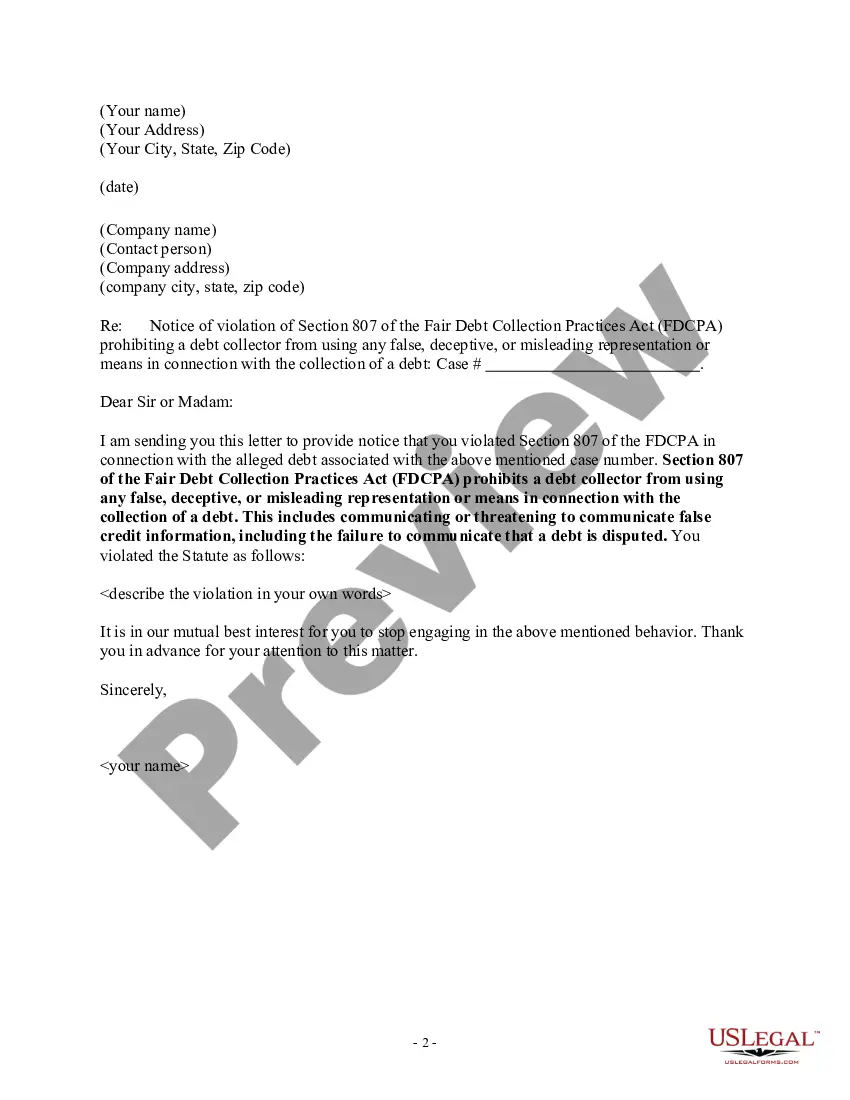

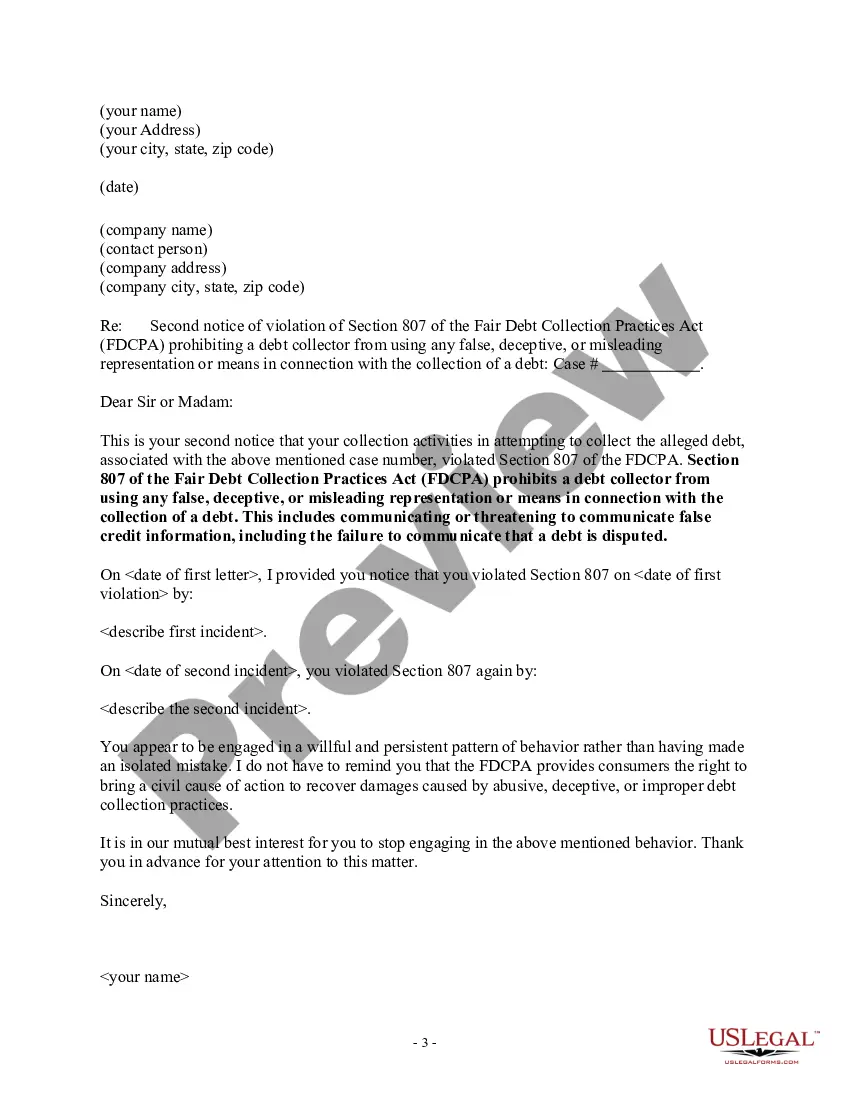

Notice of Violation of Fair Debt Act - False Information Disclosed

Description Violation Debt

How to fill out Violation Debt Sample?

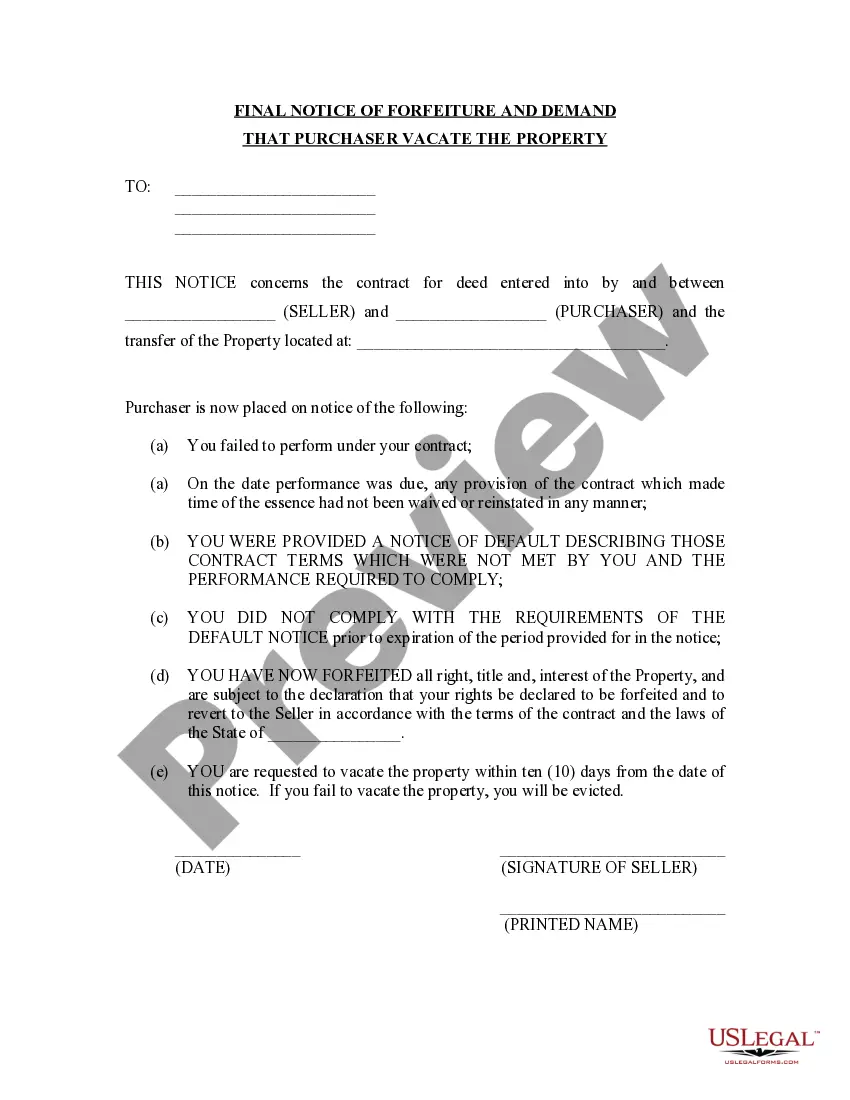

When it comes to drafting a legal document, it is better to delegate it to the experts. Nevertheless, that doesn't mean you yourself can’t get a sample to utilize. That doesn't mean you yourself can’t get a sample to use, however. Download Notice of Violation of Fair Debt Act - False Information Disclosed from the US Legal Forms web site. It gives you numerous professionally drafted and lawyer-approved forms and samples.

For full access to 85,000 legal and tax forms, users just have to sign up and choose a subscription. As soon as you are registered with an account, log in, find a particular document template, and save it to My Forms or download it to your device.

To make things easier, we have incorporated an 8-step how-to guide for finding and downloading Notice of Violation of Fair Debt Act - False Information Disclosed promptly:

- Make sure the document meets all the necessary state requirements.

- If available preview it and read the description before purchasing it.

- Hit Buy Now.

- Select the appropriate subscription to suit your needs.

- Create your account.

- Pay via PayPal or by debit/credit card.

- Choose a needed format if a number of options are available (e.g., PDF or Word).

- Download the file.

As soon as the Notice of Violation of Fair Debt Act - False Information Disclosed is downloaded you may complete, print out and sign it in almost any editor or by hand. Get professionally drafted state-relevant documents within a matter of minutes in a preferable format with US Legal Forms!

Notice Fair Debt Act Form popularity

Violation Act Information Other Form Names

Violation Fair Information FAQ

Under the Fair Debt Collection Practices Act, debt collectors are required to identify themselves in any communication with a debtor. This rule prevents collection agents from tricking consumers into returning calls or other communications without knowing the nature of the communication.

It is the purpose of this subchapter to eliminate abusive debt collection practices by debt collectors, to insure that those debt collectors who refrain from using abusive debt collection practices are not competitively disadvantaged, and to promote consistent State action to protect consumers against debt collection

Harassment of the debtor by the creditor More than 40 percent of all reported FDCPA violations involved incessant phone calls in an attempt to harass the debtor.

1 attorney answer As a franchise attorney, I believe the states that have mini miranda requirements include, but may not be limited to, Colorado, Connecticut, Georgia, Hawaii, Iowa, Maine, North Carolina, Texas, Vermont, West Virginia and Wyoming.

At the beginning of a collection call, a debt collector must recite wording that has come to be called the mini-Miranda disclosure. It informs the consumer that the call is from a debt collector, that they are calling to collect a debt, and that any information revealed in the call will be used to collect that debt.

When third-party debt collectors contact you by mail or by phone, one of the first things they'll say is, "This is an attempt to collect a debt, and any information obtained will be used for that purpose." This statement is commonly referred to as the "mini Miranda," because it is similar to the Miranda rights that law

Debt collectors must be truthful The Fair Debt Collection Practices Act states that debt collectors cannot use any false, deceptive or misleading representation to collect the debt. Along with other restrictions, debt collectors cannot misrepresent: The amount of the debt. Whether it's past the statute of limitations.

The Fair Debt Collection Practices Act (FDCPA) is the main federal law that governs debt collection practices. The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

When a debt collector calls, it's important to know your rights and what you need to do. The FTC enforces the Fair Debt Collection Practices Act (FDCPA), which makes it illegal for debt collectors to use abusive, unfair, or deceptive practices when they collect debts.