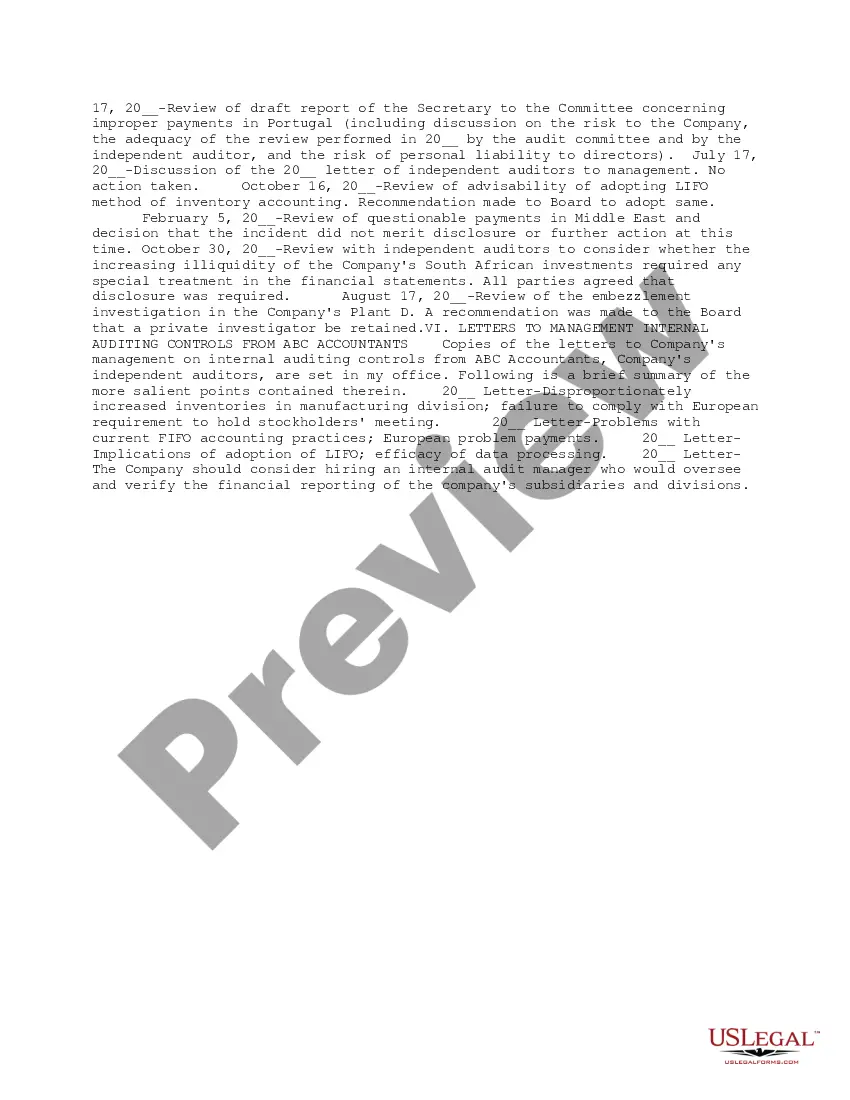

This form is a memorandum that is used by the Diligence Attorney as an important component for documenting the materials that will be utilized in preparing client-oriented executive summaries. This due diligence form documents the efforts of the diligence team to date, descriptions of significant findings, and potential trouble spots within the prospective corporation.

Periodic Diligence Memorandum

Description

How to fill out Periodic Diligence Memorandum?

When it comes to drafting a legal form, it is easier to leave it to the professionals. However, that doesn't mean you yourself can not get a sample to utilize. That doesn't mean you yourself can’t get a sample to utilize, however. Download Periodic Diligence Memorandum from the US Legal Forms website. It gives you a wide variety of professionally drafted and lawyer-approved forms and samples.

For full access to 85,000 legal and tax forms, customers simply have to sign up and select a subscription. Once you are signed up with an account, log in, find a particular document template, and save it to My Forms or download it to your device.

To make things less difficult, we’ve provided an 8-step how-to guide for finding and downloading Periodic Diligence Memorandum quickly:

- Make confident the document meets all the necessary state requirements.

- If possible preview it and read the description before purchasing it.

- Press Buy Now.

- Choose the appropriate subscription for your needs.

- Make your account.

- Pay via PayPal or by debit/credit card.

- Select a preferred format if several options are available (e.g., PDF or Word).

- Download the file.

As soon as the Periodic Diligence Memorandum is downloaded you are able to fill out, print and sign it in almost any editor or by hand. Get professionally drafted state-relevant documents within a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

Due Diligence is a process of estimating the commercial potential of an entity, comprehensive evaluation of the financial viability of the entity concerning its assets and liabilities, and; an examination and verification of the operations and material facts in relation to a proposed transaction.

Due Diligence Examples Conducting thorough inspections on a property before buying it in order to make sure that it is a good investment. An underwriter auditing an issuer's business and operations prior to selling it.

Write for the target audience. Focus on the report objectives. Limit the report to information that has material impact to your company. Structure the information to be used as valuable reference material later.

A Statement describing the subject of research. Documents in support of the research such as corporate reports, legal documents, transaction copies, market research, etc. SWOT Analysis i.e. an overview of the strengths, weaknesses, opportunities, and threats linked with the proposal.

Legal due diligence is the process of collecting, understanding and assessing all the legal risks associated during a M&A process. During due diligence, the acquirer reviews all the documents pertaining to a target company and interviews people associated with it.

Reviewing and auditing financial statements. Scrutinizing projections for future performance. Analyzing the consumer market. Seeking operating redundancies that can be eliminated. Reviewing potential or ongoing litigation. Reviewing antitrust considerations.

The report will include a list of key findings and valid recommendations, as well as a reasoned conclusion with a financial analysis explaining the feasibility of our recommendations, and its impact on the company.

A due diligence checklist is an organized way to analyze a company that you are acquiring through sale, merger, or another method. By following this checklist, you can learn about a company's assets, liabilities, contracts, benefits, and potential problems.