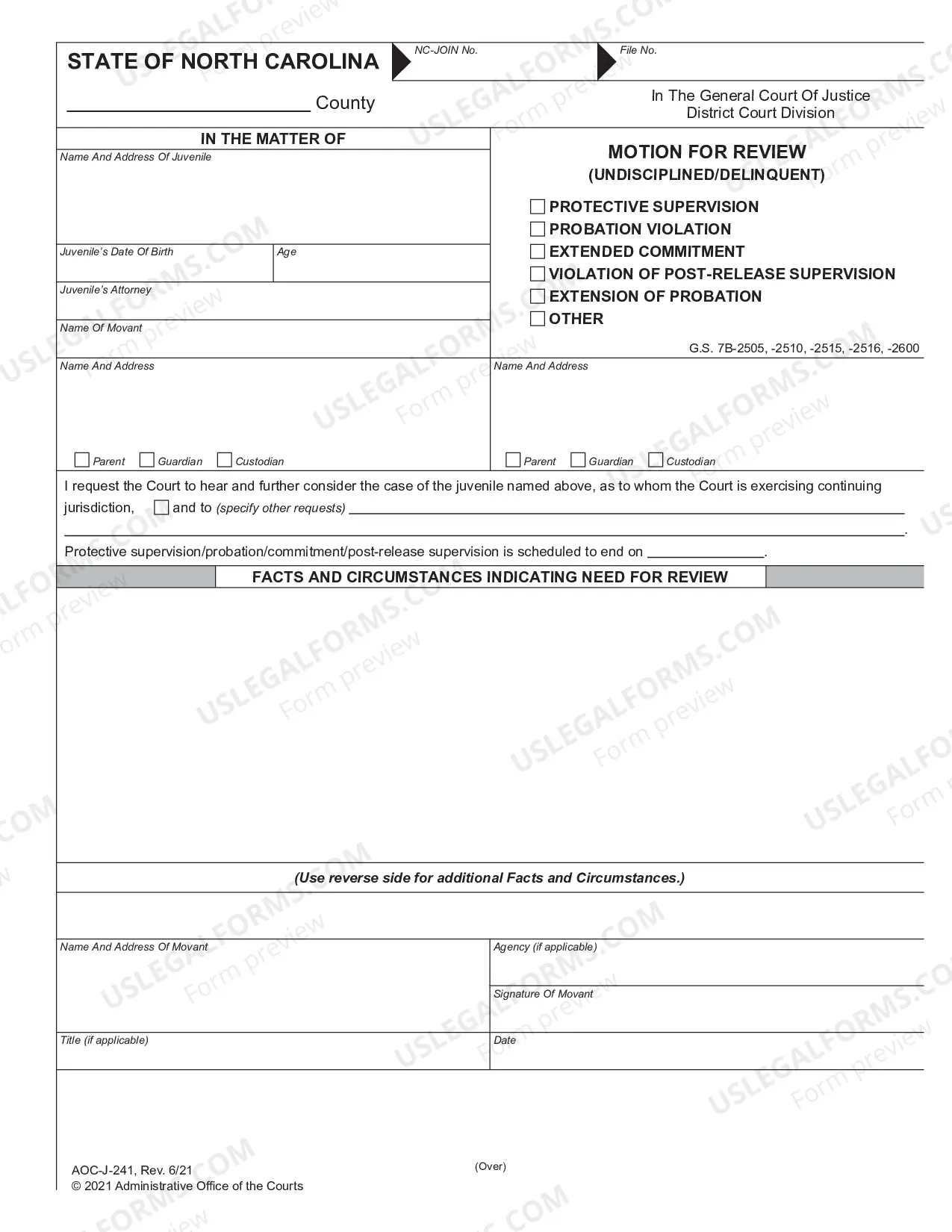

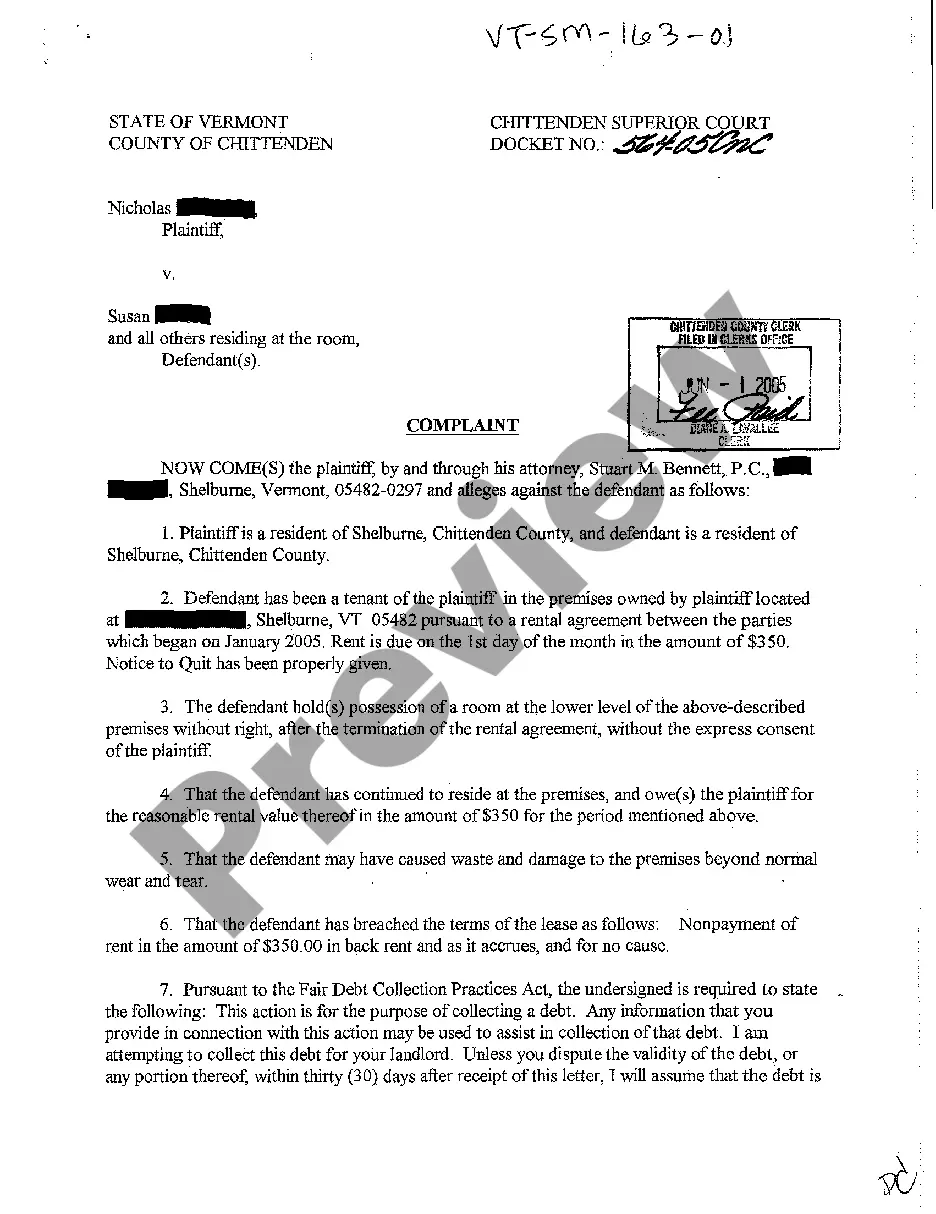

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes using a document designed to falsely imply that it issued from a state or federal source or creates a false impression as to its source, authorization or approval.

Notice to Debt Collector - Falsely Representing a Document's Authority

Description

How to fill out Notice To Debt Collector - Falsely Representing A Document's Authority?

When it comes to drafting a legal document, it is better to leave it to the experts. Nevertheless, that doesn't mean you yourself can’t get a template to utilize. That doesn't mean you yourself can not find a template to use, however. Download Notice to Debt Collector - Falsely Representing a Document's Authority from the US Legal Forms website. It gives you numerous professionally drafted and lawyer-approved forms and templates.

For full access to 85,000 legal and tax forms, users just have to sign up and select a subscription. Once you are registered with an account, log in, find a specific document template, and save it to My Forms or download it to your gadget.

To make things much easier, we’ve included an 8-step how-to guide for finding and downloading Notice to Debt Collector - Falsely Representing a Document's Authority quickly:

- Make confident the document meets all the necessary state requirements.

- If possible preview it and read the description prior to buying it.

- Hit Buy Now.

- Choose the appropriate subscription to suit your needs.

- Create your account.

- Pay via PayPal or by debit/visa or mastercard.

- Choose a preferred format if a number of options are available (e.g., PDF or Word).

- Download the document.

As soon as the Notice to Debt Collector - Falsely Representing a Document's Authority is downloaded you are able to complete, print out and sign it in any editor or by hand. Get professionally drafted state-relevant files within a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

Never Give Them Your Personal Information. A call from a debt collection agency will include a series of questions. Never Admit That The Debt Is Yours. Even if the debt is yours, don't admit that to the debt collector. Never Provide Bank Account Information.

You have the right to sue the collection agency if they act improperly for one year from the improper action. You can sue for lost wages and other expenses incurred, including legal and court costs. Also, the judge is allowed to award you up to $1,000 in punitive damages.

If you pay the collection agency directly, the debt is removed from your credit report in six years from the date of payment. If you don't pay, it purges six years from the last activity date, but you may be at risk for wage garnishment.

When a Debt Collector Calls, How Should You Answer? The phone call from a debt collector never comes at a good timebut the best response is to confront the state of these affairs head-on. You may want to hide or ignore the situation and hope it goes awaybut that can make things worse.

The definition of debt collection harassment is to intimidate, abuse, coerce, bully or browbeat consumers into paying off debt. This happens most often over the phone, but harassment could come in the form of emails, texts, direct mail or talking to friends or neighbors about your debt.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

Write a letter disputing the debt. You have 30 days after receiving a collection notice to dispute a debt in writing. Dispute the debt on your credit report. Lodge a complaint. Respond to a lawsuit. Hire an attorney.

Their name. Company name. Address. Call-back phone number. Website URL. State license number, if available as not all states license collectors.

For example, they can't: misrepresent the amount you owe. lie about being attorneys or government representatives. falsely claim you'll be arrested, or claim legal action will be taken against you if it's not true.