Loan Modification Agreement - Multistate

Description Modify Loan

How to fill out Loan Modification Documents Needed?

When it comes to drafting a legal form, it is easier to leave it to the specialists. However, that doesn't mean you yourself can’t get a sample to utilize. That doesn't mean you yourself cannot find a template to utilize, however. Download Loan Modification Agreement - Multistate right from the US Legal Forms web site. It provides a wide variety of professionally drafted and lawyer-approved documents and templates.

For full access to 85,000 legal and tax forms, users simply have to sign up and select a subscription. After you are registered with an account, log in, look for a particular document template, and save it to My Forms or download it to your gadget.

To make things much easier, we’ve provided an 8-step how-to guide for finding and downloading Loan Modification Agreement - Multistate fast:

- Make confident the form meets all the necessary state requirements.

- If possible preview it and read the description before purchasing it.

- Click Buy Now.

- Select the suitable subscription for your requirements.

- Create your account.

- Pay via PayPal or by debit/credit card.

- Choose a preferred format if a number of options are available (e.g., PDF or Word).

- Download the file.

Once the Loan Modification Agreement - Multistate is downloaded you may fill out, print out and sign it in almost any editor or by hand. Get professionally drafted state-relevant documents within a matter of minutes in a preferable format with US Legal Forms!

Loan Agreement Form Template Form popularity

Loan Modification Regulations Other Form Names

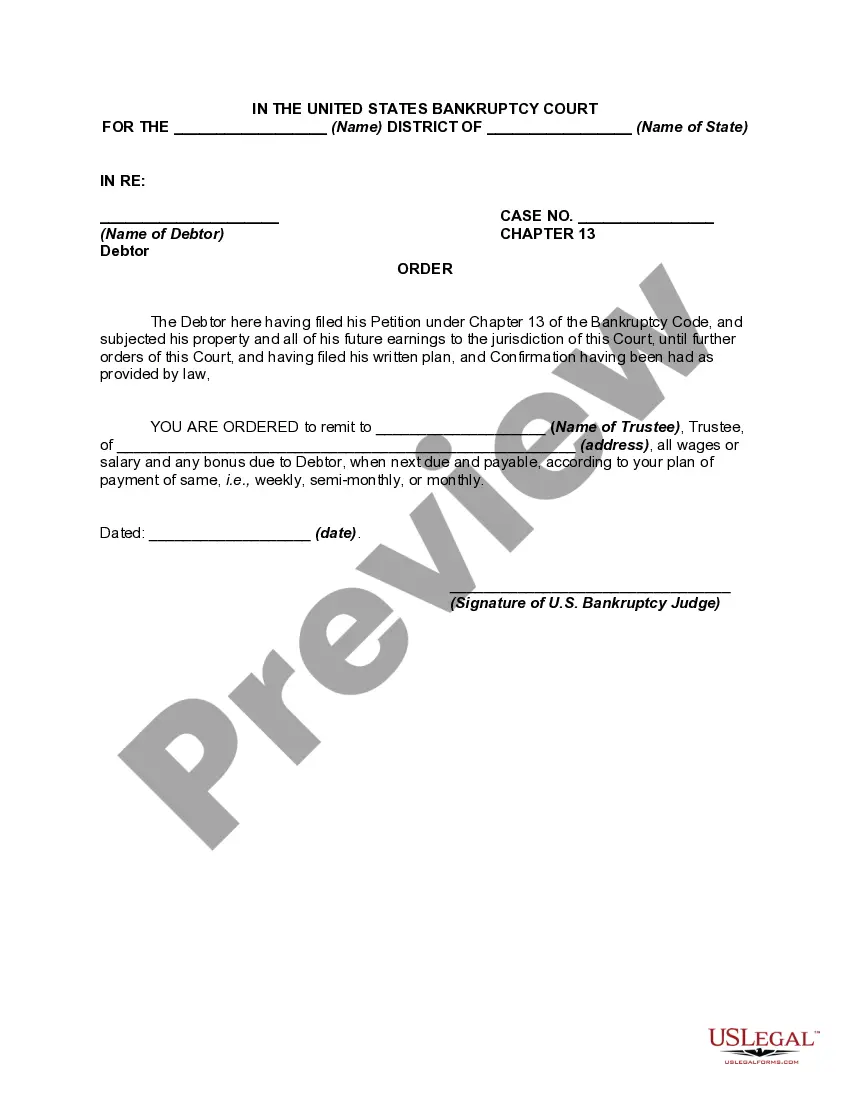

Loan Modification During Chapter 13 FAQ

Under this option, you reach an agreement between you and your mortgage company to change the original terms of your mortgagesuch as payment amount, length of loan, interest rate, etc. In most cases, when your mortgage is modified, you can reduce your monthly payment to a more affordable amount.

Technically, a loan modification should not have any negative impact on your credit score.If that's the case, those the Consumer Data Industry Association missed or partial payments will damage your credit, but the loan modification itself will not.

You have to be suffering a financial hardship. You have to show you cannot afford your current mortgage payments. You have to be able to show that you can stay current on a modified payment schedule.

A loan modification can help if you're behind on paying a loan, such as a mortgage. Defaulting on a secured loan can result in the loss of your home, car, or other valuable possession. Although refinancing a loan is one possibility that can avoid, for example, foreclosure, it may also be possible to modify your loan.