"Capital Markets Mortgage" is a American Lawyer Media form. This is a book created by the Mortgage Bankers Association of America, The National Association of Realtors, and the National Realty Committee, for the Capital Consortium explaining everything about capital markets mortgage.

Capital Markets Mortgage

Description

How to fill out Capital Markets Mortgage?

When it comes to drafting a legal form, it is easier to leave it to the experts. However, that doesn't mean you yourself cannot get a sample to utilize. That doesn't mean you yourself can not find a template to utilize, nevertheless. Download Capital Markets Mortgage from the US Legal Forms web site. It provides a wide variety of professionally drafted and lawyer-approved forms and templates.

For full access to 85,000 legal and tax forms, customers just have to sign up and choose a subscription. Once you’re registered with an account, log in, look for a specific document template, and save it to My Forms or download it to your device.

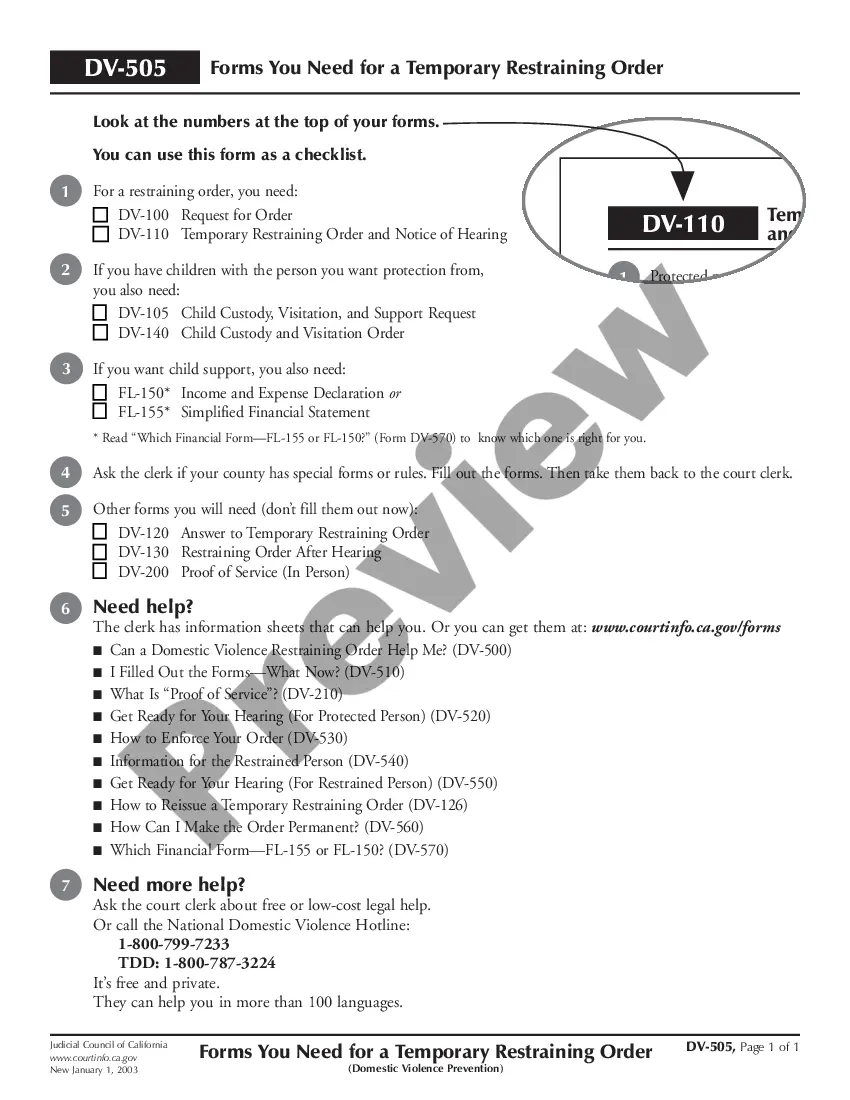

To make things less difficult, we’ve incorporated an 8-step how-to guide for finding and downloading Capital Markets Mortgage quickly:

- Make sure the document meets all the necessary state requirements.

- If possible preview it and read the description prior to buying it.

- Hit Buy Now.

- Choose the suitable subscription to suit your needs.

- Make your account.

- Pay via PayPal or by debit/bank card.

- Choose a preferred format if a number of options are available (e.g., PDF or Word).

- Download the document.

When the Capital Markets Mortgage is downloaded you can complete, print out and sign it in any editor or by hand. Get professionally drafted state-relevant papers within a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

A primary mortgage lender makes money from the loan processing fees rather than the interest paid on the loan. These primary lenders often lend money to customers and then sell a large number of the notes to investors in the secondary market.Other private banks or financial institutions also buy mortgage notes.

Most capital market instruments, including mortgages (loans on real estate collateralProperty pledged as security for the repayment of a loan.), corporate bonds, government bonds, and commercial and consumer loans, have fixed maturities ranging from a year to several hundred years, though most capital market

The Nigerian capital market is principally a market for long-term investments where corporate equities and long-term debt securities are issued and traded. It is a market that is regulated by the Securities and Exchange Commission (SEC), which is the apex regulatory body of the Nigerian Capital Market.

Definition: Capital market is a market where buyers and sellers engage in trade of financial securities like bonds, stocks, etc. The buying/selling is undertaken by participants such as individuals and institutions. Capital market consists of primary markets and secondary markets.

A capital market is an organized market in which both individuals and business entities buy and sell debt and equity securities.Examples of highly organized capital markets are the New York Stock Exchange, American Stock Exchange, London Stock Exchange, and NASDAQ.

Capital markets products include securities, units in a collective investment scheme (CIS), over-the-counter (OTC) derivatives, exchange-traded derivatives and spot foreign exchange for the purposes of leveraged foreign exchange trading.

When budgeting, businesses of all kinds typically focus on three types of capital: working capital, equity capital, and debt capital.

Capital markets refer to the places where savings and investments are moved between suppliers of capital and those who are in need of capital. Capital markets consist of the primary market, where new securities are issued and sold, and the secondary market, where already-issued securities are traded between investors.

The most common capital market securities include stocks, bonds, and real estate investment trusts (REITs). Money markets are the markets for financial products with maturities of less than one year.