Changing state of incorporation

Description Company Corporate Legal

How to fill out Corporation Law Legal?

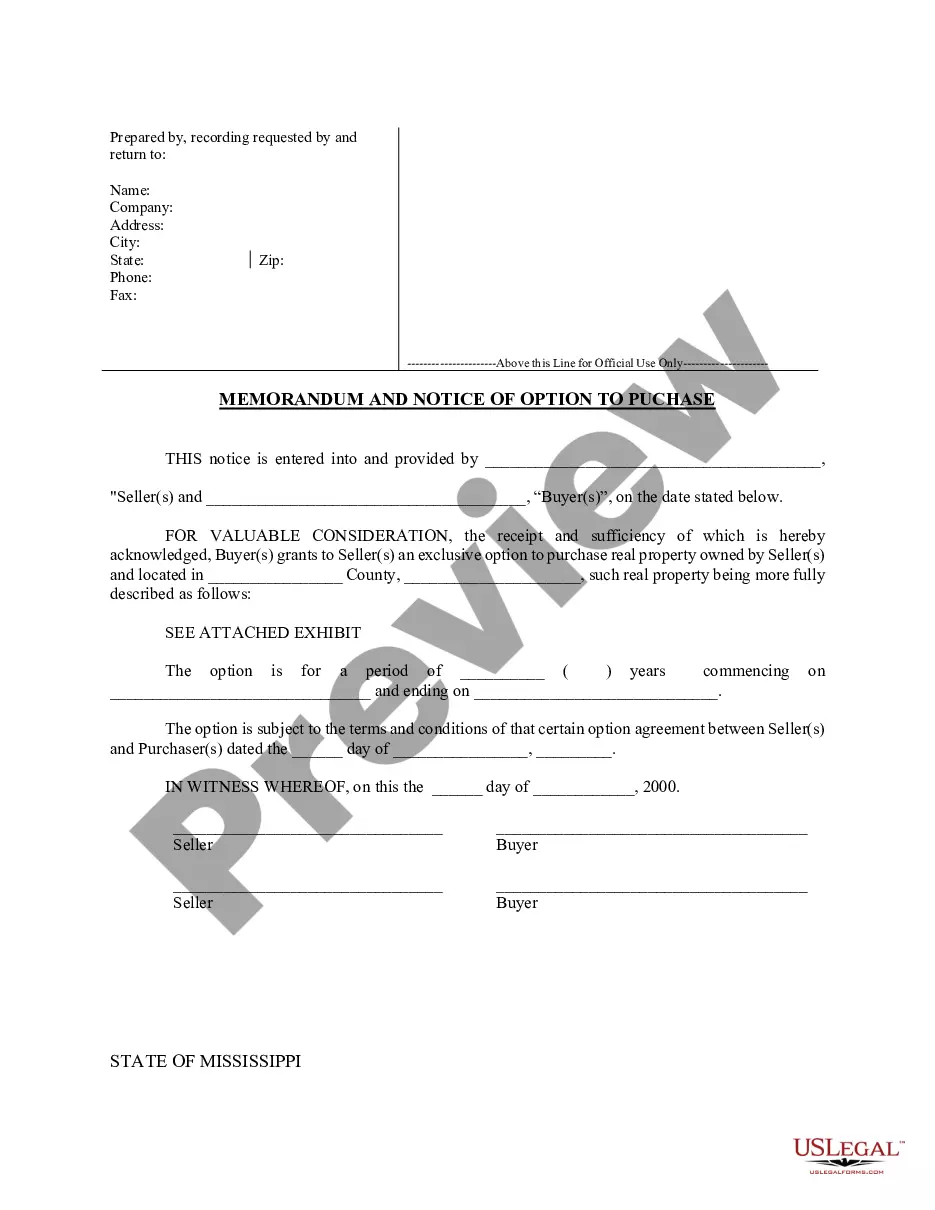

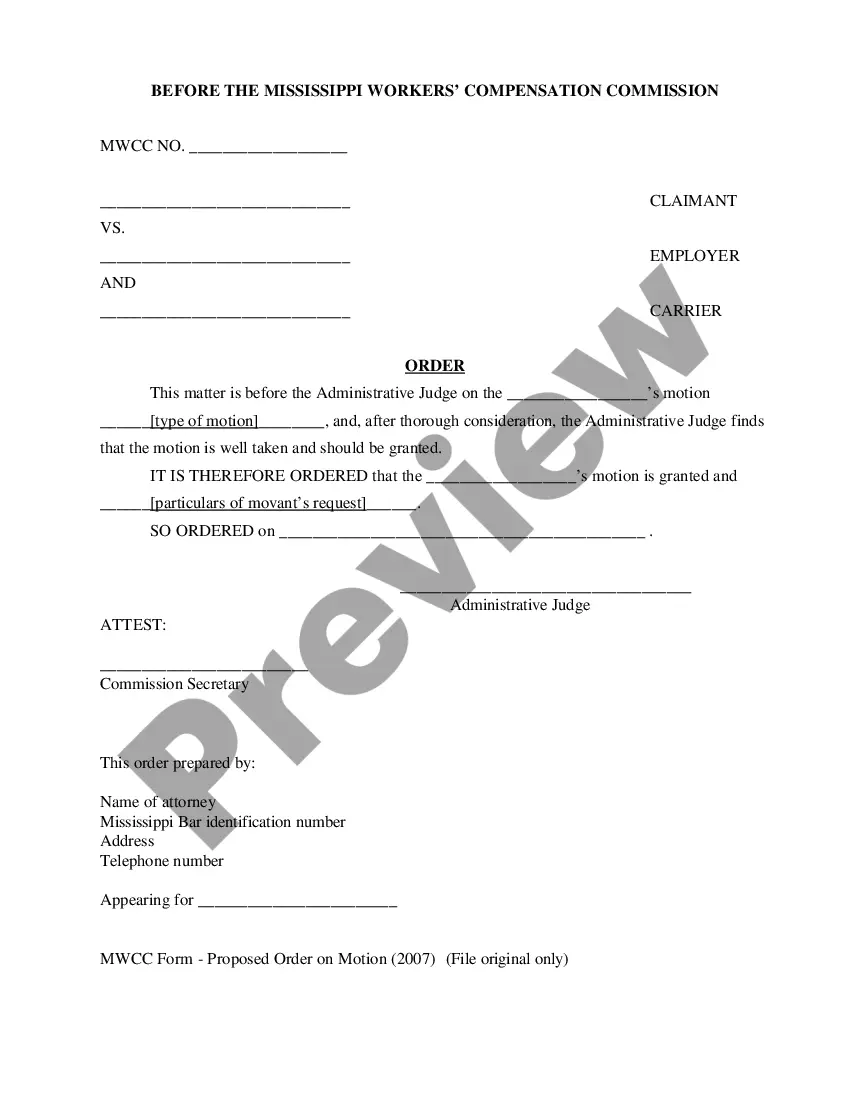

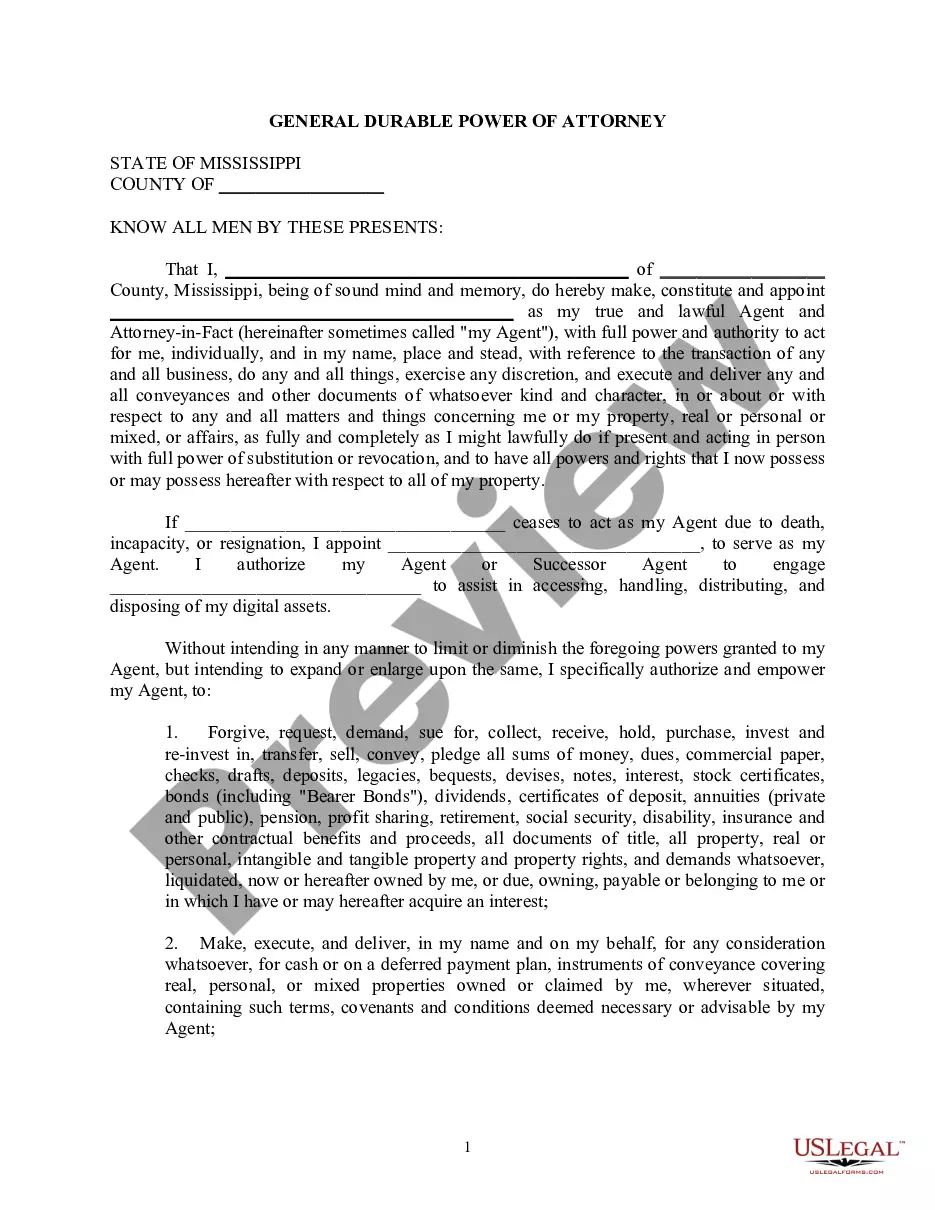

When it comes to drafting a legal form, it’s easier to leave it to the professionals. However, that doesn't mean you yourself cannot get a template to utilize. That doesn't mean you yourself cannot get a sample to use, however. Download Changing state of incorporation right from the US Legal Forms site. It provides numerous professionally drafted and lawyer-approved documents and samples.

For full access to 85,000 legal and tax forms, users just have to sign up and choose a subscription. When you’re registered with an account, log in, find a particular document template, and save it to My Forms or download it to your device.

To make things less difficult, we have incorporated an 8-step how-to guide for finding and downloading Changing state of incorporation promptly:

- Make confident the form meets all the necessary state requirements.

- If available preview it and read the description prior to buying it.

- Hit Buy Now.

- Choose the suitable subscription to meet your needs.

- Make your account.

- Pay via PayPal or by credit/credit card.

- Select a preferred format if a few options are available (e.g., PDF or Word).

- Download the file.

When the Changing state of incorporation is downloaded you may fill out, print and sign it in any editor or by hand. Get professionally drafted state-relevant documents within a matter of minutes in a preferable format with US Legal Forms!

Corporation Delaware Law Form popularity

Corporation Delaware Legal Other Form Names

Changing Incorporation FAQ

You should incorporate your business (LLC or Corporation) in the state in which you're doing business. For example, if you'll be operating your business in California, then you should form your LLC in California.

Keep Old LLC and Register In New State Perhaps the easiest way to move your LLC to a new state is to keep your old LLC and register it as a foreign LLC in the new state where you want to relocate. This entails filing a form and paying an annual fee, which varies from state to state.

Can you incorporate in multiple states? No; although your corporation or limited liability company can register and do business in multiple states, you are only allowed to incorporate in one state.

Form the new-state corporation. Transfer assets and liabilities of the existing corporation to the new-state corporation. Form the new-state corporation. Convert the existing corporation to a new-state corporation.

If you move your corporate or LLC offices to a new state, and you decide you want to change your state of formation, you have one of three options:Do a reorganization, where a corporation or LLC is formed in the new state and the old corporation or LLC is merged into it. Enter into a statutory conversion/domestication

You don't have to incorporate in the state where you live, but you should choose the state carefully. When you incorporate your business, you take on tax obligations as well as regulations regarding how you operate your company.

Every state levies some form of taxation upon companies that incorporate within their jurisdiction: corporate tax, franchise tax, annual reporting fees, etc. But taxes must be paid in any state where your business has either a physical or economic nexus.

Can you incorporate in multiple states? Technically, you incorporate a business in a single state, but can register to operate your business in additional states by filing a foreign qualification. This basically allows you to register your business in any other state you plan on conducting business.

A new corporation or LLC has to be formed in the new state and the dissolved corporation's or LLC's assets, properties, and liabilities will have to be transferred, by contract, to the new one.Since S corporations are pass-through entities, there may be no immediate cost to the corporation or its shareholders.