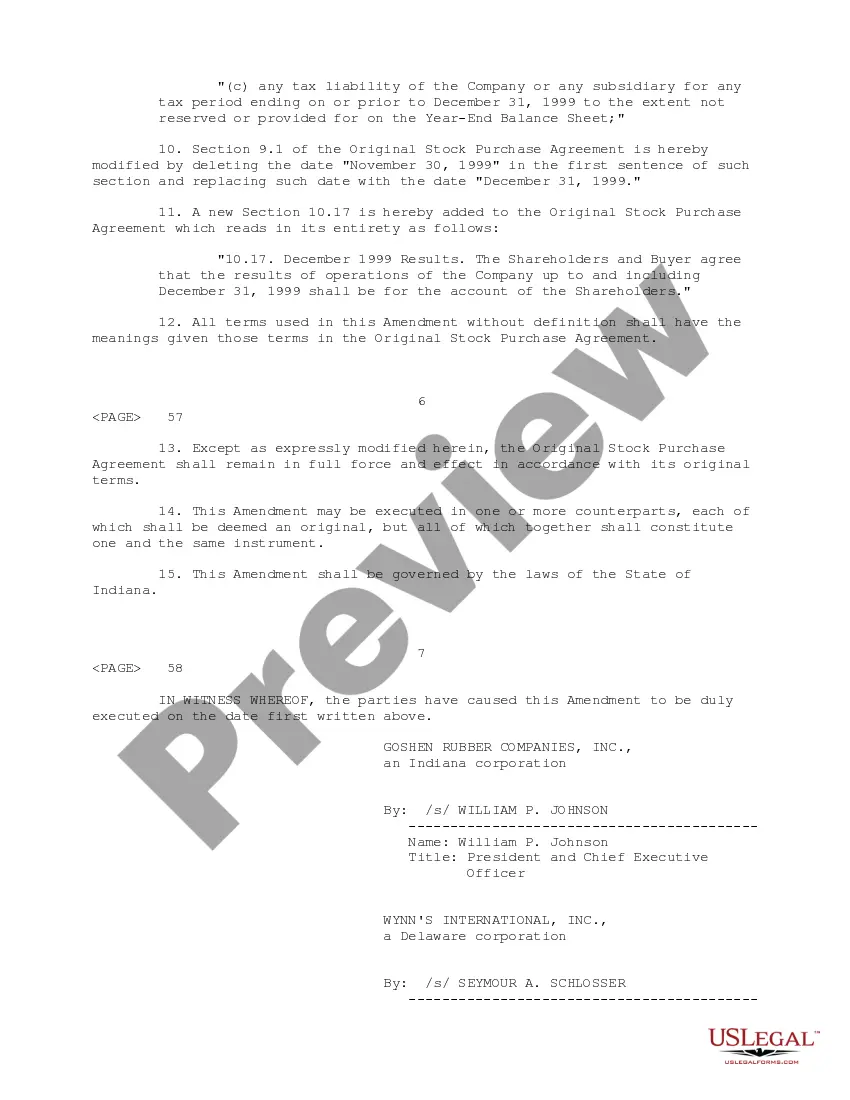

Sample Amendment to Stock Purchase Agreement between Wynn's International, Goshen Rubber Co., Inc., shareholders and Berkshire Taconic Community Foundation

Description Sample Stock Agreement

How to fill out Agreement Shareholders Form?

When it comes to drafting a legal form, it is easier to delegate it to the professionals. Nevertheless, that doesn't mean you yourself cannot find a sample to utilize. That doesn't mean you yourself cannot get a template to utilize, however. Download Sample Amendment to Stock Purchase Agreement between Wynn's International, Goshen Rubber Co., Inc., shareholders and Berkshire Taconic Community Foundation from the US Legal Forms site. It provides numerous professionally drafted and lawyer-approved forms and samples.

For full access to 85,000 legal and tax forms, users simply have to sign up and select a subscription. Once you’re registered with an account, log in, find a particular document template, and save it to My Forms or download it to your gadget.

To make things easier, we have provided an 8-step how-to guide for finding and downloading Sample Amendment to Stock Purchase Agreement between Wynn's International, Goshen Rubber Co., Inc., shareholders and Berkshire Taconic Community Foundation promptly:

- Make sure the document meets all the necessary state requirements.

- If possible preview it and read the description before purchasing it.

- Press Buy Now.

- Choose the suitable subscription to meet your needs.

- Create your account.

- Pay via PayPal or by credit/credit card.

- Select a preferred format if a few options are available (e.g., PDF or Word).

- Download the document.

Once the Sample Amendment to Stock Purchase Agreement between Wynn's International, Goshen Rubber Co., Inc., shareholders and Berkshire Taconic Community Foundation is downloaded it is possible to fill out, print and sign it in any editor or by hand. Get professionally drafted state-relevant papers in a matter of seconds in a preferable format with US Legal Forms!

Stock Agreement Between Shareholders Form popularity

Stock Purchase Agreement Form Other Form Names

Stock Purchase Agreement Between FAQ

An asset purchase involves the purchase of the selling company's assets -- including facilities, vehicles, equipment, and stock or inventory. A stock purchase involves the purchase of the selling company's stock only.

In an asset purchase, the buyer agrees to purchase specific assets and liabilities.In a stock purchase, the buyer purchases the entire company, including all assets and liabilities.

This Stock Purchase Agreement (sometimes called an Share Purchase Agreement or SPA) sets forth terms of the sale and transfer of a company's stock to a purchaser. Stock Purchase Agreements are often used to effect the acquisition of a company through the purchase of the majority of stock in that company.

Name of company. Par value of shares. Name of purchaser. Warranties and representations made by the seller and purchaser. Possible employee issues such as benefits and bonuses. How many shares are being sold. Where and when the transaction takes place.