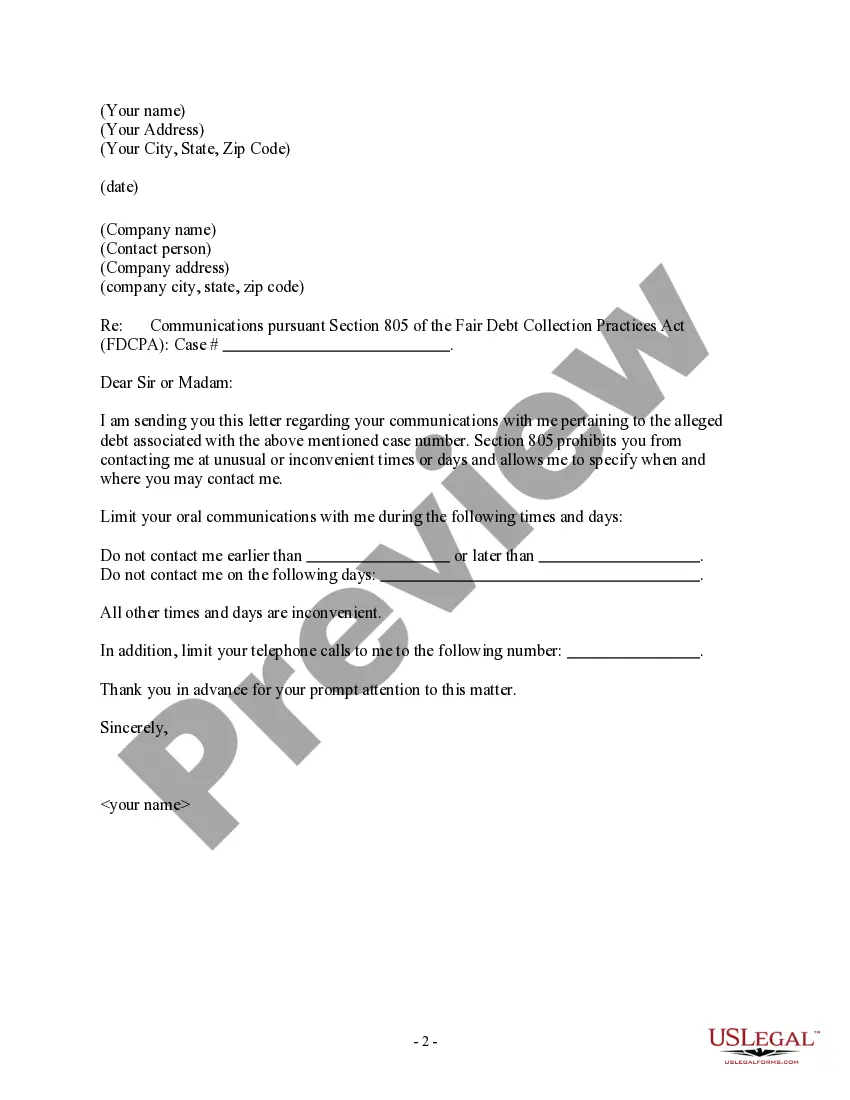

Letter to Debt Collector - Only call me on the following days and times

Description Debt Collector Only

How to fill out Letter Debt Days?

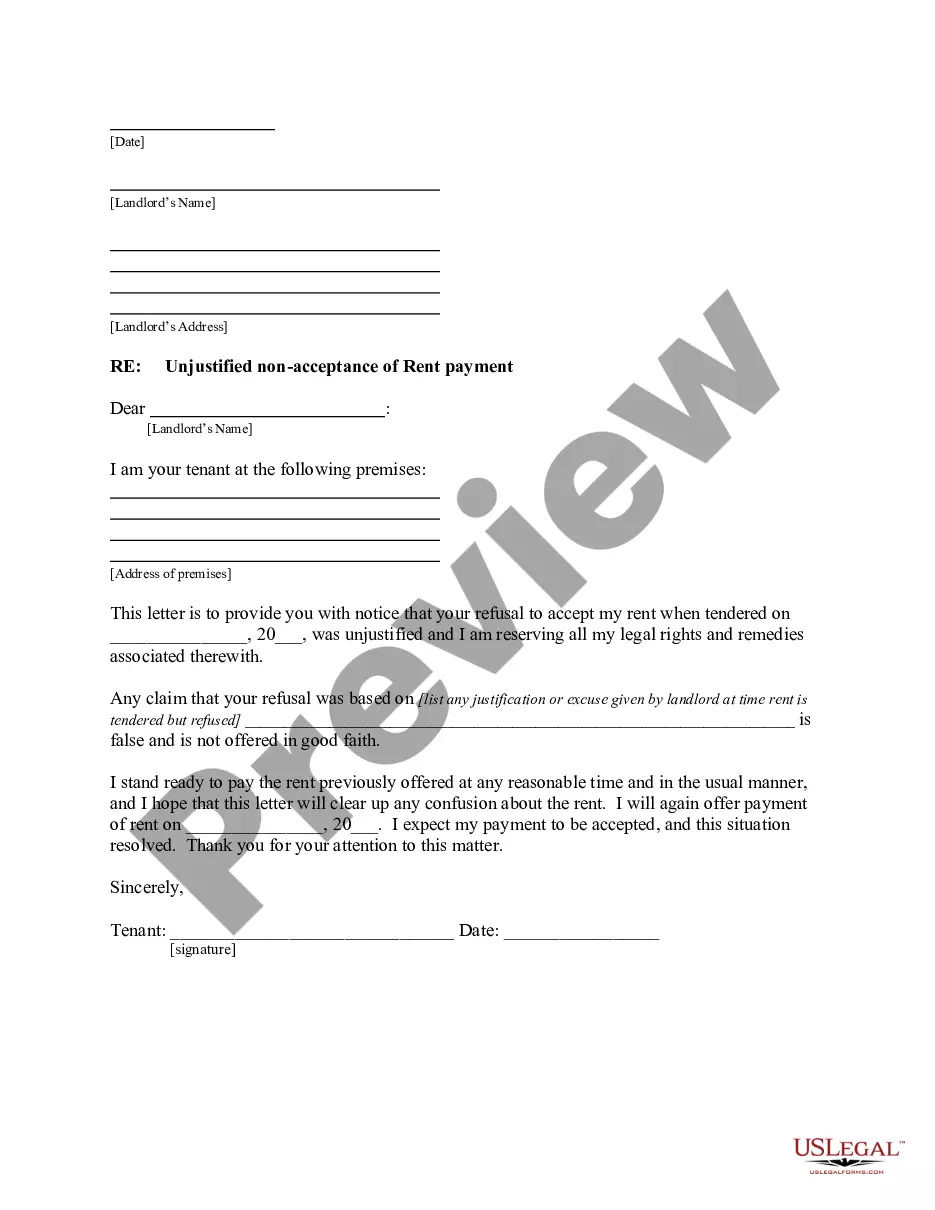

When it comes to drafting a legal form, it is easier to delegate it to the experts. However, that doesn't mean you yourself cannot find a template to use. That doesn't mean you yourself cannot find a sample to utilize, nevertheless. Download Letter to Debt Collector - Only call me on the following days and times straight from the US Legal Forms site. It provides numerous professionally drafted and lawyer-approved documents and templates.

For full access to 85,000 legal and tax forms, customers just have to sign up and choose a subscription. Once you are signed up with an account, log in, look for a specific document template, and save it to My Forms or download it to your device.

To make things much easier, we have provided an 8-step how-to guide for finding and downloading Letter to Debt Collector - Only call me on the following days and times fast:

- Make confident the form meets all the necessary state requirements.

- If available preview it and read the description prior to buying it.

- Press Buy Now.

- Choose the suitable subscription to suit your needs.

- Make your account.

- Pay via PayPal or by credit/bank card.

- Choose a preferred format if a few options are available (e.g., PDF or Word).

- Download the file.

When the Letter to Debt Collector - Only call me on the following days and times is downloaded you can complete, print and sign it in almost any editor or by hand. Get professionally drafted state-relevant files in a matter of minutes in a preferable format with US Legal Forms!

Letter Collector Call Form popularity

Collector Call Me Other Form Names

Collector Call Pdf FAQ

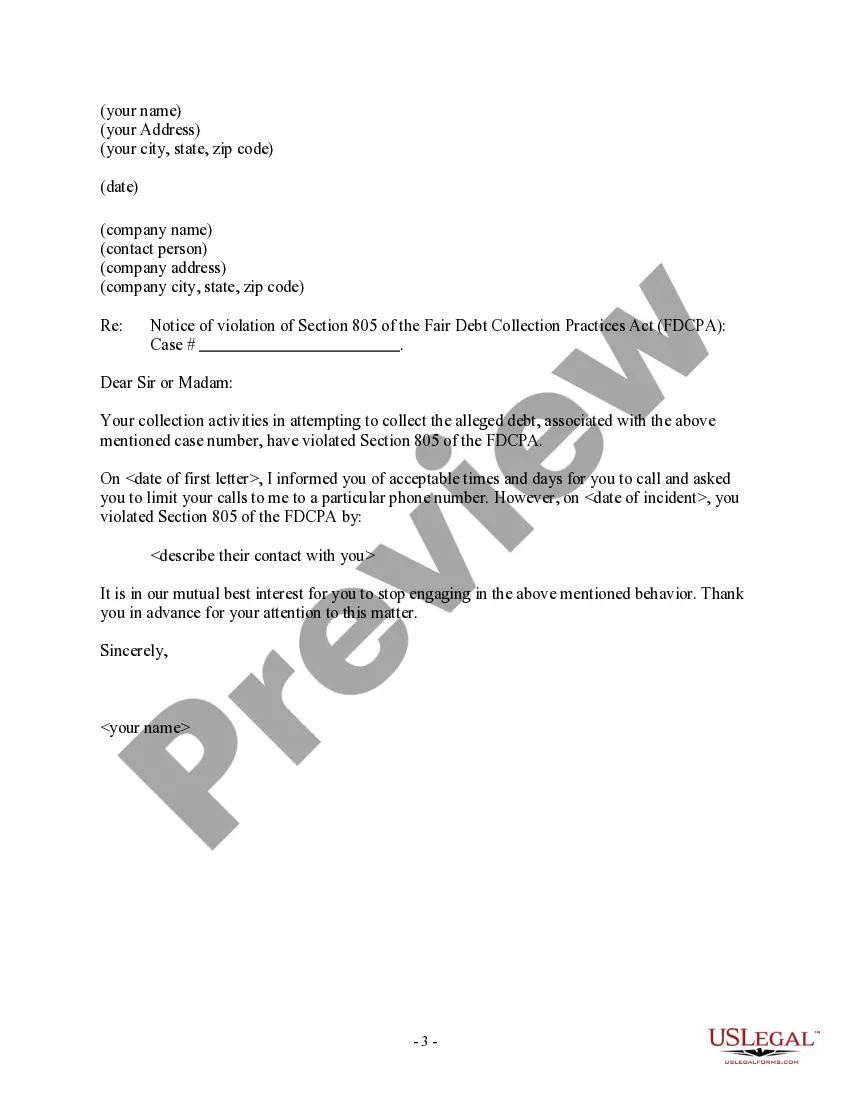

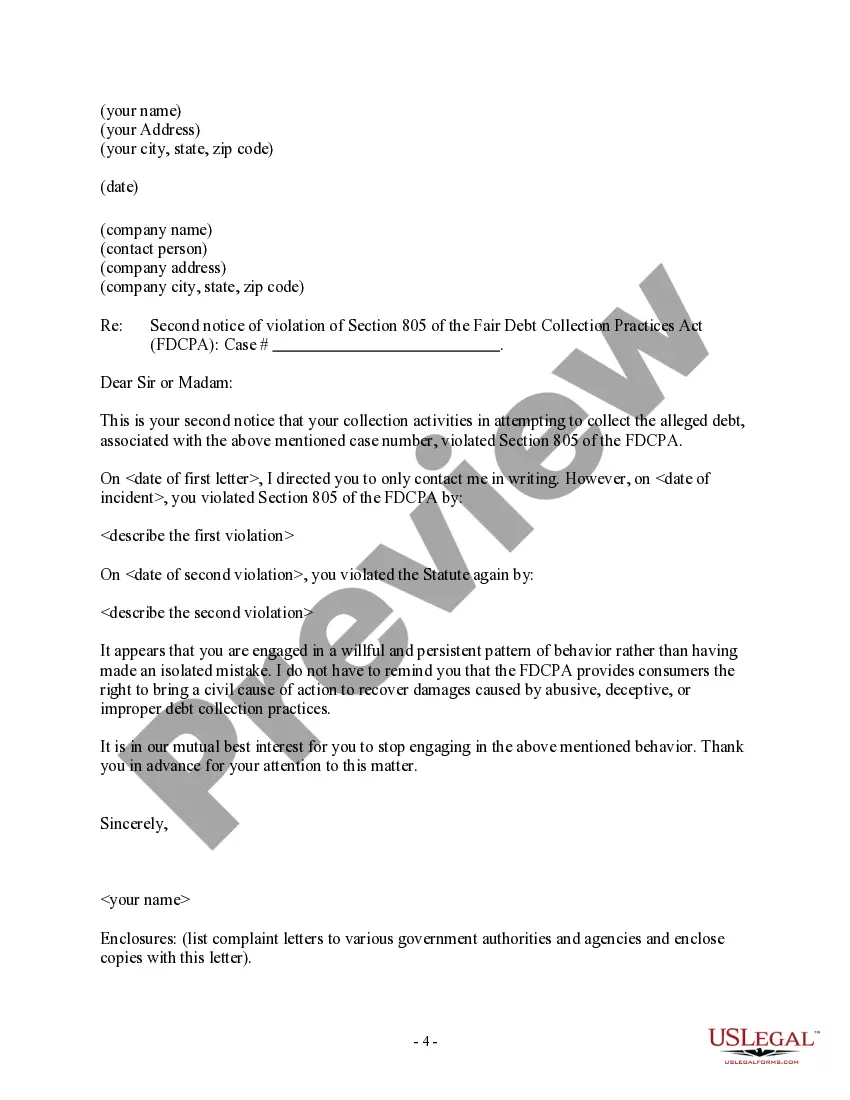

Even if the debt is yours, you still have the right not to talk to the debt collector and you can tell the debt collector to stop calling you. However, telling a debt collector to stop contacting you does not stop the debt collector or creditor from using other legal ways to collect the debt from you if you owe it.

Federal law doesn't give a specific limit on the number of calls a debt collector can place to you. A debt collector may not call you repeatedly or continuously intending to annoy, abuse, or harass you or others who share the number. You do have a right to tell the debt collector to stop calling you.

Debt Collectors Can't Call You Repeatedly to Harass You This means that while the FDCPA doesn't place a specific limit on the number of calls debt collectors can make, it prohibits them from calling you multiple times just to harass you. (15 U.S. Code § 1692d).

Federal law doesn't give a specific limit on the number of calls a debt collector can place to you. A debt collector may not call you repeatedly or continuously intending to annoy, abuse, or harass you or others who share the number. You do have a right to tell the debt collector to stop calling you.

Answer the phone and explain you're not the person they're looking for. Tell them that the number they're calling is not the right one. Send a cease and desist letter to request that they stop contacting you.

As per the FDCPA rules and regulations, debt collectors can call you during the weekdays (that is from Monday to Saturday) between 8 am and 9 pm. But on Sunday, debt collectors can call you between 1 pm and 5 pm. They can't call you beyond that time.

The act prohibits publicizing your debts, and showing up at your job to collect your debt counts. They may, however, call you at work, though they can't reveal to your co-workers that they are debt collectors. To stop these calls, ask the debt collector not to contact you at work. They must stop, according to the law.

Never Give Them Your Personal Information. A call from a debt collection agency will include a series of questions. Never Admit That The Debt Is Yours. Even if the debt is yours, don't admit that to the debt collector. Never Provide Bank Account Information.

Generally, debt collectors cannot call you at an unusual time or place, or at a time or place they know is inconvenient to you and they are prohibited from contacting you before 8 a.m. or after 9 p.m.