Section 806 of the Fair Debt Collection Practices Act states in part that a debt collector may not harass, oppress, or abuse any person in connection with the collection of a debt. One example of such activity involves using threats (including implied threats), violence, or other criminal means to harm anyone's reputation, property, or physical person.

Letter Informing Debt Collector of Harassment or Abuse in Collection Activities Involving Threats to Use Violence or other Criminal Means to Harm the Physical Person, Reputation, and/or Property of the Debtor

Description Debt Harassment

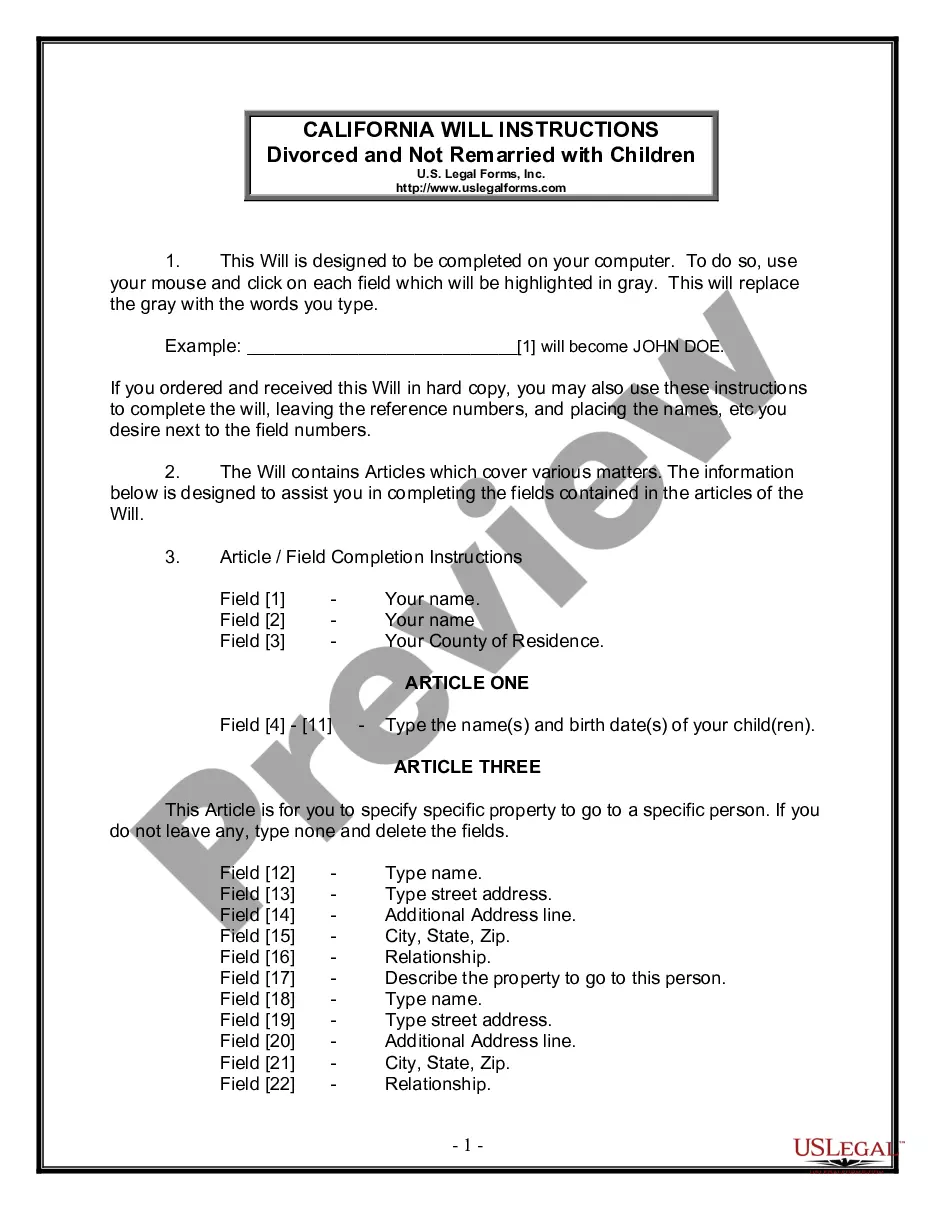

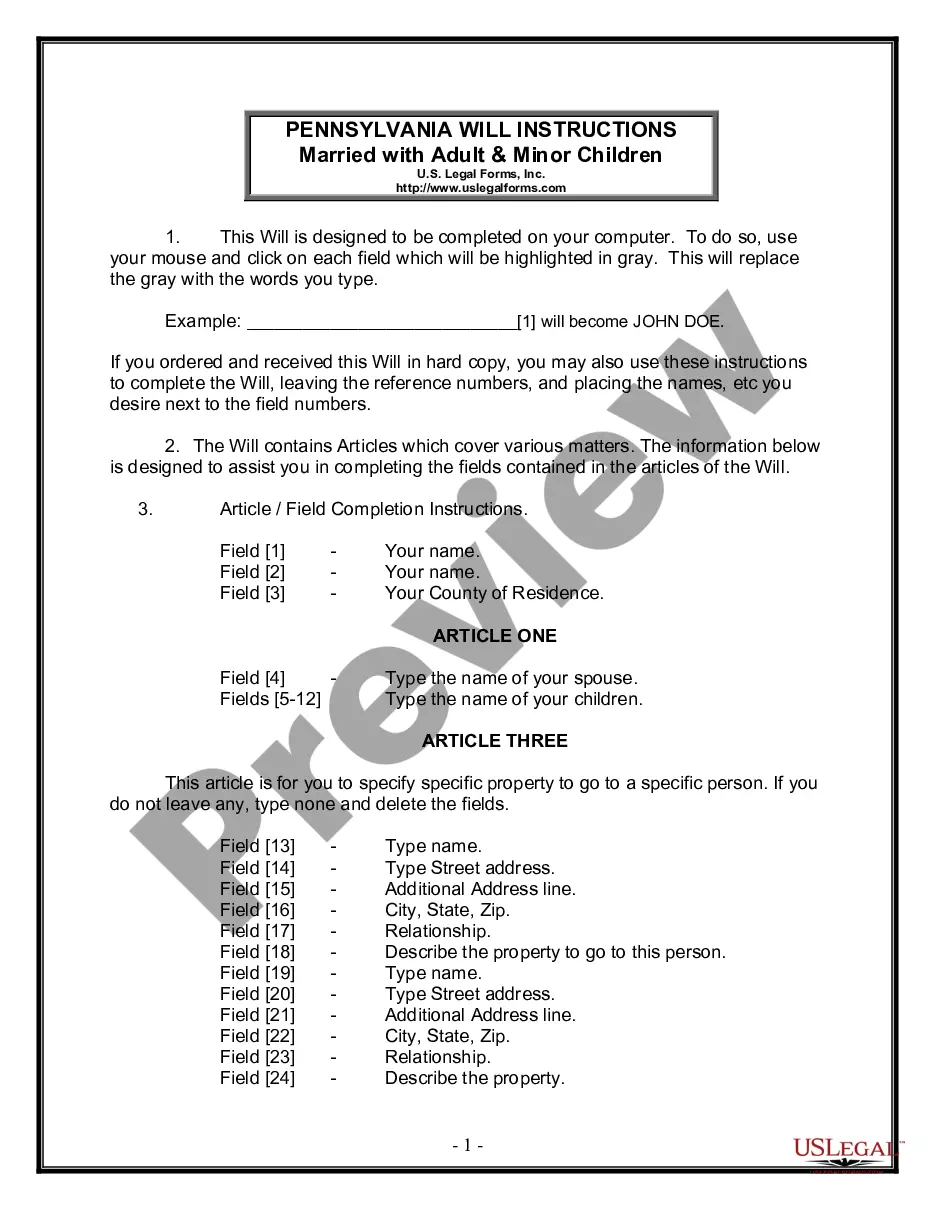

How to fill out Violence Person Property?

When it comes to drafting a legal document, it is better to delegate it to the professionals. However, that doesn't mean you yourself cannot find a sample to use. That doesn't mean you yourself cannot find a sample to use, however. Download Letter Informing Debt Collector of Harassment or Abuse in Collection Activities Involving Threats to Use Violence or other Criminal Means to Harm the Physical Person, Reputation, and/or Property of the Debtor right from the US Legal Forms website. It gives you numerous professionally drafted and lawyer-approved forms and templates.

For full access to 85,000 legal and tax forms, users just have to sign up and select a subscription. As soon as you’re registered with an account, log in, find a certain document template, and save it to My Forms or download it to your device.

To make things less difficult, we’ve provided an 8-step how-to guide for finding and downloading Letter Informing Debt Collector of Harassment or Abuse in Collection Activities Involving Threats to Use Violence or other Criminal Means to Harm the Physical Person, Reputation, and/or Property of the Debtor fast:

- Make confident the form meets all the necessary state requirements.

- If possible preview it and read the description before buying it.

- Click Buy Now.

- Select the suitable subscription to meet your needs.

- Make your account.

- Pay via PayPal or by debit/credit card.

- Choose a preferred format if a few options are available (e.g., PDF or Word).

- Download the document.

As soon as the Letter Informing Debt Collector of Harassment or Abuse in Collection Activities Involving Threats to Use Violence or other Criminal Means to Harm the Physical Person, Reputation, and/or Property of the Debtor is downloaded you may complete, print and sign it in any editor or by hand. Get professionally drafted state-relevant files in a matter of minutes in a preferable format with US Legal Forms!

Violence Means Physical Form popularity

Harassment Person Other Form Names

Collector Harassment FAQ

In the letter, reference the date of the initial contact and the method, for example, "a phone call received from your agency on April 25, 2019." You also need to provide a statement that you're requesting validation of the debt. Do not admit to owing the debt or make any reference to payment.

Debt Collectors Can't Call You Repeatedly to Harass You This means that while the FDCPA doesn't place a specific limit on the number of calls debt collectors can make, it prohibits them from calling you multiple times just to harass you. (15 U.S. Code § 1692d).

Creditor harassment is any type of unsolicited and repeated contact from the creditor or a debt collection agency that disturbs you, frightens you, or makes you feel threatened.

Never Give Them Your Personal Information. A call from a debt collection agency will include a series of questions. Never Admit That The Debt Is Yours. Even if the debt is yours, don't admit that to the debt collector. Never Provide Bank Account Information.

If you believe a debt collector is harassing you, you can submit a complaint with the CFPB online or by calling (855) 411-CFPB (2372). You can also contact your state's attorney general .

Under the Fair Debt collection Practices Act (FDCPA), I have the right to request validation of the debt you say I owe you. I am requesting proof that I am indeed the party you are asking to pay this debt, and there is some contractual obligation that is binding on me to pay this debt.

How Long Can a Debt Collector Pursue an Old Debt? Each state has a law referred to as a statute of limitations that spells out the time period during which a creditor or collector may sue borrowers to collect debts. In most states, they run between four and six years after the last payment was made on the debt.

Your creditor also has to report your complaint to the Financial Conduct Authority (FCA), even if they respond within 3 business days. If you need help with this, you can phone our debt helpline on 0300 330 1313. We can usually help between 9am and 8pm, Monday to Friday.

The definition of debt collection harassment is to intimidate, abuse, coerce, bully or browbeat consumers into paying off debt. This happens most often over the phone, but harassment could come in the form of emails, texts, direct mail or talking to friends or neighbors about your debt.