Landlord Tenant Investment Trust REIT Due Diligence Supplemental Checklist

Description Reit Testing Checklist

How to fill out Landlord Tenant Investment Trust REIT Due Diligence Supplemental Checklist?

When it comes to drafting a legal document, it is easier to leave it to the experts. However, that doesn't mean you yourself can’t find a template to utilize. That doesn't mean you yourself cannot find a template to use, however. Download Landlord Tenant Investment Trust REIT Due Diligence Supplemental Checklist from the US Legal Forms website. It offers a wide variety of professionally drafted and lawyer-approved documents and templates.

For full access to 85,000 legal and tax forms, customers simply have to sign up and choose a subscription. Once you’re registered with an account, log in, search for a particular document template, and save it to My Forms or download it to your device.

To make things much easier, we have included an 8-step how-to guide for finding and downloading Landlord Tenant Investment Trust REIT Due Diligence Supplemental Checklist quickly:

- Make sure the document meets all the necessary state requirements.

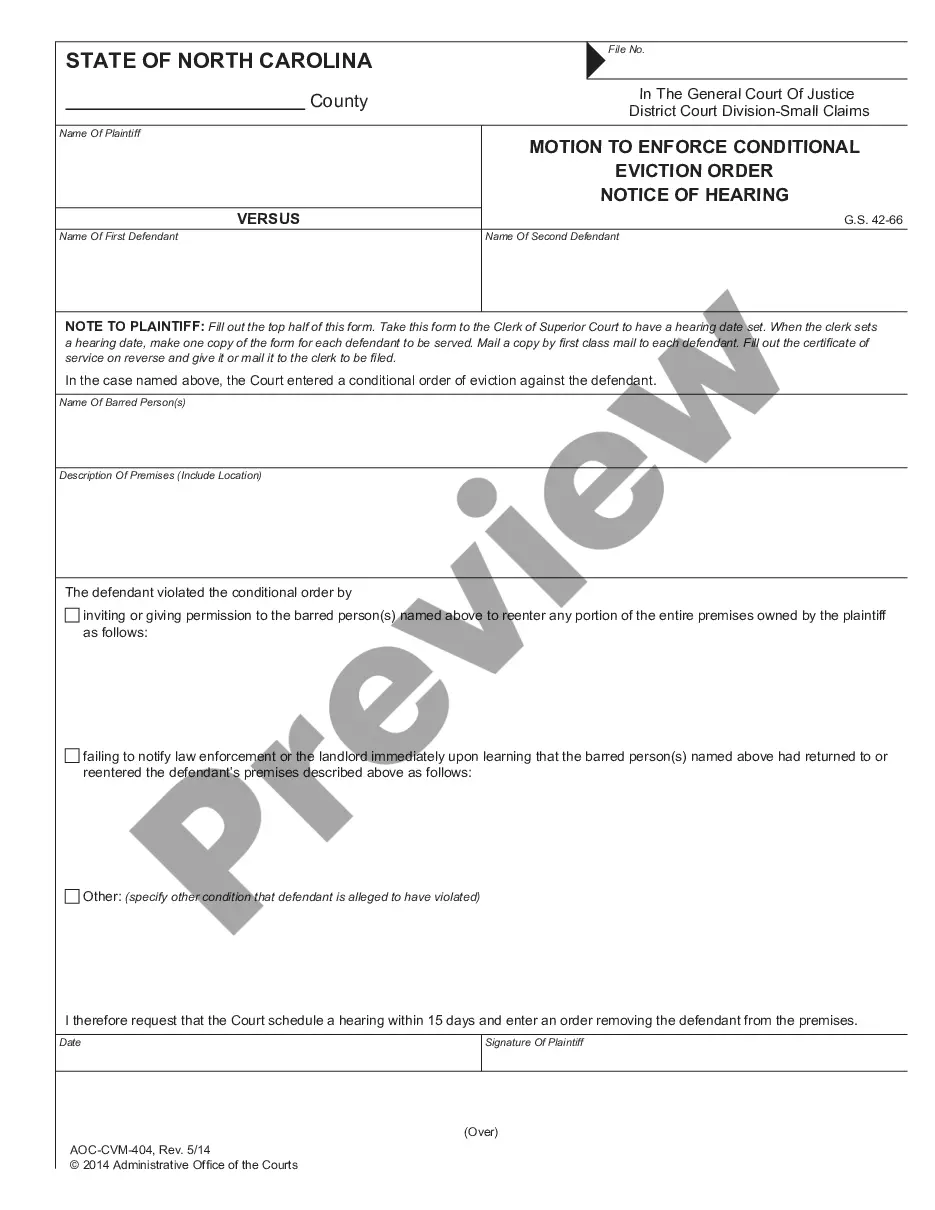

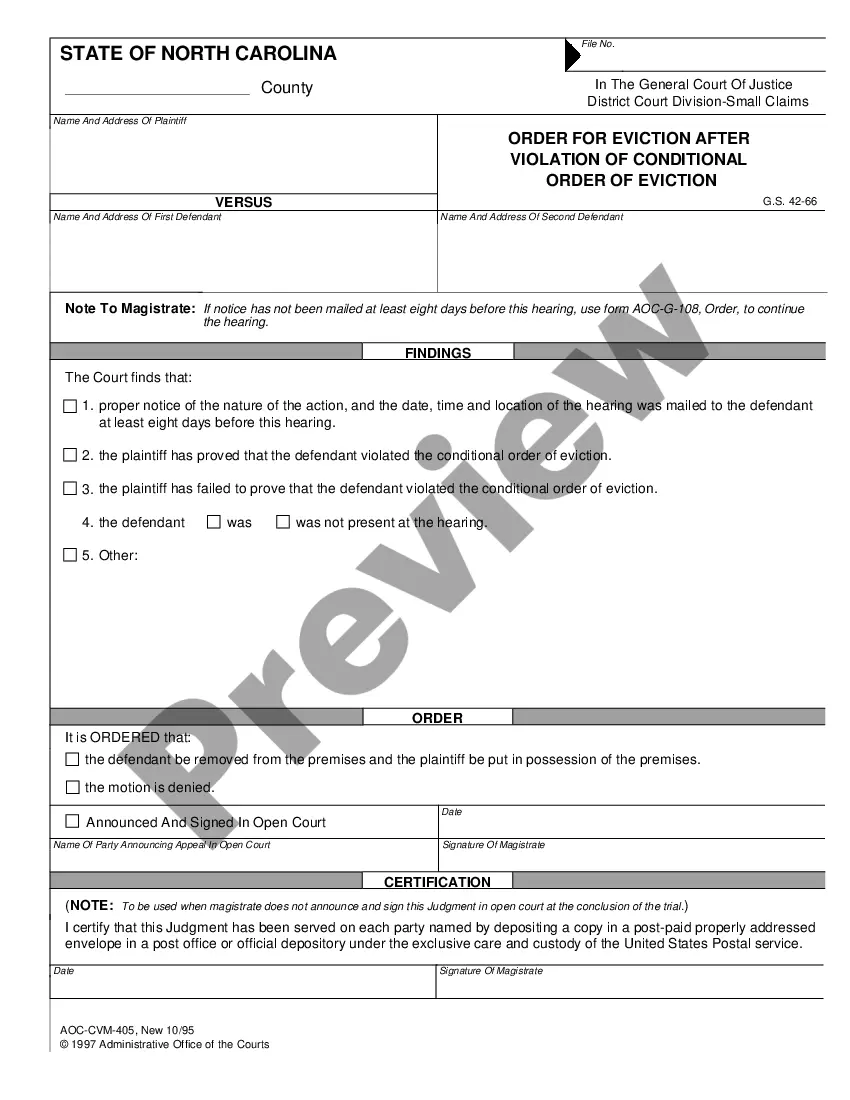

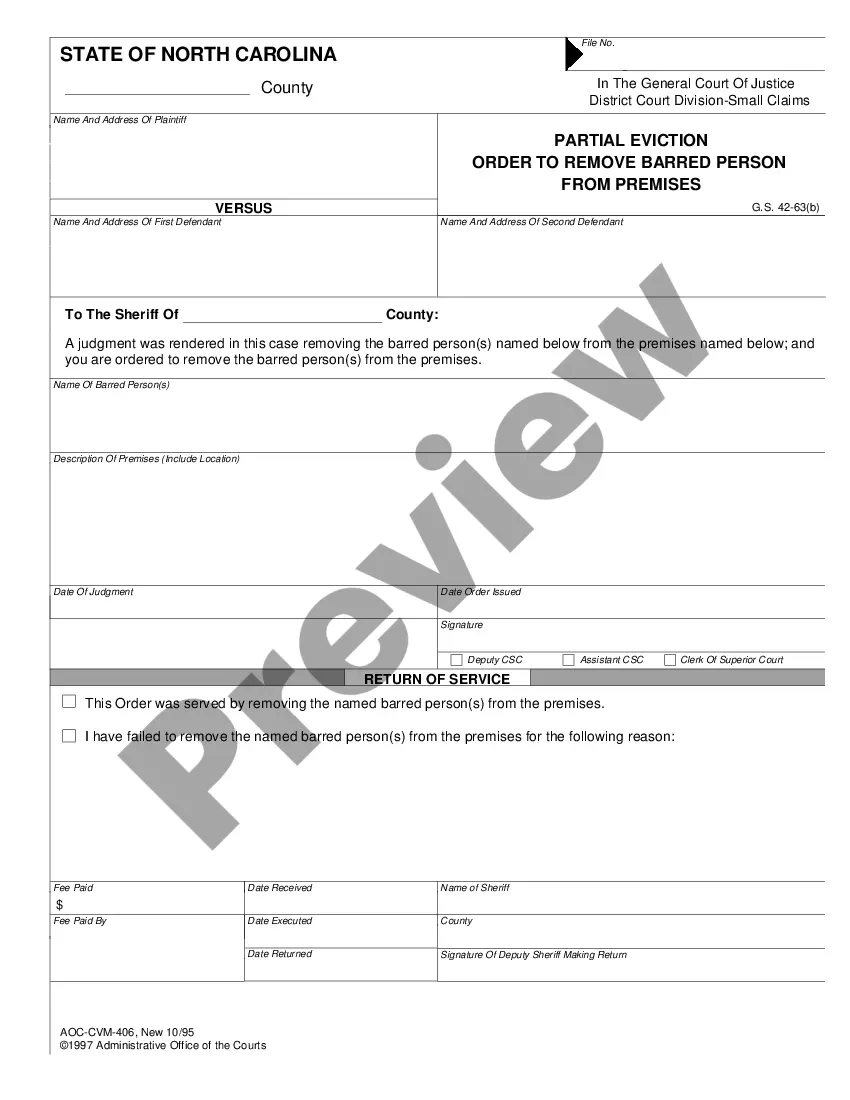

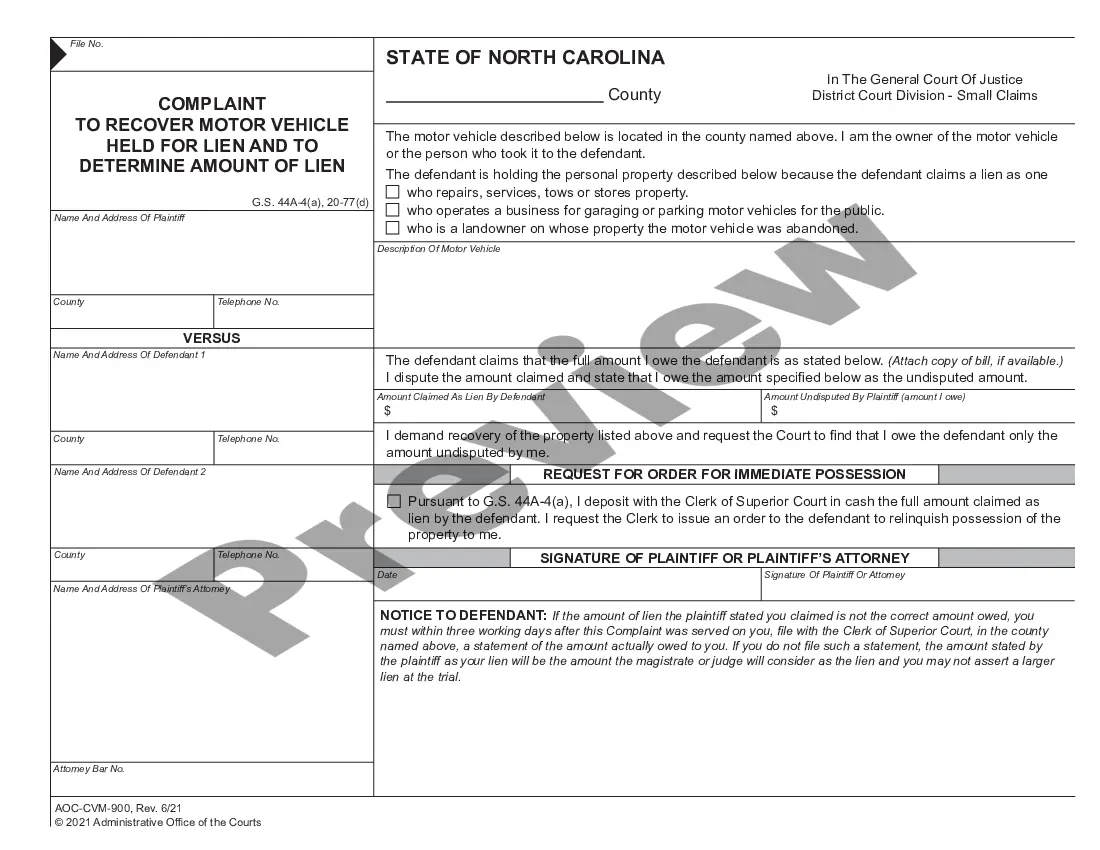

- If available preview it and read the description before purchasing it.

- Press Buy Now.

- Choose the appropriate subscription to meet your needs.

- Create your account.

- Pay via PayPal or by debit/bank card.

- Choose a preferred format if a few options are available (e.g., PDF or Word).

- Download the document.

When the Landlord Tenant Investment Trust REIT Due Diligence Supplemental Checklist is downloaded you are able to fill out, print and sign it in almost any editor or by hand. Get professionally drafted state-relevant documents within a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

The REIT sector has now achieved gains in 4 of the first 11 months of 2020, with a 22.2% total return in November. Micro cap (+29.22%) and small cap REITs (+27.91%) surged in November, while large caps (+9.14%) saw smaller gains. 89.44% of REIT securities had a positive total return in November.

Invest at least 75% of total assets in real estate, cash, or U.S. Treasuries. Derive at least 75% of gross income from rents, interest on mortgages that finance real property, or real estate sales. Pay a minimum of 90% of taxable income in the form of shareholder dividends each year.

There are three types of REITs: Equity REITs which usually earn income from rents, Mortgage REITs that earn money from interest, and. Hybrid REITs, a combination that earns income from both rent and interest.

No corporate tax. High dividend yields. Total return potential. Access to commercial real estate. Portfolio diversification. Liquidity. Dividend taxation. Interest rate sensitivity.

REITs. The outlook for REITs in 2020 remains favorable. We expect modest economic growth and see few signs of recession on the horizon. Real estate markets enjoy low vacancy rates and a balance of new supply and growing demand, supporting rent growth and REIT earnings in the year ahead.

What is a REIT?To qualify as a REIT, a company must have the bulk of its assets and income connected to real estate investment and must distribute at least 90 percent of its taxable income to shareholders annually in the form of dividends.

2020 Performance Recap Equity REITs (VNQ) finished 2020 with price-returns of -8.5% and Mortgage REITs (REM) declined by 28.5%. This compares with the 16.2% gain on the S&P 500, the 11.8% gain on the S&P Mid-Cap 400 (MDY).

Invest at least 75% of total assets in real estate, cash, or U.S. Treasuries. Derive at least 75% of gross income from rents, interest on mortgages that finance real property, or real estate sales. Pay a minimum of 90% of taxable income in the form of shareholder dividends each year.

Bad news: REITs have suffered large losses and significantly underperformed in 2020. Good news: Most of these REITs will survive and fully recover. We think that the pre-crisis valuations are too low now that we are in a 0% interest rate world.