This form is a memorandum documenting a proposed due diligence schedule for team members.

Preliminary Due Diligence Team Memorandum

Description

How to fill out Preliminary Due Diligence Team Memorandum?

When it comes to drafting a legal document, it’s easier to delegate it to the experts. Nevertheless, that doesn't mean you yourself can’t find a sample to utilize. That doesn't mean you yourself can’t find a template to use, however. Download Preliminary Due Diligence Team Memorandum from the US Legal Forms site. It gives you numerous professionally drafted and lawyer-approved forms and samples.

For full access to 85,000 legal and tax forms, users simply have to sign up and select a subscription. After you are signed up with an account, log in, look for a specific document template, and save it to My Forms or download it to your device.

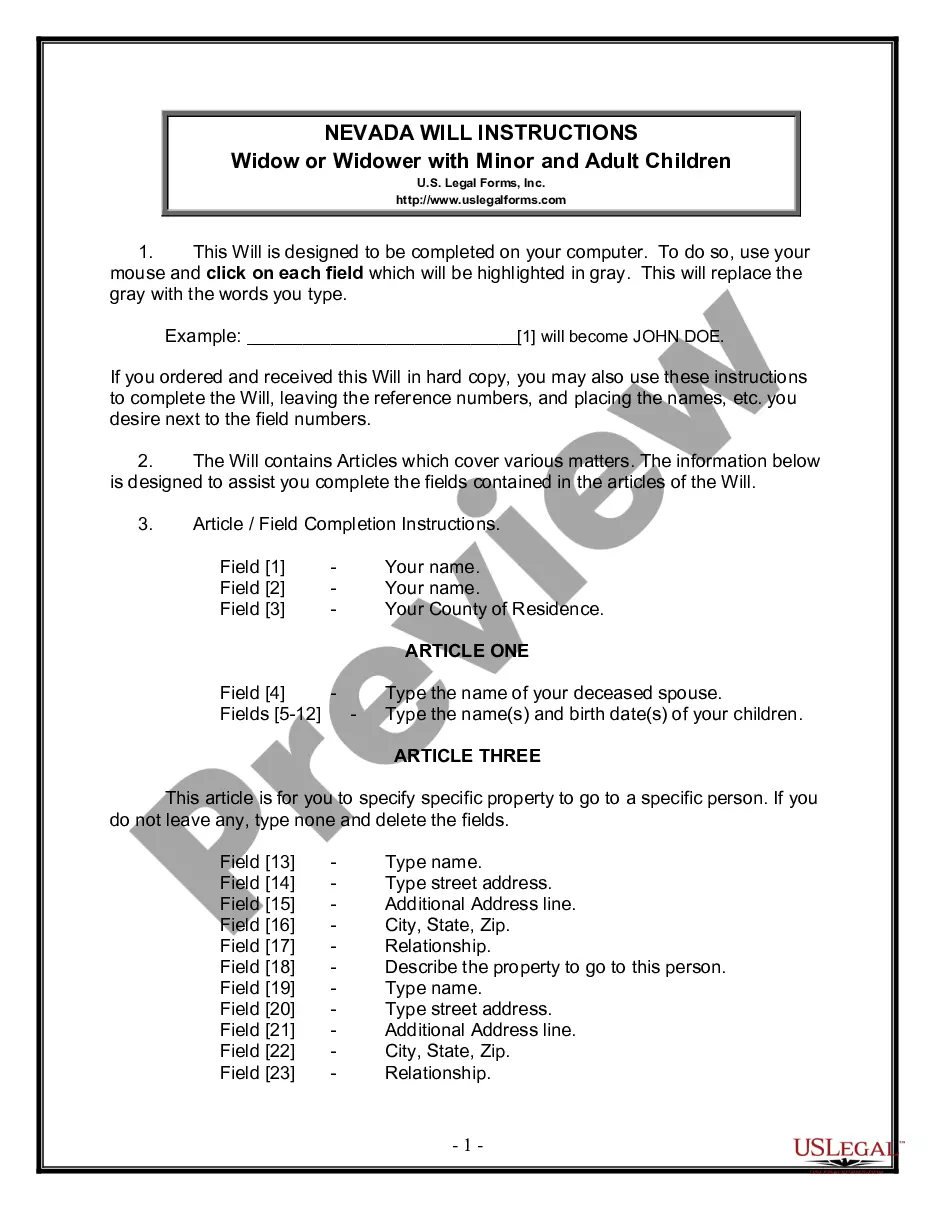

To make things less difficult, we’ve provided an 8-step how-to guide for finding and downloading Preliminary Due Diligence Team Memorandum quickly:

- Make confident the form meets all the necessary state requirements.

- If possible preview it and read the description prior to buying it.

- Hit Buy Now.

- Select the appropriate subscription for your needs.

- Create your account.

- Pay via PayPal or by credit/visa or mastercard.

- Select a needed format if a few options are available (e.g., PDF or Word).

- Download the file.

After the Preliminary Due Diligence Team Memorandum is downloaded you are able to fill out, print and sign it in any editor or by hand. Get professionally drafted state-relevant files within a matter of minutes in a preferable format with US Legal Forms!

Form popularity

FAQ

Due diligence is a process of research and analysis that is initiated before an acquisition, investment, business partnership or bank loan, in order to determine the value of the subject of the due diligence or whether there are any major issues involved.

Investment banker, preliminary due diligence refers to the evaluation of the. company that takes place after the letter of interest is accepted and before. the letter of intent is signed.

Step 1: Company Capitalization. Step 2: Revenue, Margin Trends. Step 3: Competitors & Industries. Step 4: Valuation Multiples. Step 5: Management and Ownership. Step 6: Balance Sheet Exam. Step 7: Stock Price History. Step 8: Stock Options & Dilution.

Financial Due Diligence. Review business strategy. Review proposed transaction terms. Accounting Due Diligence. Ensure compliance with relevant accounting rules and policies. Tax Due Diligence. Analyze current tax position. Legal Due Diligence. Assess balance sheet and off-balance sheet liabilities and potential risks.

Write for the target audience. Focus on the report objectives. Limit the report to information that has material impact to your company. Structure the information to be used as valuable reference material later.

There are several reasons why due diligence is conducted: To confirm and verify information that was brought up during the deal or investment process. To identify potential defects in the deal or investment opportunity and thus avoid a bad business transaction.

Due Diligence Examples Conducting thorough inspections on a property before buying it in order to make sure that it is a good investment. An underwriter auditing an issuer's business and operations prior to selling it.

Statement of what is being studied, research or proposed. Background and supporting documentation on the proposal (corporate reports, financial statements, legal documents, copies of transaction history, market research)