Articles Supplementary - classifying Preferred Stock as Cumulative Convertible Preferred Stock

Description Preferred Stock Convertible

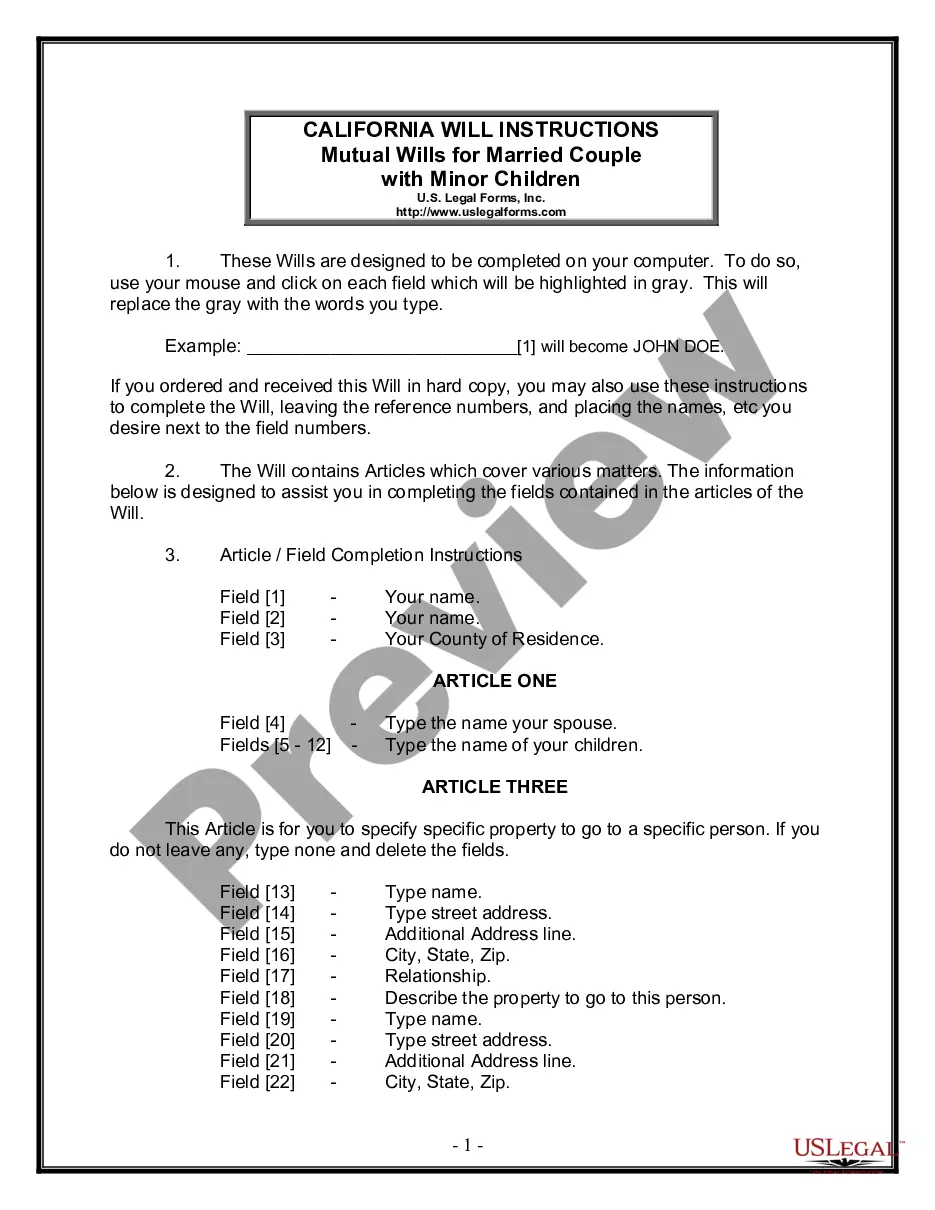

How to fill out Supplementary Classifying Convertible?

When it comes to drafting a legal form, it’s easier to delegate it to the specialists. Nevertheless, that doesn't mean you yourself can’t get a sample to use. That doesn't mean you yourself can’t find a template to utilize, however. Download Articles Supplementary - classifying Preferred Stock as Cumulative Convertible Preferred Stock straight from the US Legal Forms site. It gives you numerous professionally drafted and lawyer-approved documents and samples.

For full access to 85,000 legal and tax forms, customers just have to sign up and select a subscription. As soon as you’re signed up with an account, log in, search for a particular document template, and save it to My Forms or download it to your gadget.

To make things much easier, we’ve incorporated an 8-step how-to guide for finding and downloading Articles Supplementary - classifying Preferred Stock as Cumulative Convertible Preferred Stock quickly:

- Be sure the document meets all the necessary state requirements.

- If possible preview it and read the description prior to buying it.

- Hit Buy Now.

- Choose the suitable subscription for your needs.

- Make your account.

- Pay via PayPal or by credit/credit card.

- Select a needed format if a number of options are available (e.g., PDF or Word).

- Download the file.

When the Articles Supplementary - classifying Preferred Stock as Cumulative Convertible Preferred Stock is downloaded you can complete, print out and sign it in any editor or by hand. Get professionally drafted state-relevant files within a matter of minutes in a preferable format with US Legal Forms!

Stock Cumulative Template Form popularity

Preferred Cumulative Template Other Form Names

Stock Cumulative Pdf FAQ

Find the dividend rate for the cumulative preferred stock. Multiply the dividend percentage rate by the par value to find the dollar amount of the dividend per share. Check the company's annual and quarterly reports to see if any cumulative preferred stock dividends have not been paid.

Find the dividend rate for the cumulative preferred stock. Multiply the dividend percentage rate by the par value to find the dollar amount of the dividend per share. Check the company's annual and quarterly reports to see if any cumulative preferred stock dividends have not been paid.

Preferred shares usually pay cumulative dividends, but not always.

Accounting for Cash Dividends When Only Common Stock Is Issued. The journal entry to record the declaration of the cash dividends involves a decrease (debit) to Retained Earnings (a stockholders' equity account) and an increase (credit) to Cash Dividends Payable (a liability account).

Cumulative preferred dividends go from being a balance sheet footnote to a recognized liability when your board of directors declares a dividend. The dividends are accounted for in the Dividends Payable account in the current liabilities section on the balance sheet.

Multiply the number of missed quarterly preferred dividend payments by the company's quarterly dividend payment. Continuing the same example, $1.50 x 5 = $7.50. This figure represents the cumulative dividend per share of preferred stock owed by the company.

Due to this lower cost of capital, most companies' preferred stock offerings are issued with the cumulative feature. Generally, only blue-chip companies with strong dividend histories can issue non-cumulative preferred stock without increasing the cost of capital.

It sports the name preferred because its owners receive dividends before the owners of common stock. On a classified balance sheet, a company separates accounts into classifications, or subsections, within the main sections. Preferred stock is classified as part of capital stock in the stockholders' equity section.