-time set-up fee and the charges for selling shares are usually higher.

The Shareholders has the Power More than 10 but Less than 25% The overall limit of buy-back is 25% or less of the total paid-up equity capital and free reserves of the company with Approval of Shareholders by General Meeting by Special Resolution.

If you are not an employee, you can buy stock from a company directly through either a Direct Stock Purchasing Program (DSPP) or a Dividend Reinvestment Plan (DRIP). By purchasing stock through a DSPP or DRIP, you can bypass brokers and brokerage fees to buy stock directly from your company of choice.

When one public company buys another, stockholders in the company being acquired will generally be compensated for their shares. This can be in the form of cash or in the form of stock in the company doing the buying. Either way, the stock of the company being bought will usually cease to exist.

A stock buyback, also known as a share repurchase, occurs when a company buys back its shares from the marketplace with its accumulated cash. A stock buyback is a way for a company to re-invest in itself. The repurchased shares are absorbed by the company, and the number of outstanding shares on the market is reduced.

The correct answer is that a buyback of all shares is a liquidation. If there are zero shares, this can only mean the company no longer exists.If the company is undervalued on the market compared to what it can liquidate its net assets for, the shareholders might pursue liquidation.

Choose an order type Placing a "market order," which instructs your broker to buy the stock immediately and at the best available price, is typically the best order type for buy-and-hold investors.

Examples of companies that offer direct stock purchase plans are Walmart, Starbucks, and Coca-Cola. Similar to the brokerage model, investors initiate the direct stock purchase by transferring money from their checking or savings accounts, and the money is used to purchase shares.