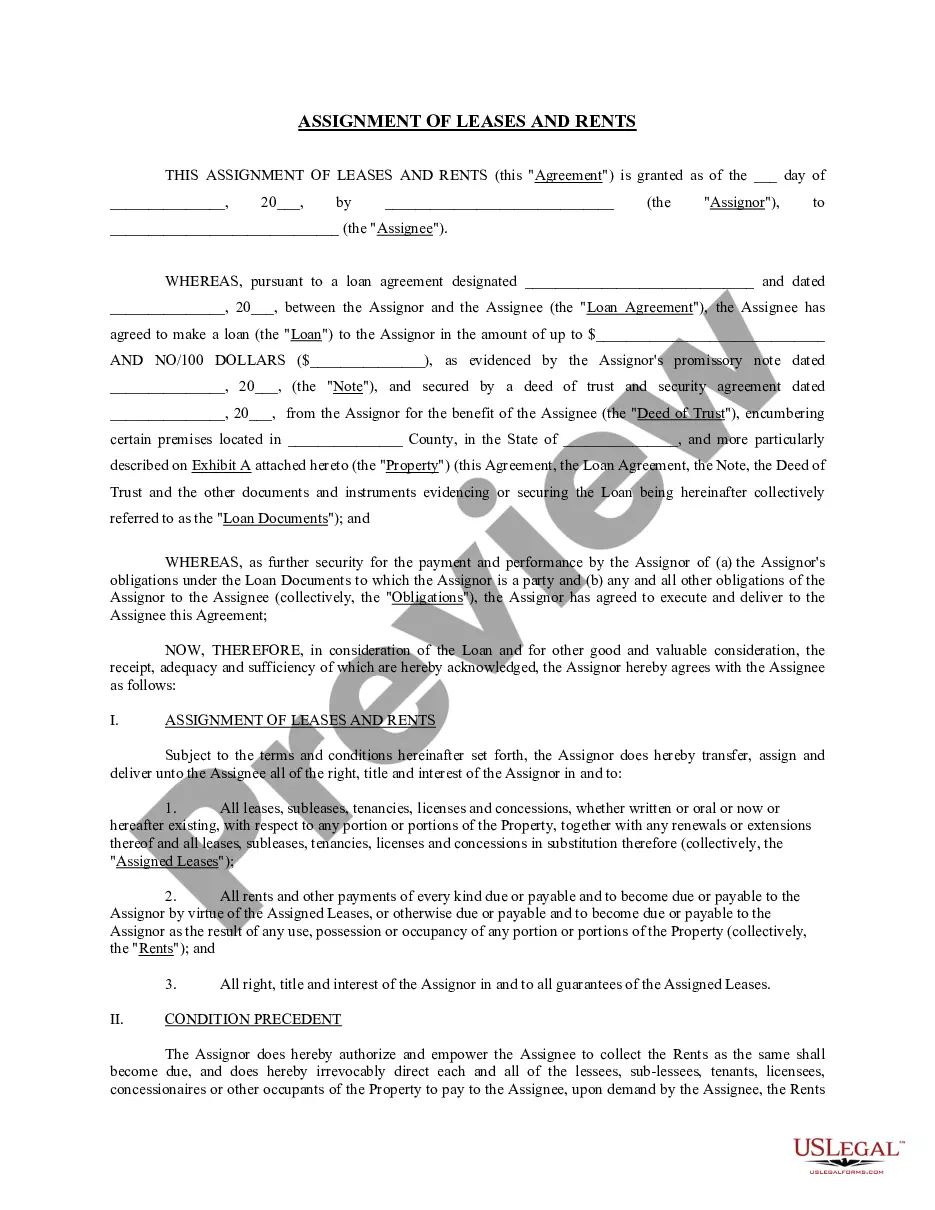

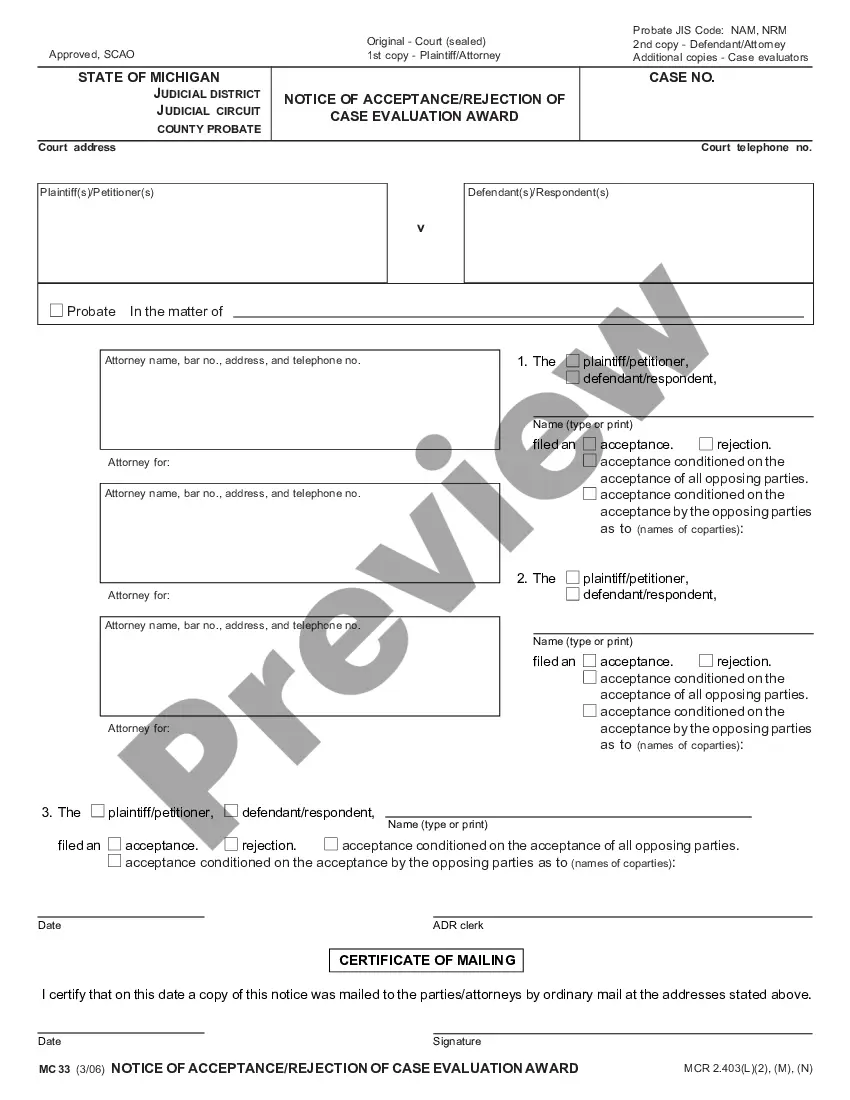

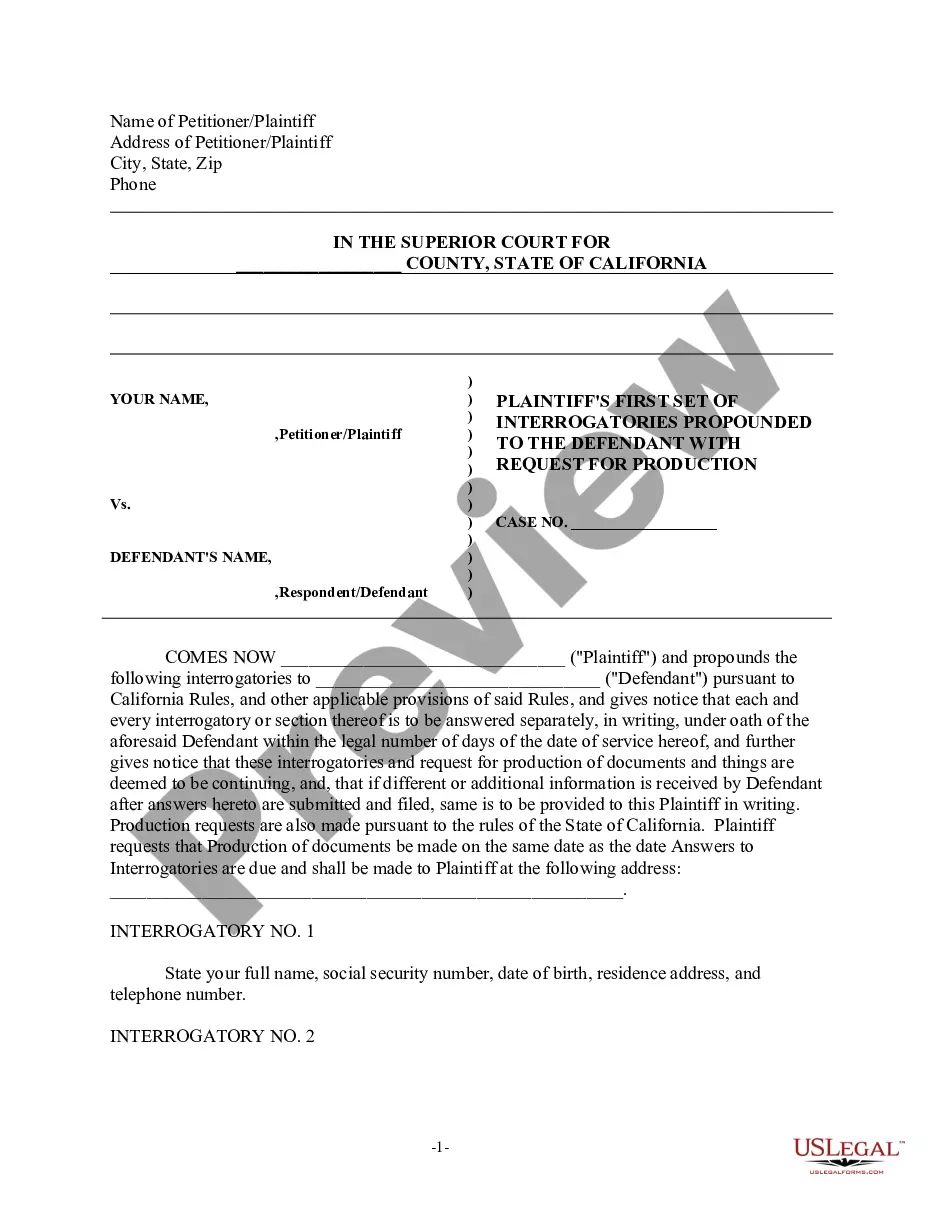

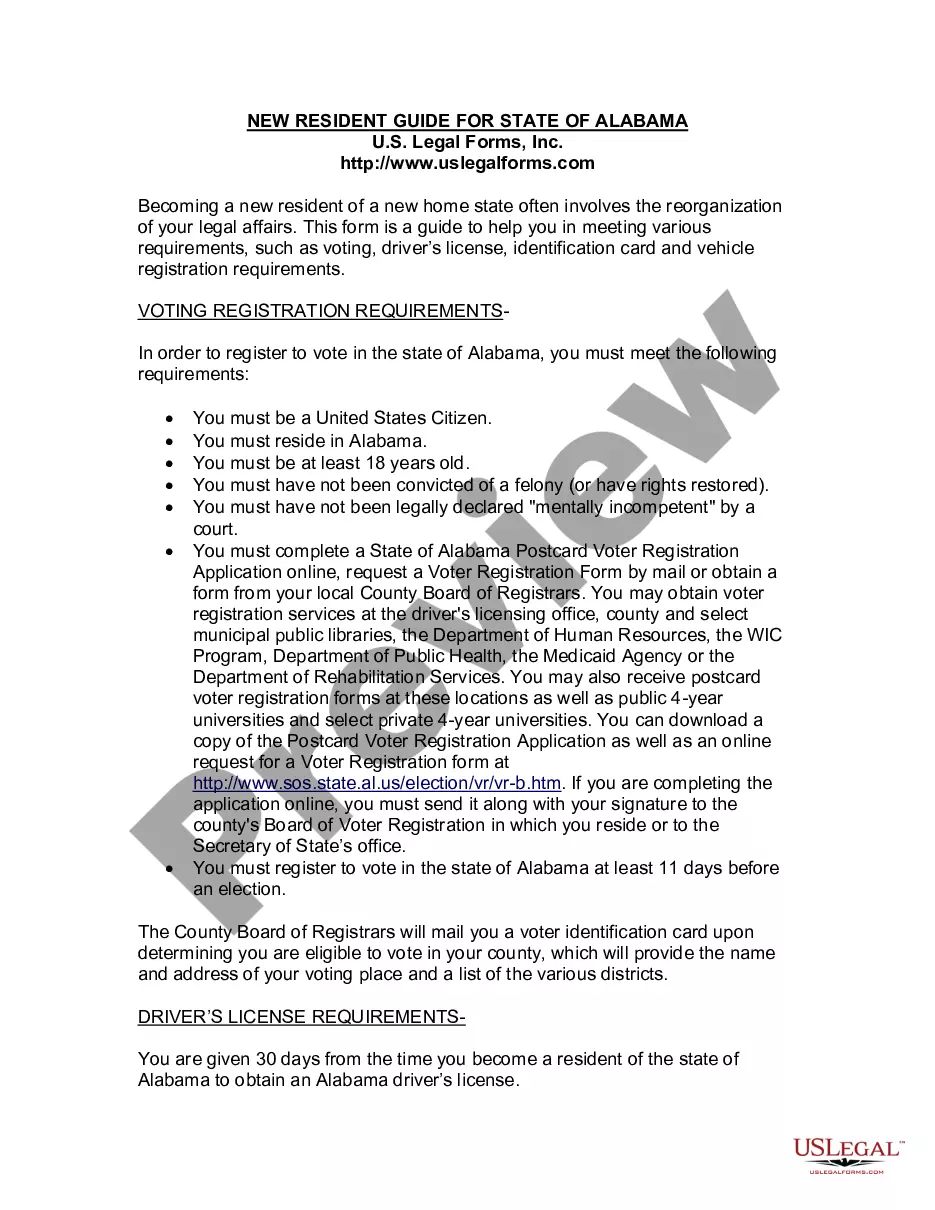

Notice of Violation of Fair Debt Act - Improper Document Appearance

Description Violation Appearance

How to fill out Notice Fair Debt?

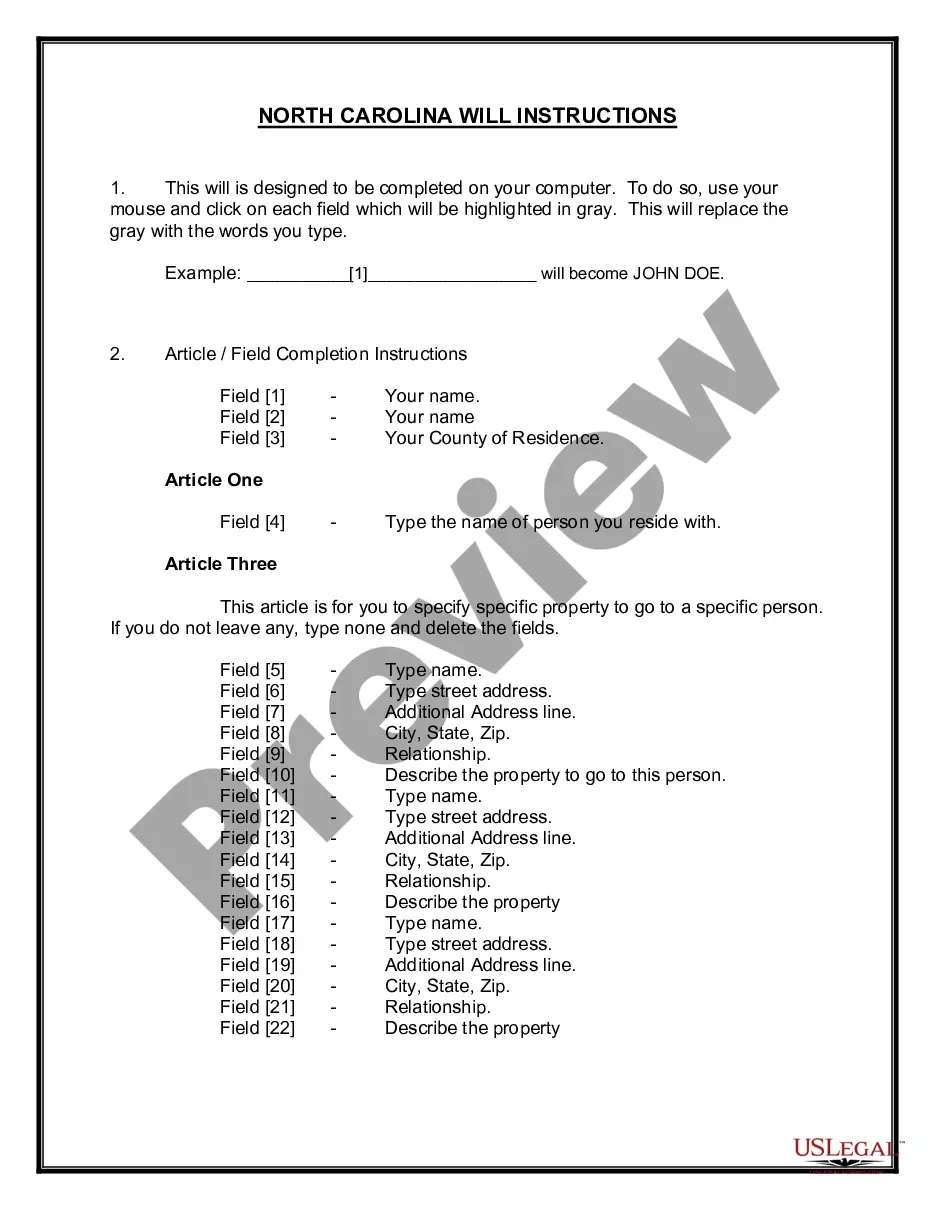

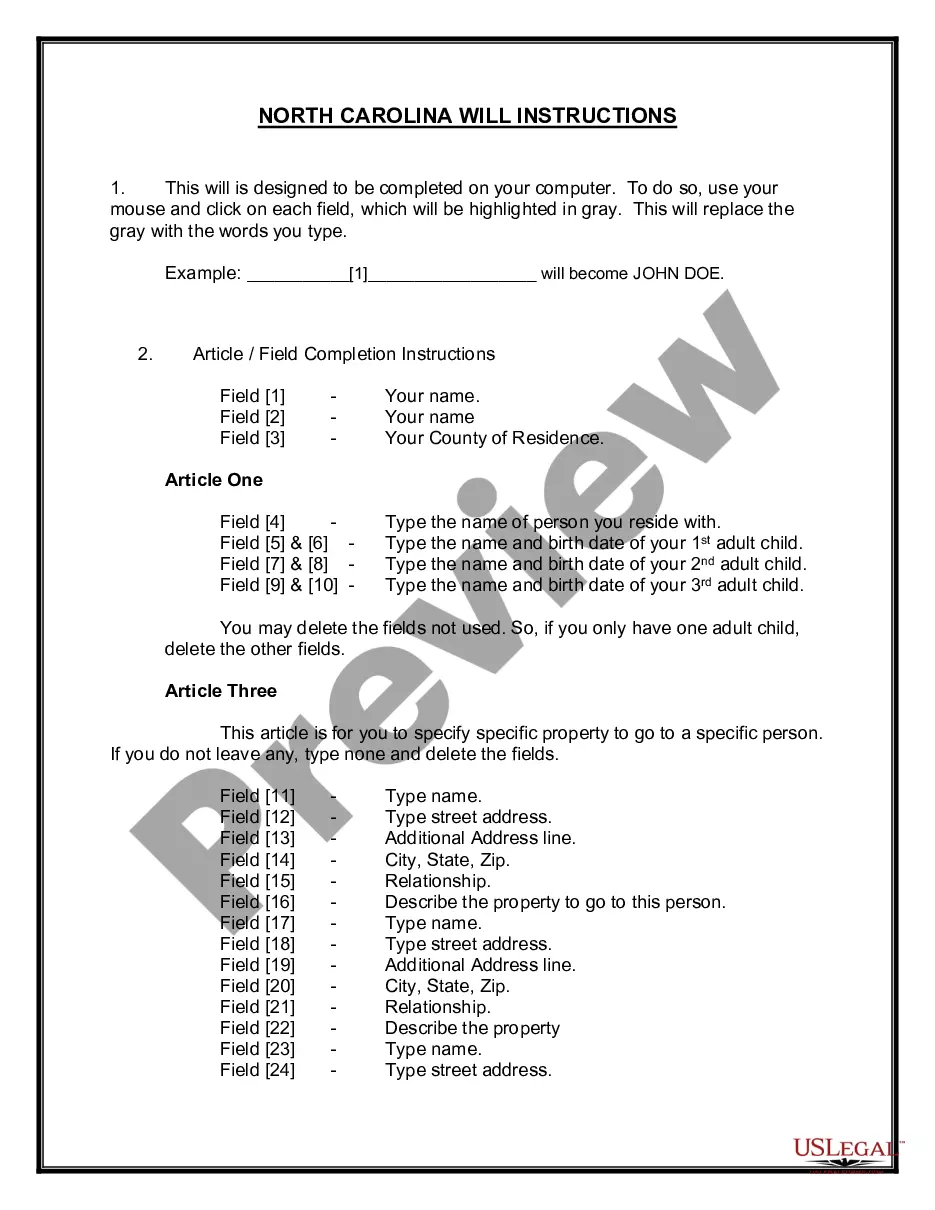

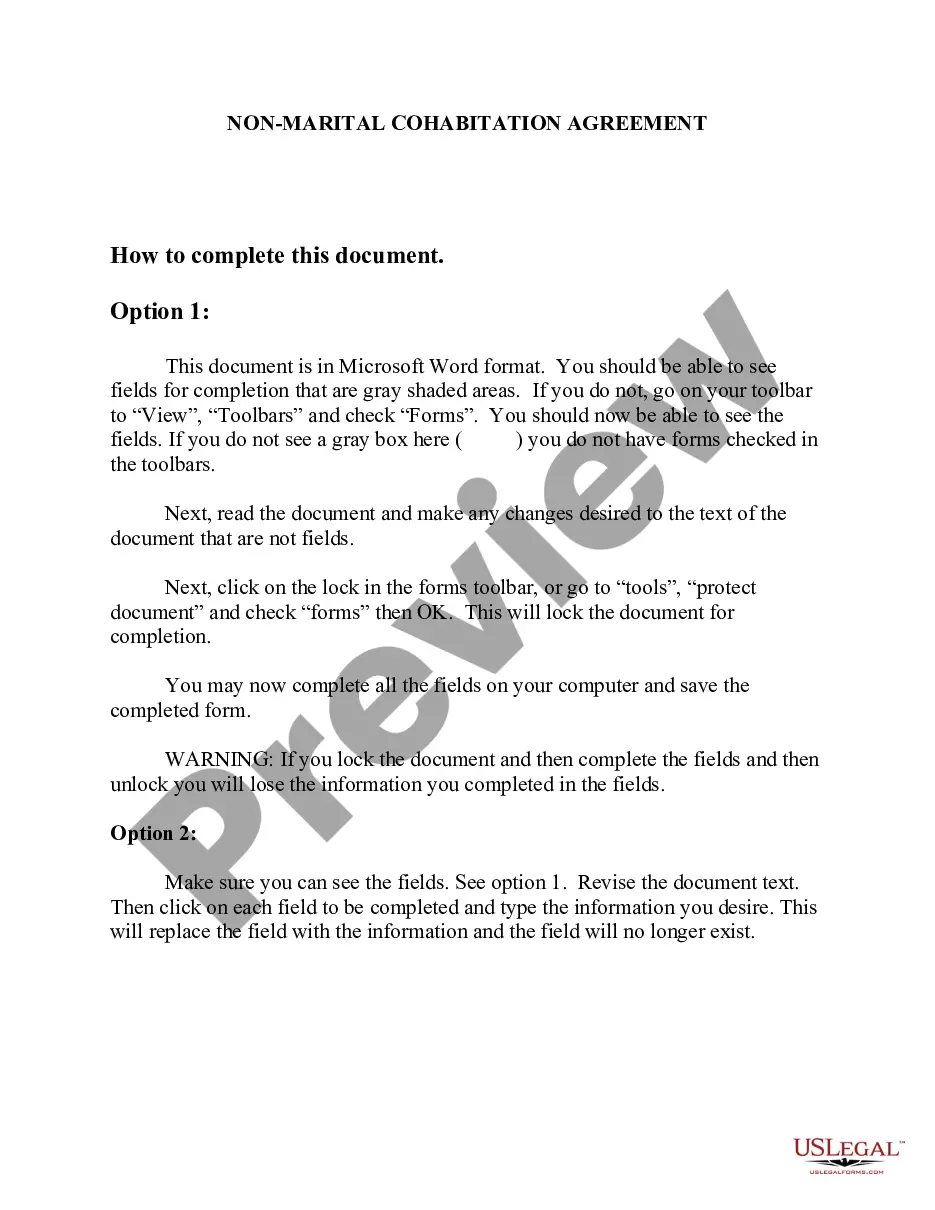

When it comes to drafting a legal document, it is easier to delegate it to the specialists. Nevertheless, that doesn't mean you yourself cannot get a template to use. That doesn't mean you yourself can not find a sample to utilize, however. Download Notice of Violation of Fair Debt Act - Improper Document Appearance from the US Legal Forms web site. It provides a wide variety of professionally drafted and lawyer-approved forms and samples.

For full access to 85,000 legal and tax forms, customers simply have to sign up and select a subscription. When you are signed up with an account, log in, search for a particular document template, and save it to My Forms or download it to your gadget.

To make things less difficult, we have incorporated an 8-step how-to guide for finding and downloading Notice of Violation of Fair Debt Act - Improper Document Appearance promptly:

- Make sure the document meets all the necessary state requirements.

- If available preview it and read the description before buying it.

- Click Buy Now.

- Choose the suitable subscription to suit your needs.

- Create your account.

- Pay via PayPal or by debit/bank card.

- Choose a preferred format if several options are available (e.g., PDF or Word).

- Download the file.

As soon as the Notice of Violation of Fair Debt Act - Improper Document Appearance is downloaded you can fill out, print out and sign it in almost any editor or by hand. Get professionally drafted state-relevant files within a matter of seconds in a preferable format with US Legal Forms!

Act Appearance Form popularity

Notice Violation Act Other Form Names

Violation Document Appearance FAQ

If you pay the collection agency directly, the debt is removed from your credit report in six years from the date of payment. If you don't pay, it purges six years from the last activity date, but you may be at risk for wage garnishment.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

The Fair Debt Collection Practices Act (FDCPA) is the main federal law that governs debt collection practices. The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

Debt collectors must be truthful The Fair Debt Collection Practices Act states that debt collectors cannot use any false, deceptive or misleading representation to collect the debt. Along with other restrictions, debt collectors cannot misrepresent: The amount of the debt. Whether it's past the statute of limitations.

The law makes it illegal for debt collectors to harass debtors in other ways, including threats of bodily harm or arrest. They also cannot lie or use profane or obscene language. Additionally, debt collectors cannot threaten to sue a debtor unless they truly intend to take that debtor to court.

Improve Your Credit Score After seven years, collection accounts drop off your credit report, even if you never pay them. 1 But if the accounts are less than seven years old and not approaching the credit reporting time limit, a paid collection is better for your credit score than an unpaid one.

Harassment of the debtor by the creditor More than 40 percent of all reported FDCPA violations involved incessant phone calls in an attempt to harass the debtor.