Assumption Agreement of NAB Nordamerika Beteiligungs Holding GMBH between France Telecom and Deutsche Telecom AG regarding acquisition of Class A Stock

Description Nordamerika Holding Template

How to fill out Assumption Agreement Regarding?

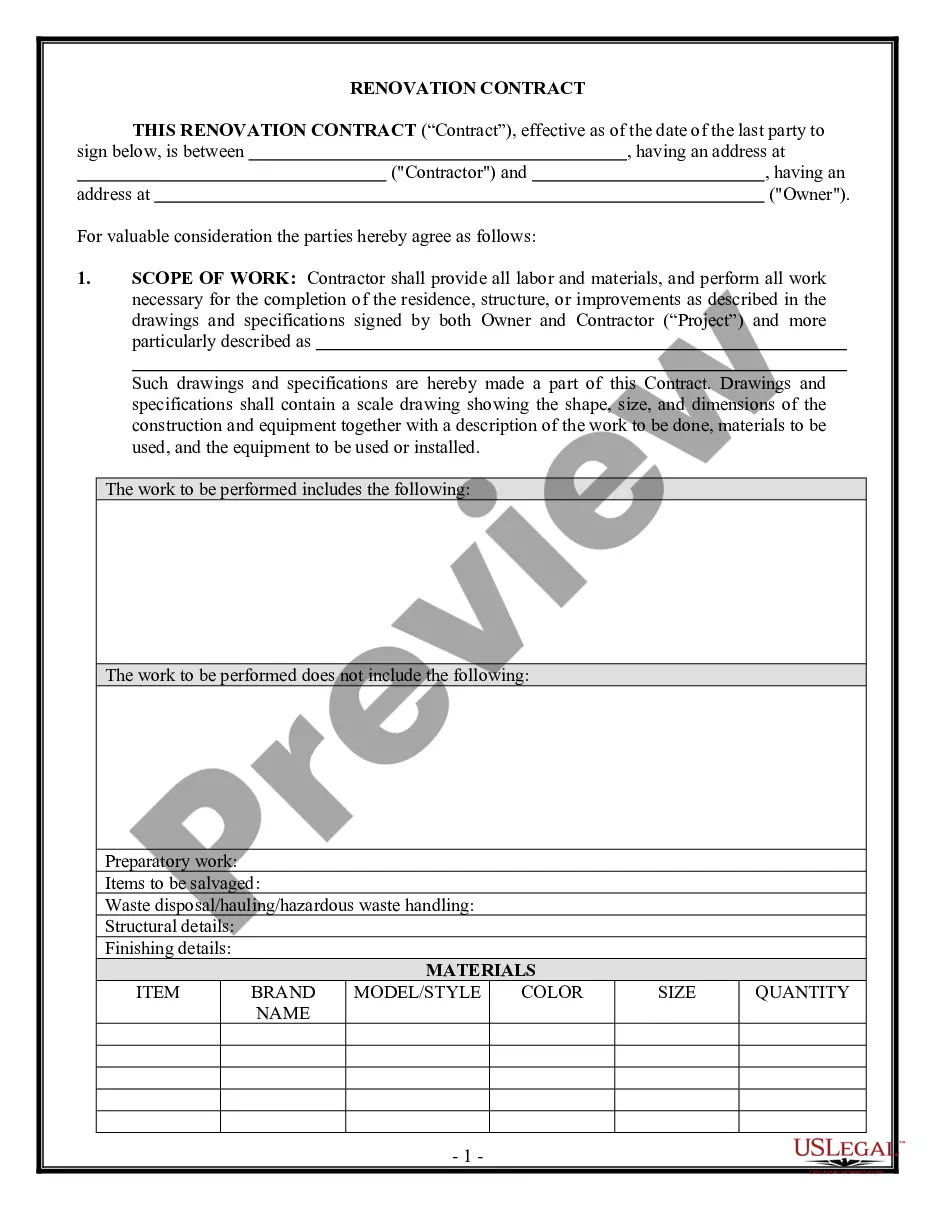

When it comes to drafting a legal document, it’s easier to delegate it to the professionals. Nevertheless, that doesn't mean you yourself cannot get a template to use. That doesn't mean you yourself can’t get a sample to utilize, however. Download Assumption Agreement of NAB Nordamerika Beteiligungs Holding GMBH between France Telecom and Deutsche Telecom AG regarding acquisition of Class A Stock from the US Legal Forms website. It gives you a wide variety of professionally drafted and lawyer-approved documents and samples.

For full access to 85,000 legal and tax forms, customers just have to sign up and select a subscription. After you’re signed up with an account, log in, look for a certain document template, and save it to My Forms or download it to your device.

To make things much easier, we’ve provided an 8-step how-to guide for finding and downloading Assumption Agreement of NAB Nordamerika Beteiligungs Holding GMBH between France Telecom and Deutsche Telecom AG regarding acquisition of Class A Stock quickly:

- Be sure the document meets all the necessary state requirements.

- If available preview it and read the description prior to buying it.

- Hit Buy Now.

- Choose the appropriate subscription to meet your needs.

- Create your account.

- Pay via PayPal or by debit/visa or mastercard.

- Choose a preferred format if a few options are available (e.g., PDF or Word).

- Download the document.

After the Assumption Agreement of NAB Nordamerika Beteiligungs Holding GMBH between France Telecom and Deutsche Telecom AG regarding acquisition of Class A Stock is downloaded you are able to complete, print and sign it in almost any editor or by hand. Get professionally drafted state-relevant papers in a matter of seconds in a preferable format with US Legal Forms!

Under Qualified Stock Form popularity

Nab Nordamerika Other Form Names

Assumption Agreement Between FAQ

Key Takeaways. Class A shares refer to a classification of common stock that was traditionally accompanied by more voting rights than Class B shares. Traditional Class A shares are not sold to the public and also can't be traded by the holders of the shares.

KEY TAKEAWAYS. Class A shares charge upfront fees and have lower expense ratios, so they are better for long-term investors. Class A shares also reduce upfront fees for larger investments, so they are a better choice for wealthy investors.

Class A, Common Stock Each share confers one vote and ordinary access to dividends and assets. Class B, Preferred Stock Each share confers one vote, but shareholders receive $2 in dividends for every $1 distributed to Class A shareholders. This class of stock has priority distribution for dividends and assets.

This benefits the investor because Class A shares have lower annual expense ratios than Class B shares. Class C mutual fund shares are best for investors who have a short time horizon and plan on redeeming their shares soon.Additionally, investors who purchase Class C shares could pay a high annual management fee.

The only difference between Class A and Class B is the voting power one receives along with the share. A company that issues multiple levels of stock usually does so to concentrate voting power. Thus, directors, for example, would own Class A shares while Class B shares are sold to the general market.

When more than one class of stock is offered, companies traditionally designate them as Class A and Class B, with Class A carrying more voting rights than Class B shares. Class A shares may offer 10 voting rights per stock held, while class B shares offer only one.

When more than one class of stock is offered, companies traditionally designate them as Class A and Class B, with Class A carrying more voting rights than Class B shares. Class A shares may offer 10 voting rights per stock held, while class B shares offer only one.

Class-A shares are held by regular investors and carry one vote per share. Class-B shares, held primarily by Brin and Page, have 10 votes per share. Class-C shares are typically held by employees and have no voting rights.