Credit and Term Loan Agreement

Description

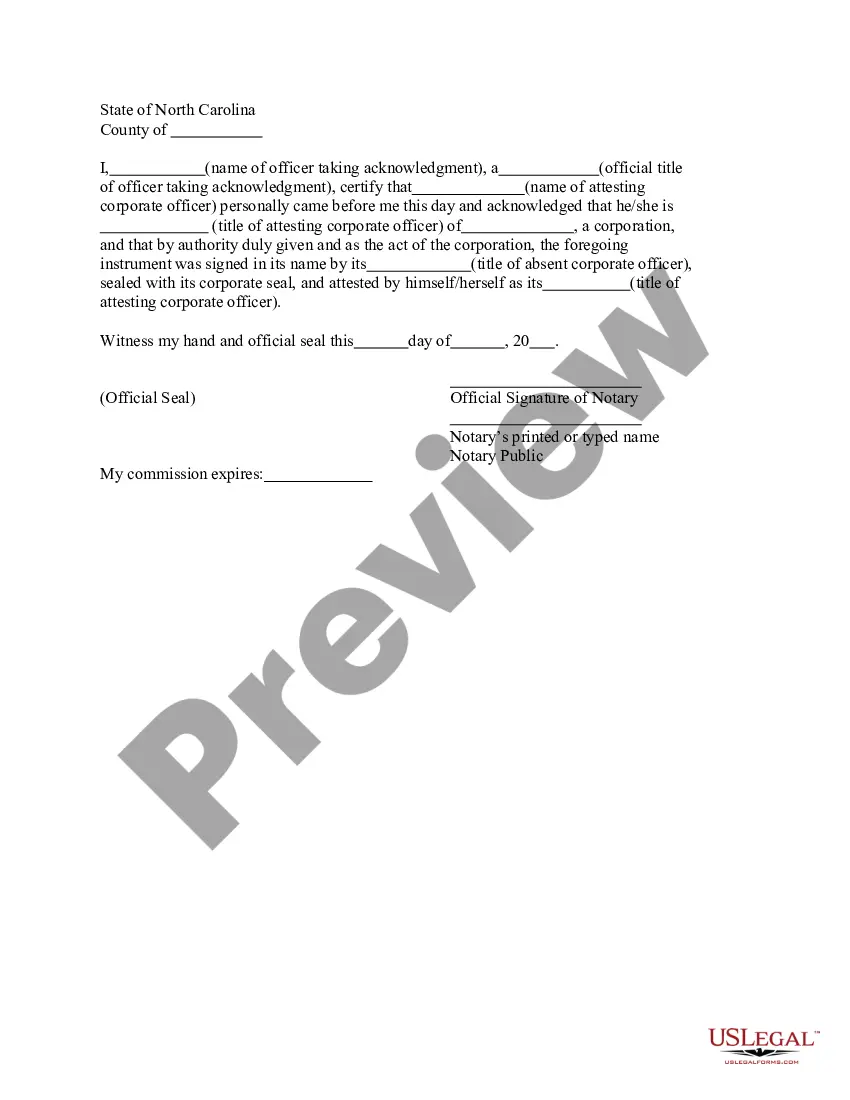

How to fill out Credit And Term Loan Agreement?

When it comes to drafting a legal document, it is better to leave it to the professionals. However, that doesn't mean you yourself can’t find a template to utilize. That doesn't mean you yourself can’t find a sample to utilize, nevertheless. Download Credit and Term Loan Agreement straight from the US Legal Forms site. It provides numerous professionally drafted and lawyer-approved documents and templates.

For full access to 85,000 legal and tax forms, customers simply have to sign up and select a subscription. Once you are registered with an account, log in, look for a particular document template, and save it to My Forms or download it to your gadget.

To make things less difficult, we have included an 8-step how-to guide for finding and downloading Credit and Term Loan Agreement quickly:

- Be sure the document meets all the necessary state requirements.

- If possible preview it and read the description before purchasing it.

- Click Buy Now.

- Select the appropriate subscription for your requirements.

- Create your account.

- Pay via PayPal or by debit/credit card.

- Select a needed format if a few options are available (e.g., PDF or Word).

- Download the file.

As soon as the Credit and Term Loan Agreement is downloaded it is possible to complete, print and sign it in any editor or by hand. Get professionally drafted state-relevant files in a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

D) Example of Term Loan A term loan is a type of advance that comes with a fixed duration for repayment, a fixed amount as loan, a repayment schedule as well as a pre-determined interest rate. A borrower can opt for a fixed or floating rate of interest for repayment of the advance.

For loans by a commercial lender, the lender will provide the agreement. But for loans between friends or relatives, you will need to create your own loan agreement.

A credit agreement has two main characteristics: Firstly, there must be some deferral of repayment, or a prepayment and secondly, the credit provider must impose a fee, charge or interest with respect to deferred payments or the credit provider must give a discount with respect to prepayment. a credit guarantee.

Also known as a loan agreement. The main transaction document for a loan financing between one or more lenders and a borrower.

Key Takeaways. A term loan is a loan issued by a bank for a fixed amount and fixed repayment schedule with either a fixed or floating interest rate. Companies often use a term loan's proceeds to purchase fixed assets, such as equipment or a new building for its production process.

Loan agreements are an important part of borrowing money; they protect both the borrower and the lender. A loan agreement spells out the details of the transaction, including the loan amount, the interest rate, and the terms.

Term Loan A This layer of debt is typically amortized evenly over 5 to 7 years. Term Loan B This layer of debt usually involves nominal amortization (repayment) over 5 to 8 years, with a large bullet payment in the last year.Depending on the credit terms, bank debt may or may not be repaid early without penalty.

Term out is the transfer of debt internallycapitalizing short-term debt to long-term debt on its balance sheet.The ability of a company or lending institution to "term out" a loan is an important strategy for debt management and normally occurs in two situationswith facility loans or evergreen loans.

A credit agreement has two main characteristics: Firstly, there must be some deferral of repayment, or a prepayment and secondly, the credit provider must impose a fee, charge or interest with respect to deferred payments or the credit provider must give a discount with respect to prepayment. a credit guarantee.