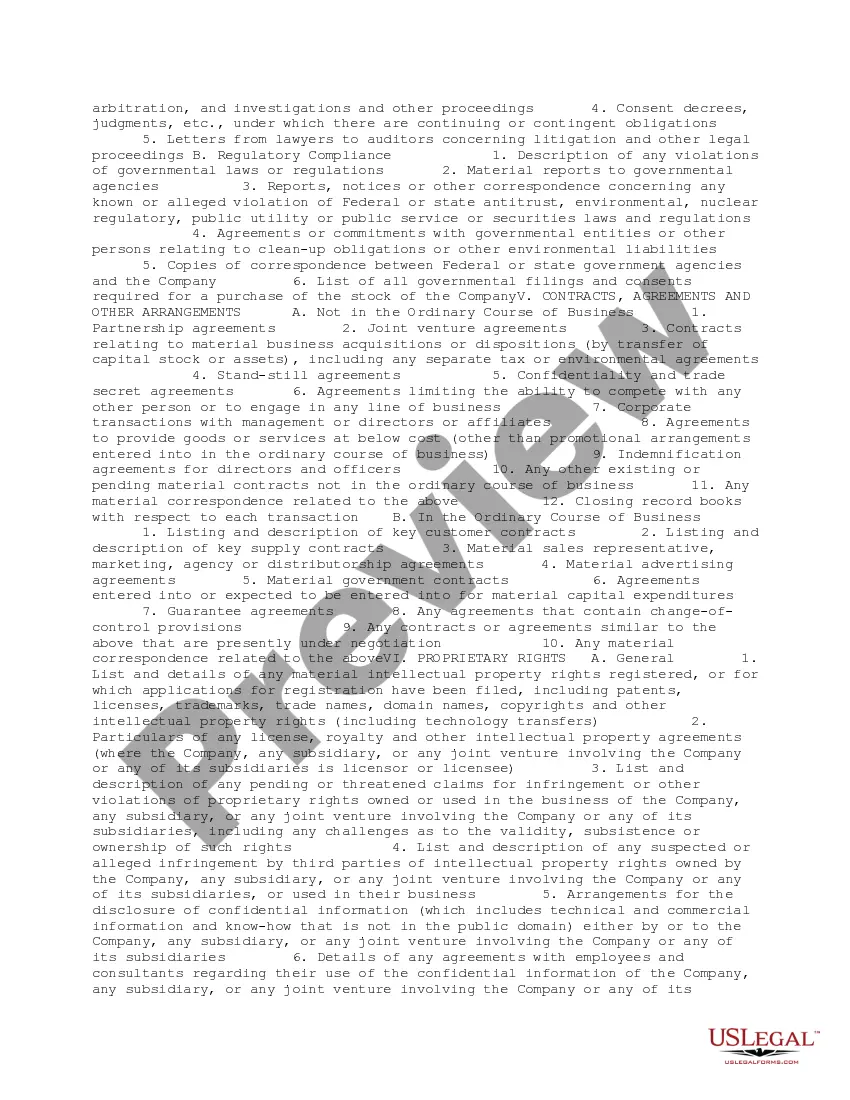

This form is a list of requested due diligence documents from a technology company for the purchase of shares of stock. The list consists of documents and information to be submitted to the due diligence team.

Request for Due Diligence Documents from a Technology Company

Description

How to fill out Request For Due Diligence Documents From A Technology Company?

When it comes to drafting a legal document, it is easier to delegate it to the professionals. Nevertheless, that doesn't mean you yourself can’t find a sample to utilize. That doesn't mean you yourself can not find a sample to use, however. Download Request for Due Diligence Documents from a Technology Company right from the US Legal Forms website. It gives you a wide variety of professionally drafted and lawyer-approved forms and templates.

For full access to 85,000 legal and tax forms, customers simply have to sign up and select a subscription. Once you are registered with an account, log in, search for a particular document template, and save it to My Forms or download it to your gadget.

To make things much easier, we’ve incorporated an 8-step how-to guide for finding and downloading Request for Due Diligence Documents from a Technology Company quickly:

- Be sure the document meets all the necessary state requirements.

- If available preview it and read the description prior to buying it.

- Hit Buy Now.

- Select the suitable subscription to suit your needs.

- Create your account.

- Pay via PayPal or by credit/credit card.

- Select a preferred format if several options are available (e.g., PDF or Word).

- Download the document.

As soon as the Request for Due Diligence Documents from a Technology Company is downloaded you may complete, print and sign it in almost any editor or by hand. Get professionally drafted state-relevant documents in a matter of minutes in a preferable format with US Legal Forms!

Form popularity

FAQ

Write for the target audience. Focus on the report objectives. Limit the report to information that has material impact to your company. Structure the information to be used as valuable reference material later.

Financial Due Diligence. Review business strategy. Review proposed transaction terms. Accounting Due Diligence. Ensure compliance with relevant accounting rules and policies. Tax Due Diligence. Analyze current tax position. Legal Due Diligence. Assess balance sheet and off-balance sheet liabilities and potential risks.

Technical due diligence (TDD) requires dedicated, specialist teams of chartered building surveyors and engineers to properly appraise a building.Different opportunities, such as the feasibility of adding an extra floor or conversion of an underused part of a building, may need to be considered.

Step 1: Company Capitalization. Step 2: Revenue, Margin Trends. Step 3: Competitors & Industries. Step 4: Valuation Multiples. Step 5: Management and Ownership. Step 6: Balance Sheet Exam. Step 7: Stock Price History. Step 8: Stock Options & Dilution.

A due diligence package includes the materials and information that potential investors will appraise during the pitching process.In essence, there is a due diligence checklist which guides the start-up entrepreneur in shaping this package.

During the due diligence process, an investor will request information about your company that will inform their investment decision moving forward. In addition to asking questions of you and key members of your management team during meetings or phone calls, they will provide you with a request list.

The report will include a list of key findings and valid recommendations, as well as a reasoned conclusion with a financial analysis explaining the feasibility of our recommendations, and its impact on the company.

A due diligence checklist is an organized way to analyze a company. The checklist will include all the areas to be analyzed, such as ownership and organization, assets and operations, the financial ratios, shareholder value, processes and policies, future growth potential, management, and human resources.