Approval of transfer of outstanding stock with copy of Liquidating Trust Agreement

Description Copy Liquidating Application

How to fill out Outstanding Copy Trust?

When it comes to drafting a legal form, it’s better to delegate it to the professionals. Nevertheless, that doesn't mean you yourself can not get a sample to use. That doesn't mean you yourself cannot get a template to utilize, nevertheless. Download Approval of transfer of outstanding stock with copy of Liquidating Trust Agreement from the US Legal Forms web site. It offers numerous professionally drafted and lawyer-approved documents and samples.

For full access to 85,000 legal and tax forms, customers simply have to sign up and choose a subscription. After you are signed up with an account, log in, search for a certain document template, and save it to My Forms or download it to your device.

To make things much easier, we have provided an 8-step how-to guide for finding and downloading Approval of transfer of outstanding stock with copy of Liquidating Trust Agreement fast:

- Make sure the document meets all the necessary state requirements.

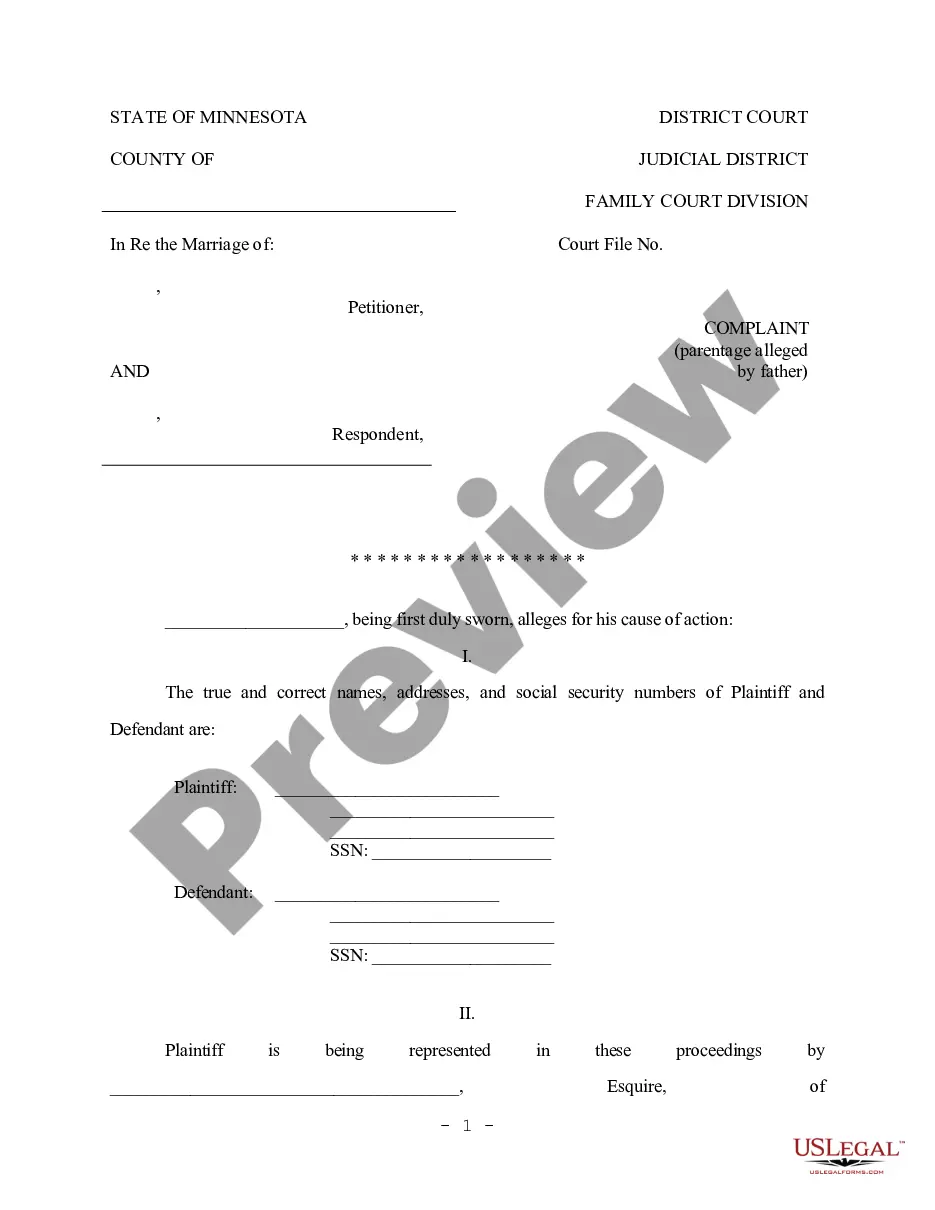

- If possible preview it and read the description prior to buying it.

- Press Buy Now.

- Select the suitable subscription to meet your needs.

- Make your account.

- Pay via PayPal or by debit/visa or mastercard.

- Choose a preferred format if a number of options are available (e.g., PDF or Word).

- Download the file.

As soon as the Approval of transfer of outstanding stock with copy of Liquidating Trust Agreement is downloaded it is possible to complete, print out and sign it in any editor or by hand. Get professionally drafted state-relevant documents within a matter of seconds in a preferable format with US Legal Forms!

Liquidating Form Form popularity

Liquidating Trust Other Form Names

Liquidating Trust Agreement FAQ

Liquidation is the process of converting a company's assets into cash, and using those funds to repay, as much as possible, the company's debts. Liquidation results in the company being shut down.Court liquidation starts as a result of a court order, usually made after an application by a creditor of the company.

Hire a professional auctioneer and hold a public auction. Pay a business broker a fee to sell off your assets. File bankruptcy, in which case the a bankruptcy trustee will sell your assets and pay off your creditors with the proceeds. Assign your assets and debts to a company that specializes in liquidating businesses.

When a company goes into liquidation its assets are sold to repay creditors and the business closes down. The company name remains live on Companies House but its status switches to 'Liquidation'.Insolvent liquidation occurs when a company cannot carry on for financial reasons.

From beginning to end, it usually takes between six and 24 months to fully liquidate a company. Of course, it does depend on your company's position and the form of liquidation you're undertaking.

Liquidate means converting property or assets into cash or cash equivalents by selling them on the open market. Liquidation similarly refers to the process of bringing a business to an end and distributing its assets to claimants.

Talk to your lawyer & accountant. Scrutinize your assets: inventory, assess, & prepare each item for sale. Secure your merchandise. Establish the liquidation value of your assets. Make certain that a sale is worthwhile. Choose the best type of sale for your merchandise. Select the best time for your sale.

Most small businesses don't have stocks and bonds on their balance, but if yours does, these assets are the quickest to liquidate. An open market exists for their sale. Converting these assets to cash takes less than a day or so.

Talk to your lawyer & accountant. Scrutinize your assets: inventory, assess, & prepare each item for sale. Secure your merchandise. Establish the liquidation value of your assets. Make certain that a sale is worthwhile. Choose the best type of sale for your merchandise. Select the best time for your sale.

What Is Liquidation? Liquidation in finance and economics is the process of bringing a business to an end and distributing its assets to claimants. It is an event that usually occurs when a company is insolvent, meaning it cannot pay its obligations when they are due.