Notice to Debt Collector - Posing Lengthy Series of Questions or Comments

Description

Section 806 of the Fair Debt Collection Practices Act says a debt collector may not harass, oppress, or abuse any person in connection with the collection of a debt. This includes posing a lengthy series of questions or comments to the consumer without giving the consumer a chance to reply.

How to fill out Notice To Debt Collector - Posing Lengthy Series Of Questions Or Comments?

When it comes to drafting a legal document, it is easier to leave it to the experts. However, that doesn't mean you yourself cannot get a sample to utilize. That doesn't mean you yourself can’t find a template to use, however. Download Notice to Debt Collector - Posing Lengthy Series of Questions or Comments from the US Legal Forms web site. It gives you numerous professionally drafted and lawyer-approved documents and templates.

For full access to 85,000 legal and tax forms, users just have to sign up and select a subscription. Once you are signed up with an account, log in, find a particular document template, and save it to My Forms or download it to your gadget.

To make things easier, we have provided an 8-step how-to guide for finding and downloading Notice to Debt Collector - Posing Lengthy Series of Questions or Comments fast:

- Be sure the form meets all the necessary state requirements.

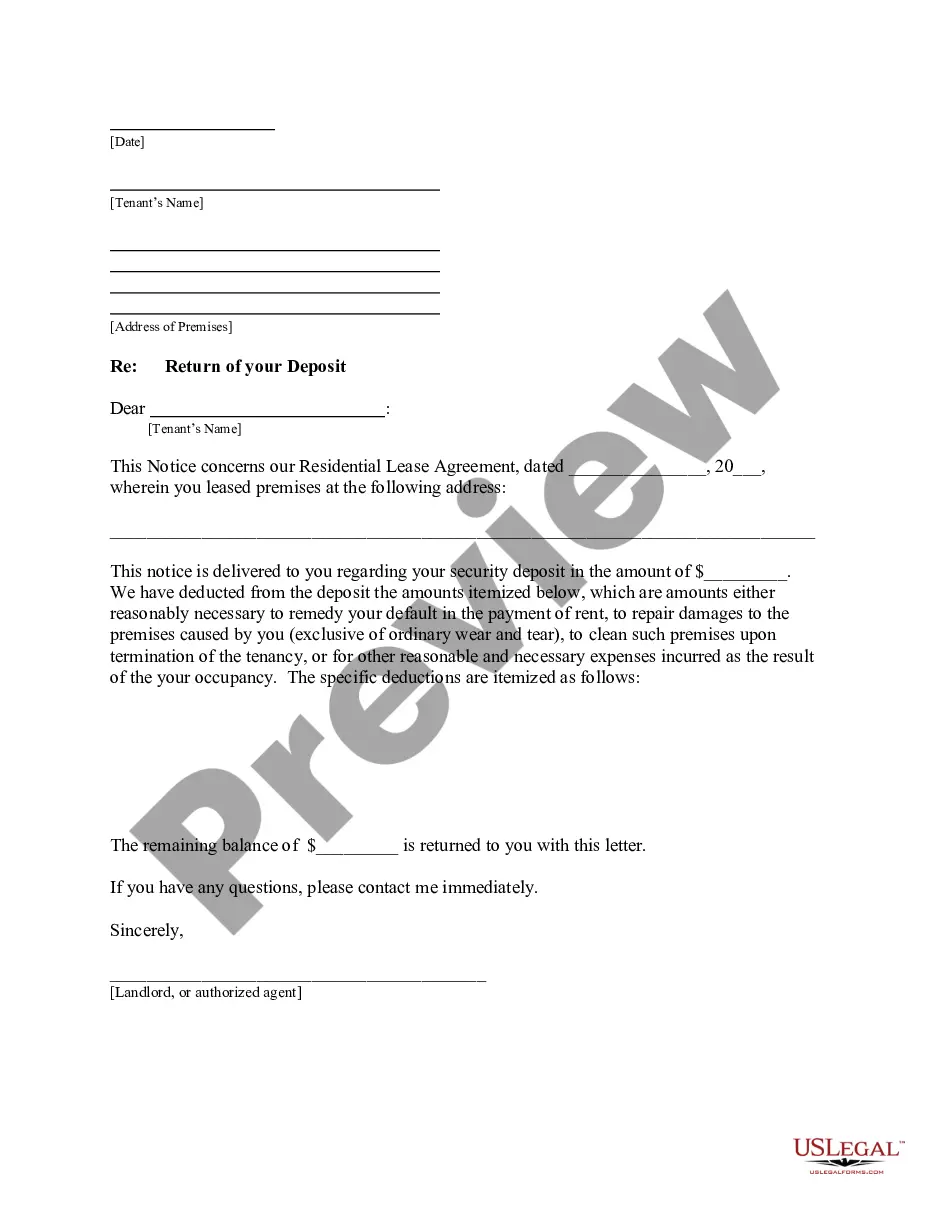

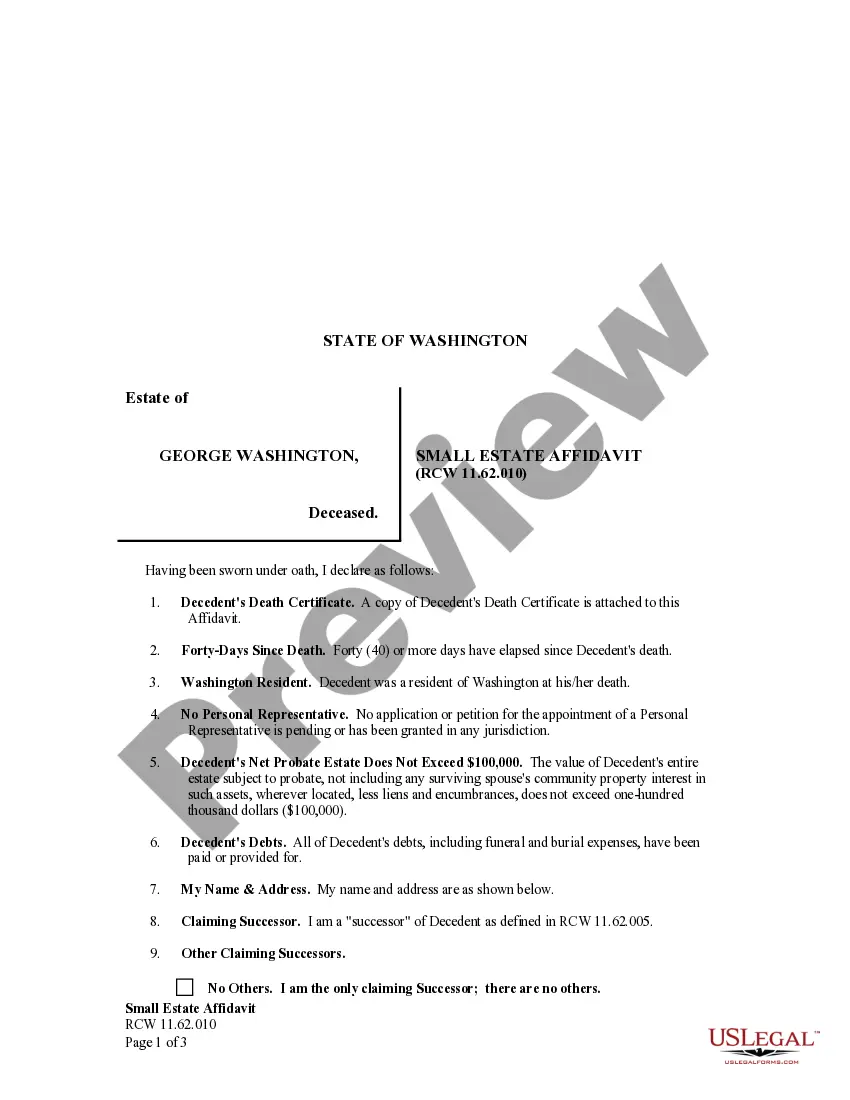

- If available preview it and read the description before buying it.

- Hit Buy Now.

- Select the suitable subscription to suit your needs.

- Create your account.

- Pay via PayPal or by debit/credit card.

- Select a preferred format if a number of options are available (e.g., PDF or Word).

- Download the document.

As soon as the Notice to Debt Collector - Posing Lengthy Series of Questions or Comments is downloaded you can complete, print and sign it in almost any editor or by hand. Get professionally drafted state-relevant papers within a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

Consumers have 30 days from the initial communication about the debt (for example, the first letter received explaining the debt is in collections) to call the collector and ask for the debt to be verified in writing. The collector must return your request before it can start trying to collect the debt again.

If you discover that an old debt has reappeared on your credit report as a new account or contains inaccurate information about its age or status, it might be because a debt buyer "parked" the debt on your credit report, or re-aged the status of your debt. These debt collection practices might be illegal.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

If you pay the collection agency directly, the debt is removed from your credit report in six years from the date of payment. If you don't pay, it purges six years from the last activity date, but you may be at risk for wage garnishment.

Never Give Them Your Personal Information. A call from a debt collection agency will include a series of questions. Never Admit That The Debt Is Yours. Even if the debt is yours, don't admit that to the debt collector. Never Provide Bank Account Information.

A collection account is considered a continuation of the original debt. It is a violation of law for a collection agency to report old past-due amounts as if they are new again when the debts are sold.Check your credit report and make sure the old debt not some more recent one is actually showing on your report.

Some debt collectors may try to report a debt on a consumer's credit report twice. Doing so can make a single bad debt hurt twice as much. Though some consumers may have multiple debts owed to the same debt collector or creditor (which can be reported separately), each debt can only be reported one time.

Unpaid collection accounts can get sold from debt collector to another, leaving your credit report with multiple collection accounts for one debt. It is up to you to review your credit reports to make sure you do not have multiple debt collectors reporting for the same debt.

This is important: You have just 30 days to respond to a debt validation letter. If you don't dispute the debt within 30 days, the debt is assumed valid. That means the debt collector can continue to contact you. You can send a dispute after 30 days.