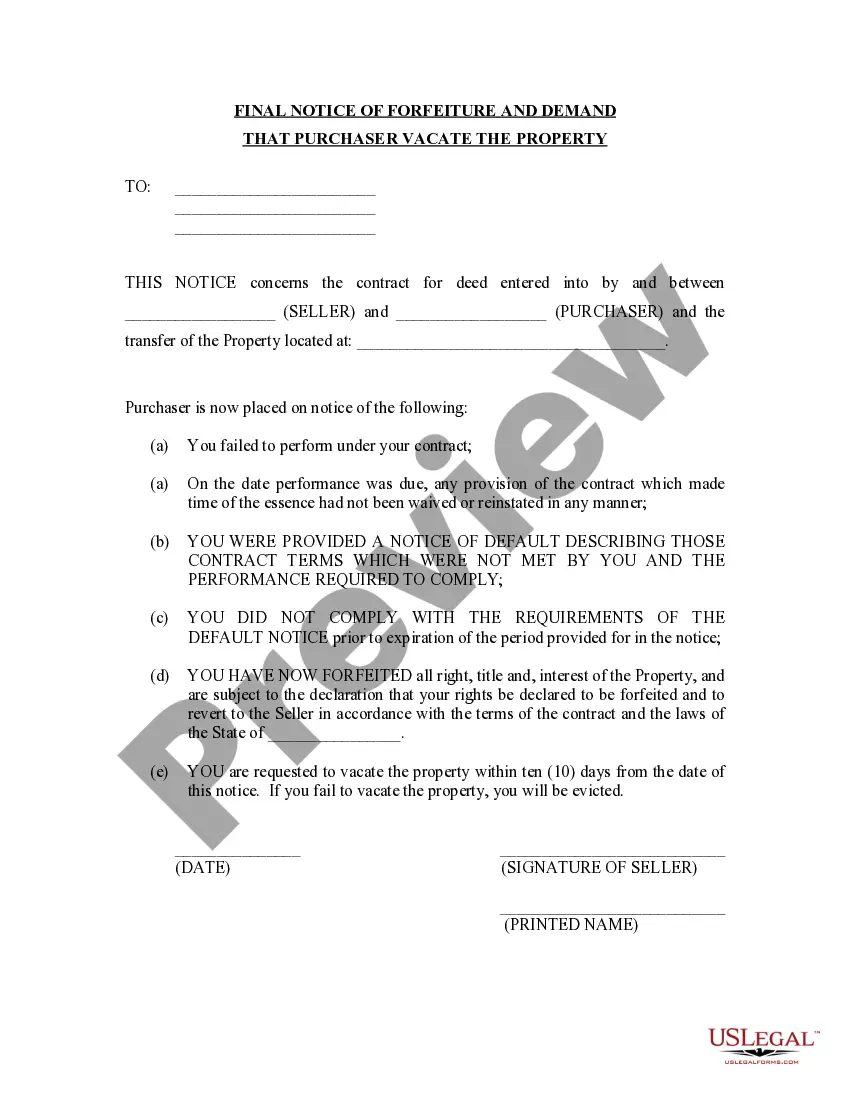

When it comes to drafting a legal document, it is easier to delegate it to the professionals. Nevertheless, that doesn't mean you yourself can’t find a template to use. That doesn't mean you yourself can’t find a sample to use, nevertheless. Download Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities - Falsely Representing that Debtor has or is Committing Criminal Fraud by Nonpayment of a Debt right from the US Legal Forms website. It gives you a wide variety of professionally drafted and lawyer-approved forms and templates.

For full access to 85,000 legal and tax forms, customers simply have to sign up and select a subscription. As soon as you’re registered with an account, log in, search for a certain document template, and save it to My Forms or download it to your device.

To make things much easier, we’ve included an 8-step how-to guide for finding and downloading Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities - Falsely Representing that Debtor has or is Committing Criminal Fraud by Nonpayment of a Debt quickly:

- Make sure the form meets all the necessary state requirements.

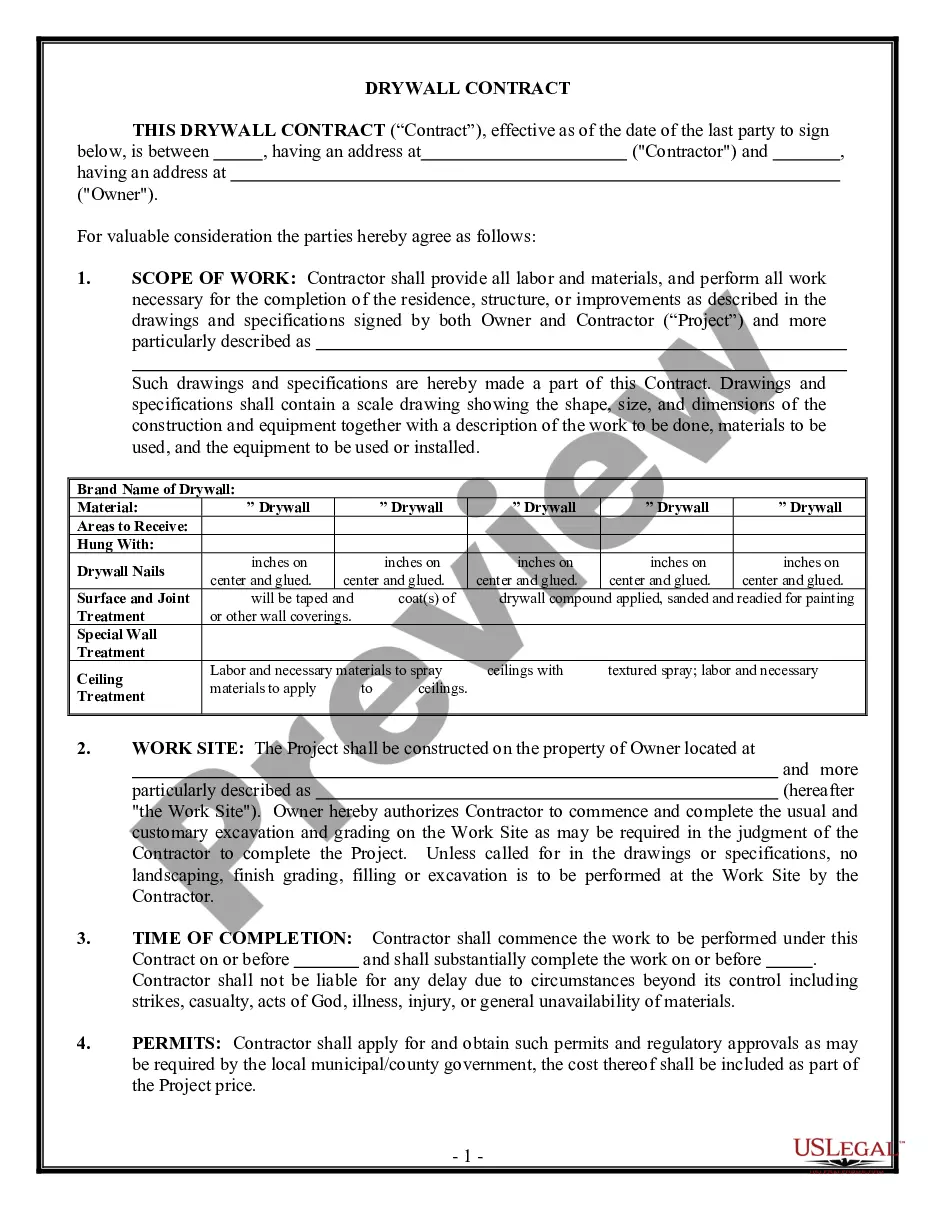

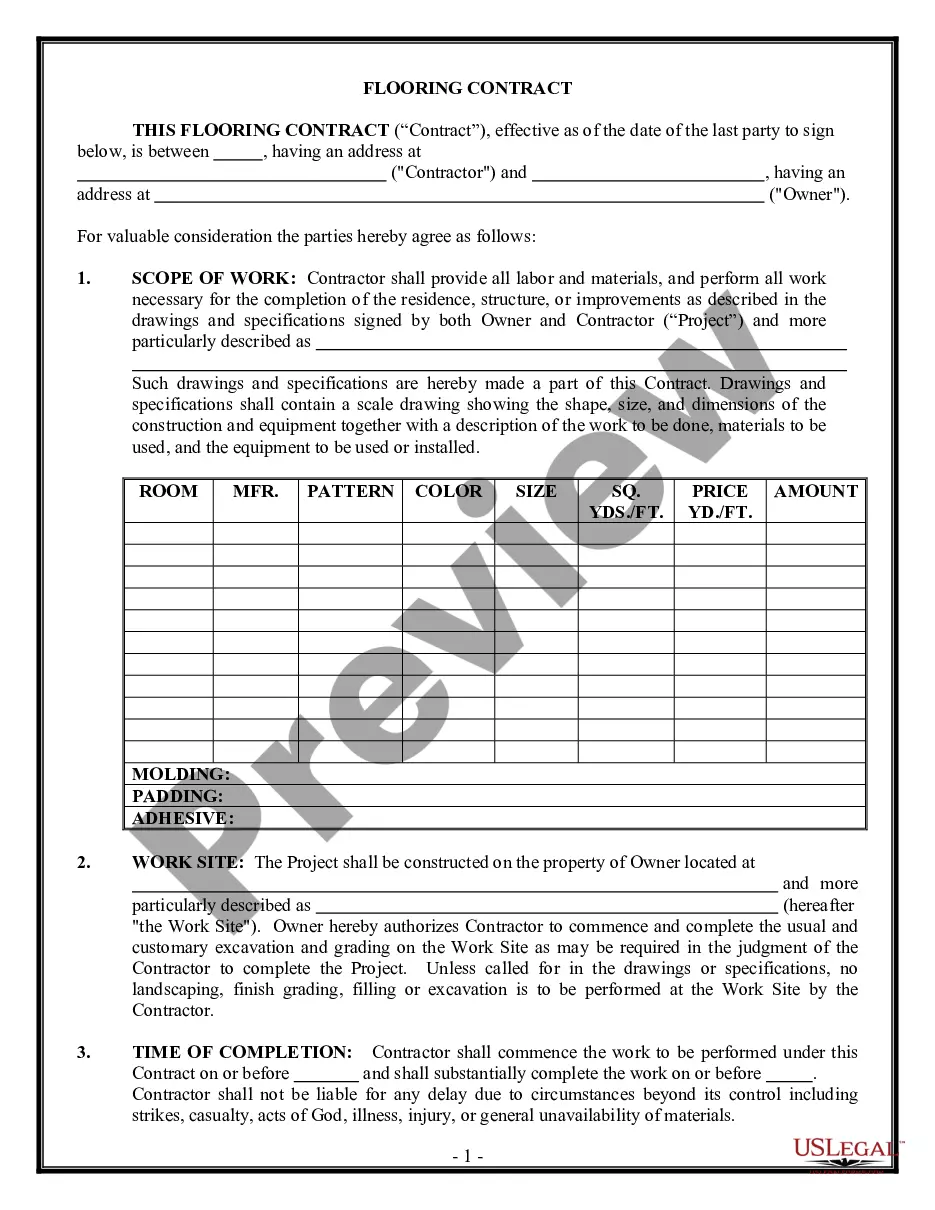

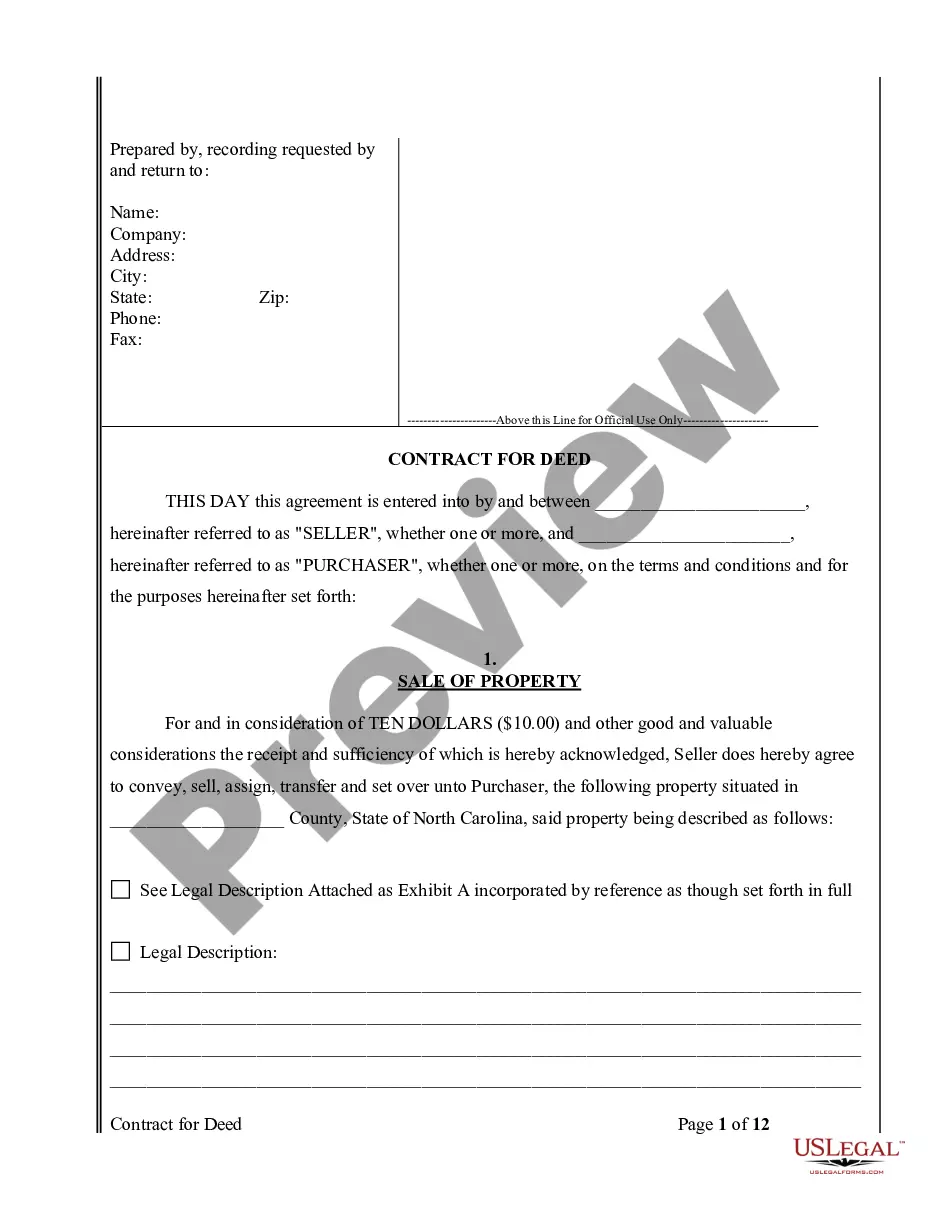

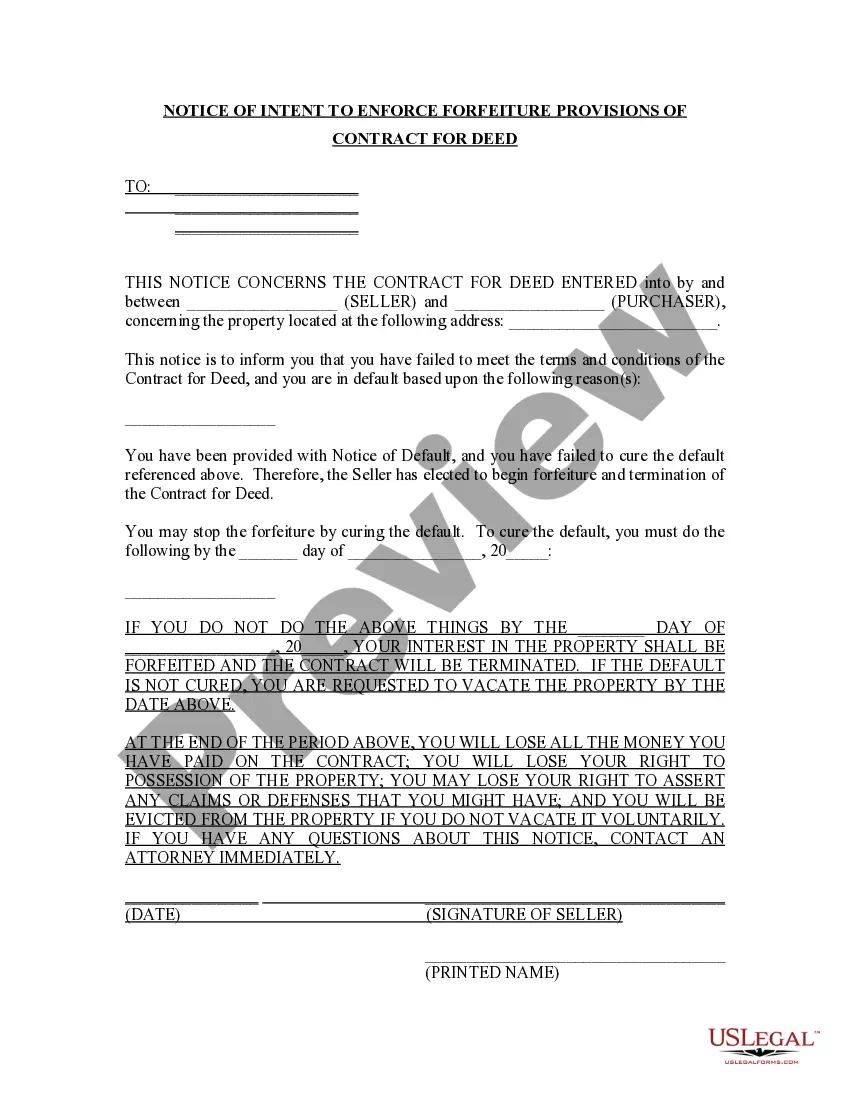

- If available preview it and read the description before buying it.

- Hit Buy Now.

- Select the appropriate subscription for your needs.

- Create your account.

- Pay via PayPal or by credit/credit card.

- Choose a needed format if several options are available (e.g., PDF or Word).

- Download the document.

Once the Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities - Falsely Representing that Debtor has or is Committing Criminal Fraud by Nonpayment of a Debt is downloaded you can fill out, print and sign it in any editor or by hand. Get professionally drafted state-relevant documents in a matter of minutes in a preferable format with US Legal Forms!