Stock Option Plan of Star States Corporation

Description

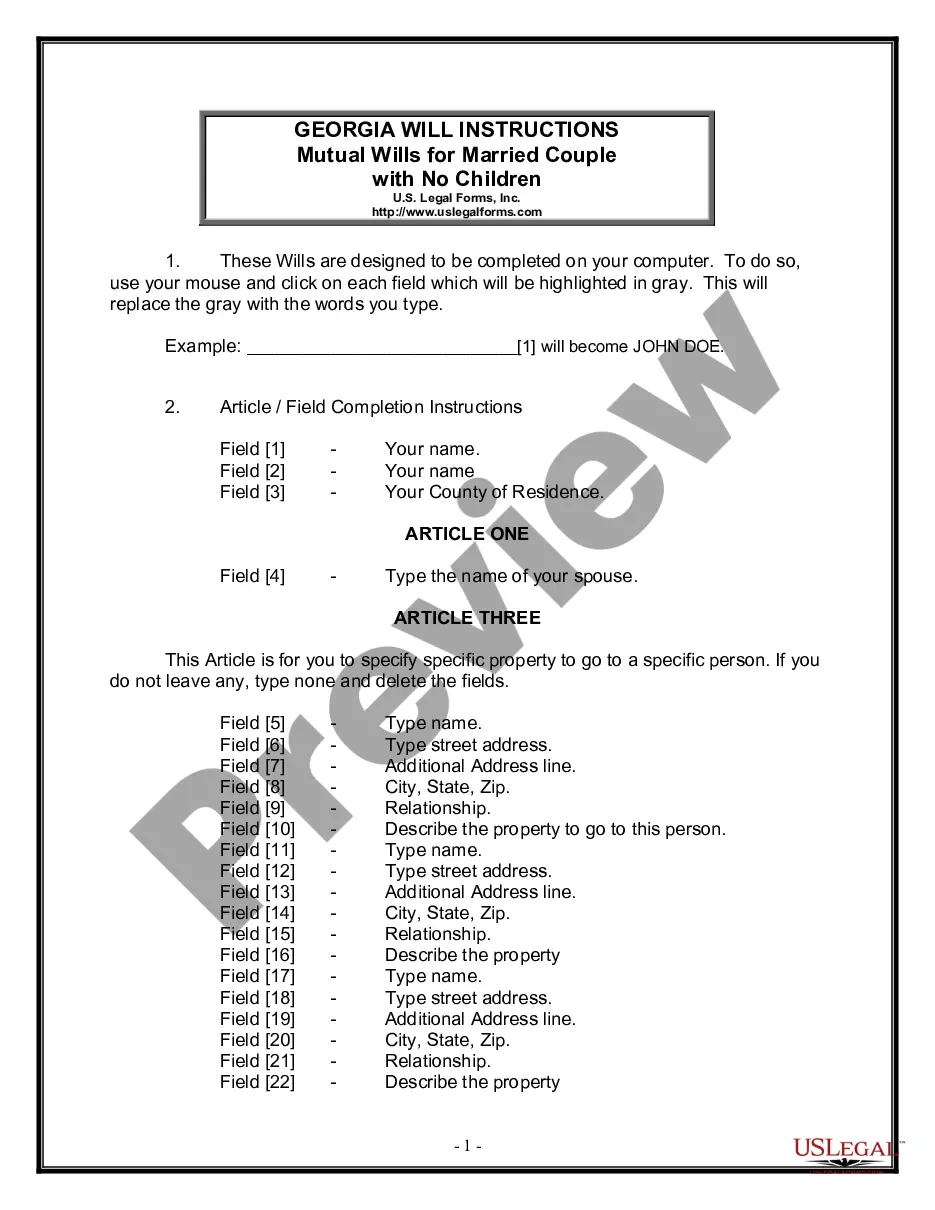

How to fill out Stock Option Plan Of Star States Corporation?

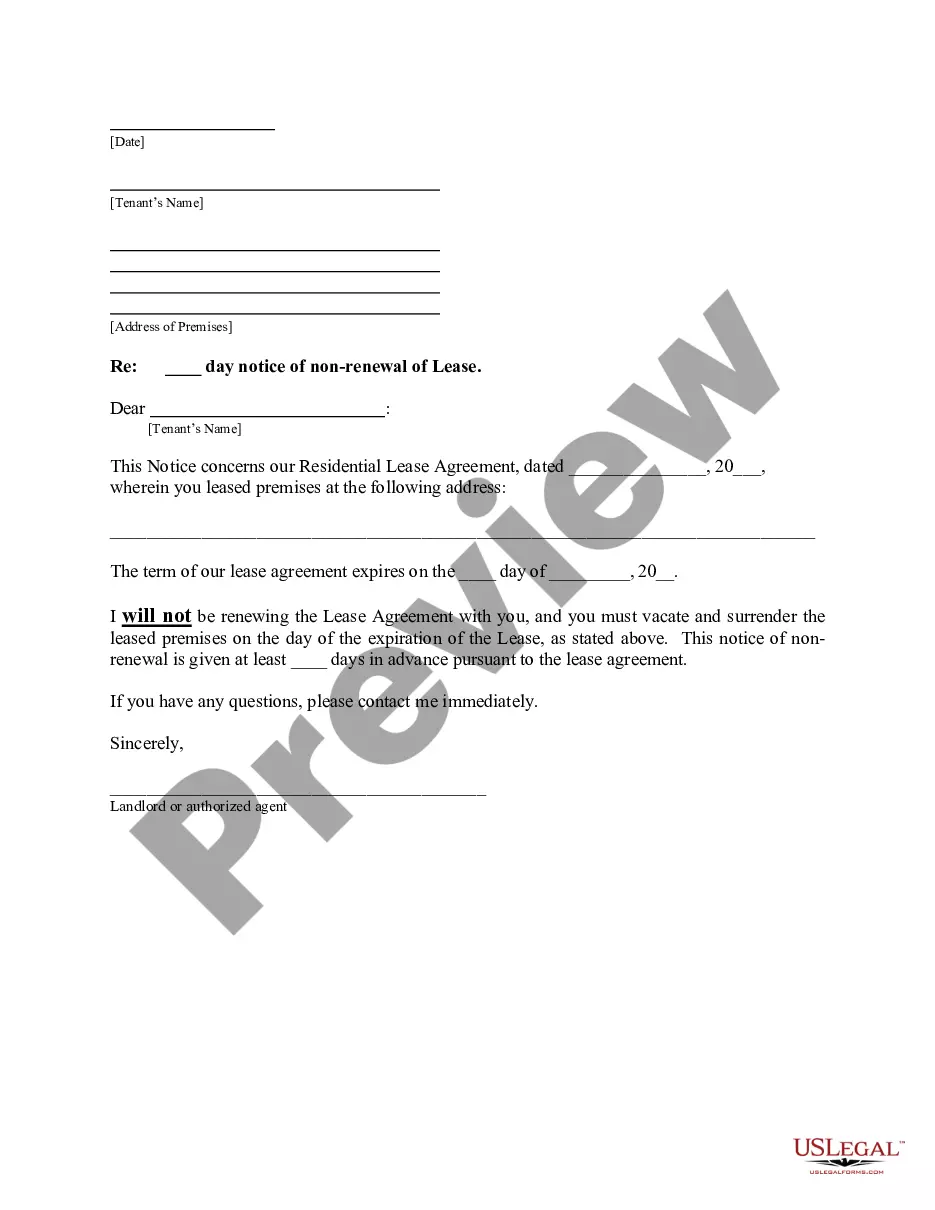

When it comes to drafting a legal document, it’s better to leave it to the professionals. Nevertheless, that doesn't mean you yourself can not find a sample to utilize. That doesn't mean you yourself cannot find a sample to use, however. Download Stock Option Plan of Star States Corporation straight from the US Legal Forms web site. It gives you a wide variety of professionally drafted and lawyer-approved forms and samples.

For full access to 85,000 legal and tax forms, customers just have to sign up and select a subscription. As soon as you’re registered with an account, log in, search for a particular document template, and save it to My Forms or download it to your gadget.

To make things easier, we’ve provided an 8-step how-to guide for finding and downloading Stock Option Plan of Star States Corporation fast:

- Make sure the document meets all the necessary state requirements.

- If possible preview it and read the description before buying it.

- Click Buy Now.

- Select the appropriate subscription for your requirements.

- Create your account.

- Pay via PayPal or by debit/bank card.

- Choose a needed format if several options are available (e.g., PDF or Word).

- Download the document.

As soon as the Stock Option Plan of Star States Corporation is downloaded you can complete, print out and sign it in any editor or by hand. Get professionally drafted state-relevant papers within a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

If you have been given the opportunity to purchase stock options, you may want to take advantage of them if you can afford to do so. But you should not go into debt to purchase stock options.You should also only purchase stock options if you are confident that the company is going to continue to grow and profit.

Employee Stock Option Plan (ESOP) is an employee benefit scheme under which the company encourages its employees to acquire ownership in the form of shares. These shares are allotted to the employees at a rate considerably lesser than the prevailing market rate.

An employee stock option is the right given to you by your employer to buy ("exercise") a certain number of shares of company stock at a pre-set price (the "grant," "strike" or "exercise" price) over a certain period of time (the "exercise period").It can be lower or higher than that, depending on the type of option.

In addition, because the revised section 162(m) applies to only a handful of top employees at publicly traded corporations, it will not limit stock option tax deductions at private corporations, will not cover many employees who receive stock option pay at publicly traded corporations, and will not curb tax deductions

The current price of the stock is $30. If the price of the stock shoots up to $55 on the day of expiration, Jon can exercise his option to buy 100 shares of CSX at $45 and then sell them at $55 on the day of expiration, making a profit of $10 per share.

Stock options are a form of compensation. Companies can grant them to employees, contractors, consultants and investors. These options, which are contracts, give an employee the right to buy or exercise a set number of shares of the company stock at a pre-set price, also known as the grant price.

With an employee stock option plan, you are offered the right to buy a specific number of shares of company stock, at a specified price called the grant price (also called the exercise price or strike price), within a specified number of years.

Employee stock options (ESOs) are a type of equity compensation granted by companies to their employees and executives.When a stock's price rises above the call option exercise price, call options are exercised and the holder obtains the company's stock at a discount.

However, when you sell an optionor the stock you acquired by exercising the optionyou must report the profit or loss on Schedule D of your Form 1040. If you've held the stock or option for less than one year, your sale will result in a short-term gain or loss, which will either add to or reduce your ordinary income.