Terms of Class One Preferred Stock

Description Terms Class Online

How to fill out Class Stock Paper?

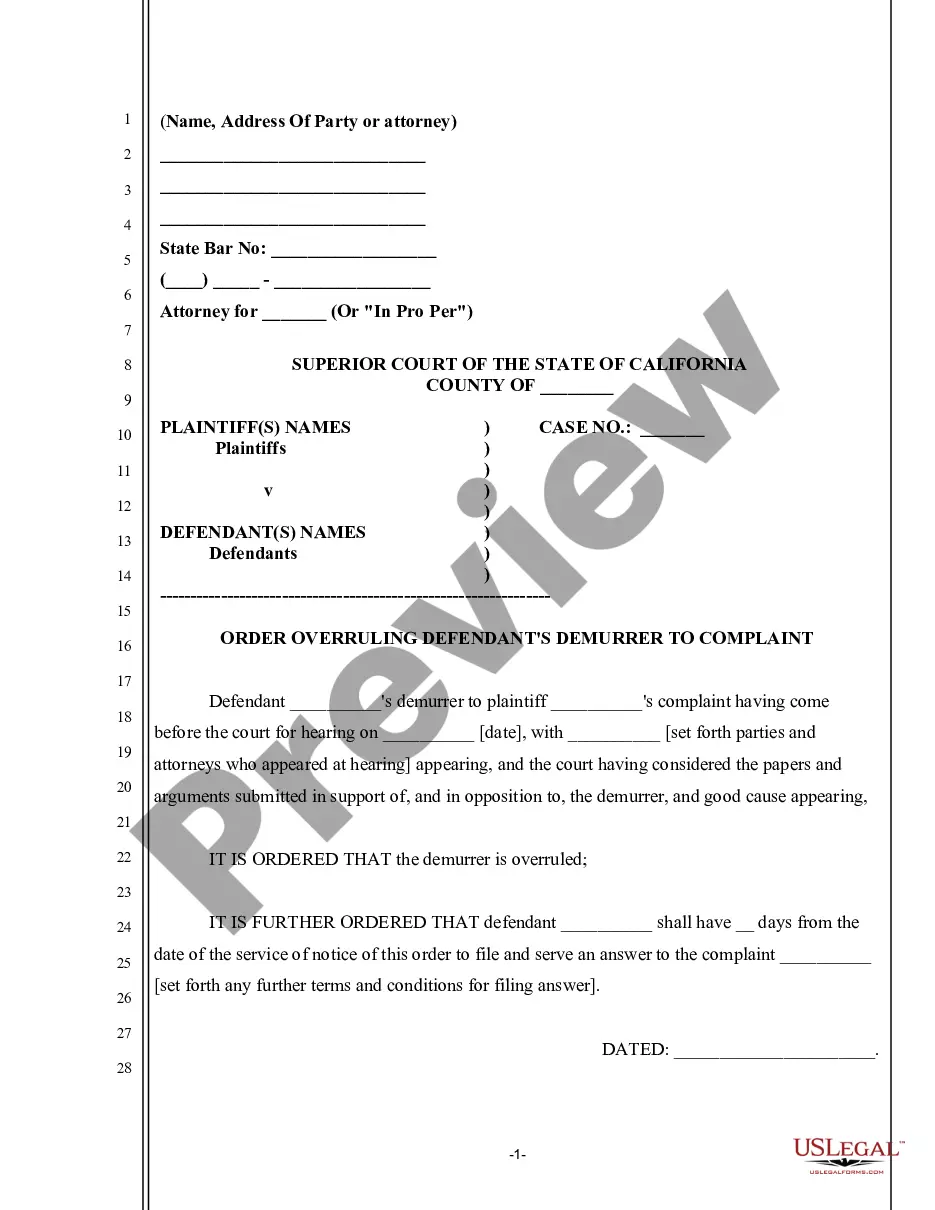

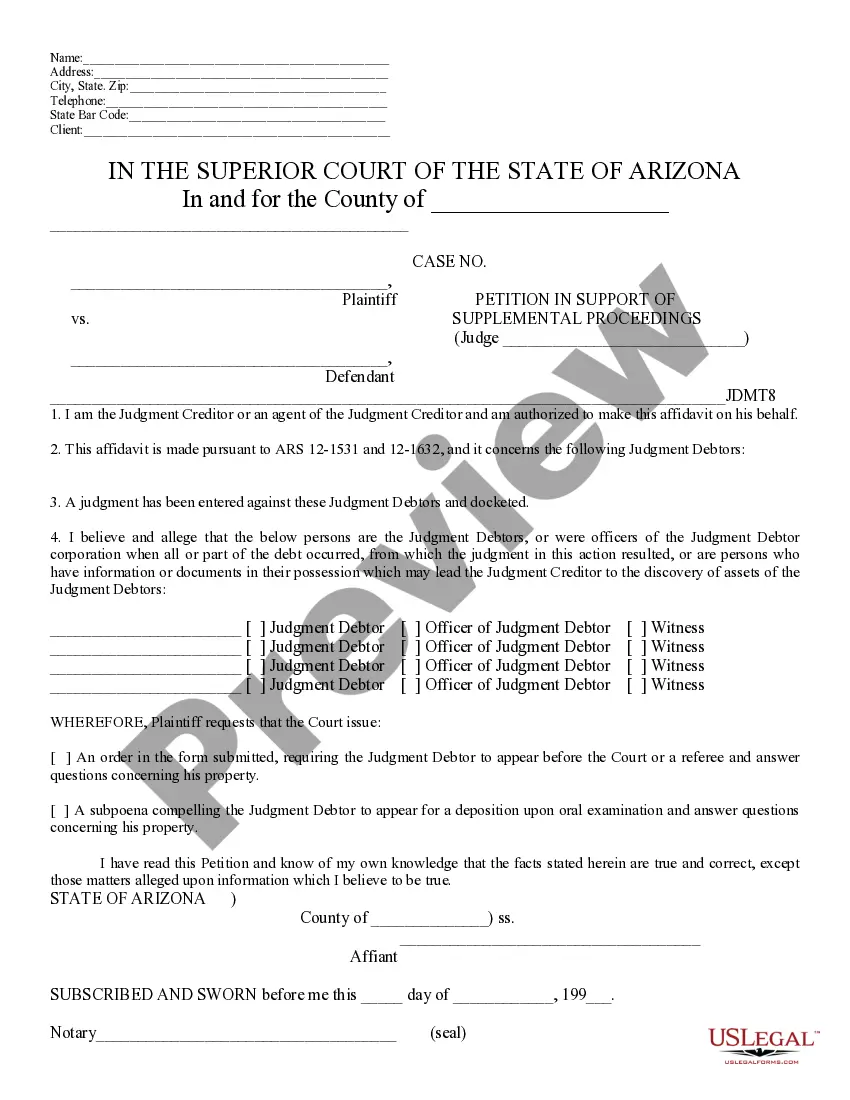

When it comes to drafting a legal document, it’s better to delegate it to the professionals. However, that doesn't mean you yourself can’t find a sample to use. That doesn't mean you yourself cannot find a sample to utilize, however. Download Terms of Class One Preferred Stock from the US Legal Forms website. It provides numerous professionally drafted and lawyer-approved documents and samples.

For full access to 85,000 legal and tax forms, customers simply have to sign up and choose a subscription. Once you’re registered with an account, log in, look for a certain document template, and save it to My Forms or download it to your device.

To make things much easier, we have incorporated an 8-step how-to guide for finding and downloading Terms of Class One Preferred Stock quickly:

- Be sure the document meets all the necessary state requirements.

- If available preview it and read the description prior to buying it.

- Press Buy Now.

- Select the suitable subscription for your needs.

- Make your account.

- Pay via PayPal or by debit/visa or mastercard.

- Choose a needed format if a few options are available (e.g., PDF or Word).

- Download the file.

After the Terms of Class One Preferred Stock is downloaded you may fill out, print and sign it in almost any editor or by hand. Get professionally drafted state-relevant files in a matter of minutes in a preferable format with US Legal Forms!

Class One Stock Form popularity

Class Stock Pdf Other Form Names

Class Share Corporation FAQ

Series A financing (also known as series A round or series A funding) is one of the stages in the capital-raising process by a startup.This means that a company secures the required capital from investors by selling the company's shares. However, in most cases, series A financing comes with anti-dilution provisions.

A-2 Common Stock means the Series A-2 common stock, par value $0.01 per share, of the Company and any securities issued in respect thereof, or in substitution therefor, in connection with any stock split, dividend or combination, or any reclassification, recapitalization, merger, consolidation, exchange or other

Key Takeaways. Class A shares refer to a classification of common stock that was traditionally accompanied by more voting rights than Class B shares. Traditional Class A shares are not sold to the public and also can't be traded by the holders of the shares.

There are two main types of stocks: common stock and preferred stock.

Class B shares are issued by corporations as a class of common stock with fewer voting rights and lower dividend priority than Class A shares.Class B shares may also refer to mutual fund shares that carry no sales load.

Growth stocks. These are the shares you buy for capital growth, rather than dividends. Dividend aka yield stocks. New issues. Defensive stocks. Strategy or Stock Picking?

There are two main types of stocks: common stock and preferred stock.

In America, Series A preferred stock is the first round of stock offered during the seed or early stage round by a portfolio company to the venture capital investor. Series A preferred stock is often convertible into common stock in certain cases such as an Initial public offering (IPO) or the sale of the company.