Third-Party Consultant Nondisclosure Agreement

Description

How to fill out Third-Party Consultant Nondisclosure Agreement?

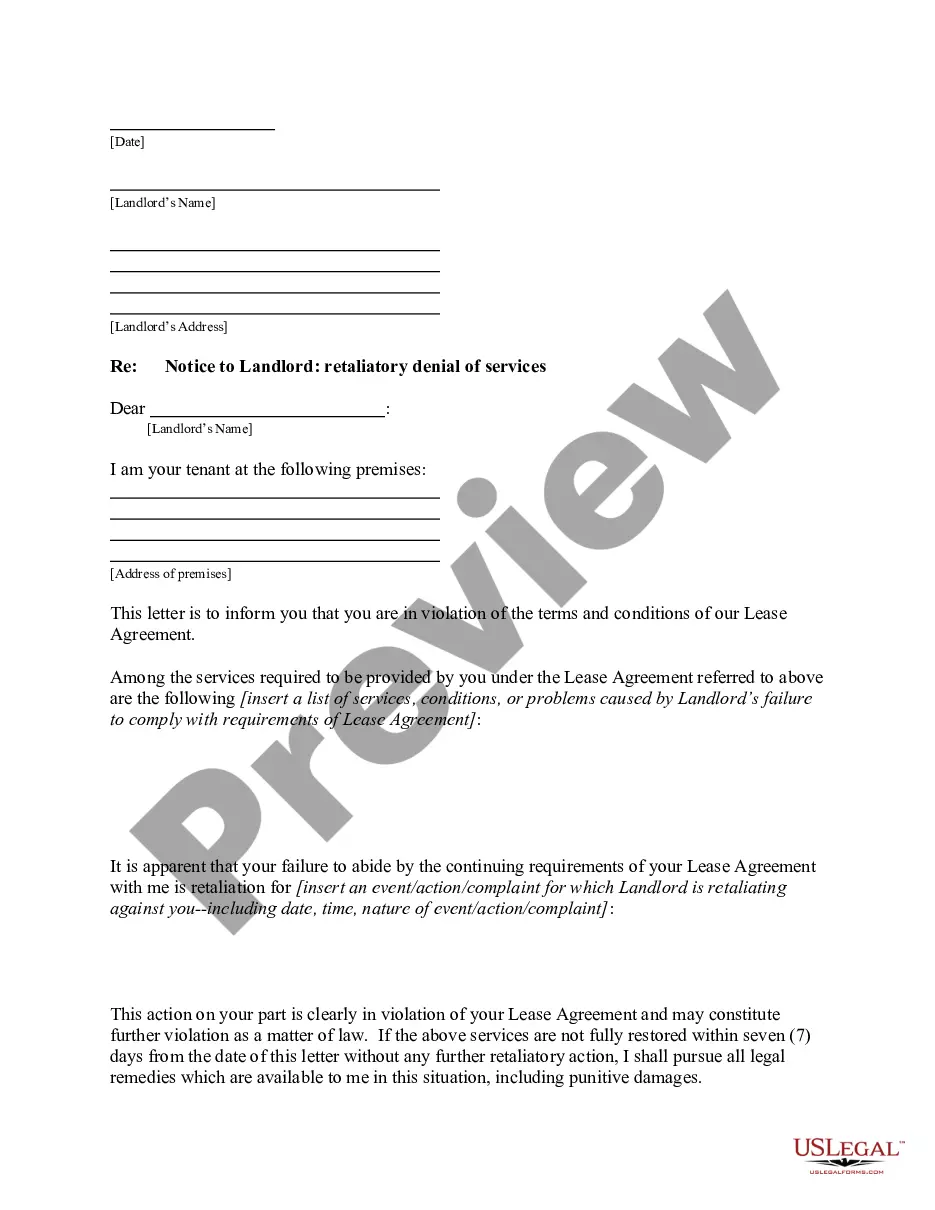

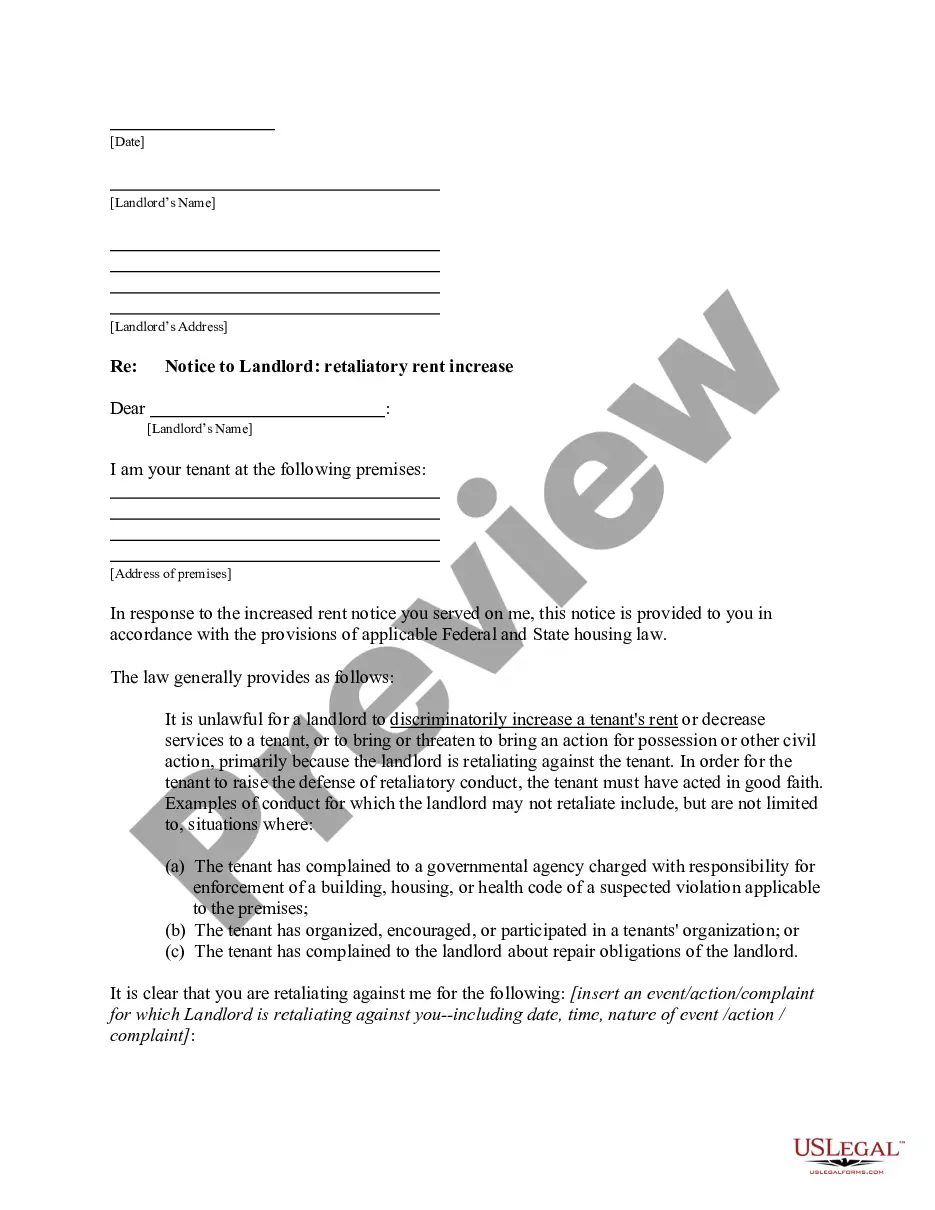

Use US Legal Forms to obtain a printable Third-Party Consultant Nondisclosure Agreement. Our court-admissible forms are drafted and regularly updated by professional attorneys. Our’s is the most comprehensive Forms catalogue online and provides affordable and accurate templates for consumers and legal professionals, and SMBs. The templates are categorized into state-based categories and many of them might be previewed before being downloaded.

To download samples, customers must have a subscription and to log in to their account. Press Download next to any form you want and find it in My Forms.

For people who don’t have a subscription, follow the following guidelines to easily find and download Third-Party Consultant Nondisclosure Agreement:

- Check to make sure you have the proper template in relation to the state it’s needed in.

- Review the form by looking through the description and by using the Preview feature.

- Click Buy Now if it’s the template you want.

- Create your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it multiple times.

- Use the Search field if you need to find another document template.

US Legal Forms provides a large number of legal and tax templates and packages for business and personal needs, including Third-Party Consultant Nondisclosure Agreement. Above three million users have already utilized our service successfully. Select your subscription plan and have high-quality documents in just a few clicks.

Form popularity

FAQ

The party to be charged must have signed the contract. Since the NDAs benefit you, so long as the other party has signed, that ishould be sufficient.

Identify each party in the first section of the form. The NDA form will start by declaring it to be an agreement and identifying who the agreement is between. Whoever is disclosing the information to be protected is the "disclosing party"; write his or her name on this space.

An employer will often require an employee to sign an NDA because it allows their company to operate at a higher level, with less risk.Understand, your employer is not asking you to sign an NDA out of mistrust, they are asking you to sign one because it is essential to conducting business smoothly and efficiently.

Set the date of the agreement. Describe the two parties, sometimes called the Disclosing Party and the Receiving Party.7feff Include names and identification, so there can be no misunderstanding about who signed the agreement.

Identification of the parties. Definition of what is deemed to be confidential. The scope of the confidentiality obligation by the receiving party. The exclusions from confidential treatment. The term of the agreement.

A third-party beneficiary may legally enforce that contract, but only after his or her rights have already been vested (either by the contracting parties' assent or by justifiable reliance on the promise).

An individual enters into a contract with an insurance company that requires the payment of death benefits to a third party. That third party does not sign the contract and may not even be aware of its existence, yet is entitled to benefit from it.

An example of a third party would be the escrow company in a real estate transaction; the escrow party acts as a neutral agent by collecting the documents and money that the buyer and seller exchange when completing the transaction. A collection agency may be another example of a third party.

A third party is someone who is not one of the main people involved in a business agreement or legal case, but who is involved in it in a minor role. You can instruct your bank to allow a third party to remove money from your account.