Letter to Trans Union Requesting Free Copy of Your Credit Report based on Denial of Credit

Description Letter Trans Credit

How to fill out Requesting Credit Denial?

When it comes to drafting a legal form, it’s better to leave it to the professionals. Nevertheless, that doesn't mean you yourself can’t find a template to use. That doesn't mean you yourself can’t get a sample to use, nevertheless. Download Letter to Trans Union Requesting Free Copy of Your Credit Report based on Denial of Credit straight from the US Legal Forms website. It offers a wide variety of professionally drafted and lawyer-approved forms and templates.

For full access to 85,000 legal and tax forms, customers simply have to sign up and select a subscription. Once you’re signed up with an account, log in, look for a particular document template, and save it to My Forms or download it to your device.

To make things easier, we have provided an 8-step how-to guide for finding and downloading Letter to Trans Union Requesting Free Copy of Your Credit Report based on Denial of Credit promptly:

- Make confident the form meets all the necessary state requirements.

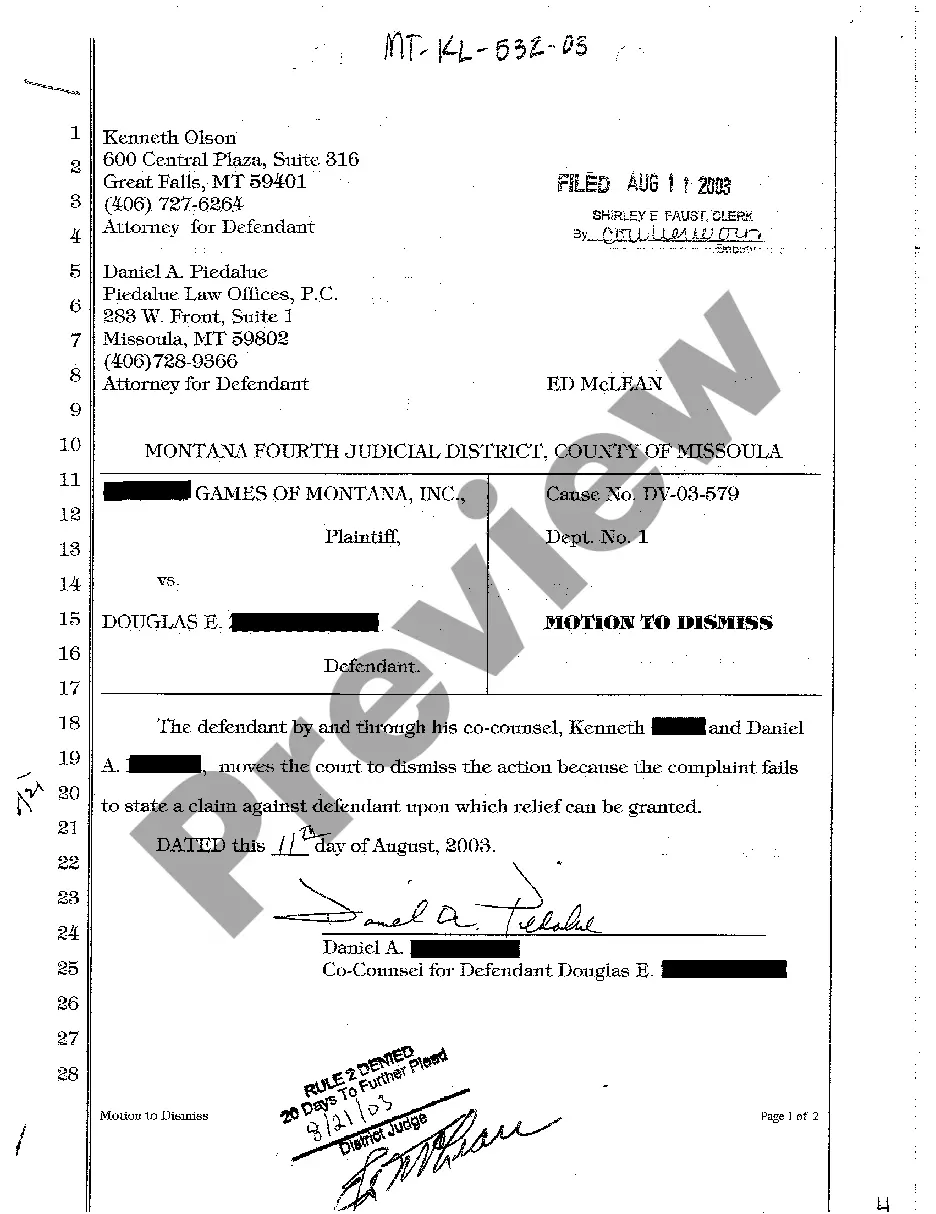

- If available preview it and read the description before buying it.

- Click Buy Now.

- Choose the appropriate subscription for your requirements.

- Create your account.

- Pay via PayPal or by credit/visa or mastercard.

- Select a preferred format if a number of options are available (e.g., PDF or Word).

- Download the file.

After the Letter to Trans Union Requesting Free Copy of Your Credit Report based on Denial of Credit is downloaded you may fill out, print out and sign it in any editor or by hand. Get professionally drafted state-relevant files within a matter of seconds in a preferable format with US Legal Forms!

Letter Requesting Credit Sample Form popularity

Letter Credit Form Pdf Other Form Names

Letter Requesting Credit Report FAQ

On AnnualCreditReport.com you are entitled to a free annual credit report from each of the three credit reporting agencies. These agencies include Equifax, Experian, and TransUnion.

The credit report you get when you're denied credit is in addition to the annual credit report that you can order once a year from the three credit bureaus through AnnualCreditReport.com.

TransUnion is pleased to offer you free weekly credit reports through April 20, 2022 as part of our commitment to supporting all Americans during this difficult time. Get your free report now at annualcreditreport.com.

Tell the credit reporting company, in writing, what information you think is inaccurate. Tell the information provider (that is, the person, company, or organization that provides information about you to a credit reporting company), in writing, that you dispute an item in your credit report.

TransUnion is pleased to offer you free weekly credit reports through April 20, 2022 as part of our commitment to supporting all Americans during this difficult time. Get your free report now at annualcreditreport.com.

Equifax. Experian or call 1-866-200-6020. TransUnion.

How long information is kept by credit reference agencies. Information about you is usually held on your file for six years. Some information may be held for longer, for example, where a court has ordered that a bankruptcy restrictions order should last more than six years.

Why Can't I Get My Report Online? The most common reasons for being unable to access your credit reports online is being unable to remember key pieces of information. The other issue may be that the address you entered when requesting the report does not match the address the credit bureau has on file.

If your credit dispute is rejected, the Fair Credit Reporting Act gives you the right to add a 100-word consumer statement to your report explaining your position.