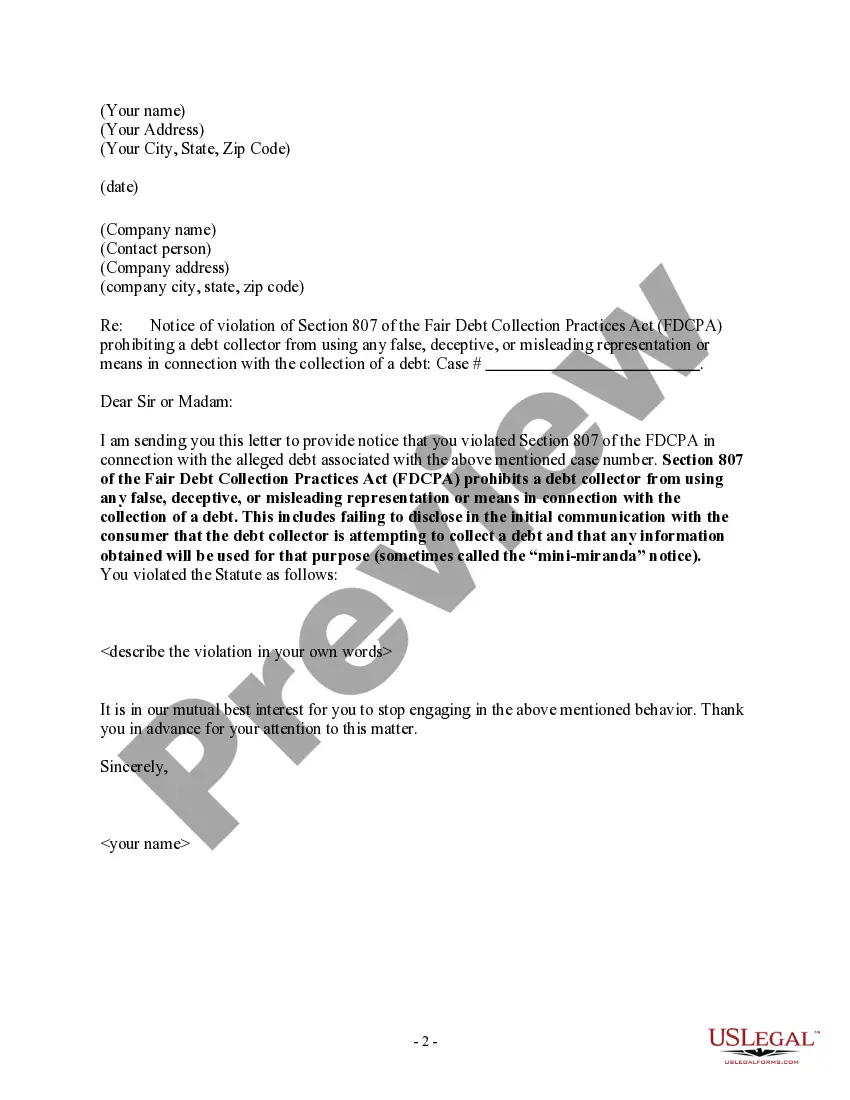

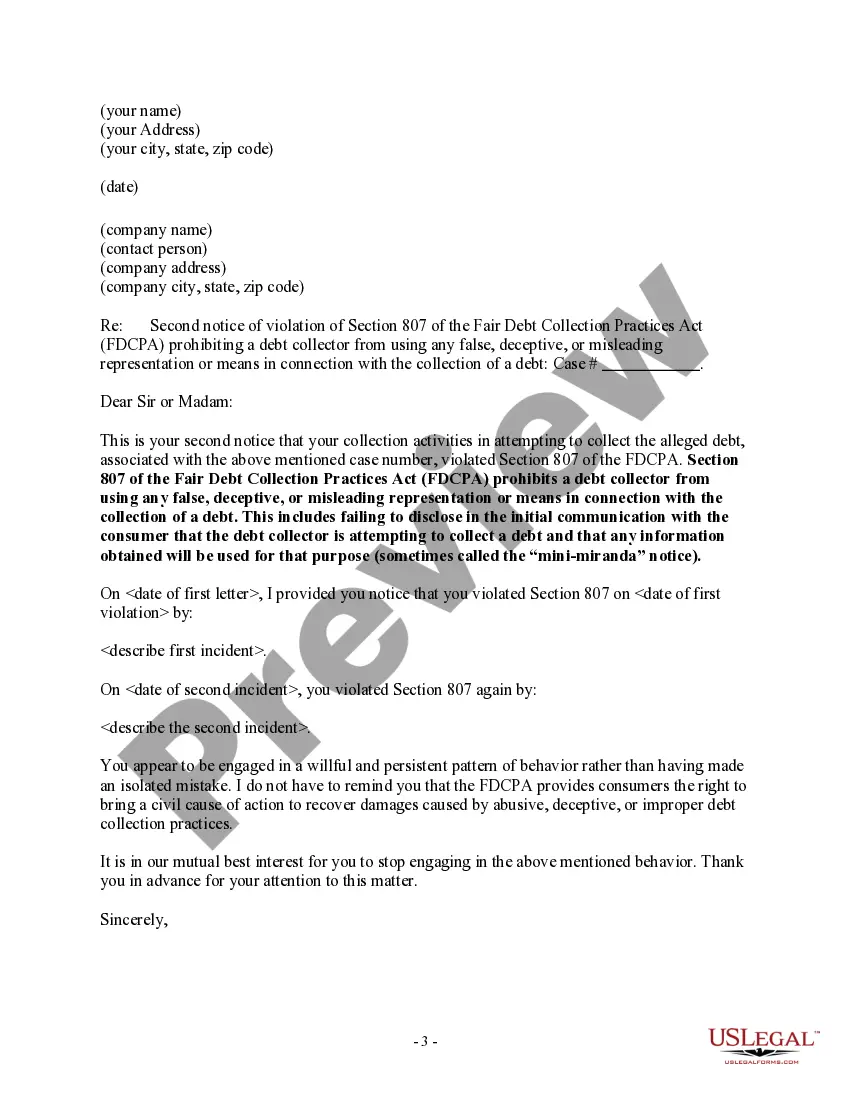

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes failing to disclose in the initial communication with the consumer that the debt collector is attempting to collect a debt and that any information obtained will be used for that purpose (Mini Miranda)

Notice to Debt Collector - Failure to Provide Mini-Miranda

Description Spanish Miranda Rights

How to fill out Fdcpa Mini Miranda?

When it comes to drafting a legal document, it’s better to delegate it to the experts. However, that doesn't mean you yourself can not get a sample to use. That doesn't mean you yourself cannot get a sample to utilize, nevertheless. Download Notice to Debt Collector - Failure to Provide Mini-Miranda right from the US Legal Forms website. It gives you numerous professionally drafted and lawyer-approved forms and templates.

For full access to 85,000 legal and tax forms, users simply have to sign up and select a subscription. When you are signed up with an account, log in, look for a specific document template, and save it to My Forms or download it to your gadget.

To make things less difficult, we’ve included an 8-step how-to guide for finding and downloading Notice to Debt Collector - Failure to Provide Mini-Miranda promptly:

- Make confident the form meets all the necessary state requirements.

- If possible preview it and read the description prior to buying it.

- Click Buy Now.

- Select the appropriate subscription to suit your needs.

- Create your account.

- Pay via PayPal or by debit/credit card.

- Select a preferred format if several options are available (e.g., PDF or Word).

- Download the file.

After the Notice to Debt Collector - Failure to Provide Mini-Miranda is downloaded you may fill out, print and sign it in any editor or by hand. Get professionally drafted state-relevant files within a matter of seconds in a preferable format with US Legal Forms!

Mini Miranda States Form popularity

List Of Miranda Rights Other Form Names

Notice Collector Failure FAQ

When a debt collector calls, it's important to know your rights and what you need to do. The FTC enforces the Fair Debt Collection Practices Act (FDCPA), which makes it illegal for debt collectors to use abusive, unfair, or deceptive practices when they collect debts.

Instances When the Mini Miranda Must Be Stated Debt collectors are required to give the full mini Miranda in their initial communication with you, no matter what form. 1fefffeff The first time a third-party debt collector speaks with you on the phone or sends you a letter, the mini Miranda statement must be included.

It's a violation of the collection practices act for a debt collector to refuse to send a validation notice or fail to respond to your verification letter. If you encounter such behavior, you can file a complaint with the Consumer Financial Protection Bureau.

If you can prove the debt collector has violated your rights under the FDCPA, you can sue in federal or state court for up to $1,000, including damages. 5feff You should also report violations to the Federal Trade Commission (FTC).

Never Give Them Your Personal Information. A call from a debt collection agency will include a series of questions. Never Admit That The Debt Is Yours. Even if the debt is yours, don't admit that to the debt collector. Never Provide Bank Account Information.

It is the purpose of this subchapter to eliminate abusive debt collection practices by debt collectors, to insure that those debt collectors who refrain from using abusive debt collection practices are not competitively disadvantaged, and to promote consistent State action to protect consumers against debt collection

1 attorney answer As a franchise attorney, I believe the states that have mini miranda requirements include, but may not be limited to, Colorado, Connecticut, Georgia, Hawaii, Iowa, Maine, North Carolina, Texas, Vermont, West Virginia and Wyoming.

Instances When the Mini Miranda Doesn't Have to Be Stated 1fefffeff Your creditors have no such obligation under this law.

At the beginning of a collection call, a debt collector must recite wording that has come to be called the mini-Miranda disclosure. It informs the consumer that the call is from a debt collector, that they are calling to collect a debt, and that any information revealed in the call will be used to collect that debt.