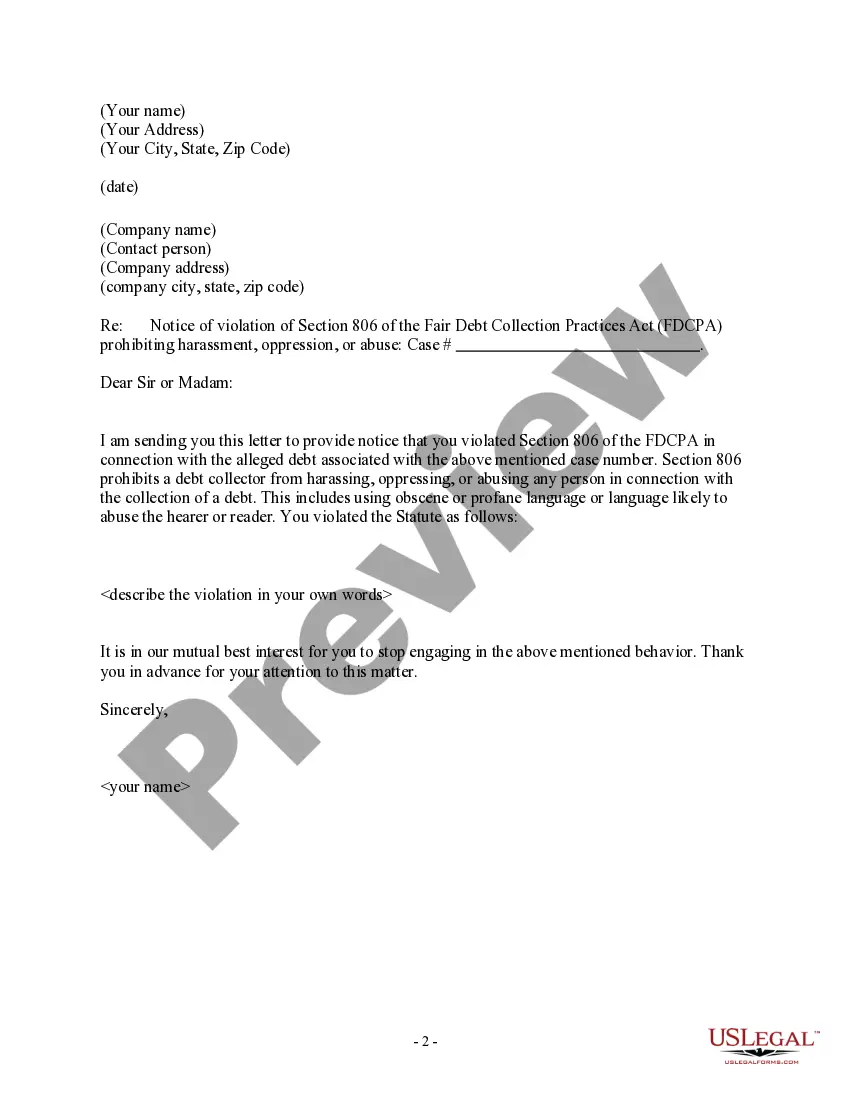

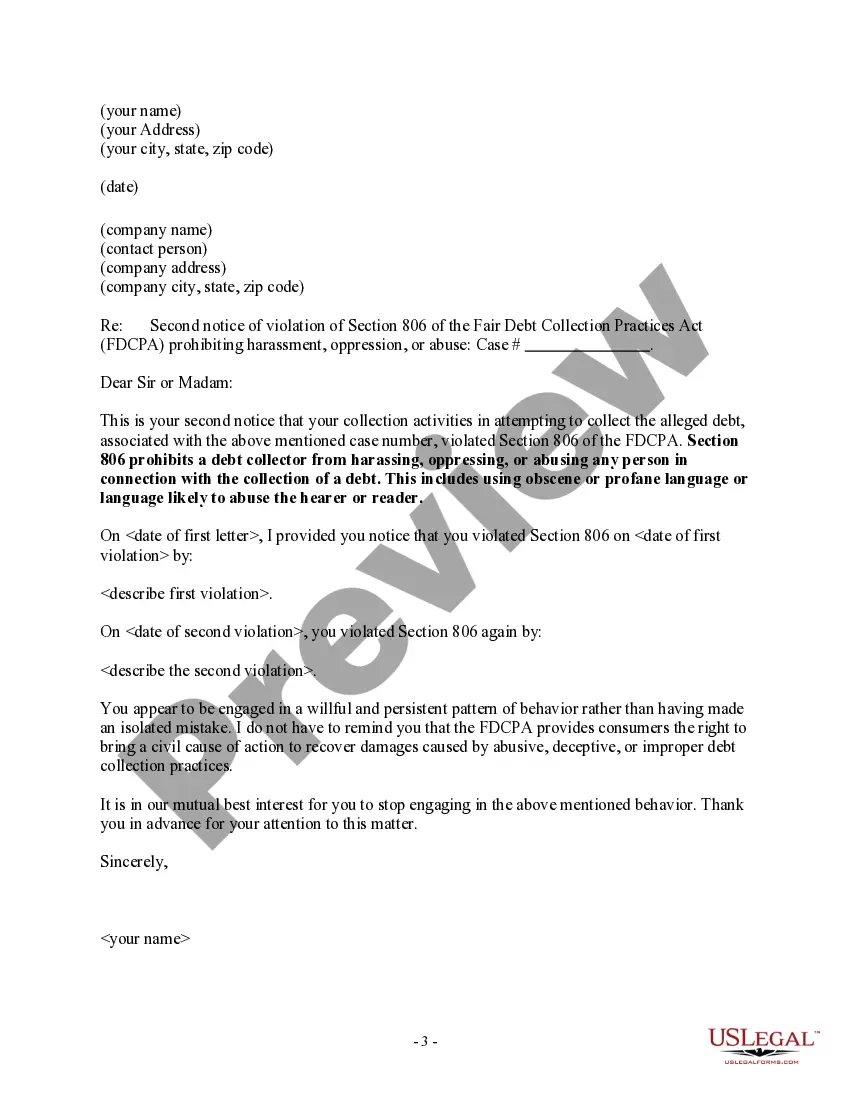

A debt collector may not use obscene or profane language or language likely to abuse the hearer or reader. This includes abusive language includes religious slurs, profanity, obscenity, calling the consumer a liar or a deadbeat, and the use of racial or sexual epithets.

Notice to Debt Collector - Use of Abusive Language

Description Notice Abusive Language

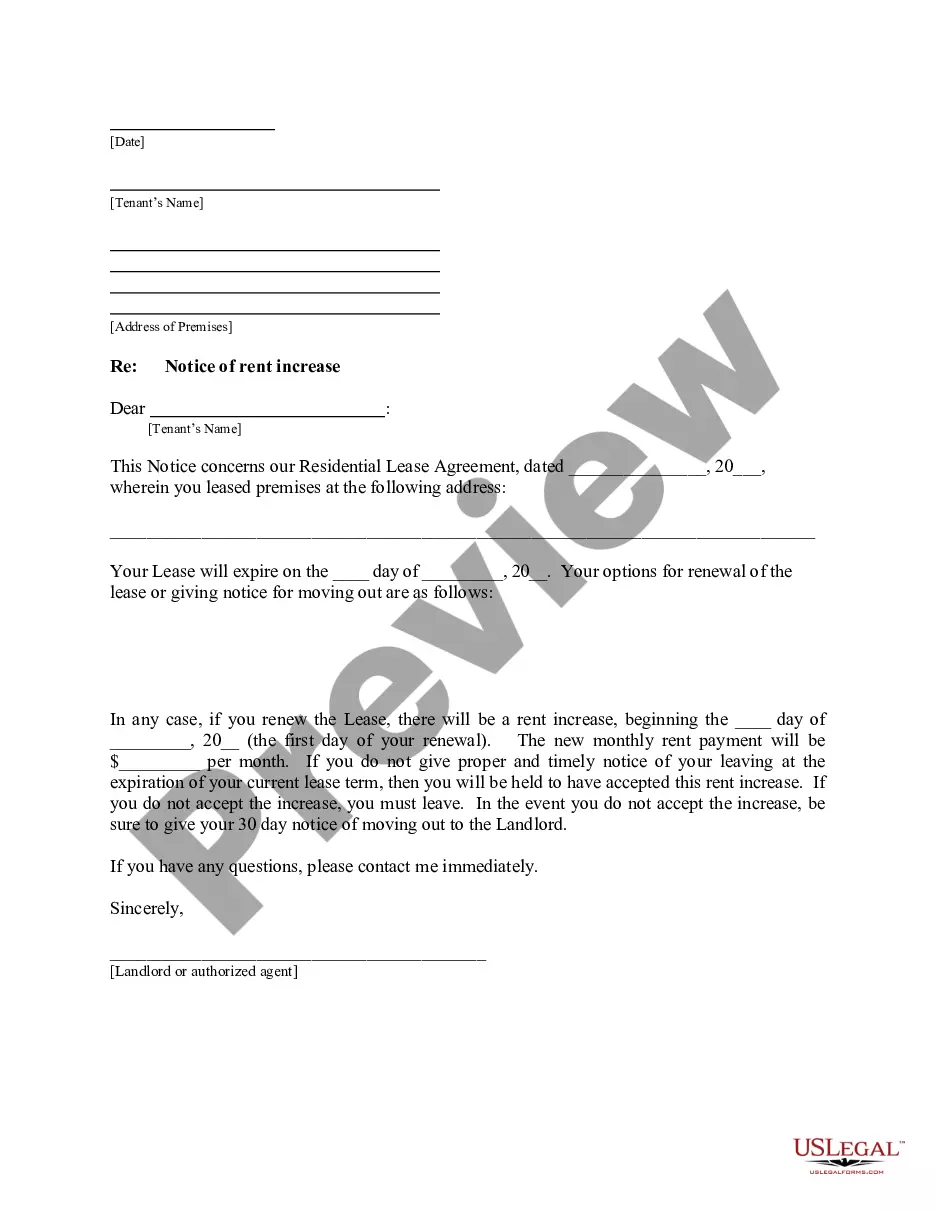

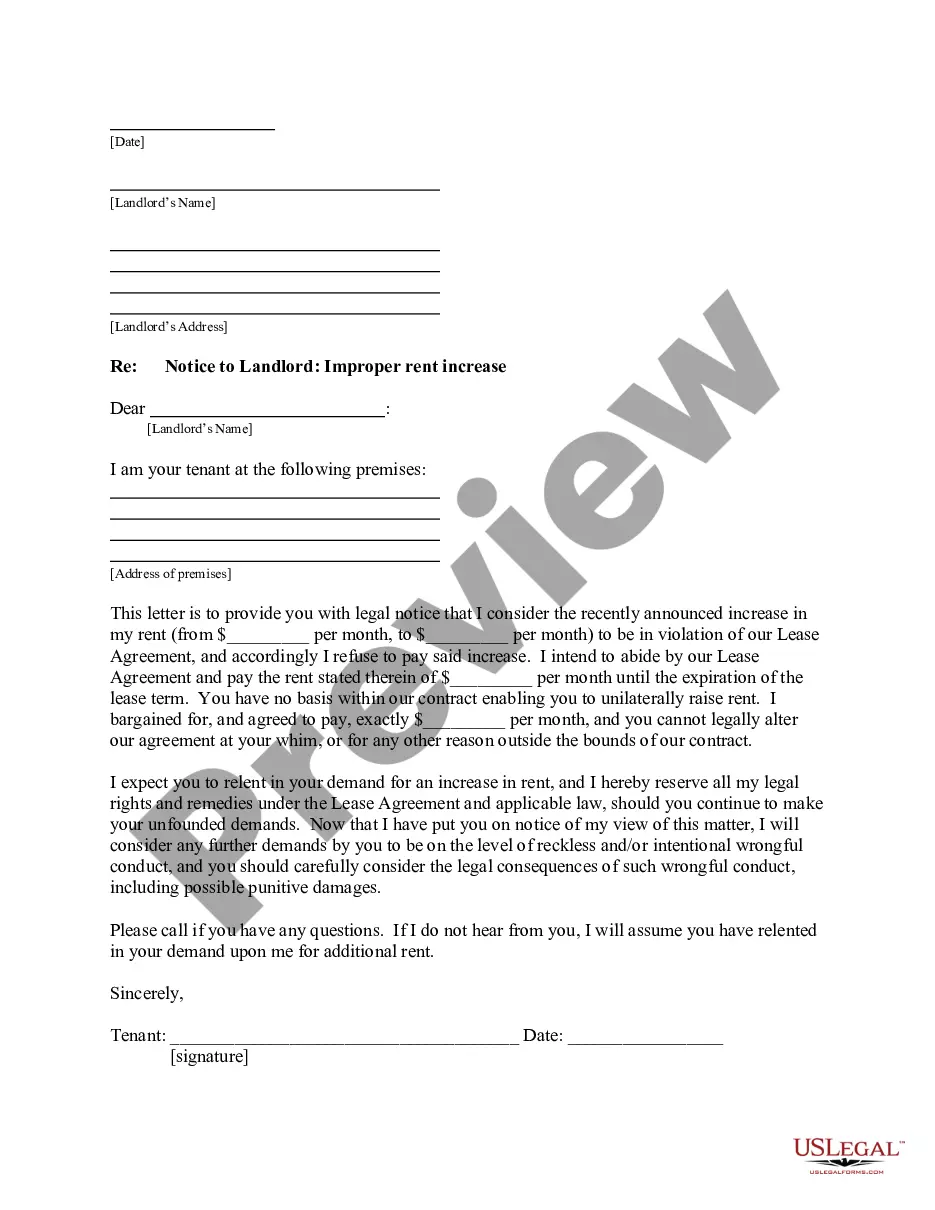

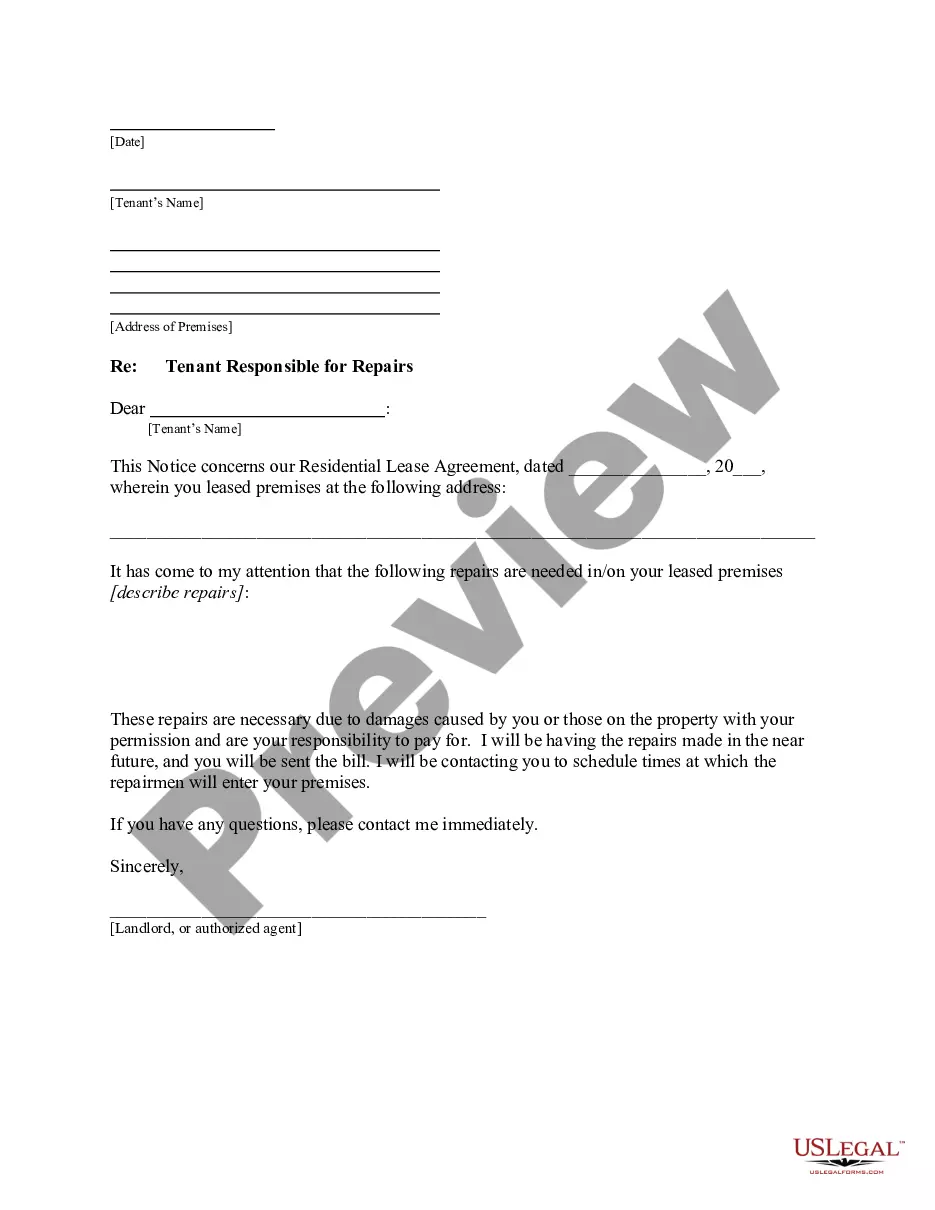

How to fill out Notice To Debt Collector - Use Of Abusive Language?

When it comes to drafting a legal document, it’s better to leave it to the specialists. However, that doesn't mean you yourself cannot get a template to use. That doesn't mean you yourself can not find a sample to utilize, nevertheless. Download Notice to Debt Collector - Use of Abusive Language straight from the US Legal Forms site. It provides numerous professionally drafted and lawyer-approved documents and templates.

For full access to 85,000 legal and tax forms, customers just have to sign up and select a subscription. When you’re registered with an account, log in, look for a particular document template, and save it to My Forms or download it to your device.

To make things less difficult, we’ve incorporated an 8-step how-to guide for finding and downloading Notice to Debt Collector - Use of Abusive Language fast:

- Be sure the form meets all the necessary state requirements.

- If available preview it and read the description before buying it.

- Click Buy Now.

- Select the appropriate subscription to suit your needs.

- Make your account.

- Pay via PayPal or by credit/visa or mastercard.

- Select a needed format if a number of options are available (e.g., PDF or Word).

- Download the document.

When the Notice to Debt Collector - Use of Abusive Language is downloaded you may complete, print out and sign it in almost any editor or by hand. Get professionally drafted state-relevant papers in a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

The definition of debt collection harassment is to intimidate, abuse, coerce, bully or browbeat consumers into paying off debt. This happens most often over the phone, but harassment could come in the form of emails, texts, direct mail or talking to friends or neighbors about your debt.

Know Your Rights. Take Notes. Keep Your Emotions Under Control. Stop Trying to Explain Yourself. End the Call. Don't Pick Up the Phone. Make Them Stop Calling. Dispute the Debt.

No. Debt collectors are prohibited from deceiving or misleading you while trying to collect a debt. Debt collectors are generally prohibited under federal law from using any false, deceptive, or misleading misrepresentation in collecting a debt.

The FDCPA does not permit debt collectors to disclose your personal information to any third party. This means that if your voicemail is shared with your family or roommates or if it is monitored by your employer, debt collectors are not allowed to leave a message. Messages can only be left on private voicemail.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

Debt collectors are allowed to contact third parties to obtain or confirm location information, but the FDCPA does not allow debt collectors to leave messages with third parties.The collector cannot ask the third-party to pass on a message, ask for other information, or harass the third-party.

You received a letter in the mail. The agency is licensed in your state. The collector can verify your personal details. You can request information about the debt. There's more than one method of payment. A company works with you, not against you.

Never Give Them Your Personal Information. A call from a debt collection agency will include a series of questions. Never Admit That The Debt Is Yours. Even if the debt is yours, don't admit that to the debt collector. Never Provide Bank Account Information.