Insurance Clause is a contractual agreement between two parties, typically an insurer and an insured, which specifies the terms and conditions of the insurance coverage. It is a legally binding document that is included in an insurance policy to ensure that both parties understand and agree to the coverage provided. Insurance clauses detail the rights, duties, and obligations of both parties, and the scope of the coverage and any exclusions, limitations, or other conditions that may apply. There are several types of insurance clauses, including Conditional clauses, Warranty clauses, Time clauses, Exclusions clauses, and Subrogation clauses. Conditional clauses specify the terms and conditions that an insured must comply with in order to be eligible for coverage. Warranty clauses define the coverage that is provided in the event of a claim, as well as any restrictions or limitations that may apply. Time clauses set a defined period of time during which the policy is in effect. Exclusions clauses specify any risks or losses that are not covered under the policy. Finally, Subrogation clauses allow the insurer to seek reimbursement from a third party for any losses paid out under the policy.

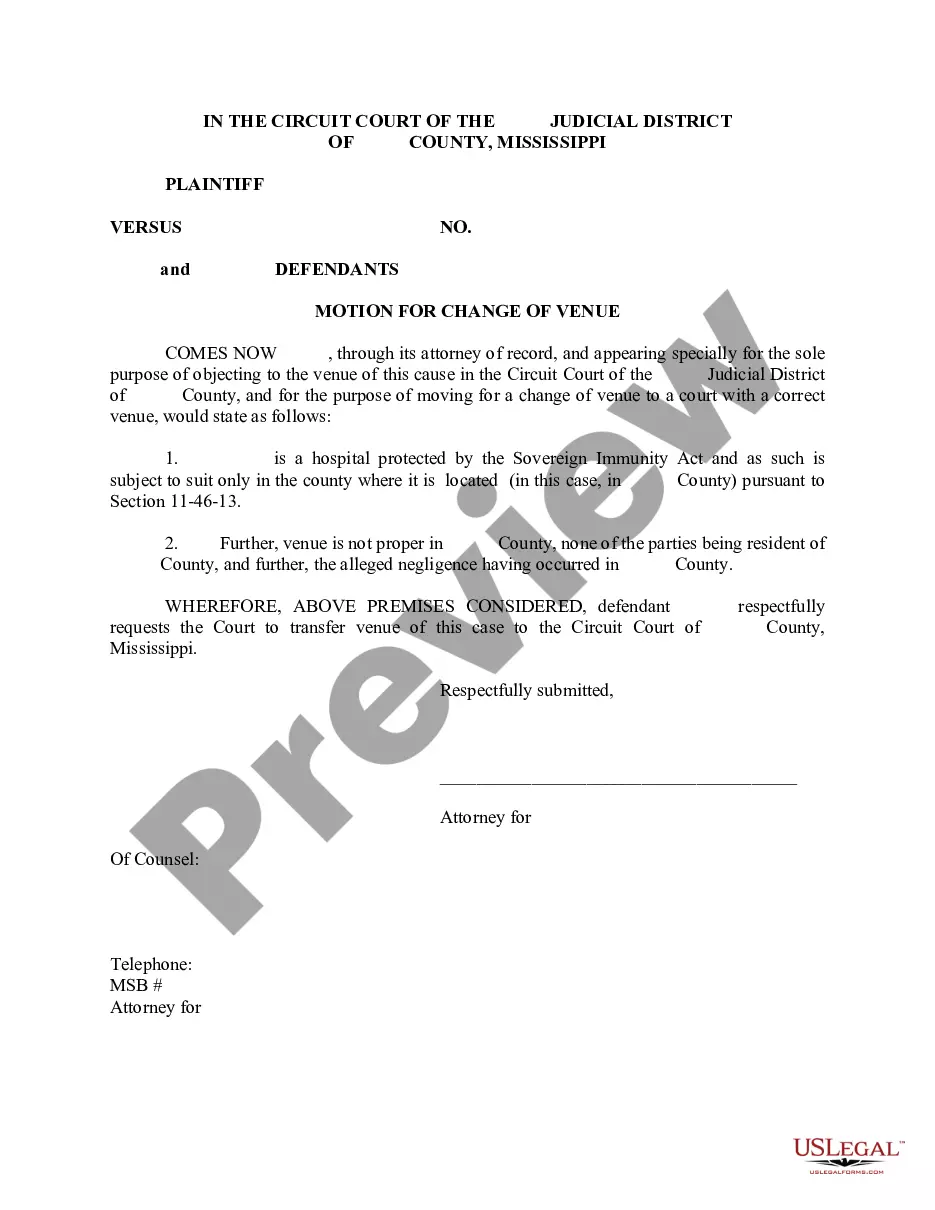

Insurance Clause

Description

How to fill out Insurance Clause?

US Legal Forms is the most easy and affordable way to find suitable formal templates. It’s the most extensive online library of business and personal legal documentation drafted and verified by attorneys. Here, you can find printable and fillable templates that comply with federal and local regulations - just like your Insurance Clause.

Obtaining your template takes just a few simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the form on their device. Later, they can find it in their profile in the My Forms tab.

And here’s how you can get a properly drafted Insurance Clause if you are using US Legal Forms for the first time:

- Read the form description or preview the document to make certain you’ve found the one meeting your demands, or locate another one utilizing the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and select the subscription plan you prefer most.

- Register for an account with our service, log in, and pay for your subscription using PayPal or you credit card.

- Select the preferred file format for your Insurance Clause and download it on your device with the appropriate button.

Once you save a template, you can reaccess it whenever you want - just find it in your profile, re-download it for printing and manual completion or upload it to an online editor to fill it out and sign more efficiently.

Take full advantage of US Legal Forms, your trustworthy assistant in obtaining the required official documentation. Try it out!